Revolut to Release 2023 Results Early

Hey FinTech Fanatic!

Revolut plans to publish its 2023 results in the upcoming days, ahead of the deadline, marking progress in its bid for a UK bank license after missing deadlines in previous years.

Revolut, is set to release its highly anticipated results, expected to reveal 𝘀𝗶𝗴𝗻𝗶𝗳𝗶𝗰𝗮𝗻𝘁 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗲𝘀 𝗶𝗻 𝗯𝗼𝘁𝗵 𝗿𝗲𝘃𝗲𝗻𝘂𝗲 𝗮𝗻𝗱 𝗻𝗲𝘁 𝗶𝗻𝗰𝗼𝗺𝗲, in the coming days, according to sources familiar with the matter.

Releasing these results ahead of the statutory deadline marks a significant achievement for Revolut, which has long been striving to secure a banking license from UK regulators—a move that would allow the company to broaden its services in its home market.

Organizing its financial accounts has been a key hurdle in this process. This will be the first time in several years that Revolut has not requested an extension to file its accounts.

In the previous year, the company required a three-month extension to publish its 2022 annual accounts, and its 2021 accounts were not made public until March 2023, well past the extended deadline.

Revolut in December said revenue for 2023 was on track to reach $2 billion and Chief Executive Officer Nik Storonsky told a conference in Dubai in May that net income for last year was $350 million.

That would all be an improvement from 2022, when Revolut generated revenue of $1.2 billion and notched $5.8 million in profit.

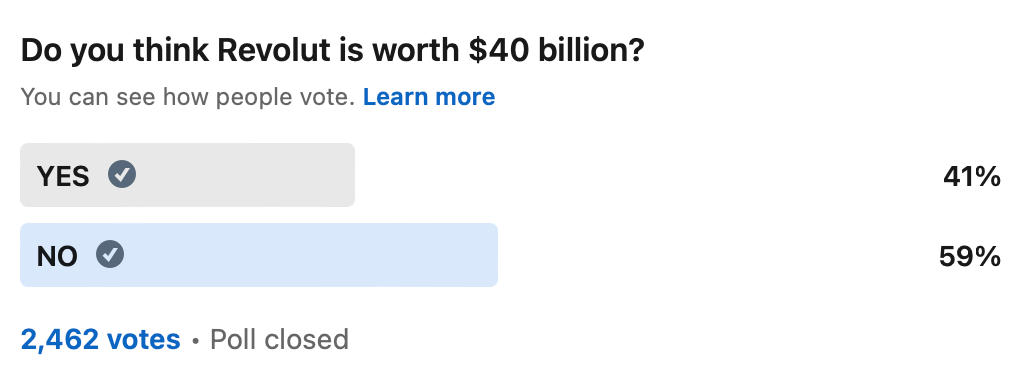

Remember when I asked you if you think Revolut is worth 40 billion, a week ago? The poll results are in, and it was a close call:

Cheers,

POST OF THE DAY

🇸🇪 Klarna CEO Sebastian Siemiatkowski led the rise from a profitable business to their peak of almost $𝟱𝟬 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 𝘃𝗮𝗹𝘂𝗮𝘁𝗶𝗼𝗻, in which they were burning $𝟭𝟱𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 a month. This and more in Logan Bartlett’s latest podcast episode👇

#FINTECHREPORT

📊 UK Credit Card Trends 2023-24: FICO Data Shows Rising Spend and Missed Payments. Analysis by global analytics software firm FICO of its proprietary UK credit cards data for March 2023 to March 2024 illustrates the impact these pressures have had on credit card usage and debt management. Find out more

INSIGHTS

📈 Visa Foundation focused on empowering women entrepreneurs. Visa Foundation is supporting women in growing their small businesses and making them more resilient, increasing economic mobility and creating wealth for themselves. Read the full piece here

FINTECH NEWS

💳 Airwallex introduced the Deel Card. With Airwallex’s global financial infrastructure, Deel can set up numerous accounts in multiple locations and issue local cards to customers in Brazil, Chile, Ecuador, Egypt, and more. Read on

🇩🇪 Wefox rescued from insolvency amid "profound" restructuring. The one-time insurance unicorn has secured €25 million in new capital amid a brutal restructuring effort to keep the business afloat. Over the past 18 months, wefox has streamlined operations, shedding non-core assets and enhancing core strengths.

🇺🇸 US start-up Arrow emerges from stealth aiming to streamline healthcare payments. Formerly known as Walnut, Arrow has emerged from stealth offering the US healthcare sector a range of tools that enable “fast and accurate” payments for both healthcare providers and payers.

🇺🇸 With Google Wallet replacing Fitbit Pay in July, the newer service is rolling out support for American Express cards, and adds support for Hotel keys. As Fitbit owners made the switch to Google Wallet, they noticed a lack of American Express support. Continue reading

PAYMENTS NEWS

🏦 Five Asian markets to link domestic instant payment schemes. The Bank for International Settlements is to move toward live implementation of Project Nexus, an initiative that seeks to enhance cross-border payments by connecting multiple domestic instant payment systems globally.

🇬🇧 UK FinTech Modulr’s embedded payments give Multifi access to real-time payment rails including faster payments, SEPA Instant in Europe. Multifi’s mission is to simplify finance for small businesses. Unlike traditional banks, its streamlined process allows businesses to obtain an indicative credit limit with just a few details entered.

🇺🇸 Swiftcrypt Exchange has launched a new cross-border payment solution designed to provide users with secure and cost-effective payment services. Built on blockchain technology, the solution enables instant settlement and transparent fund flow, simplifying traditional cross-border payments.

OPEN BANKING NEWS

🇧🇷 Noda is expanding its open banking network to Brazil. The global open banking and payments provider, Noda, already operates in Europe, the UK and Canada. The expansion enhances the convenience for merchants, enabling them to conduct business seamlessly across different regions.

DIGITAL BANKING NEWS

🇬🇧 Monzo introduces trio of new fraud controls to help customers reduce the risk of fraudulent payments from phone theft, shoulder surfing, or impersonation scams. The controls, which are called Known Locations, Trusted Contacts and Secret QR codes will be rolled out over the coming weeks.

🇬🇧 UK bank customers hit by payment delays. Thousands of major bank customers in the UK were hit by payments problems that saw some people not receiving their salaries last week. Read more

BLOCKCHAIN/CRYPTO NEWS

🇨🇭 Swiss FinTech Fiat24 joins Web3-powered ONTO Wallet to offer users an easy entry into decentralized banking features. The partnership exemplifies how Web3 is making inroads into the real world, providing tangible benefits to users and showcasing the potential of decentralized technologies.

🇯🇵 Tech Giant Sony enters Japanese crypto market with purchase Of Amber Japan Exchange, in a move to diversify its already extensive portfolio. Sony has a market value exceeding $100 billion, primarily focusing on gaming, music, and camera technology.

🇺🇸 Conio, in partnership with Mesh, launches Europe’s first Open Banking solution for Bitcoin. This groundbreaking integration within Conio’s platform offers its 430,000+ customers in Italy a unified access point to the entire crypto ecosystem, allowing them to link their Bitcoin wallets with leading digital asset exchange platforms.

🇨🇳 Alibaba’s FinTech arm Ant Digital expands capital for blockchain push. The strategic move comes despite China’s ongoing ban on cryptocurrency transactions, showing the country’s distinction between crypto and blockchain technology. Read more

DONEDEAL FUNDING NEWS

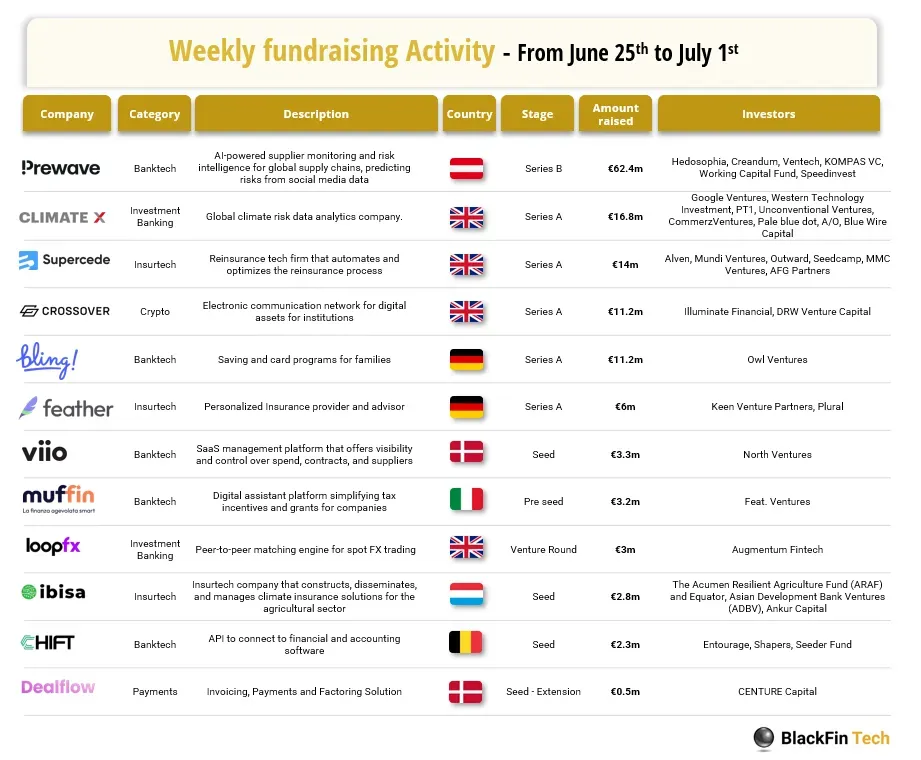

💰 Last week we saw 12 official FinTech deals in Europe for a total amount of 136.7m€ raised with 4 deals in the UK, 2 deals in Denmark, 2 deals in Germany, 1 deal in Austria, 1 deal in Belgium, 1 deal in Italia and 1 deal in Luxembourg. Read the complete BlackFin Tech article here

🇦🇺 Dash Technology Group has raised $22 million in a round led by listed venture fund Bailador Technology Investments. The Bailador deal will see the VC invest an initial $15 million now with $5m in follow-on funding in six months in January 2025.

M&A

🇳🇱 Ant Group announced that it completed the acquisition of MultiSafepay, one of the leading payment service providers in the Netherlands / Belgium / Luxembourg (Benelux region) targeted at the SME and lower-end enterprise market. Through this acquisition, Ant will bolster its global capabilities in the Netherlands and across Europe.

🇺🇸 Investment app Robinhood is adding more AI features for investors with its acquisition of AI-powered research platform Pluto Capital, Inc., announced on Monday. The company says that Pluto will allow Robinhood to add tools for quicker identification of trends and investment opportunities, help guide users with their investment strategies, and offer real-time portfolio optimization.

MOVERS & SHAKERS

🇸🇬 Mastercard and Wilson Sonsini FinTech experts to join Pomelo Group Advisory Board. Mr Joshua Kaplan, Wilson Sonsini’s partner and former COO of Checkout. com, and Mr Sapan Shah, Senior VP of Mastercard and Head of Acceptance APAC, were appointed to the Advisory Board. They will advise Pomelo’s leadership team on strategic decisions, product, customer and partnership initiatives.

🇳🇱 Mambu hires Mark Geneste as chief revenue officer. Geneste’s appointment is expected to drive growth and strengthen Mambu’s position in the market, further enhancing its reputation as a leader in the banking technology sector. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()