Revolut Takes on UBS and Morgan Stanley in Private Banking Push

Hey FinTech Fanatic!

Revolut is developing private banking services for high net worth individuals who hold liquid assets over $1 million, positioning itself to compete with traditional banks like UBS and Morgan Stanley. This expansion adds to their existing suite of business banking, travel insurance, and stock trading services.

The move follows their record profits in 2024 and UK banking license acquisition, with plans to offer specialized services including investment options and dedicated relationship managers for wealthy clients.

A Revolut spokesperson states: "Private banking is an area we're exploring as part of our ongoing efforts to expand and enhance our product offerings. As with any new initiative, we're continually assessing how best to resource our teams, but it's still early days, and we have no further details to share at this stage."

Revolut's 2025 product roadmap includes an AI-powered financial assistant, mortgages, and branded ATMs, putting them in competition with both traditional banks and emerging FinTechs like Swiss neobank Alpian and London wealthtech Sidekick.

If you’re interested in reading a bit about what’s been happening in FinTech, keep scrolling!

Cheers,

Transform Your Banking Experience! Subscribe to my Daily Banking Newsletter for the latest trends and updates delivered daily to your inbox. Embrace the Future of Banking—Never miss an update!

#FINTECHREPORT

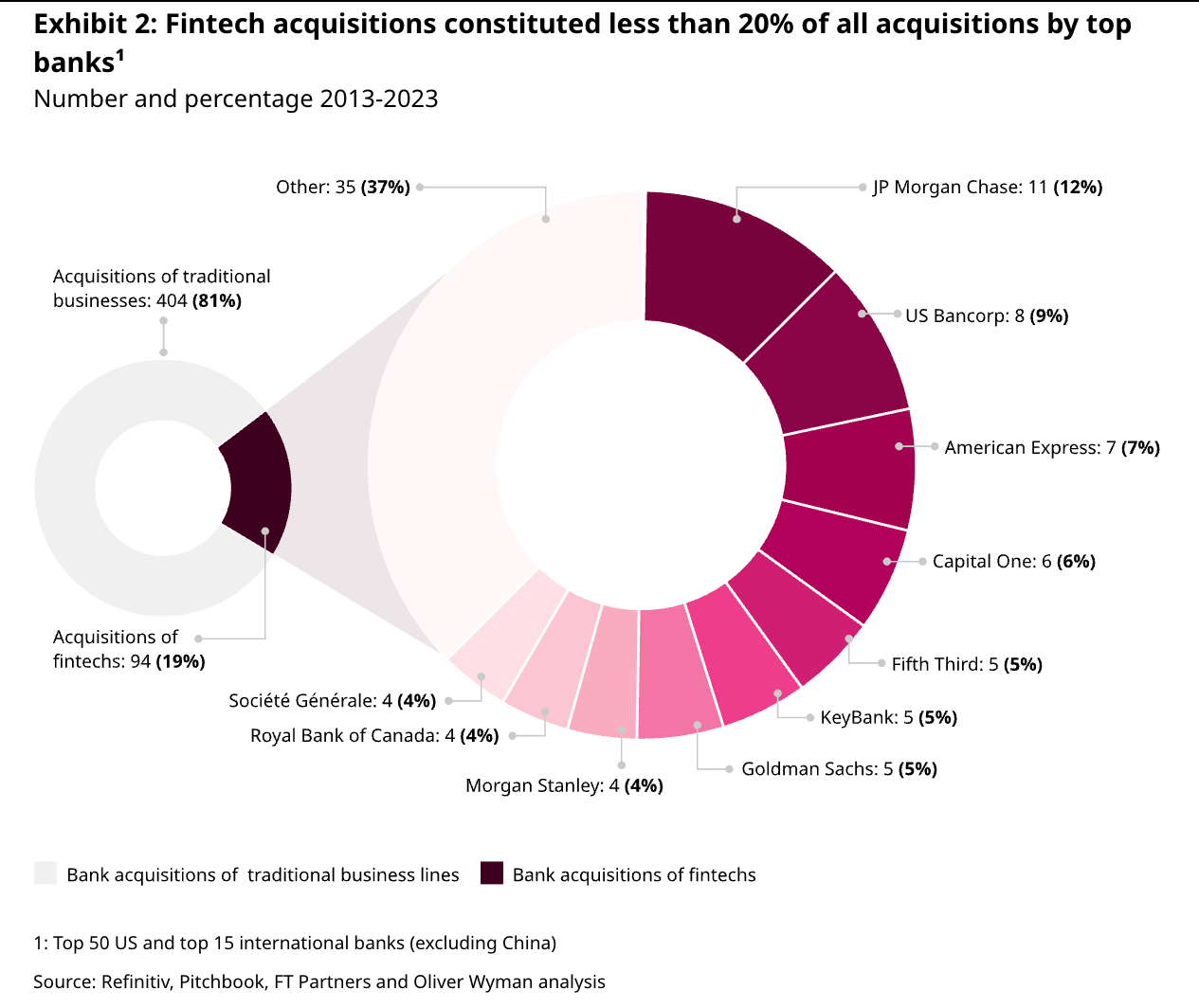

📊 A Comprehensive Analysis Of Bank-Fintech M&A. Check out Oliver Wyman's complete paper and discover how bank-FinTech synergy can drive M&A success. Link here

FINTECH NEWS

🇺🇸 Wall Street expected to shed 200,000 jobs as AI erodes roles. Back office, middle office and operations are likely to be most at risk, according to a Bloomberg Intelligence report analyst. Customer services could see changes as bots manage client functions, while know-your-customer duties would also be vulnerable.

🇬🇧 UK FinTech funding races ahead of Europe. The UK’s FinTech sector ranked second globally in investment last year, behind only the US, despite a sharp funding decline from 2023 levels. Global FinTech investment fell 20% to $43.5bn, with the UK attracting $3.6bn. Industry leaders remain optimistic about a rebound in 2025.

eToro launches new portfolio tools. Designed to help users plan, identify opportunities and benchmark their portfolio against other assets, the new insights provide valuable information on portfolio composition, risk factors and passive income generation. Continue reading

🇬🇧 Tradu launches spread betting. Spread betting enables clients to seamlessly speculate on market movements without owning the underlying assets, creating an intuitive and flexible trading experience. Powered by Tradu’s Spread Tracker, the platform aims to deliver the tightest spreads amongst competitors.

🇵🇭 Top Philippine FinTech taps banks for IPO. GCash has picked banks to work on an initial public offering that could take place this year. It has selected JPMorgan Chase & Co., Morgan Stanley and UBS Group AG to work on the potential share sale, the people said, asking not to be identified because the matter is private.

PAYMENTS NEWS

UX on another level 🤯 What do you think? And which South African bank is this? ➡️ Watch video

UX on another level

🇬🇧 Ecommpay Chief Marketing Officer shortlisted in Women in Payments EMEA 2025 Awards. Miranda McLean, CMO has advocated for women and other minority groups in the tech community for a number of years and firmly believes that the FinTech sector must be as open and diverse as possible. Winners will be announced at an Awards dinner in London on 9th April.

🌍 Can Wero shape the future of European payments? Martina Weimert, CEO of European Payments Initiative (EPI), explains the motivation behind Wero. Wero digital wallet aims to offer a European sovereign unified payment solution to address the needs of consumers, professionals and merchants in all European markets.

🇵🇪 Kuady launches physical prepaid Mastercard in Peru. The physical Kuady card allows users to make secure in-store purchases with any merchant accepting Mastercard using their Kuady wallet balance. Online payments can continue via the virtual card, providing a flexible mix of both digital and physical payment options.

🇸🇬 Nium launches Diners Club International Card. The introduction provides Nium travel customers with even greater payment flexibility, acceptance and choice, reinforcing Nium’s position as a scheme-agnostic innovator in the travel payments industry.

🇳🇱 Adyen introduces Adyen Uplift: The payment solution optimizing every transaction with AI. With Adyen Uplift, companies benefit from AI trained on over a $𝟭 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻+ of global payments data. Adyen customers can leverage data-driven insights and test payment setups to optimize performance.

OPEN BANKING NEWS

🇺🇸 CFPB approves Financial Data Exchange. The CFPB has officially recognised FDX as a “standard setting body” under the new Personal Financial Data Rights rule. The rule requires banks, credit card companies and other financial services providers to let their customers transfer their personal financial data to another provider, free of charge.

REGTECH NEWS

🇬🇧 EBA consults on crypto asset rules for capital requirements. The EBA published a Consultation Paper on its draft Regulatory Technical Standards (RTS) to specify the technical elements necessary for institutions to calculate and aggregate crypto-asset exposures in relation to the prudential treatment of such exposures.

DIGITAL BANKING NEWS

🇬🇧 Revolut eyes wealthy clients. Revolut is making a push into private banking, putting it in direct competition with big incumbents like UBS and Morgan Stanley. It is gradually expanding its offering, which now includes business banking, travel insurance and stock trading, while increasing investments in AI.

🇬🇧 Lloyds will allow customers to use Halifax and BoS branches. Customers would be able to conduct their in-person banking at branches of any of the group’s three brands, regardless of which lender they held accounts with. But unions representing Lloyds Banking Group staff are concerned this could lead to job cuts.

🇮🇩 Grab-backed Superbank adds OVO to ecosystem. Superbank, the Indonesian digital bank, is set to expand its ecosystem by integrating with OVO. Through this collaboration, Superbank aims to broaden its financial service offerings. Read More

🇪🇺 StanChart forms new entity for digital assets custody services. Standard Chartered, has formed a new entity in Luxembourg to offer crypto and digital asset custody services in the European Union, as the global lender looks to cash in on the growing demand for digital security.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Revolut joins Pyth Network with digital asset data. This will allow decentralized finance ("DeFi") developers to incorporate high quality digital asset quote and trade data from a digital banking platform with over 45 million users across 200 countries into their decentralized applications (dApps).

🇸🇬 Bitget launches bank deposits with ZEN. With this integration, Bitget users can now seamlessly deposit and withdraw funds using 11 supported fiat currencies. This collaboration shows Bitget's focus on enhancing accessibility and improving the user experience, particularly in underserved European markets and major regions such as Oceania.

🇪🇺 FTX disputes sale of EU assets to ex-employees as complete. Backpack Exchange, founded by ex-FTX employees, announced a $32.7 million purchase of FTX EU to expand its derivatives offerings. However, the US-based FTX estate disputes the ownership transfer, stating it hasn’t been finalized.

🇹🇭 Thailand tests crypto payments with Phuket for tourists. The initiative, announced by Deputy Prime Minister and Finance Minister, aims to allow foreign visitors to make payments using Bitcoin and other digital currencies, offering a seamless alternative to cash transactions. Continue reading

PARTNERSHIPS

🇦🇪 Arf and LuLu Financial Holdings announce strategic partnership to revolutionize settlement times in global and cross-border payments. This collaboration will allow LuLuFin to leverage Arf's advanced settlement infrastructure, offering T-0 settlement times.

🇰🇼 Objectway enters MENA with Markaz partnership. This collaboration marks a significant milestone in Objectway's growth in the region. Objectway will support Markaz in delivering an enhanced client experience for their clients, by significantly improving and automating processes and seamless client journeys.

🇦🇹 IXOPAY and Riskified announce partnership to boost fraud prevention and enhance enterprise payment orchestration. It will help ecommerce customers securely expand their businesses by leveraging omnichannel payment orchestration with AI fraud detection.

🇵🇷 FV Bank expands stablecoin offerings with PayPal Pact. The integration of PYUSD deposits and payments, along with auto-conversion to and from USD, is a key accomplishment in FV’s commitment to provide the most comprehensive integrated banking service for our global customers.

DONEDEAL FUNDING NEWS

🇺🇸 OnPay raises over USD 100 million in Series B funding. The funds secured will enable the company to scale its capabilities, invest in product development, expand partnerships and integrations, and accelerate go-to-market strategy. This latest investment marks the increasing market demand for turnkey payroll software.

🌍 Defiant is a new European VC firm that uses data and products to make better investments. Joseph Pizzolato and Cam Rail have already secured $30 million and plan to raise as much as $70 million for their initial fund. Defiant is willing to lead or co-lead funding rounds. The goal is to spend anything between $1 million and $10 million per deal.

MOVERS AND SHAKERS

🇺🇸 Orion names Arun Anur as new COO. US-based wealthtech Orion has hired former Oracle VP Arun Anur to oversee “client experience delivery, including service, operations, data reconciliation and onboarding” as its new COO. Read More

🇬🇧 UrbanChain has appointed Lee Stretton as its new CTO. Lee, with 25 years of experience in tech and FinTech, previously served as CIO at Monevo and MD at Raisin UK. He expressed excitement about joining UrbanChain, praising its revolutionary energy matching platform, which saw over 8,000% growth last year.

🇺🇸 Gemini makes senior hires in Europe as it expands in region. Mark Jennings has joined Gemini as its new head of Europe, Daniel Slutzkin will lead UK business, and Vijay Selvam, Gemini’s former general counsel for the Apac region, has relocated to London to take on the role of general counsel for the company’s international business.

🇺🇸 Boost Payment Solutions names Rinku Sharma as CTO. Sharma will drive growth and scalability by continuing to modernize and automate payment processes while strengthening data governance, quality, and security measures. He will utilize advanced solutions and incorporate innovations, including AI.

🇺🇸 DailyPay names Nelson Chai as Executive Chair. Chai will be providing strategic oversight to the company as executive chair. In a press release, the company noted that Chai brings more than three decades of experience in finance and technology to the role.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()