Revolut's Ambitious Plans Face Setbacks

Hey FinTech Fanatic!

Despite the challenge of adapting to New York City's chilly weather, I'm thoroughly enjoying my time here. It's undoubtedly one of my top favorite cities to be.

Are you attending NYC FinTech Coffee by any chance? I would love to meet you there!

Meanwhile in FinTech, Revolut, a global neobank giant with over 35 million customers and robust backing from prestigious investors like Tiger Global and SoftBank, has faced a series of challenges in India since its highly anticipated debut in 2021.

Initially poised to disrupt the dominant trio of Paytm, Walmart's PhonePe, and Google Pay in India's digital payments sector, Revolut's journey has been less than smooth.

The company's ambitious plan to introduce an international app, starting with remittances and expanding to trading, investment, and credit services, was spearheaded by industry veteran Paroma Chatterjee.

However, three years into its venture, Revolut, Europe's largest neobank, has struggled to make a significant impact in the Indian market. Despite an initial investment of $45 million (approximately Rs 320 crore), the firm's application for digital payments licenses remains in limbo.

Revolut's current focus is the launch of a travel card, similar to offerings by Scapia, Niyo Global, and some major banks, a stark contrast to its grand plans in 2021. The company had announced a multi-million-pound investment in India, promising to create around 300 new jobs. Operating through two entities, Revolut Payments and Revolut Technologies, the latter serves as a global business hub, employing about 2,000 workers.

Despite the challenges, Revolut acquired Mumbai-based Arvog Forex in February 2022, gaining an authorized dealer license to offer forex services in India. However, the company still lacks crucial licenses for wallet, payment, or UPI services and has yet to confirm the timeline for its travel card launch.

Leadership changes have also marked Revolut's journey in India, with key executives resigning and new appointments being made, including former Jio executive Abhishek Padhy and former Flipkart executive Sandeep Nainwal. Internationally, the company faces numerous challenges, including regulatory issues in the EU, a legal battle with Allianz, and efforts to secure a banking license in the UK.

Despite launching financial services in new markets like New Zealand and Brazil, Revolut's global expansion plans have led to a loss of $32 million in 2022, a stark contrast to its pre-tax profit of $50 million in the previous year.

This series of events has put Revolut's ambitious plans for India on hold, as the company navigates a complex landscape of regulatory challenges and internal restructuring.

To be continued...

Enjoy more FinTech industry updates I listed for you below and I'll be back in you inbox tomorrow!

Cheers,

Marcel

SPONSORED CONTENT

POST OF THE DAY

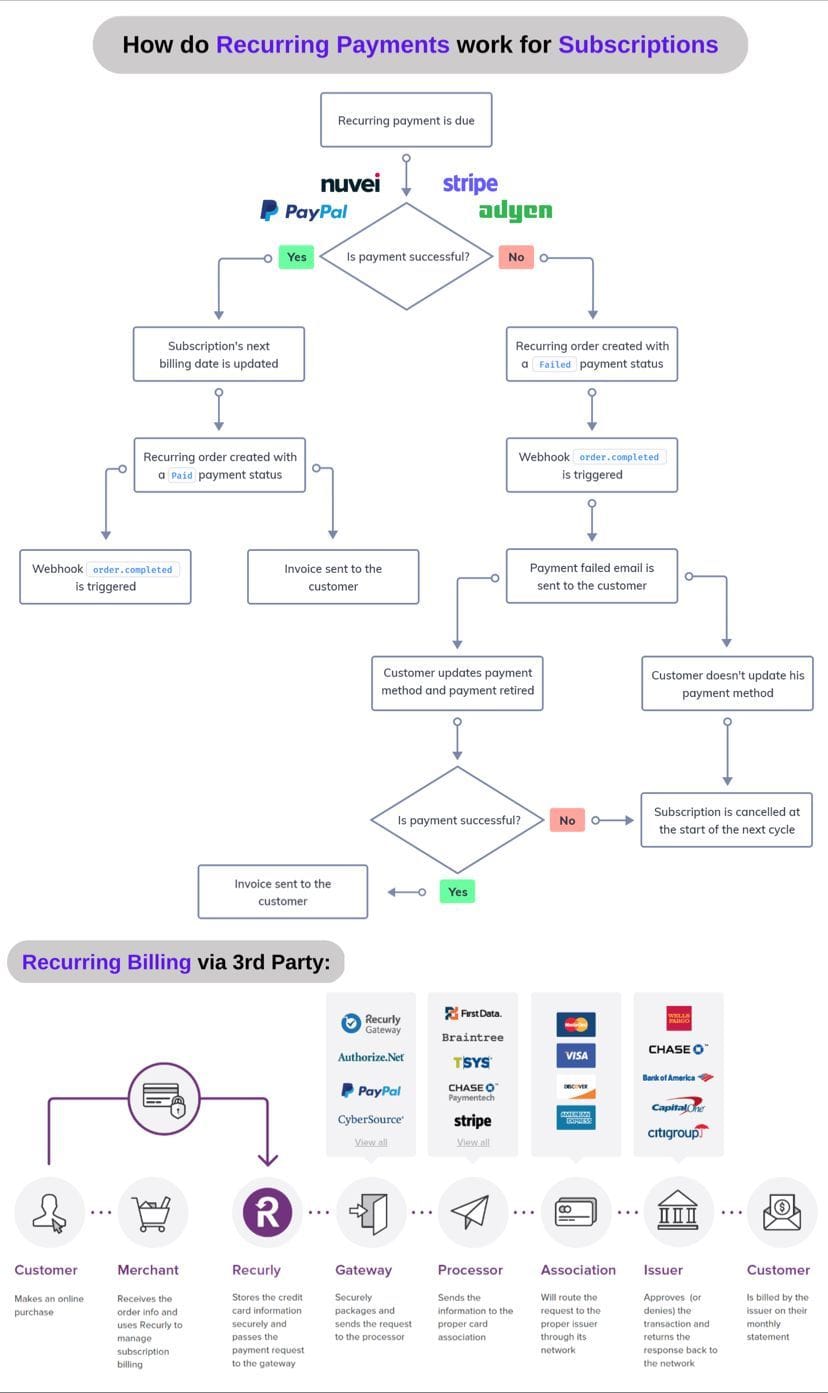

Recurring payments, especially for subscription-based services, may appear to be simple but in reality, are quite complex. 𝗟𝗲𝘁’𝘀 𝘁𝗮𝗸𝗲 𝗮 𝗹𝗼𝗼𝗸:

FEATURED NEWS

Airwallex sets up for IPO by 2026. The firm, last valued at US$5.5 billion (A$8.5bn), turns 10 next year, having raised US$902 million in the seven years since it was founded. CEO Jack Zhang said that the company is “going to get IPO ready in the next two years”, but added that “there is no immediate plan to go public.”

#FINTECHREPORT

Banking on AI. Check out the Banking Top 10 Trends For 2024 by Accenture. To read the full report, please click here

INSIGHTS

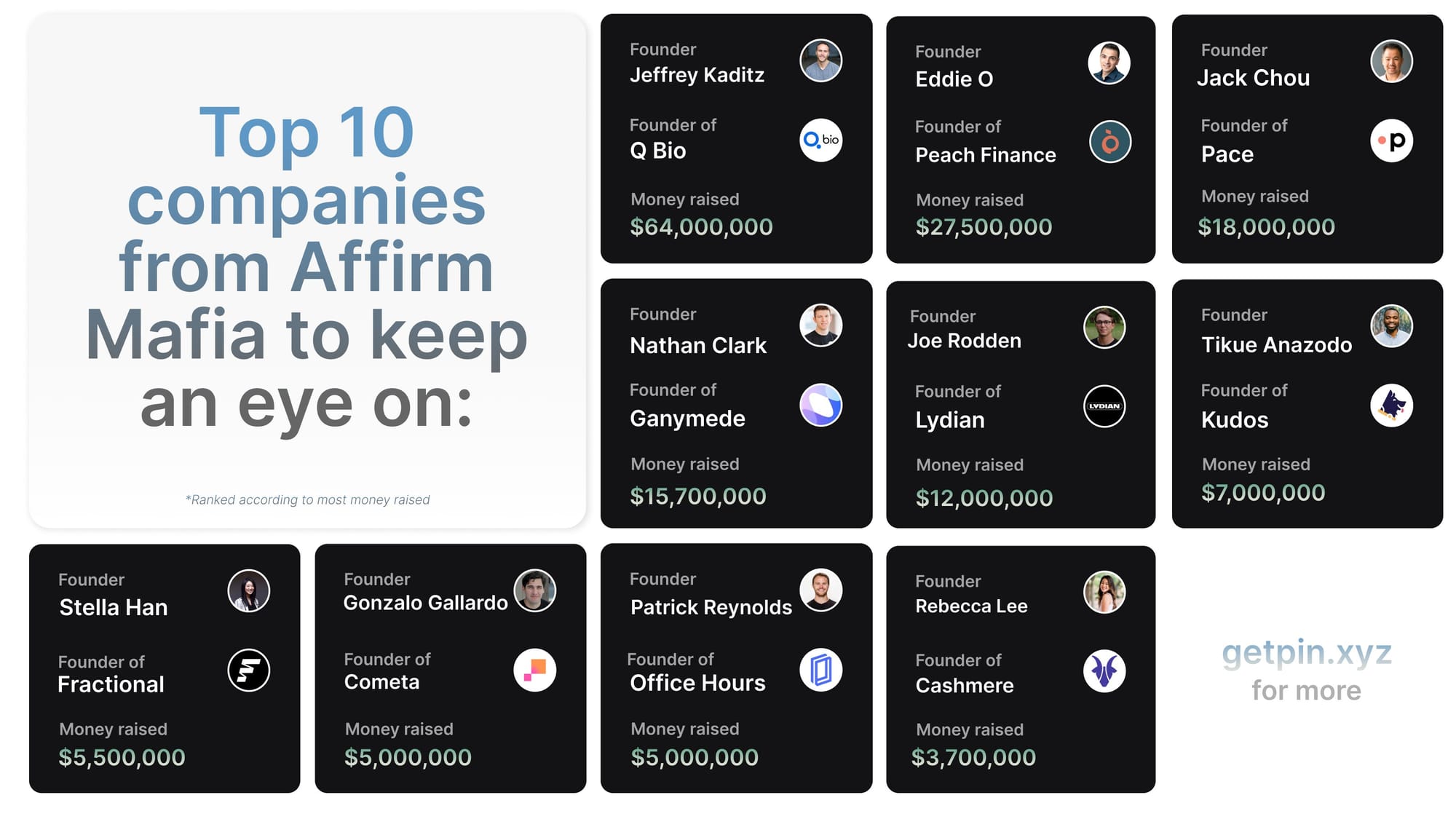

The Affirm Mafia 👉 17 Companies + $3.2 billion Venture Capital Raised. Let’s dive into this group:

FINTECH NEWS

🇧🇭 stc pay strengthens its digital payment offerings through a strategic partnership with Mastercard. The collaboration enhances user experience, offering added benefits aligned with lifestyles. stc pay and Mastercard aim to simplify transactions, providing a secure and efficient payment journey to advance Bahrain's digital payment landscape.

PAYMENTS NEWS

🇮🇳 India’s Unified Payments Interface (UPI) is a remarkable tale of policy innovation that has drawn in millions of previously unbanked people. It has transformed not only the way money changes hands but also the very language of exchange. Read more

🇨🇦 Tulip announces Tulip Pay, a Payment Integration powered by Stripe. The release of Tulip Pay reflects the company’s deep commitment to retail innovation by making the checkout experience as easy for both its retailers and its customers, by offering more services without having to manage more vendors.

DIGITAL BANKING NEWS

🇮🇳 Revolut’s India grand Super App plans still on shelf three years on but is now looking to offer a travel card in April. After entering the market in 2021 with the aim of challenging Paytm, Walmart's PhonePe, and Google Pay in India's digital payments sector, Revolut's journey has faced challenges. Read more

🇬🇧 Monzo, Starling and Revolut see a 45 percent drop in customer complaints about account closures between 2022 and 2023, according to new data. Bank account closures became a hot topic last year following the Nigel Farage banking scandal, which led to the resignation of Dame Alison Rose, NatWest Group CEO and Coutts CEO Peter Flavel.

DONEDEAL FUNDING NEWS

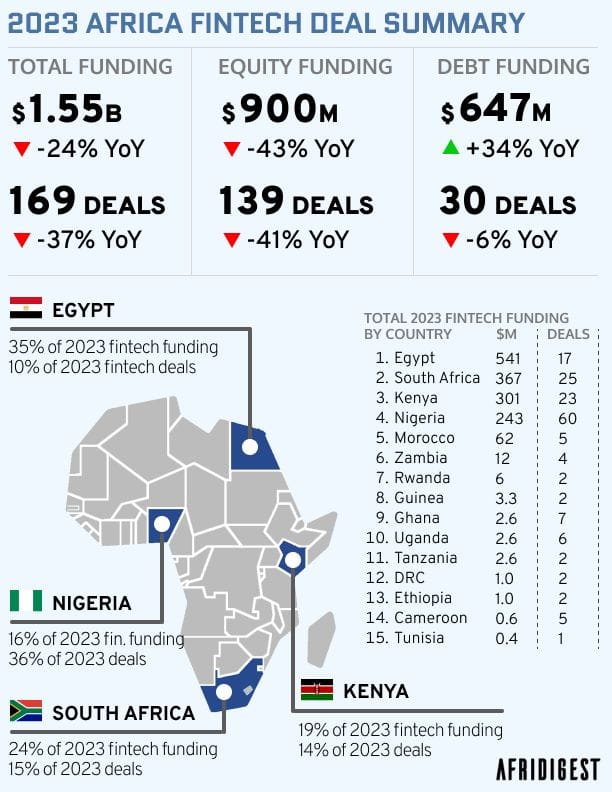

In 2023, 149 fintech companies in Africa raised ~$1.55B in funding (equity & debt) across 169 transactions, a 24% decline from the amount recorded in 2022, according to the Afridigest FinTech Transactions Database. Link here

🇸🇬 Grab injects another $109m into its digital banking subsidiary GXS Bank according to regulatory filings. This payout adds to the capital commitment made by Grab, which injected US$101 million into the digibank in July 2023. Read on

🇬🇧 10x Banking announces fresh funding as core banking market soars. The round, led by existing investors BlackRock and JPMorgan Chase, marks the latest significant milestone in the company’s journey to revolutionise the banking industry through cutting-edge technology and innovative financial solutions.

🇬🇧 CapitalRise secures £250m bank funding line. Founded in 2015, CapitalRise says the funding facility is the fifth and largest it has ever secured. CEO and co-founder Uma Rajah said the credit meant CapitalRise has “a resilient and varied capital base”.

🇪🇬 Egyptian customer loyalty fintech Zeal raises $4m funding to expand its technology. The startup is set to channel this capital infusion towards expanding its cutting-edge technology solutions throughout the EMEA region, building on its recent entry into the UK market. Read full article

🇺🇸 Pier banks $2.4M to launch ‘Stripe for credit.’ Pier, a SaaS platform, charges a monthly fee with a minimum and usage fee based on loan volume and use case, including credit builders, salary advance loans, BNPL for weddings, merchant advance and clean energy.

🇬🇧 UK-based Trudenty raises funding from Fuel Ventures, Techstars, others. The funds will help Trudenty to expedite product development and strengthen the team for an “impactful” launch. Committed to fostering trust and security in payments, the team aims to empower consumers as custodians of their own data.

MOVERS & SHAKERS

🇩🇪 Hawk AI welcomes intelligence and banking veteran Michael Shearer as Chief Solution Officer. Shearer, having spent a significant portion of his career at HSBC, brings a wealth of experience to Hawk AI, whose financial crime technology is used by banks and payment providers globally. Read more

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()