Revolut Streamlines Share Classes in Pursuit of Banking License

Hey FinTech Fanatic!

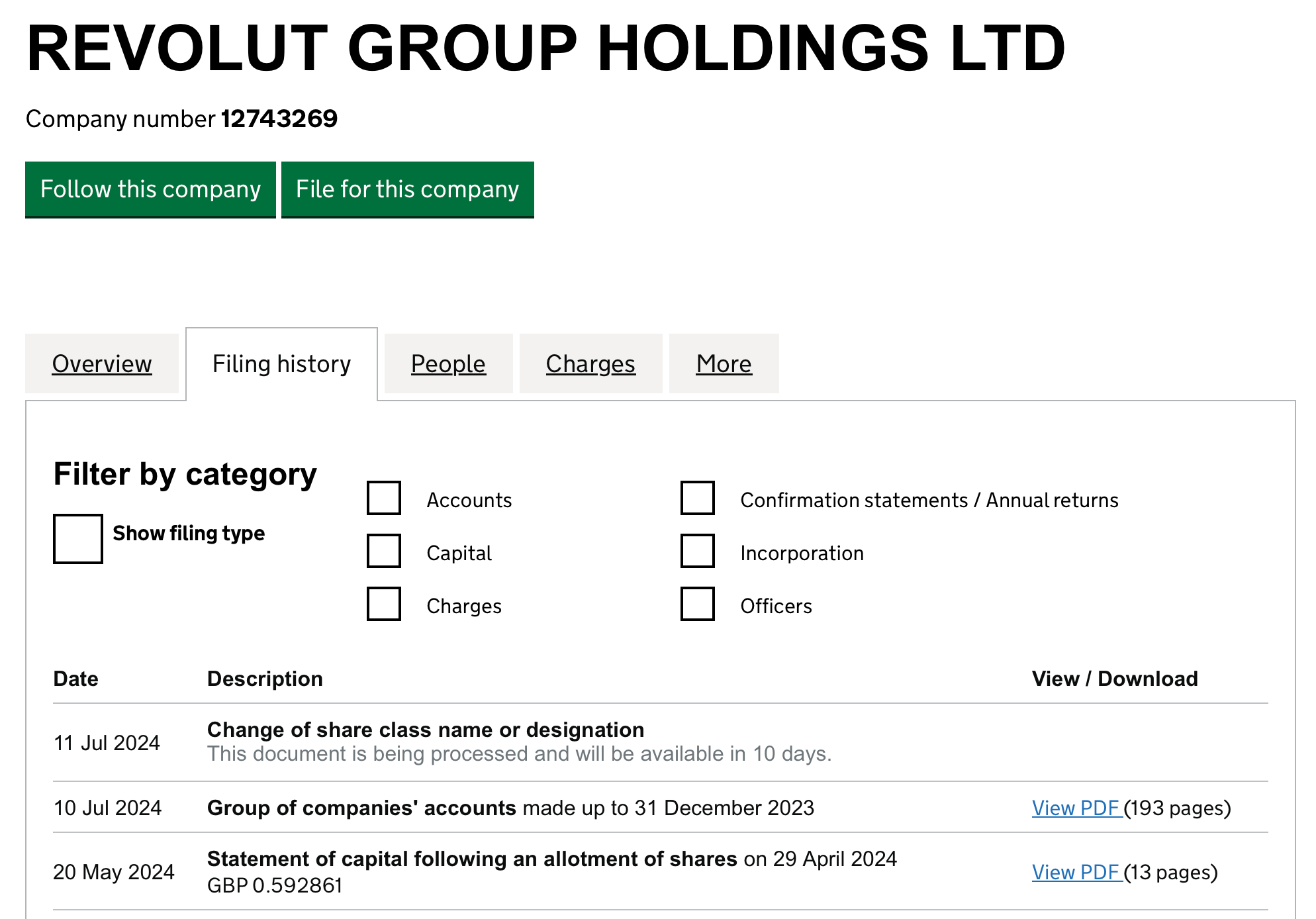

Revolut has filed a change of share class document with companies house. This could be the merging of all classes to one ordinary stock type as stipulated by the BoE as a hurdle to obtain the Banking License.

More info to follow once the document becomes available.

Have a great start to the week and I'll be back in your inbox with more FinTech industry news tomorrow!

Cheers,

Join my Telegram channel for instant access to daily updates and exclusive breaking news from the FinTech industry. Connect with fellow FinTech Fanatics and stay ahead with the latest trends and insights.

FINTECH NEWS

🇮🇹 Adyen, in collaboration with Mastercard, will support Tot in managing business expenses. Through this collaboration, they will assist companies in their administrative management by providing a tool that enables entrepreneurs to simplify business expense management and enhance the autonomy of their collaborators.

🇬🇧 Nuvei introduces off-ramping of Digital Assets to cards via Mastercard Move in Europe. Nuvei's off-ramp solution with Mastercard is the latest example of its strategy to connect the worlds of traditional payments, open banking and blockchain technology into one seamless experience.

🇨🇴 Clara launches Insights, an AI tool to optimize business expenses. The new feature, powered by artificial intelligence, promises to unravel the mystery of corporate payments and help companies save money.

🇬🇧 Investing platform and provider of equity crowdfunding services Seedrs announced that it will officially start trading as Republic Europe. The platform will enable individuals to invest in startups, growth companies, and VC funds, while also helping entrepreneurs raise capital from communities, angels, and institutional investors.

🇨🇴 FinTech AAvance launches virtual and physical debit card targeting migrant population in the region. Magreth Gutiérrez, CEO of AAvance, explains the general features of this financial platform, who can benefit from it, and how it can help the unbanked population build a credit history.

🇮🇳 ixigo & AU Bank launch RuPay travel credit card with UPI integration, comprehensive insurance, and reward points. The card is designed to meet the needs of modern travelers, especially those from tier 2,3 & 4 cities.

PAYMENTS NEWS

🇲🇾 AFFIN BANK partners with ACI Worldwide to modernise payments for Malaysian businesses. The new enterprise payments platform streamlines and enhances payment efficiency by consolidating all payment instructions from various channels into a centralized system, handling both high-value and low-value payments.

🇧🇷 On the same day that 99Pay received its license to operate as a Payment Institution (PI), a leak of Pix keys was also revealed. The Central Bank declared on July 10, that no sensitive data had been leaked, only registration data. The issue was caused by "occasional system failures" within the institution.

🇦🇺 GoCardless, the bank payment company, has announced a strategic partnership with insurance software platform ICE InsureTech, to deliver faster and seamless automated payment collection for insurance companies in Australia and New Zealand.

🇺🇸 Finix launches New No-Code and Low-Code Payment features. The new tools enable businesses to rapidly build and configure reliable and tailored payment experiences. More on that here

🇮🇳 Walmart-owned Indian eCommerce marketplace Flipkart added new ways for customers to pay bills and recharge payments while shopping on the platform. The company has added FASTag, direct-to-home recharges, landline, broadband and mobile prepaid bill payments to its app, Flipkart said in a press release.

🇦🇪 Ajman Transport and Visa collaborate to implement contactless payment on buses. The agreement aims to enhance cooperation by forming a partnership to achieve strategic goals and streamline the passenger experience with the country's first contactless payment system in transportation.

🇺🇸 Billtrust teams Up with Visa to extend Business Payments Network (BPN) collaboration. Visa will continue to offer BPN access to its financial institution clients to streamline the B2B digital payments process for their corporate customers.

🇪🇺 European Taxi app FREENOW has integrated Alipay+ cross-border mobile payment solutions with its taxi cab services in seven European countries: Spain, Germany, Ireland, Italy, France, Greece and Austria. The partnership improves the travel experience for Asian visitors to Europe, benefiting from peak summer tourism.

OPEN BANKING NEWS

🇳🇬 African open finance platform Mono launches data enrichment API. The platform adds value and insight to transaction data, and enables businesses to meet and exceed the expectations that customers have of modern financial services today.

REGTECH NEWS

🇩🇪 IDnow introduces two new eSignature products. InstantSign and eID eSign. InstantSign speeds up signing processes with a reusable identity, while eID eSign enables identity verification and digital signing using NFC technology. Find out more

🇮🇩 Sumsub bolsters presence in Southeast Asia with new partnerships. Sumsub, a global verification provider, has announced strategic partnerships with several resellers in Southeast Asia including Nexus Technologies in the Philippines, PT Secure Pasifik Teknologi in Indonesia, and Spectrum Edge in Malaysia.

🇺🇸 On Wednesday, July 17, global risk and compliance technology leader Unit21 will bring together the world’s top anti-money laundering, risk and fraud prevention experts for its inaugural Fraud Fighters Virtual Summit. This one-day event builds upon last year’s Fraud Fighters Manual which brought industry perspective together in an actionable book.

DIGITAL BANKING NEWS

🇨🇭 Finastra completes Swiss Interbank Clearing instant payments readiness project. Using Finastra’s cloud-based Service Bureau offering, Swiss banks can seamlessly transition to facilitating instant interbank payments. It is expected that the 50 largest banks must be able to facilitate instant interbank payments in Switzerland and Liechtenstein by August this year.

🇬🇧 Revolut has just filed a change of share class document with companies house. This could be the merging of all classes to one ordinary stock type as stipulated by the BoE as a hurdle to obtain the Banking License. Read more

🇺🇸 JPMorgan notches record profit on Visa gain, dealmaking jump. “There has been some progress bringing inflation down, but there are still multiple inflationary forces in front of us: large fiscal deficits, infrastructure needs, restructuring of trade and remilitarization of the world,” CEO Jamie Dimon said. “Therefore, inflation and interest rates may stay higher than the market expects.”

🇵🇰 Paysys Labs partners with Raqami Islamic Digital Bank Pakistan to revolutionize digital payments in Pakistan. The collaboration aims to develop an innovative digital payment solution integrating real-time payment systems such as RAAST.

🇩🇪 German bank Solaris SE faces financial penalties if it doesn’t meet deadlines for fixing controls, after failing to do so for years. Solaris hasn’t fully remedied issues it was ordered to address in 2022, and new problems have since cropped up too, the country’s financial watchdog BaFin said in a statement.

🇺🇸 Banks in Synapse mess make progress toward releasing deposits of stranded FinTech customers. Staff of Evolve Bank & Trust and Lineage Bank in particular have made headway after hiring a former Synapse engineer late last month to unlock data from the failed FinTech middleman, a person briefed on the matter said.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase launches wallet web app for “Everything Onchain.” According to a statement from Coinbase executives, the platform aims to be a "one-stop destination" for interacting with people, communities, and businesses within the blockchain ecosystem.

🇺🇸 Binance has $115B in user crypto — only 20% of it is stablecoins. Despite the Securities and Exchange Commission dropping its probe into Paxos over its Binance-branded stablecoin (BUSD), Binance appears largely unaffected. Explore more

🪙 Solana protocol tops Ethereum in daily revenue thanks to $51bn memecoin craze. Pump. fun dethroned Ethereum in daily revenue for the time ever recently. The protocol is used to generate and trade memecoins on the Solana and Blast blockchains and has generated over $51.3 million in revenue since its inception in January.

DONEDEAL FUNDING NEWS

🇩🇪 Berlin-based brokerage-as-a-service platform lemon.markets has raised €12 million in a funding round led by CommerzVentures. The new funding will be used to introduce more partners and products, while the company also plans to expand across Europe in 2025.

🇦🇺 The Commonwealth Bank’s venture-scaling arm, x15ventures, is seeking startups reimagining the customer and employee experience with data and artificial intelligence (AI) for its annual Xccelerate program, which helps early-stage founders explore pathways to partnership with the Bank.

🇸🇬 FinTech company Partior raised more than US$60 million in a series B funding round led by Peak XV Partners (formerly Sequoia Capital India &SEA). The investment will help build new capabilities including intraday forex swaps, cross-currency repo agreements, a programmable liquidity manager, and "just-in-time" multibank payments.

M&A

🇺🇸 Private equity firms Bain Capital and Reverence Capital have agreed to buy Envestnet in a deal that values the provider of wealth management technology and data at $4.5 billion. The agreement is slated to close in the fourth quarter, and will see shareholders receive $63.15 in cash for each share.

MOVERS & SHAKERS

🇺🇸 Clear Street welcomes Edward Tilly as president. Tilly will work closely with Chris Pento, Clear Street's Chief Executive Officer, as they lead Clear Street through the next phase of growth. Tilly will report to Clear Street’s Board of Directors. Read on

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()