Revolut CMO; "We don’t have any competition"

Hey FinTech Fanatic!

Revolut is focusing more on customer-driven experiences and unique partnerships to fuel its international growth. Rather than comparing itself to other brands, Revolut claims it has no direct competition, opting instead to carve its own path in the industry. According to Chief Growth and Marketing Officer Antoine Le Nel in an interview.

This November, the company will host its inaugural members-only event, “The Revolutionaries,” at London’s Outernet. Set to mark an impressive milestone of reaching 50 million customers, this two-day celebration will feature live music, seminars, and inspiring sessions, accessible to members both online and in-person.

And a live start-up surgery session with Revolut founder Nik Storonsky and entrepreneur Steven Bartlett helping solve challenges from budding entrepreneurs.

Speaking of events, Money20/20 kicked off on a high note yesterday with some exciting meetings and lively happy hours. It was wonderful catching up with my good friend Harvey Hudes and so many others at the Fin&Juice happy hour hosted by The FR.

Looking forward to meeting even more people today!

Cheers,

#FINTECHREPORT

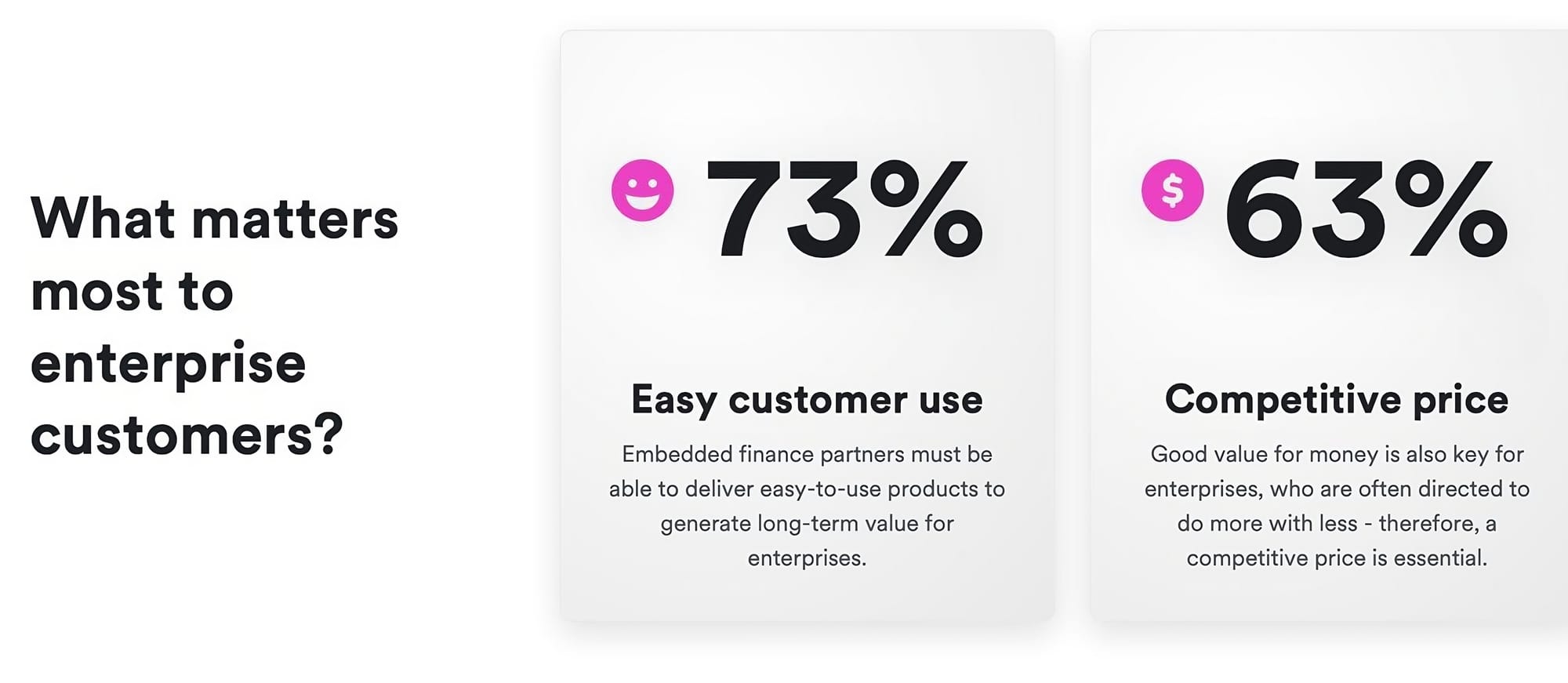

📊 Scaling Embedded Finance. Learn about the challenges and opportunities in embedding financial services as an enterprise with Airwallex’s report, in partnership with NewtonX. Download the full report here

FINTECH NEWS

🇬🇧 Banking and credit financial complaints skyrocket in 2024 FOS reports. The Financial Ombudsman Service (FOS) has reported that they received 40% more complaints in the first half of 2024 than in the same period in 2023 with the majority of complaints related to banking and credit.

🇺🇸 Square adds sales and back-office features for beauty and wellness sellers. These tools are designed to help beauty and wellness professionals manage sales, customer service, and back-office operations, the company said in a press release.

PAYMENTS NEWS

🇪🇸 SeQura partners with Stripe to boost merchant growth with flexible payments. With this partnership, seQura will seamlessly integrate into Stripe’s ecosystem, allowing merchants to offer flexible payment options directly through Stripe’s platform. seQura and Stripe merchants can now offer flexible payments, all managed within a single, unified dashboard. Click here to learn more

🇺🇸 Mastercard is expanding its US 𝗜𝗻𝘀𝘁𝗮𝗹𝗹𝗺𝗲𝗻𝘁𝘀 𝗣𝗿𝗼𝗴𝗿𝗮𝗺 to provide more payment flexibility at checkout. It works through a single and streamlined platform, players across the ecosystem will be able to present installment offers for consumers to any eligible credit card from participating issuers.

🇭🇰 Fiserv has partnered with foodpanda. This strategic partnership will facilitate secure e-commerce payments across online, mobile, and digital wallets, positioning Fiserv as foodpanda's primary acquirer in Singapore and Hong Kong.

🇬🇧 Link Pay newest feature available in Lloyds mobile app. Lloyds customers can now request money with a secure unique link or from friends and family, quickly and easily, using the new Link Pay feature in the mobile banking app. Read on

🇺🇸 Global Partners launches E-ZPass enabled payment service in eight states. The firm has partnered with PayByCar, a mobile payments company that provides pay-by-text payment solutions at c-stores in Massachusetts, to extend the company’s program to more than 300 Global Partners sites across New England, New York and Virginia.

🇨🇦 Plooto launches Pay By Card unlocking instant access to short-term financing for SMBs. Developed in collaboration with Visa, Pay by Card gives businesses instant access to short-term financing via their commercial credit card providers that offer rewards and other benefits.

🇩🇪 FinMont and The Payments Group partner to expand travel payment solutions. This collaboration enhances FinMont's payment ecosystem by integrating TPG’s cash and e-voucher solutions, streamlining B2C and B2B payments for its global travel merchants.

🇺🇸 Sezzle partners with Shoplazza to offer flexible payment options to merchants. This collaboration enables Shoplazza merchants in the US to offer flexible payment options through Sezzle, enhancing customer experience and driving business growth.

🇨🇱 Getnet launches e-commerce payments solution in Brazil, Argentina, Mexico and Chile. This solution gives merchants in these countries access to Getnet’s payment services through a single, direct integration. Getnet by Santander is the only bank in Latin America offering this feature.

🇺🇸 Visa and USAID are working together to drive inclusive digital government ecosystems and payment digitization. Visa and USAID will work together for five years to focus on developing programs to assist governments in creating and adopting platforms that connect their constituents with local government services.

DIGITAL BANKING NEWS

🇨🇴 Nu Colombia will be offering Bre-B in Colombia. Bre-B is an instant payment system coming to Colombia in 2025, enabling transactions in seconds. It works between any bank or digital wallet, regardless of the financial institution. Designed by Banco de la República, Bre-B allows all Colombians to move their money easily, quickly, and securely at any time.

🇺🇸 Prelim integrates with Q2's digital banking platform via the Q2 Partner Accelerator Program. This integration allows financial institutions to utilize Prelim's deposit platform in conjunction with Q2's Digital Banking Platform. Continue reading

🇺🇸 Capital One wants to woo the rich without being snobby about it. With the Discover merger, the bank plans to supercharge its rewards programs. It just needs regulators to sign off. Read the full piece

BLOCKCHAIN/CRYPTO NEWS

🇳🇬 Nigeria drops charges against Binance cryptocurrency boss. Nigeria's anti-corruption agency has dropped money-laundering charges against Binance executive Tigran Gambaryan, allowing him to seek medical treatment abroad for a serious back condition which made him unable to be present during the trial.

🇺🇸 Federal Investigators probe cryptocurrency firm Tether. The federal government is investigating cryptocurrency company Tether for possible violations of sanctions and anti-money-laundering rules, according to people familiar with the matter.

🇺🇸 Fireblocks and industry leaders launch $1 Million Stablecoin grant program to boost PYUSD adoption. Following a successful pilot, the program allows businesses to build products and earn rebates for building with PayPal USD with Fireblocks

🇯🇵 Japan group backs prioritizing Bitcoin, Ether for crypto ETFs. A group of Japanese companies suggested that discussions on cryptocurrency ETFs should focus on major tokens like Bitcoin and Ether, as the country considers following global trends.

🇸🇮 Bitstamp secures MiFID MTF license from European regulator. The company has reached a milestone by securing the MiFID Multilateral Trading Facility license from Slovenia’s Securities Market Agency, allowing the exchange to offer crypto derivatives, including perpetual swaps.

🇺🇸 Crypto exchange Kraken plans to launch its own blockchain early next year. The new digital ledger, Ink, will use technology similar to Coinbase's Base. Kraken is trying to simplify the experience and to make it cheaper and more intuitive to use DeFi to earn yield and for other functions.

DONEDEAL FUNDING NEWS

🇺🇸 DailyPay secures additional $100 million credit commitment from Citi. The secured credit facility will provide DailyPay access to significant funding to service its ever-growing roster of clients. Read more

🇸🇦 Saudi B2B FinTech Mala secures $7 Million seed funding. Designed for the region's SMEs, the platform offers buyers flexible credit while ensuring suppliers get immediate payments, providing a seamless procurement experience tailored to evolving business needs.

M&A

🇺🇸 BM Technologies shares jump after buyout offer from First Carolina Bank. BM Technologies shares rose 50% to $4.83 after the company agreed to be bought by First Carolina Bank in an all-cash transaction with an equity value of $67 million.

MOVERS & SHAKERS

🇬🇧 ING appoints Alexandra MacMahon as UK country manager. Alexandra’s leadership will drive the ongoing development and expansion of ING’s Wholesale Banking client base across the UK. She will also play a crucial role in shaping ING’s commercial strategy.

🇺🇸 Payouts Network expands the executive team with CFO Jon Anderson. Anderson will focus on advancing the company’s financial strategy, driving scalable growth and implementing technology-driven financial processes.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()