Revolut’s $45B Valuation Milestone & Nubank’s $404M Share Sale

Hey FinTech Fanatic!

Revolut has achieved a remarkable $45 billion valuation through a recent share sale by employees. This milestone places Revolut as the UK’s second-most valuable bank, trailing only HSBC, and surpasses its previous $33 billion valuation from 2021.

The UK government is keen to leverage this momentum, urging Revolut to consider a London listing over New York.

This development follows Revolut’s acquisition of a UK banking license in July, a milestone reached after a prolonged three-year battle with regulators. The new license not only allows Revolut to hold deposits and expand its lending capabilities within the UK but also enhances its potential to secure similar licenses in other major markets, such as the US.

Despite this progress, Revolut’s leadership, including CEO Nik Storonsky, appears inclined towards a potential IPO in New York, favoring the liquidity of Nasdaq over London’s stock exchange.

As London faces increased competition from New York, the UK government is intensifying efforts to keep Revolut's IPO on home soil.

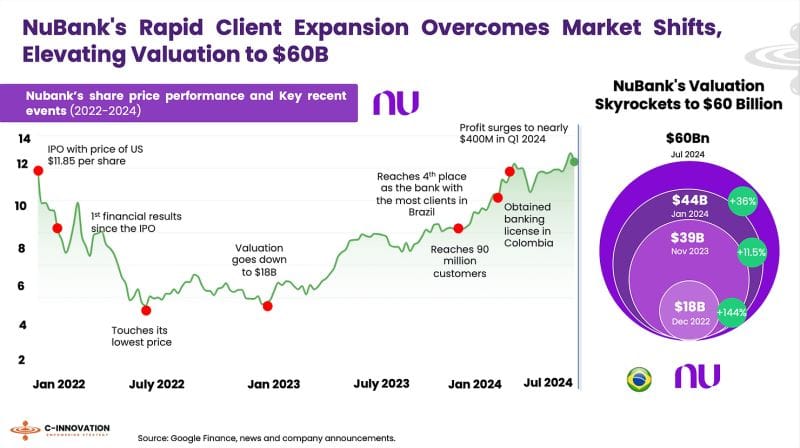

Meanwhile, across the Atlantic, Nubank’s CEO and co-founder, David Vélez, made headlines with a $404 million share sale as the digital bank’s stock soared to record highs.

Vélez offloaded 31 million shares, roughly 3% of his stake, through his trust Rua California Ltd., primarily for estate planning purposes.

Nubank's shares have surged over 69% this year, buoyed by a more than doubling of its second-quarter profits, reflecting strong investor confidence in the digital bank's ongoing growth.

FinTech is alive and kicking 😉

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

FEATURED NEWS

🇦🇺 Airwallex, the Tencent-backed digital payments startup, just hit $𝟱𝟬𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 🤯 of annual run rate (ARR) revenue and is seeking to get IPO-ready by 2026, according to CEO Jack Zhang. Read the complete interview by Ryan Browne for more interesting info.

INSIGHTS

💡 How are AI and real-time payments shaping Middle East’s financial future? Damon Madden, Strategic Solution Consultant – Fraud, MEASA, at ACI Worldwide explains: Discover more insights here

🇧🇷 David Vélez, the billionaire co-founder and chief executive officer of Nubank sells $𝟰𝟬𝟰 𝗠𝗶𝗹𝗹𝗶𝗼𝗻 of shares as stock hits record 🤯 Velez unloaded 31 million shares, or about 3% of his total stake, via his trust Rua California Ltd. to raise $404 million, according to a filing. The sale is intended for “estate planning purposes,” the company said.

FINTECH NEWS

🇲🇽 Stori is set to expand its credit card portfolio by launching a card aimed at customers who have established a strong credit history and are seeking a premium product. Stori Black will offer 3% cashback on purchases over 100 pesos with no annual fee.

🇺🇸 Robinhood hits 24 Million funded customers as trading volumes and assets surge over 50%. Robinhood reported a total of 24.2 million funded customers at the end of July, marking an increase of approximately 70,000 from the previous month and over one million compared to the same period last year.

PAYMENTS NEWS

🇬🇧 PSR sets out next steps on expanding VRPs in the UK. On 15 August 2024, the Payment Systems Regulator (PSR) published the response to its December 2023 call for views which set out initial proposals on how to expand variable recurring payments (VRPs) into new use cases, through a Phase 1 roll-out.

🇺🇸 US-based provider of AI-enabled software platforms for real estate RealPage has selected Flex as its preferred technology provider for flexible rent payments. This partnership enhances RealPage’s integration by enabling Flex as a payment option in LOFT, RealPage’s new resident portal and app.

DIGITAL BANKING NEWS

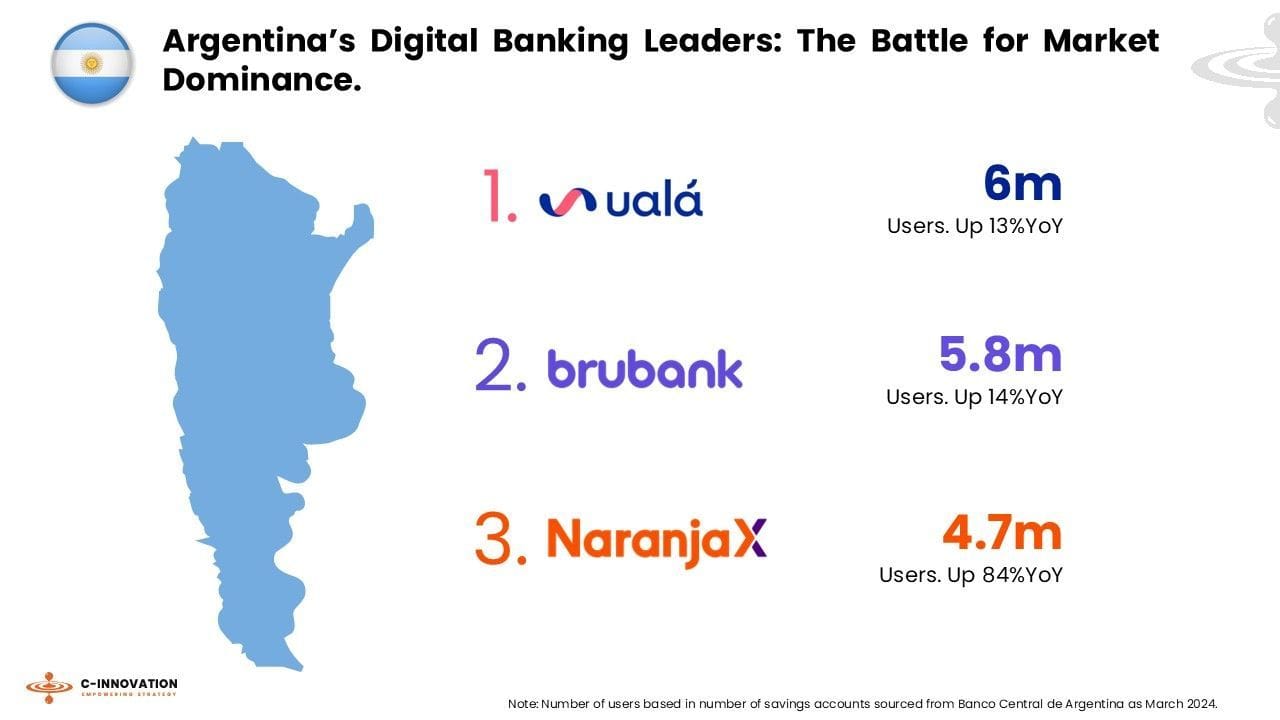

🇦🇷 Ualá hits 6 Million customers 🤯

The Argentine neobanking battle is heating up 🔥

🇺🇸 JPMorgan, Zelle may have upper hand if litigation ensues. With the Consumer Financial Protection Bureau investigating the peer-to-peer payment tool Zelle, its bank owners are on the defensive. However, Zelle’s owners might find a friendly reception in the federal courts if they follow through on threats to litigate, according to lawyers familiar with the industry. Zelle is owned by seven banks through the parent company Early Warning Services.

🇧🇷 Mercado Pago CEO on building Brazil’s biggest digital bank. Mercado Libre, as well as Mercado Pago, is ready to test that innovative spirit outside of Brazil. The company has bold expansion plans as it looks to become the dominant digital bank in Latin America, including its recent application of a digital banking license in Mexico.

🇺🇸 Michigan Educational Credit Union (MECU) implements new digital banking platform from Lumin Digital. MECU's rollout of Lumin's digital banking platform comes as the institution works to continually enhance its members' banking experience by evolving with the latest industry standards and innovations.

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 Crypto. com has secured a global sponsorship agreement with UEFA to become the Champions League’s first cryptocurrency partner. The multi-year partnership will see Crypto com and UEFA collaborate on bringing unique experiences to fans with an aim to drive fan engagement by bringing the worlds of crypto and football together.

🇺🇸 Investment banks Goldman Sachs and Morgan Stanley revealed in regulatory filings that they hold $600 million between them in US spot Bitcoin exchange-traded funds. The investment banks’ disclosures “signal a new consensus,” Dramane Meite, head of US and Europe product at the crypto-native asset manager, told DL News.

DONEDEAL FUNDING NEWS

🇺🇸 Amount’s $30M investment to revolutionize digital lending for credit unions. In addition to expanding its presence in the credit union market, Amount plans to use the new funding to enhance its artificial intelligence and machine learning capabilities.

🇺🇸 Chaos Labs secures $55M series A funding to bolster Defi risk management solutions. The company plans to use the funds to further enhance its technology, which automates real-time protocol parameter recommendations to improve the security and efficiency of defi protocols.

🇸🇬 WSPN secures $30 Million in seed funding to redefine the future of digital payments with stablecoin 2.0. WSPN is building a more secure, efficient, and transparent payment solution by working towards establishing a global framework and a new digital payment ecosystem.

🇳🇱 European investing App Peaks has raised €1.38 Million on Republic Europe topping its initial goal of €1,000,000. According to the offering page, Peaks was selling equity at a pre-money valuation of €52 million. Investors in the securities offering numbered 2128, acquiring a 2.55% equity stake in the early stage firm.

M&A

🇳🇱 The Dutch payment giant Adyen reaffirmed that the FinTech was unlikely to pursue future growth through M&A, saying consolidation can be “very painful.” Ingo Uytdehaage, Adyen co-CEO, was asked by an analyst, given falling FinTech valuations, whether Adyen, which is famous for rejecting acquisitions as a growth strategy, would consider future acquisitions.

🇸🇬 DCS Innov, a subsidiary of DCS FinTech, has announced that it acquired HolyWally, a Wallet-as-a-Service (WaaS) platform provider, to further expand its operations. Through this strategic move, DCS Innov aims to further advance its global expansion plans, especially into the US and European markets

🇺🇸 Communify acquires Fincentric from S&P Global. Wealthtech entrepreneur John Wise and PE firm Stellex Capital Management have acquired S&P Global’s Fincentric business with a view to providing digital experiences and financial data distribution to the wealth, broking and asset management industries.

MOVERS & SHAKERS

🇬🇧 allpay, a payment services provider in the UK, announced the appointment of Matt Marskell as Sales and Marketing Director (Non-Board) to its leadership team. Matt brings a focus on first class account management and optimisation of product for improved customer relationships taking over the commercial function at allpay at a time of exciting growth.

🇺🇸 Plinqit promotes Kirsten Longnecker to CMO. In her new role, Longnecker will oversee Plinqit’s marketing team and the company’s go-to-market strategy across its suite of deposit growth tools, including its most recently launched white-labeled savings product, High Yield Savings by Plinqit.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()