Revolut Reaches 10M UK Customers, Ties with Monzo

Hey FinTech Fanatic!

Big news from Revolut today! The FinTech giant just hit 10 million retail customers in the UK, adding nearly 2 million new users this year alone. This milestone ties Revolut with its challenger bank rival, Monzo, which also boasts over 10 million UK customers. The competition for the top spot in the UK is heating up! 🔥

Francesca Carlesi, CEO of Revolut UK, called it a “tremendous achievement,” noting that the UK is Revolut’s biggest market, where the FinTech was founded in 2015. Globally, Revolut now has over 45 million customers and recently reported annual revenues of $500 million from its business accounts.

In comparison, Monzo also has 10 million UK customers, while Starling trails with 3.6 million. For context, Barclays leads with 20 million UK retail customers, followed by Lloyds with 15 million and NatWest with 19 million.

Cheers,

FINTECH NEWS

🇩🇰 Revolut is piloting a new standalone investment app in Greece, Denmark, and the Czech Republic. A new app has appeared on the app download marketplace with a new logo color. Learn more

🇳🇬 GTCO’s FinTech HabariPay begins recovery of ₦1.1 billion mistakenly disbursed to thousands of account holders in 2023. A federal high court in Lagos granted an application for over 40 financial institutions to restrict accounts that received those funds.

🇺🇸 Credlix goes global: Launches in the US and Mexico. This expansion aligns with Credlix’s broader vision of empowering SMEs in emerging markets to participate in global trade opportunities, reflecting India’s emphasis on boosting exports and enhancing global trade partnerships.

🇦🇪 Watermelon Ecosystem partners with Biz2X for embedded lending & invoice financing to Food & Beverage SMEs. This strategic partnership pairs Biz2X’s small business financing platform with Watermelon's digital ecosystem for restaurateurs and F&B entrepreneurs, a growing sector in the MENA region.

🇺🇸 Backbase announces strategic partnership with OneAZ Credit Union. Through Backbase's platform, OneAZ will offer a streamlined banking experience, expanding its services to include insurance, real estate, and other lifestyle options, creating a one-stop-shop for members.

🇲🇾 TNG Digital eyes Malaysian IPO in next 2-3 years, sources say. TNG Digital could potentially fetch the valuation of a unicorn - a startup with a market value of $1 billion or more - before the potential IPO, the sources added. Read on

🇺🇸 Robinhood nets Jersey sponsorship deal with NBA Memphis Grizzlies. This partnership extends beyond financial services and basketball, and is set to begin in the 2024–25 NBA season, and will place the FinTech giant’s logo on the Grizzlies’ uniforms.

🇱🇹 Local Lithuania media announced that kevin. has gone bankrupt. A court official confirmed that a bankruptcy case has been opened. According to public records, the company owes €420,000 to the state social insurance alone, not to mention delays in payments to employees and partners. Find out more

🌐 dLocal & MoneyGram to expand remittances across APAC, EMEA and LATAM. This partnership will help MoneyGram continue to expand its services into new markets across APAC and EMEA with future expansion plans for LATAM. This will further enhance the company’s digital receiving capabilities.

PAYMENTS NEWS

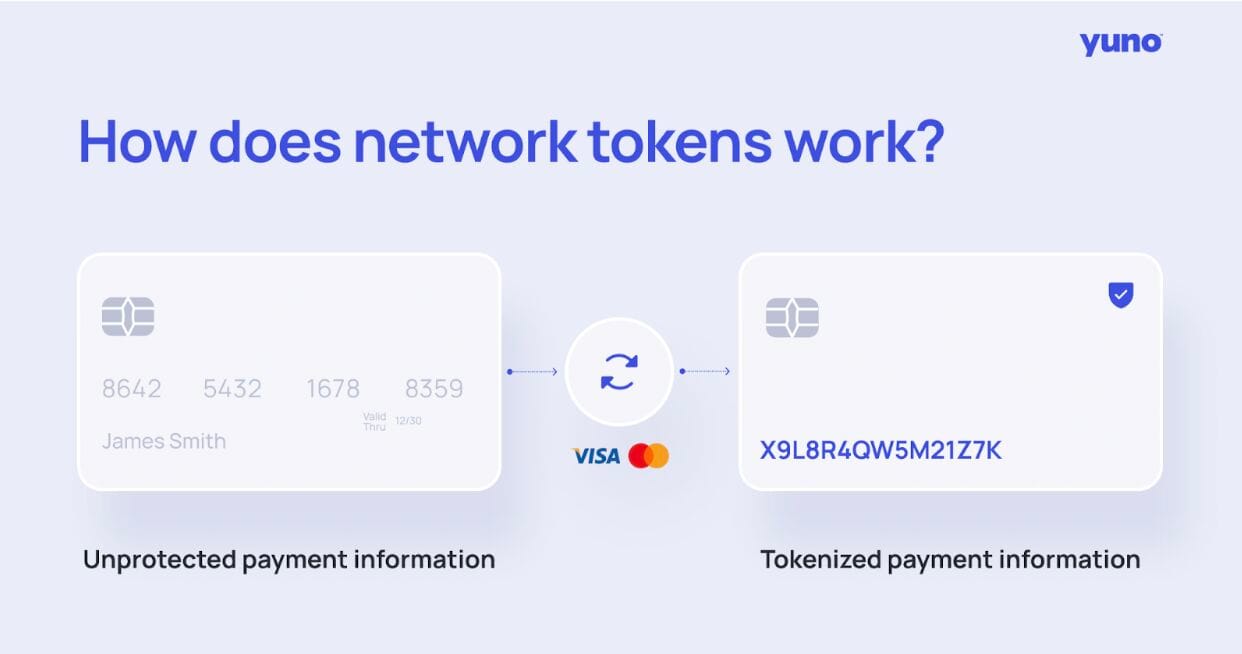

➡️ How do Network Tokens work? And why are they so fundamentally beneficial?

Let's dive in:

🇰🇪 Safaricom and Mastercard expand payment solutions via M-PESA for 600K+ merchants in Kenya. This partnership combines M-PESA's vast merchant network with Mastercard’s global payment system to deliver seamless, secure, and scalable payment solutions, allowing merchants to reach global markets.

🇺🇸 Adyen offers Cinemark moviegoers more payment options. The collaboration offers moviegoers increased payment options and ease of use, per a release. Adyen is powering payments on Cinemark’s website and mobile app, along with purchases made at the chain’s box offices, lobby kiosks and concessions counters.

🇮🇳 MobiKwik's ZaakPay integrates Meta to deliver payments on WhatsApp. Users are set to be able to conduct transactions leveraging MobiKwik Wallet, ZIP, and Pocket UPI, benefiting from increased flexibility and services that can meet their unique payment preferences.

🇳🇱 PayU has introduced Flash Pay, a biometric authentication solution for card payments. This solution combines the ease of a seamless payment experience with robust security measures, meeting both customer aspirations for convenience and banks’ stringent authentication requirements.

🇦🇪 Astra Tech launches ‘Send Now Pay Later’ remittance service on BOTIM in UAE. The innovative service, which the company claimed is the first of its kind in the Middle East and North Africa (MENA) region, offers instant international money transfers with the option to defer payment.

🇨🇳 Paysend introduces instant cross-border payouts to China UnionPay Cards. By introducing the new capability, Paysend intends to enable businesses to utilise the reach and reliability of its Enterprise single API to conduct cross-border transactions directly to UnionPay cards issued in China.

📈 Real-time cross-border payments FinTech Nium reports steady business growth. The company announced that its monthly payment volume grew by 3X in Oceania over the last year. This growth has been driven by increased adoption of its real-time cross-border payment solutions by financial institutions and spend management platforms.

OPEN BANKING NEWS

🇺🇸 Walmart is reportedly enhancing its pay-by-bank offering via a partnership with Fiserv. Under the new system, customers who make pay-by-bank transactions will see the purchase show up in their bank account balance right away, with Walmart receiving the funds instantly, the report said.

DIGITAL BANKING NEWS

🇬🇧 Revolut reaches 10 Million customers in the UK. Revolut’s largest market, and where the firm was founded in 2015, has gained nearly two million UK customers in 2024 and continues to grow. The company has over 45 million customers globally.

🇨🇭 FinTech platform iCapital to provide technology to HSBC global private banking. The solution will be fully integrated into HSBC’s platform “to digitalize the private market investment experience for its relationship managers, investment counsellors and operations teams.”

🇩🇪 Deutsche Bank settles Postbank row with another plaintiff. The settlement includes an additional payment €36.50 ($40.739) per share on the price Deutsche Bank paid at the time and also covers costs following legal guidelines. Read on

BLOCKCHAIN/CRYPTO NEWS

🇫🇷 Dfns launches Dfns wallet infrastructure availability on Temenos Exchange. This collaboration creates space for Dfns to become the first European digital asset infrastructure provider to integrate with Temenos, joining a select group that includes Wyden, Fireblocks, and Taurus.

🇺🇸 Louisiana first US state to officially embed crypto as a payment method. Louisiana State Treasurer, John Fleming, confirmed the integration of digital currencies as a payment method this week enabling Louisiana residents to have the option to pay for state services with their crypto wallets.

🇺🇸 SEC approves BlackRock's spot bitcoin ETF options listing. Options trading for BlackRock's fund iShares Bitcoin Trust has been approved with ticker symbol "IBIT", the regulator said in a notice last Friday.

DONEDEAL FUNDING NEWS

🇿🇦 Happy Pay secures USD 1.8 million in pre-seed funding. The company said that the pre-seed funding will be allocated to launching a range of new products, improving marketing efforts, and broadening Happy Pay's network of merchants. Additionally, it plans to grow its workforce strategically while prioritising expansion.

🇨🇳 Jack Ma-backed Ant Group Co. has raised $6.5 billion in loans to refinance an offshore credit line of the same size, as it expands its global operations, according to people familiar with the matter. Continue reading

🇺🇸 AtoB raises $130 million to fuel transportation payments services. “These milestones will allow us to better support truckers and the small businesses they represent — the backbone of America’s economy — with tools that allow for transparency and efficiency,” said the firm’s CEO.

🇺🇸 Solana-based Drift raises $25M to build 'SuperApp' for DeFi trading. The decentralized finance platform plans to build an array of financial services tools, including spot and derivatives trading and a predictions market.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()