FinTech Founders, Let’s Connect at Visa’s Event Amsterdam & Revolut Faces Fraud Complaints Surge

Hey FinTech Fanatic!

Revolut leads UK rivals in complaints related to authorized push payment (APP) scams, where criminals trick victims into transferring money to accounts outside their control.

According to the UK’s Financial Ombudsman, Revolut has seen a surge in complaints after tightening its reimbursement policies for fraud victims. APP scams, often complex and involving multiple banks, cost UK consumers £460 million last year.

To address this, a new UK regulation requires all banks and FinTechs to reimburse victims within five days, replacing the previous voluntary system.

Separately, the Treasury has also proposed delays to payments by as many as four business days, giving banks more time to determine if a transaction is fraudulent.

The new rules upend an earlier system where the liability that earlier solely rested on the originating party will now be split equally between institutions sending and receiving the fraudulent payment, with the maximum refund proposed at £85,000.

Revolut, which was exempt from the old system, will now be on the hook for 50% of the refunds 🤯

The UK’s Payment Systems Regulator (PSR) will implement these rules starting October 7, shifting the burden of proof onto financial institutions to show “gross negligence” by customers when rejecting claims.

The changes could serve as a global model, with APP scam losses in key markets expected to hit $8 billion by 2028.

What do you think?

Revolut Grapples With Rise in Scams

One more thing: Ever wondered how to pitch to investors? When is a good time to raise funds? What are the dos and don’ts?

You should definitely join the 'Visa x FinTech: Pitch Like A Pro To Raise Capital' on the 2nd of October at Rosarium Amstelpark in Amsterdam.

The event will take place from 9:00am to 1:00pm as part of the Amsterdam FinTech Event 2024.

My friend and colleague from Connecting the Dots in Payments, Arthur Bedel, will also be joining to present some interesting trends in the payments industry. The same goes for fellow "Dutchie" Jason Mikula 😉

See you there?

Cheers,

SPONSORED CONTENT

#FINTECHREPORT

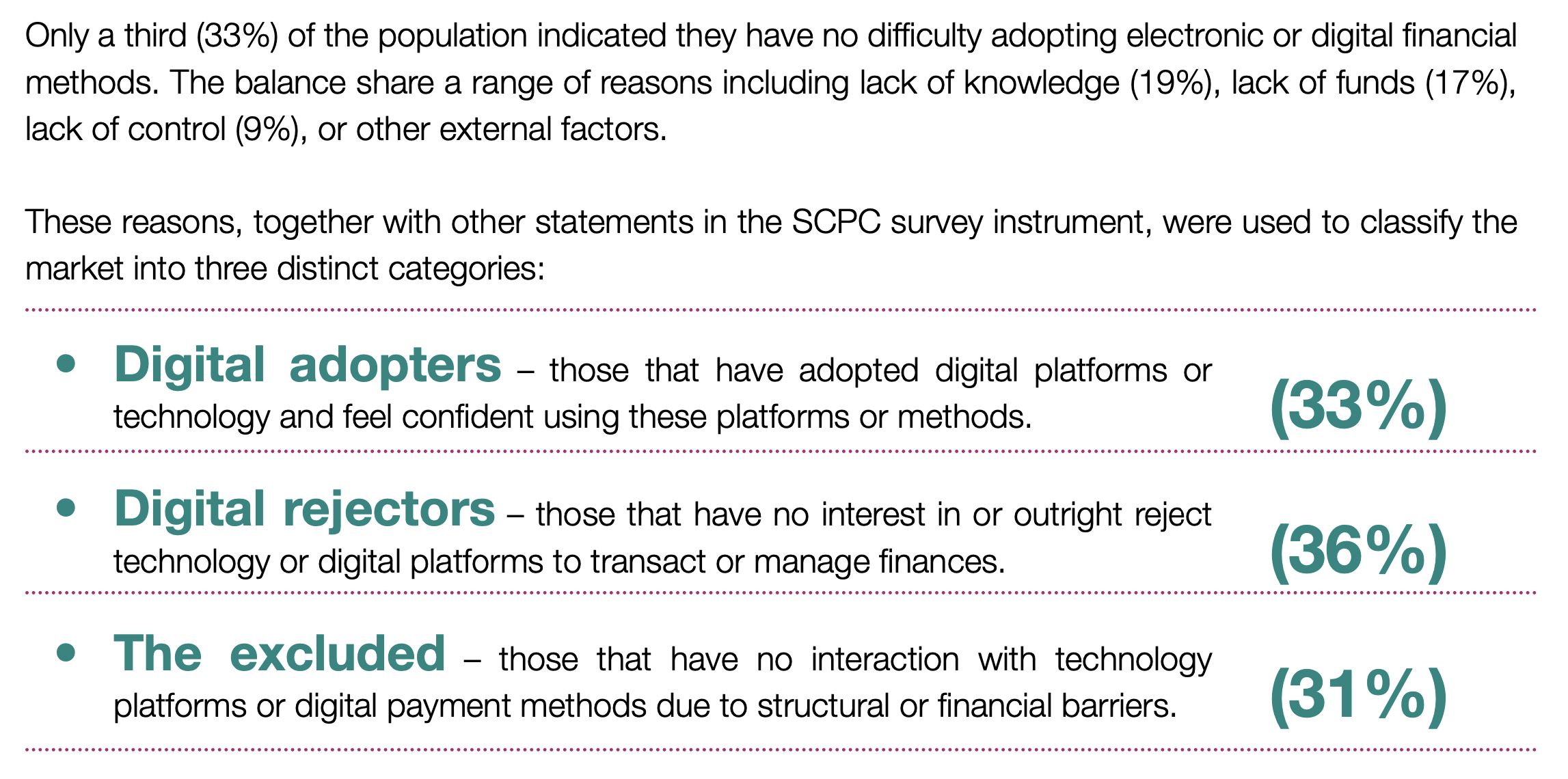

🇿🇦 The South African Reserve Bank (SARB), which operates, regulates and oversees the national payment system (NPS), has published its inaugural Payments Study Report/Study.

The study, the first of its kind in South Africa, uses individuals’ payment data and provides extensive insight into how the public perceives and uses various payment methods and instruments on offer in the country. Discover the insights here

FINTECH NEWS

🇪🇺 Enfuce announces European expansion of 2-in-1 debit and credit card with Mastercard. The firm is launching its E2 card in the UK, France and Germany. By offering both debit and credit PANs in one card, E2 further strengthens Enfuce’s track record of delivering cutting-edge products that benefit both card issuers and customers.

🇺🇸 Galileo introduces GIVE and GScore to enhance real-time fraud prevention. These products enhance transaction security by offering real-time data and risk assessments, effectively reducing fraud. They are designed to be scalable, supporting business growth into new markets without disrupting current systems.

🇧🇭 Arab Financial Services partners with Lune Technologies. Through this partnership, both companies intend to improve the efficiency of financial data services and enhance decision-making processes for the sector.

PAYMENTS NEWS

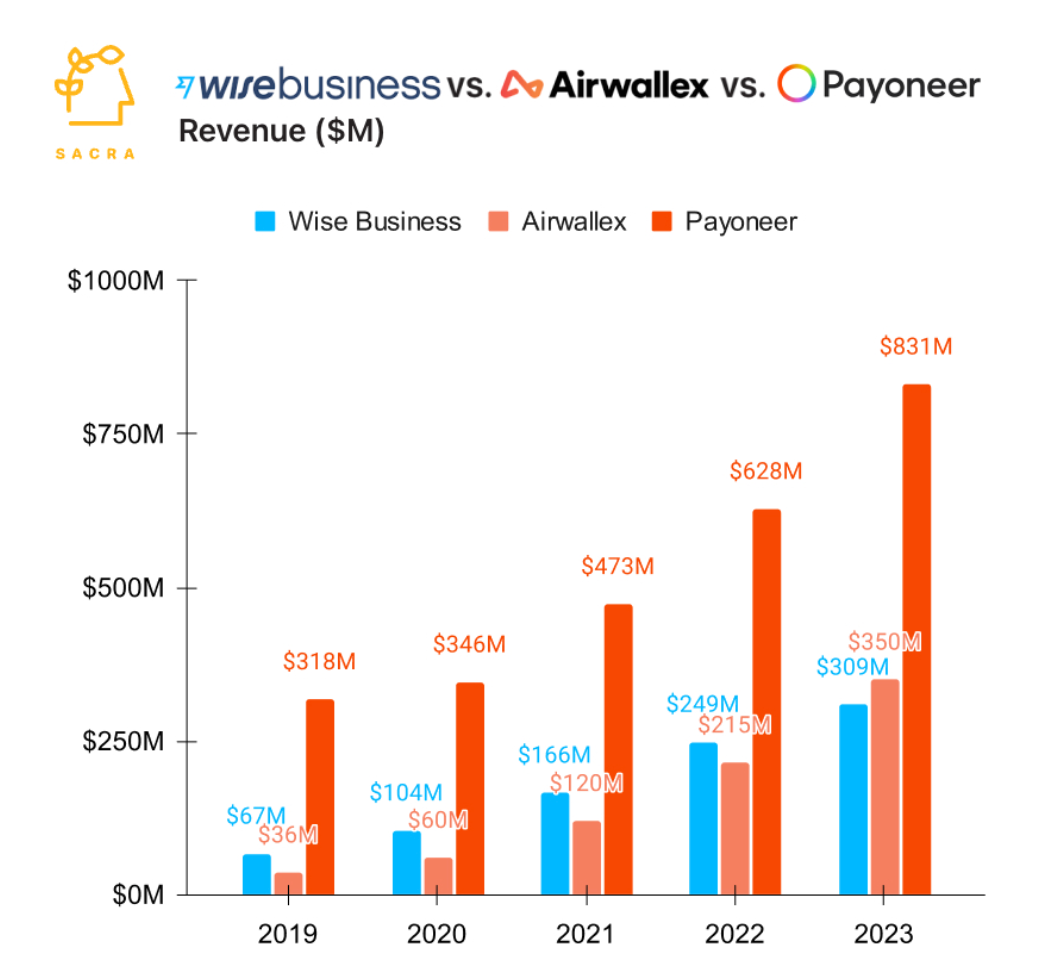

📊 Airwallex 🆚 Wise Business 🆚 Payoneer

Airwallex hit $𝟭𝟬𝟬𝗕 in annual transaction volume in 2024, up 73% (❗️) year-over-year, for a revenue run rate of $𝟱𝟬𝟬𝗠.

Now, the Aussie cross-border payments company is going global.

🇸🇦 TeleMoney, the International Remittance arm of Arab National Bank, joins Thunes’ Direct Global Network. This alliance will allow TeleMoney to send funds directly to digital wallets and facilitate seamless bank transfers across key markets in Asia and Africa. This collaboration positions Thunes as a key player in the Saudi Arabian financial ecosystem.

🇺🇸 Tech startup Ansa wants to democratize the digital wallet. The company is bringing technology pioneered by Starbucks to smaller operations, allowing them to streamline payments while reducing swipe fees. Keep reading

🇳🇬 Nigerian FinTech Grey partners dLocal to drive expansion into new emerging markets. Through this partnership, Grey will provide cross-border payouts to wallets and bank accounts, expanding its services into new markets such as Brazil, Indonesia, Mexico, the Philippines, and South Africa.

🇬🇧 Volt.io launches VX2, a new stablecoin settlement solution, led by CEO Tom Greenwood, who will transition from his current role as CEO of Volt to lead VX2 as its new CEO, with Volt Co-founder Steffen Vollert stepping up as Interim CEO of Volt. VX2 will operate as a separate entity, majority-owned by Volt and supported by the same core investors.

🇩🇪 Mondu teams up with Stripe to deliver BNPL payments to B2B merchants. Through this integration, both companies plan to support B2B merchants and marketplaces to provide Mondu’s flexible invoice payment options directly via their existing Stripe setup, optimising the checkout experience and increasing conversion rates.

🇪🇺 European card transactions to fall as A2A payments take off. The number of card transactions in Europe is set to plummet by more than a third over the next three years, driven by the rise of account-to-account payments as ventures such as the EPI's new Wero wallet gain traction, claims a Capgemini report.

🇳🇿 Finexio and Unimarket launch payment risk assessment and management tool. The new Payment Risk Score (PRS) is designed to tackle payment fraud by offering enterprises a data-driven approach to assessing risk levels across common payment methods, the companies said in a press release emailed to PYMNTS.

🇦🇪 NymCard leverages Mastercard move to offer fast and efficient cross-border payments across 47 countries. The collaboration will enhance NymCard’s BaaS platform by using Mastercard Cross-Border Services to provide efficient international remittance experiences to various countries. Read on

🇺🇸 Silverflow and Chesapeake Bank partner to deliver advanced payment processing solutions. This collaboration aims to provide Chesapeake Bank's ISO clients with a modern, high-performance, and robust payment processing solution. Read more

🇺🇸 Boost Payment Solutions empowers enterprise buyers to conveniently pay global suppliers using commercial cards with Boost 100XB. The solution was developed to simplify and streamline buyers' international transactions, allowing the use of existing U.S.-issued commercial cards to pay suppliers in over 180 countries worldwide.

OPEN BANKING NEWS

🇧🇷 PicPay is the first institution to introduce salary portability through Open Finance, simplifying the process for customers and automating the experience.This innovation will enhance workers' experience by letting them select the financial institution that suits their needs, without the usual hassles.

DIGITAL BANKING NEWS

🇬🇧 Revolut leads UK rivals in complaints related to authorized push payment (APP) scams, where criminals trick victims into transferring money to accounts outside their control. According to the UK’s Financial Ombudsman, Revolut has seen a surge in complaints after tightening its reimbursement policies for fraud victims.

🇸🇪 Intergiro launches no-code white-label platform to build custom mobile banking apps. The platform enables businesses to deploy fully branded mobile banking apps in a matter of days, without the need for technical expertise.

🇬🇧 NatWest backs Open Property Data initiative to improve homebuying process. This collaboration is part of a broader push to modernize the property market, where the average homebuying journey currently takes around 22 weeks, with less than one per cent of property information available digitally.

🇺🇸 Goldman Sachs nearing a deal to transfer GM credit card business to Barclays, source says. The exit from the business partnership with GM, with about $2 billion of outstanding balances, is part of Goldman Sachs' move to narrow its focus on consumer services.

The bank expects a $400ME writeoff in the latest hit from consumer business exit. Goldman Sachs sees trading revenue headed for a 10% decline due to difficult fixed-income conditions and year-over-year comparisons, while it is also preparing to take a $400M pretax hit related to its costly exit from the consumer arena.

🇩🇪 Landesbank Baden-Württemberg picks Fenergo. Fenergo’s system was selected to improve compliance processes via automation and enhance operational efficiencies. LBBW says this will strengthen the bank's reputation within the international market.

🇺🇸 First Citizens Bank customers can now receive instant deposits. By joining the RTP network, First Citizens enables customers to receive payments in seconds, much faster than ACH or wire transfers. This instant payment service is available 24/7.

BLOCKCHAIN/CRYPTO NEWS

🔒 Stablecoins: making financial services internet-native. Unlike other cryptocurrencies that attempt to serve both as payment mechanisms and securities, stablecoins are designed purely as a means of exchange. Find out more

🇦🇪 Standard Chartered launches digital asset custody in the UAE. “The launch of our digital asset custody offering represents a pivotal moment not just for Standard Chartered, but for the financial services industry,” said Bill Winters, Group CEO of Standard Chartered Bank.

🌐 Swift to develop concrete plans for CBDC and tokenised asset exchange. Swift is moving forward with plans to offer member banks access to emerging digital asset classes and currencies over its network, covering a range of use cases in payments, securities, FX, trade and beyond.

PARTNERSHIPS

🇺🇸 Navan and Citizens forge future in FinTech integration. The new, co-branded travel and expense system was designed exclusively for Citizens corporate card customers and features a custom design and interface that aligns with the familiar branding Citizens customers know and trust.

DONEDEAL FUNDING NEWS

🇬🇧 A syndicate of 20 business angels has invested a total of £500,000 in a Welsh small business finance assistant powered by Gen AI. Founded in August 2023, Menna.ai helps small business owners to make better financial decisions by combining generative AI with rich real-time data.

🇪🇬 Paymob, started by three college friends, lands another $22M and is profitable in Egypt. Paymob, which describes itself as a financial services enabler, has raised over $90 million to scale up to this point, and became profitable in the second quarter of this year, with revenues increasing sixfold since mid-2022.

🇺🇸 Accenture invests in EMTECH to modernize Central Bank operations. This investment will support EMTECH in its efforts to transform central banks’ financial and technology infrastructure and make it easier for central banks to regulate and supervise FinTechs in an increasingly digital economy.

MOVERS & SHAKERS

🇪🇪 Tuum appoints Stephen Frame as Head of Compliance and Risk. Stephen brings a wealth of expertise to Tuum as it continues to expand and strengthen its operations in an increasingly complex regulatory environment. More on that here

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()