Revolut is Now Applying for a Banking License in Colombia

Hey FinTech Fanatic!

Revolut has officially announced its move to obtain a full banking license in Colombia.

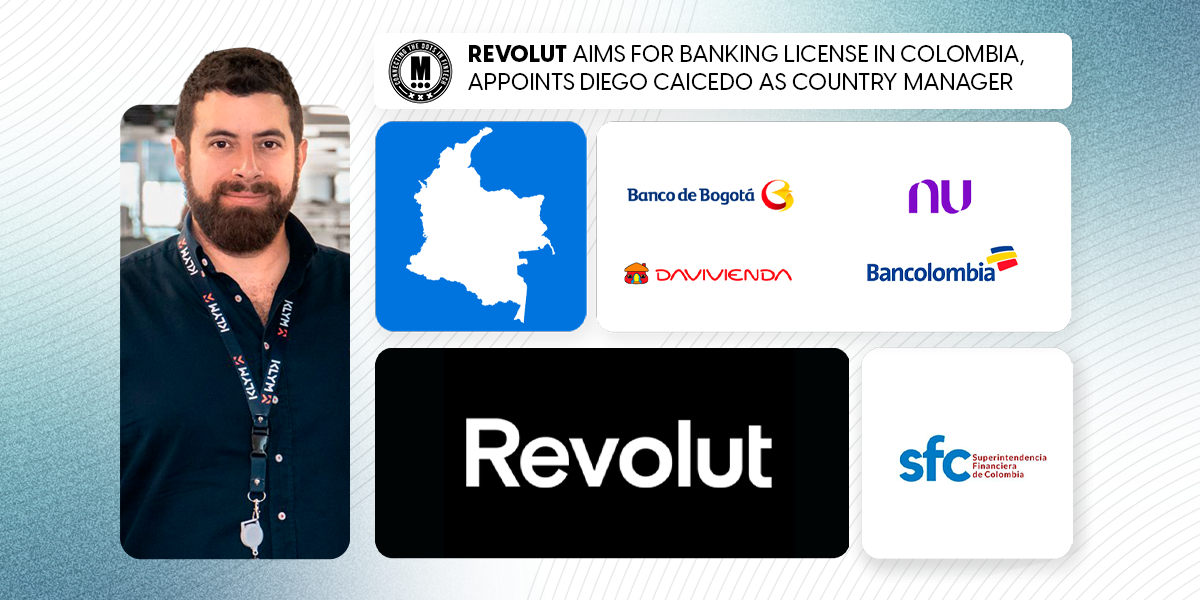

This move places them directly in competition with over 60 financial institutions, from industry giants like Bancolombia and Banco de Bogotá to digital disruptors like Nu. And they’re not stopping there – they've appointed Diego Caicedo, a familiar face in the Colombian tech scene and co-founder of KLYM, as their Country Manager.

Caicedo shared with Forbes the unexpected beginning of his Revolut journey: a 4 AM message that he initially mistook for spam. But with a vision to reshape Colombia’s banking landscape, Revolut is diving in, emphasizing remittances, transparency, and services for the independent workforce.

Having already secured a banking license in Mexico and entered the Brazilian market last year, Revolut’s Latin American expansion seems unstoppable. It’ll be fascinating to see how they navigate Colombia's financial ecosystem. This could very well mark a new era for FintTech in the region.

Stay tuned, there’s more FinTech buzz coming your way!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

PODCAST

🎙️ What really happened at Synapse according to Founder Sankaet Pathak in Lex Sokolin's podcast: They discuss what happened at Synapse, the issues around its bank partner Evolve and others, and the overall lessons from the BaaS space. Tune in now

PAYMENTS NEWS

🇭🇰 Checkout.com has partnered with Octopus to make the widely used Hong Kong payment method available for online transactions. Checkout.com is the first global PSP to offer Octopus as an online payment option. This collaboration will simplify online checkout for merchants while addressing the growing demand for digital-first payment solutions.

🇺🇸 Aeropay and Worldpay partner to advance gaming payments. Aeropay's proprietary account-to-account platform can now be integrated with Worldpay’s extensive merchant network — offering advanced A2A payments and payouts to U.S. gaming operators.

🇩🇪 FOURSOURCE selects Mangopay to transform textile marketplace experience. The partnership with Mangopay will help to take FOURSOURCE to the next level, by allowing them to offer the security and trust that buyers and sellers are looking for in what is a highly fragmented textile industry.

🇿🇦 Mastercard targets real-time card payments in South Africa. The firm says it is rolling out new "standards and solutions" which will accelerate the processing speed for card transactions. ACI Worldwide is onboard to help acquirers adopt the real-time transaction processing standards.

🇺🇸 Stripe deepens collaboration with NVIDIA to enhance Stripe’s AI-powered capabilities and expand global access to NVIDIA’s AI platform. By giving businesses easier access to NVIDIA's GPUs and AI tools, the partnership enables faster innovation and growth.

🇺🇸 Ansa partners with Plaid to lower payment costs with Pay by Bank. This partnership aims to provide merchants, especially coffee shops and quick-serve spots, with cost-effective payment solutions to boost profitability and improve the overall customer experience.

🇪🇺 Worldline moves into embedded payments market via a partnership with Online Payment Platform (OPP), a provider of payment technology for platforms and marketplaces. The collaboration will roll out across Europe, combining OPP's payment technology with Worldline's acquiring, acceptance expertise, and POS capabilities.

🇺🇸 Square launches Orders Platform. This new platform fundamentally changes how the company builds products and will provide expanded commerce capabilities like Pre-Auth and Bar Tabs to sellers of all sizes across verticals in the U.S.

🇸🇪 Klarna Director says he was ousted over objection to CEO’s bonus. Board member Mikael Walther claims he was voted out after challenging governance decisions. He has urged investors to vote against his removal at an upcoming meeting.

🇮🇹 SEPAmail.eu and CBI joins their IBAN-Name Check expertise at the service of their respective communities in order to offer an interoperable solution to fight against fraud. This partnership enables the Italian and French communities, via their PSP, to secure their cross-border payments.

🇬🇧 Privalgo partners with Experience UK to provide currency exchange solutions. As part of their collaboration, Privalgo is set to offer Experience UK members access to its customised solutions for global payments, currency risk management, and multi-currency accounts.

OPEN BANKING NEWS

🇬🇧 ASK Global partners with Yaspa to bring Open Banking to PINTO machines in the UK. This collaboration will see Yaspa integrated into ASK Global's PINTO machines, which are widely used in some of the UK's largest and most popular land-based casinos and betting shops.

DIGITAL BANKING NEWS

🇲🇽 Mexican FinTech Stori has announced the launch of Stori Inversión+, a new fixed-term investment product offering an annual return rate of up to 15.50%. This product is aimed at individuals seeking financial stability and secure growth, allowing users to invest from as little as 100 pesos.

🇮🇪 Monzo Bank pumps €4m into new Irish unit. The news follows Monzo CEO TS Anil’s announcement that the company is establishing its EU base in Ireland, which will serve as its gateway to European markets. Click here to learn more

🇨🇴 Revolut officially announced that they are in the process of applying for a banking license in Colombia, following its entry into Brazil last year and the acquisition of a banking license in Mexico in April. Country Manager, Diego Caicedo, explains Revolut's plans for Colombia in this insightful interview with Forbes.

🇺🇸 Venmo announced a new, highly requested feature that allows users to schedule one-time or recurring payments or requests with friends and family on Venmo. Users can use the new feature to set up one-time or recurring payments monthly, weekly, or bi-weekly in advance.

🇱🇹 INDEXO launches new fully-fledged banking experience for Latvians, powered by Mambu’s cloud banking platform. Leveraging Mambu’s core banking platform, powered by Microsoft Azure and integrated by Fintecor, INDEXO Bank now has a scalable, cloud-native foundation for deploying financial offerings.

🇺🇸 Treasury Prime & ComplyCo to help banks address regulatory challenges. The integration will enable banks to improve their oversight capabilities and will support FinTechs in scaling their operations responsibly, reinforcing the overall integrity of the financial ecosystem.

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 Samsung Pay adds crypto payment option with Alchemy Pay integration. The new partnership allows Alchemy Pay users to pay using their virtual crypto cards both in-store and online at supported retailers. Read more

🇸🇬 WadzChain Network unveils hybrid blockchain to simplify global payments for businesses. The hybrid blockchain is designed to cater to all types of payments needs including micropayments, high-volume payments, disbursements, benefits and many more.

PARTNERSHIPS

🇸🇬 DBS partners IRAS to allow individual and corporate taxpayers in Singapore to apply for eGIRO via IRAS’ myTax Portal. This digital GIRO application process reduces manual form handling and aims to benefit over two million GIRO users in Singapore.

DONEDEAL FUNDING NEWS

🇰🇼 Kuwait’s Krti closes $1.5 million pre-Seed. The firm aims to provide innovative technology solutions in financial technology that add value to customers through a unique and distinctive loyalty programme that allows users the highest possible benefit from all their bank cards.

🇺🇸 Mercury secures $100M credit warehouse with Natixis to scale corporate credit card business and serve more customers. For Mercury, this marks an important milestone in the growth and trajectory of their IO card business.

🇫🇷 French FinTech Kriptown raises €4.2M for blockchain-based SME stock exchange. Kriptown will offer asset managers and individual investors access to shares in SMEs, with the added benefit of liquidity through a 24/7 secondary market. Link here

🇸🇬 FinTech Surfin lands US$12.5M in first external funding round. Surfin's recent funding round marks its first external investment after being bootstrapped since its inception. With this new capital, Surfin plans to expand its financial services and reach a wider range of consumers across various income levels.

M&A

🇺🇸 Grasshopper Bancorp, Inc. and Auto Club Trust, FSB announce definitive merger agreement. The transaction has been unanimously approved by the boards of directors of each company and, subject to customary closing conditions, including regulatory approval, is expected to close in the first half of 2025.

MOVERS & SHAKERS

🇺🇸 Consumer-Finance startup Stash says founders are back as Co-CEOs. Brandon Krieg and Ed Robinson are taking the reins of the New York-based company, succeeding Liza Landsman, who is leaving the company and plans to volunteer for Kamala Harris’ presidential campaign, a Stash spokesperson said.

🇫🇷 Spendesk’s CEO to step down, replaced by Jellysmack’s Axel Demazy. Speaking on his immediate priorities in his new position, Demazy emphasises that he has a “clear goal” of “achieving profitability by 2025”.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()