Revolut Plans a Canada Comeback

Hey FinTech Fanatic!

Revolut didn’t throw in the towel—it’s making another run at the Canadian market with a completely new strategy.

The company is actively seeking a CEO to lead Revolut Canada interested in building something “from the ground up”, signaling a potential return after shutting down its Canadian operations in 2021. A significant portion of the role’s listed responsibilities focuses on regulatory matters, hinting that Revolut may be pursuing a banking license.

Unlike its previous Canadian presence, which relied on a prepaid card issued through a partner bank, Revolut may now be looking for direct control over its financial services.

This approach aligns with recent comments from CEO Nik Storonsky. Speaking in Helsinki last November, he reflected on the company’s regulatory stance, stating, “For a long time, I wanted to be as less regulated as possible, it was the completely wrong decision.”

Revolut is stepping back into the Canadian market, but the road ahead is just as steep—if not steeper—than before.

Its banking sector is dominated by five banks controlling 86% of assets, leaving little room for newcomers. Foreign banks need direct approval from the Minister of Finance for a Schedule II charter to obtain a banking license. Those that secure a license often settle into niche segments, adding another layer of complexity to Revolut’s path.

Read more global FinTech updates below 👇 and I'll be back tomorrow!

Cheers,

SPONSORED CONTENT

Time is running out! Get your ticket to the best event in FinTech.

INSIGHTS

➡️ FinTech startup launches plunge 83% in 2024, hitting a 15-year low. While transaction volumes remain strong, particularly in digital payments, which alone accounted for a staggering $11.55 trillion, VC investments and new FinTech startups have plummeted.

FINTECH NEWS

🇻🇳 Cake Digital Bank breaks even by meeting small needs. The Vietnamese digital bank credits its success to taking care of smaller financial needs such as quick loans and low-limit credit cards that traditional players have spurned. Read on

🇰🇷 Kakao Pay to end its currency exchange service. The company will end its pre-departure currency exchange solution for overseas travelers after six years. It will shift its focus from currency exchange to enhance QR payment services for international use.

🇺🇸 Interactive Brokers' trading activity rises. Client accounts grew to 3.54 million, reflecting a 32% year-over-year rise and a 3% increase from the prior month. The platform’s client equity declined 1% month-over-month to $587.8 billion but remained 31% higher compared to the same period last year.

PAYMENTS NEWS

🇵🇱 BLIK now available via Solidgate—Enhancing payment infrastructure for global merchants in Poland. This collaboration enables merchants using Solidgate to seamlessly offer BLIK, providing Polish consumers with a trusted and widely used payment method, ultimately enhancing checkout experiences and improving conversion rates.

🇲🇺 UnionPay International relaunches in Mauritius. This highlights the enduring relationship between Mauritius and China, two nations deeply connected through diplomatic, economic, and cultural ties. This reinforces its commitment to empowering businesses, fostering financial inclusion, and celebrating the island's rich cultural heritage.

REGTECH NEWS

🇫🇷 Pledg selects Trustfull to strengthen fraud protection in BNPL. This collaboration will empower Pledg and its portfolio of partners with advanced customer pre-screening capabilities, ensuring seamless purchasing experiences for consumers while effectively preventing credit fraud.

🇬🇧 Lloyds introduces cybersecurity tool to reduce false positives. By identifying shared characteristics, trends, and potential links between alerts, the system aims to improve the accuracy of threat detection. The tool cross-references data against known cyber-attack patterns to assess and determine the legitimacy of potential threats.

DIGITAL BANKING NEWS

🇵🇭 UnionBank eyes $800-M debt foray for digital bank. The bank said in a regulatory filing that the planned issuance was part of its $2-billion euro medium-term note program approved in October 2020. The program was upsized from $1 billion in November 2017, and it has so far raised $800 million.

🇬🇧 Allica Bank unveils new brand identity amid growth push. The bank has replaced its previous shield emblem with an orange bowler hat, which it states represents the combination of traditional relationship banking with technological capabilities.

🇺🇸 Dave shares surge as neobank beats estimates, raises outlook. The company reported adjusted earnings per share of $2.04 for the fourth quarter, surpassing the analyst estimate of -$1.13. Revenue for the quarter came in at $100.9m, up 38% YoY and well above the consensus estimate of $79.75m.

🇺🇸 Citi copy-paste error almost sent $6 billion to wealth account. The near-miss in Citigroup’s wealth-management business magnified the intended amount by more than a thousand times and was detected on the next business day. Keep reading

🇨🇦 Revolut is currently recruiting for the position of CEO of Revolut Canada to lead its reentry into the Canadian market and potentially secure a banking license. The London-based global neobank is looking for an executive interested in building something “from the ground up”.

🇺🇸 SoFi announces $697 million loan secularization. This transaction was a “co-contributor securitization” with collateral made up chiefly of loans previously placed with loan platform business partners. The company noted that its platform business generated $2.1 billion in personal loan volume last year.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase demands SEC to disclose full cost of crypto crackdown. The exchange has filed a FOIA request seeking details on the SEC’s spending on crypto-related investigations and enforcement actions. It claims these details were missing from documents provided to Congress and is willing to cover processing fees to obtain them.

🇺🇸 Coinbase and Gemini CEO throws support behind Bitcoin-only US crypto reserve. Brian Armstrong and Tyler Winklevoss say that Bitcoin is a clear “successor to gold,” making it most suitable for inclusion as a US reserve asset. Click here to learn more

🇺🇸 FTX and Alameda wallets unstake $431M in SOL. Wallets belonging to the defunct crypto exchange FTX and bankrupt trading firm Alameda Research unstaked over 3 million Solana tokens, its largest SOL unlock since it started selling off company tokens in November 2023.

PARTNERSHIPS

🇺🇸 Aeropay expands banking network through partnership with Regent Bank. The bank joins Aeropay’s growing ecosystem of banking partners, offering clients and end-users access to ACH, Real-Time Payments (RTP), and FedNow services. Aeropay’s banking network includes a diverse group of financial institutions, allowing businesses to leverage cutting-edge payment technologies.

🇨🇴 Samsung Pay joins Apple and Google digital wallets with the Lyra platform. This move aims to enhance the payment experience for users in Colombia by expanding Samsung Pay’s capabilities and providing more options for seamless transactions through digital wallets.

🌍 Wizz Air announces partnership with Revolut. With Revolut Pay, customers have access to booking flights with Wizz Air without the need to input their payment details. Wizz Air customers can earn up to £25 when they join Revolut and receive 10x RevPoints for each Wizz Air purchase until 4th April 2025.

🇹🇷 Turkish investment bank BankPozitif taps Taurus for crypto custody. The partnership arrives as Turkish authorities advance regulatory frameworks for digital assets, which BankPozitif hopes will create new opportunities for early adopters. Read more

🇨🇦 FinTech Cadence and Visa join forces to support payment innovation. Layial El-Hadi, Executive Director at FinTech Cadence, emphasized that, through this partnership, they are continuing their mission to advance the financial system and better serve Canadians.

🇦🇪 Deem Finance and J.P. Morgan partner with a milestone $400 million securitization facility. The transaction is structured to provide significant flexibility, allowing funding to adjust to growth in the portfolio size and composition to support Deem’s dynamic growth strategy.

🇬🇧 OakNorth teams up with FinTech North to bolster support for local FinTechs. By forging a partnership with OakNorth, FinTech North aims to ensure that FinTech firms get the support they need to ensure future growth and enable them to scale efficiently.

🇺🇸 TenantCloud introduces Stripe Capital to provide fast, flexible financing. This feature provides a seamless way to secure funding for property-related expenses, such as upgrades, emergency repairs, or expansion – directly within the TenantCloud platform.

DONEDEAL FUNDING NEWS

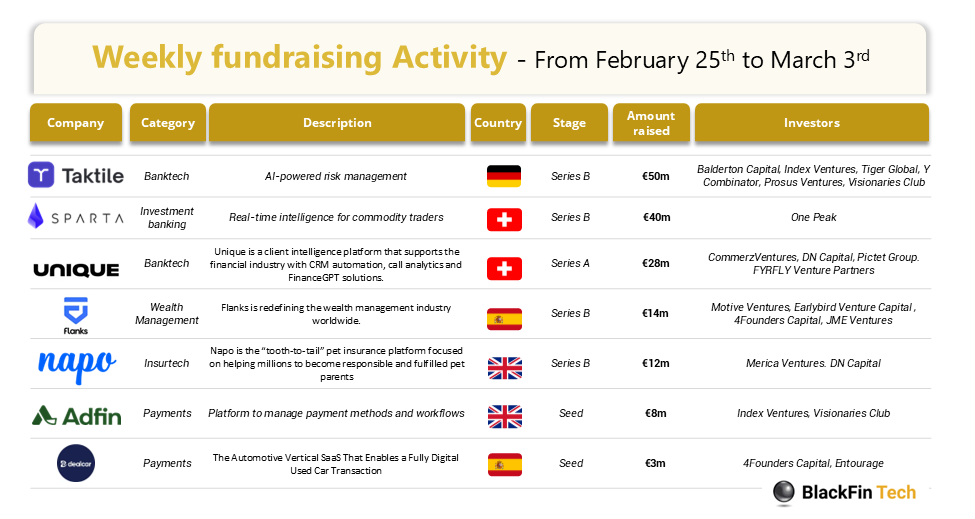

💰 Over the last week, there were 7 FinTech deals in Europe, raising a total of €155 million, 2 deals each in Switzerland, Spain and the UK, as well as one deal in Germany.

🇱🇹 myTU raises €10m in oversubscribed series A round to accelerate growth. This new funding will support product expansion, the development of acquiring and lending services, and regulatory preparations for securing a full banking license from the Bank of Lithuania.

🇬🇧 WealthTech start-up Belong raises over £489k in crowdfund campaign. Funds from this round will be used to drive high-demand product enhancements, to scale customer acquisition, and to forge strategic distribution partnerships in the U.K.

🇮🇳 Indian B2B FinTech Rupifi to raise $146m in bridge round. The company plans to use the new capital to support its growth and business expansion. The funding has been structured for investors to initially subscribe to US$2 million. The remaining US$144 million in unsubscribed shares will be disposed of.

🇬🇧 Lenkie secures £49 million in Series A funding. With fresh capital and strong industry momentum, the firm plans to enhance its data-driven underwriting models, expand partnerships with leading platforms, and explore new markets. The funding round includes £4 million in equity and a £45 million debt facility.

🇫🇷 Flowdesk finalizes $102m equity financing round with extension from HV Capital and debt from BlackRock-managed funds. Capital raised will strengthen its position as a leading digital asset trading and technology firm and accelerate global expansion to meet growing demand for its liquidity provision and OTC trading services.

🇬🇧 Bill-split app Cino to expand to UK on €3.5 million funding round. Alongside the expansion into the UK, CEO Elena Churilova says Cino will soon launch new shared payment features and explore new verticals including B2B payments and rent. Read more

🇮🇳 FinTech startup PassEntry raises €6.2 million to expand the issuance of digital passes. This investment is expected to enable PassEntry to grow its customer base by 300% and expand into five new countries with a particular focus on North America and APAC.

M&A

🇮🇳 PayPal-backed Mintoak strikes India's first e-rupee related deal worth $3.5 million. The Indian startup, which provides merchant payment services to lenders, has bought Digiledge, marking the first acquisition in the nascent central bank digital currency space.

🇧🇷 Nayax acquires UPPay in Brazil for around $5.3m. The company says the acquisition will enable the firm to “accelerate growth throughout Latin America”, with an initial focus on the Brazilian self-service market. Continue reading

🇪🇸 Santander acquires Tresmares Capital to boost growth in alternative asset management. The acquisition of this platform is one of the pillars of the bank's growth strategy in alternative asset management, promoting private debt and funds of funds verticals.

MOVERS AND SHAKERS

🇺🇸 Copper hires Tammy Weinrib as CCO for Americas as it expands in U.S. Weinrib will lead Copper's licensing efforts in the U.S., aligning with the company's expansion strategy in the region. She brings extensive experience from previous roles at Binance.US and Gemini.

🇬🇧 HSBC kicks off search for new UK CEO, after appointing Ian Stuart to a newly created role in charge of customer engagement and culture. The move is part of the lender's transition to a "simpler, more dynamic, agile organisation" by operating through four key businesses, HSBC said in a statement.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()