Revolut is Rolling Out Dedicated Crypto Payment Cards

Hey FinTech Fanatic!

Revolut is rolling out dedicated crypto payment cards for spending on everyday items.

Integrated with Apple Pay and Google Pay, the new virtual cards enable users to pay in person and online for shopping using crypto, from big budget items to everyday essentials, such as the daily commute and morning coffee.

Users can set up their cards with a few taps on the Revolut app and select which cryptocurrency they choose to spend from.

Revolut says users won't be charged exchange fees on their shopping, although 'fair usage fees' may be charged depending on the cardholder's premium subscription options.

To launch the new crypto card designs, Revolut collaborated with Own The Doge, the legal owner of the Doge IP and image. Embracing the ethos of d.o.g.e. (doing good every day), they have teamed up to make charitable donations to the Royal Society for the Prevention of Cruelty to Animals and Save the Children.

Cheers,

SPONSORED CONTENT

FEATURED NEWS

🇧🇷 Airwallex is in the "early stages" of securing a license to operate in Brazil and hopes to be operating in the Latin American country by 2025 "at the earliest," said Ravi Adusumilli, executive general manager of the Americas for Airwallex.

#FINTECHREPORT

📊 8 ways to optimize interchange and scheme fees 👉 This guide by checkout.com offers a quick overview of strategies to reduce overspending. Learn more

INSIGHTS

🇬🇧 Three men have pleaded guilty to operating a subscription-based Web service in the UK that enabled criminals to circumvent One-Time-Passcode (OTP) anti-fraud checks. Here is how they did it: Click here

🇸🇬 Singapore to empower police to stop voluntary bank transfers to scammers. Singapore's Ministry of Home Affairs is opening consultations on new rules that would empower the police to order banks to restrict the banking transactions of people who refuse to believe that they are being scammed.

FINTECH NEWS

🇦🇷 Payments service processor Open Payment Technologies Ltd has announced the expansion of its digital wallet services, Kuady, into Argentina. It brings an advanced, user-friendly experience that ensures secure and efficient money management through an e-wallet app.

🇧🇷 Vivo receives authorization from BC to have credit FinTech. Vivo Pay, the financial solutions platform of the telecommunications company Vivo, has just received authorization from the Central Bank (BC) to operate as a Direct Credit Society (SCD), a regulated type of credit FinTech.

PAYMENTS NEWS

🇺🇸 PayQuicker has been named a finalist in the Best Cross-Border Payments Solution category by FinTech Futures Paytech Awards USA. Its Earned Income Access feature, Insta-Pay, has also been named a finalist in the Best Real-Time Payments Solution category.

🇬🇧 Zilch surges to profitability, surpasses $130M in revenue, and welcomes Mark Wilson to the Board. Zilch has reported its first month of operating profit and a revenue run rate exceeding $130 million (£100 million). These achievements come within four years of launching its innovative consumer payment platform. Read on

🇮🇳 Visa has unveiled an array of innovative payment products and solutions during the Global FinTech Fest 2024. These advancements, developed in collaboration with a range of partners, are set to drive digital payment adoption across India by streamlining payment processes and enhancing transaction security and customer experience.

🇬🇧 DNA Payments launched its new Merchant Portal App for iOS and Android, bringing the full functionality of DNA Payments’ Merchant Portal to any smartphone. The app lets merchants accept online payments, manage their finances, and oversee transactional data, all from their mobile device.

🇬🇧 McLear shuts down pre-paid payment ring programme. The payments vendor is closing down its flagship Ring pre-paid programme, blaming the increasing complexity and cost of maintaining the product.

🇲🇾 Fingular launches buy now, pay later business in Malaysia under the Ahapay brand. AhaPay is set to revolutionize the way Malaysians shop. It enables consumers to purchase a wide range of products from home appliances to fashion items while easing their monthly cash flow.

🇦🇺 Square unveiled Square Kiosk, a fully integrated software, hardware, and payments solution that enables self-serve ordering for hospitality businesses. This is the latest technology from Square as it continues to invest in its hardware and software offerings for Australian hospo businesses.

💳 Mastercard wants to get rid of card numbers for online shopping. Mastercard is expanding its efforts to eliminate the use of credit card numbers when customers make purchases online in a bid to fight fraud.

OPEN BANKING NEWS

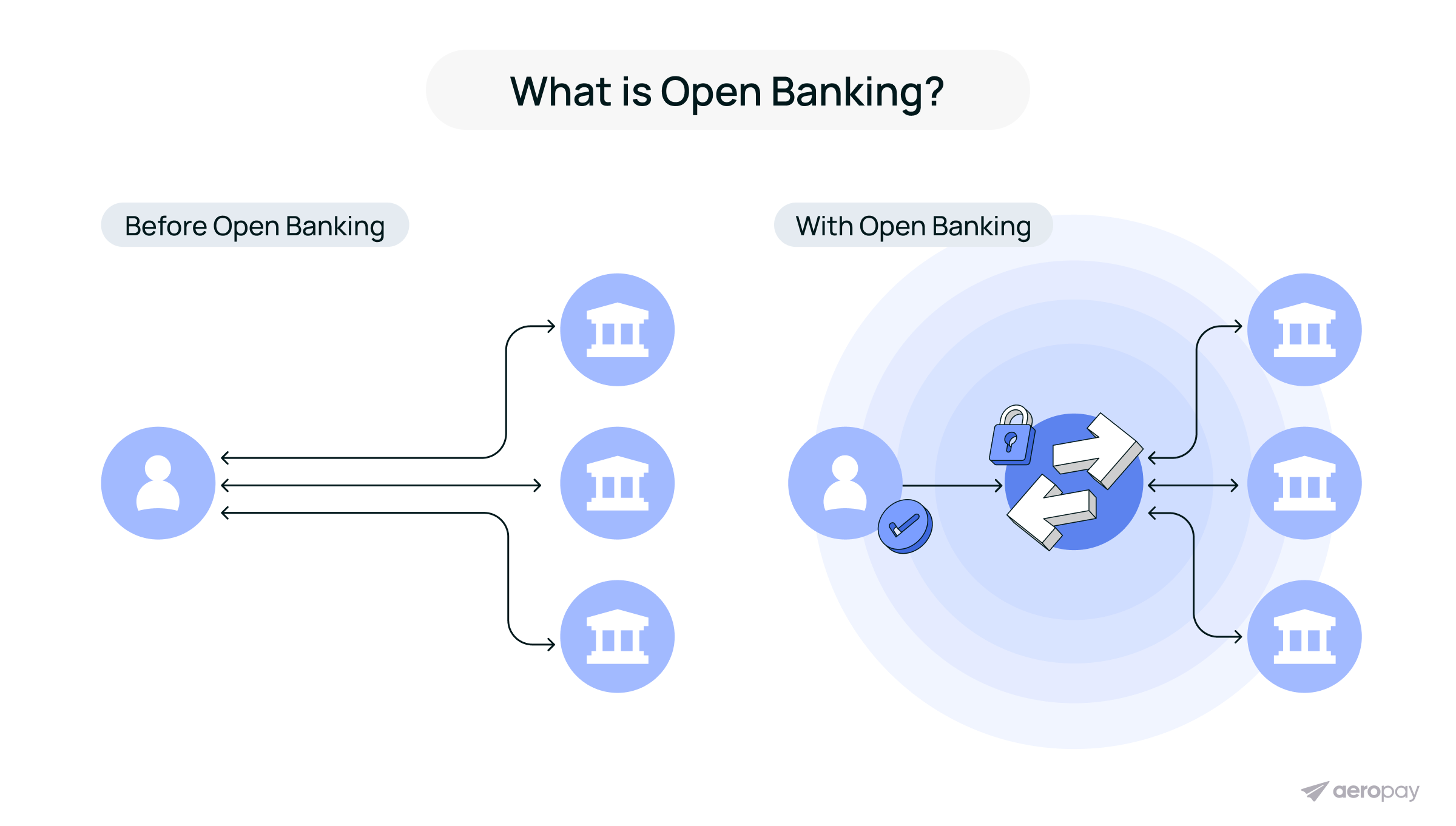

🇬🇧 Open Banking in the U.S. | A Guide to America’s Next Generation of Consumer Financial Data.

🇸🇦 Saudi Central Bank (SAMA) has announced the issuance of the second release under the Open Banking Framework, focused on the Payment Initiation Service (PIS). According to the announcement, the new release is part of SAMA's ongoing efforts to strengthen Saudi Arabia's FinTech ecosystem.

🇸🇦 SAMA permitted three new FinTech startups to test their innovative solutions in SAMA's regulatory sandbox. “XSquare" and “NeotTek" are authorized to launch an Open Banking platform, and “MoneyMoon" is authorized to launch a peer-to-peer lending platform. More here

REGTECH NEWS

🇲🇾 Sumsub establishes local data processing infrastructure in Apac region. Sumsub, a global full-cycle verification platform, has announced that Local Data Processing (LDP) capabilities are now available in the Asia-Pacific (APAC) region, specifically in Singapore, Hong Kong, Indonesia, and the Philippines.

🇺🇸 Lucinity, a FinTech in AI software for financial crime compliance, has secured a second patent from the US for its proprietary federated learning technology, which provides a unique approach to allow global financial systems to share algorithmic learning patterns without having to share sensitive data.

DIGITAL BANKING NEWS

🇨🇳 Silicon Valley Bank exits China joint venture, local partner takes full control. Silicon Valley Bank's Chinese joint venture will become a wholly owned unit of Shanghai Pudong Development Bank, following approval to change its name to Shanghai Innovation Bank.

🇸🇦 Digital challenger barq signs up 1 million users within 21 days of launch. This remarkable achievement positions barq as the fastest-growing private wallet globally, outside of China. Continue reading

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Revolut is rolling out dedicated crypto payment cards for spending on everyday items. Integrated with Apple Pay and Google Pay, the new virtual cards enable users to pay in person and online for shopping using crypto, from big budget items to everyday essentials, such as the daily commute and morning coffee.

🇳🇬 Crypto exchange Quidax secures Nigerian provisional license. Quidax announced that it has become the first crypto exchange to receive a provisional operating license by Nigeria’s Securities and Exchange Commission (SEC) as a Digital Assets Exchange.

DONEDEAL FUNDING NEWS

💰 Last month, we saw 20 official FinTech deals in Europe, raising a total of €351.8 million, with 9 deals in the UK, 3 in Germany, 2 in Switzerland, 1 in France, 2 in Lithuania, 1 in Estonia, 1 in Denmark and 1 in Norway. Check out the complete BlackFin Tech overview article

🇦🇪 Ziina banks $22M as growth explodes for the UAE-based FinTech for small businesses. Ziina’s growth has come primarily through product-led efforts without a dedicated sales team. According to the chief executive, 55% of its customers have come organically, while the rest have come from B2B referrals.

🇮🇳 User data storage startup Medront has raised INR 1.06Cr in a Pre-Seed Round led by Inflection Point Ventures. The funds will be allocated to product development, growth efforts, user acquisition, onboarding DAAS clients, and miscellaneous expenses, ensuring efficient user acquisition and strong retention.

🇬🇧 UK-based AI investment platform Stratiphy secures £350K pre-seed funding. The funding will enable the startup to accelerate its growth and continue its mission of transforming wealth management through innovative technology.

M&A

🇬🇧 UK-based business bank Allica has announced its acquisition of bridging lending Tuscan Capital, aiming to further extend its commercial finance product offering. The financial institutions are expected to share more insights on how they will be developing their bridging proposition in the following weeks.

🇸🇦 Tabby to acquire Saudi FinTech Tweeq. The acquisition will enable Tabby to expand its financial product suite with Tweeq’s digital wallet to offer its customers digital spending accounts, cards and money management tools.

🇩🇰 Danish FinTech start-up MyMonii has closed down and has been acquired by new owners, bringing to an end its eight-year stint on the market. CEO and founder Louise Ferslev stated that MyMonii has been given a "second chance" through its acquisition by new owners, whose identities and plans for the company remain undisclosed.

🇺🇸 Carta’s ill-fated secondaries business finally found a buyer. Stock-trading startup Public has acquired the brokerage accounts of Carta’s secondaries business, TechCrunch has confirmed. In an emailed statement to TC, Public said the customers of Carta Capital Markets who it acquired have a right to opt out.

MOVERS & SHAKERS

🇬🇧 Wise executive joins OakNorth board. Digital business bank OakNorth has appointed Nilan Peiris, the chief product officer of Wise as a non-executive director. Peiris, who has been working with the global remittance FinTech for more than a decade, will join the board at OakNorth as it expands internationally.

🇬🇧 The Bank of London has announced that Anthony Watson is stepping down as chief executive eight years after founding the firm. The bank announced that Watson will transition to a new role as “founder & senior adviser” and remain a non-executive director of The Bank of London Group, as well as a shareholder. Chief Risk and Compliance Officer Stephen Bell has been appointed as the new CEO, subject to regulatory approval.

🇨🇭 Swiss FinTech Yapeal appoints Michael Eidel as new CEO and secures fresh capital. Eidel brings extensive experience from listed financial institutions and technology companies. He already played a role in shaping Yapeal's strategic realignment over the past year.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()