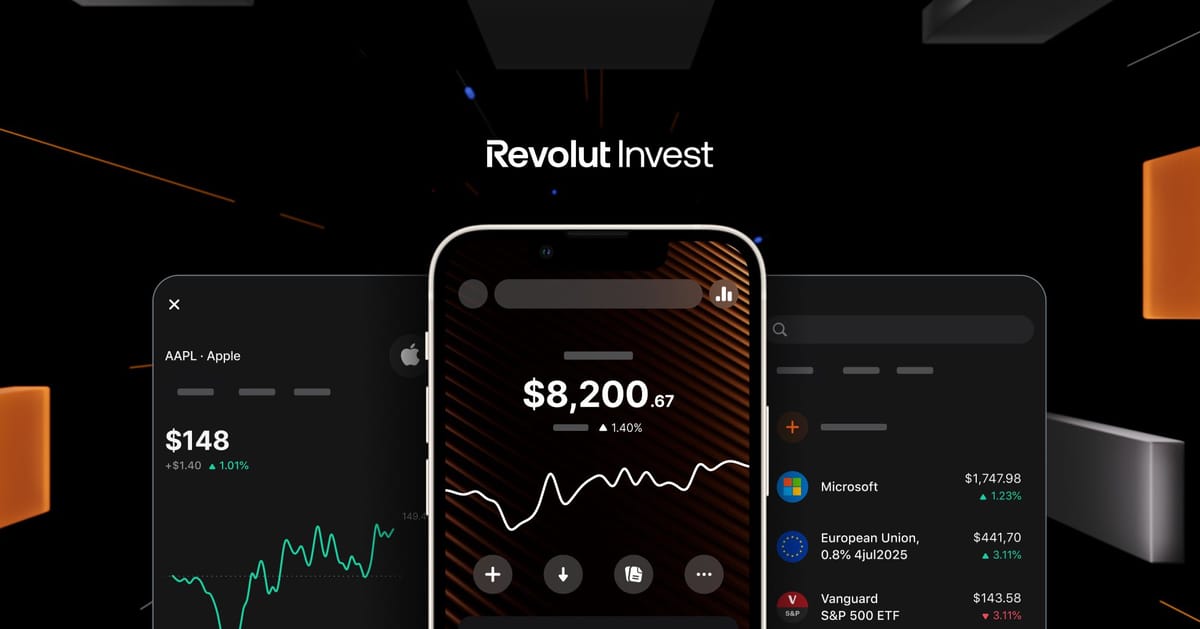

Revolut Challenges Robinhood and eToro with New Retail Wealth App

Hey FinTech Fanatic!

Revolut is making moves in the world of wealth management, spinning out its €8.5 billion investment offering into a brand-new standalone app, Revolut Invest.

Aiming to rival the big ones, Robinhood, eToro, and other big names, Revolut Invest will debut with nearly 5,000 assets, including US and European stocks, ETFs, commodities, bonds, and new products like contracts for difference (CFDs).

Revolut announced that equity and bond investments will be subject to a flat fee of either 0.25% or €1, while fees for contracts for difference (CFDs) will vary.

This new app, currently being tested in Greece, Denmark, and the Czech Republic, plans to expand across the European Economic Area by year-end, Rolandas Juteika, Revolut’s head of wealth and trading for the region, said in an interview.

Now, the big question is: Can Revolut Invest carve out its space among established giants like Robinhood and eToro?

What do you think? Tell me more in the comments.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

#FINTECHREPORT

📊 Check out "Payments Regulation in Asia" - CMSPI whitepaper: This report on payment regulation across Asia focuses on Australia, India, Japan, and Singapore, highlighting key trends in payment costs, consumer behavior, and regulatory interventions. Click here to learn more

FEATURED NEWS

📱 Revolut is spinning out its €8.5 billion wealth management offering into a standalone app, called 𝗥𝗲𝘃𝗼𝗹𝘂𝘁 𝗜𝗻𝘃𝗲𝘀𝘁, seeking to compete against the likes of Robinhood and eToro. The app will offer nearly 5,000 assets on debut, including US and European stocks, exchange-traded funds, commodities and bonds, as well as new products such as contracts for difference.

INSIGHTS

🇬🇧 Mastercard expands first-of-its-kind AI technology to help banks protect more consumers from scams in real time. The company updated its Consumer Fraud Risk (CFR) solution to better protect consumers from Real Time Payment scams. The AI-powered insights give more UK banks greater visibility into potentially fraudulent transactions so they can stop scams before they take place.

FINTECH NEWS

🇺🇸 Nasdaq Verafin unveils new product to revolutionise AML efforts. Nasdaq Verafin has introduced significant advancements to its artificial intelligence (AI)-based Targeted Typology Analytics. The new suite of tools is designed to enhance detection capabilities for combating terrorist financing and drug trafficking activities.

🇿🇦 Leading FinTech M-KOPA reaches 5 million customers across Kenya, Uganda, Nigeria, Ghana and South Africa, unlocking $1.5bn in credit across 5 markets. Two million of these customers have come onboard in the past 15 months. M-KOPA’s innovative model makes affordable smartphones embedded with financial services available to ‘Every Day Earners.’

PAYMENTS NEWS

🇫🇷 Troc Vélo chooses Mangopay to manage online payments for second-hand bike sales. Through integrating Mangopay’s solutions to improve the online payment process, Troc Vélo is removing a key barrier to second-hand purchases between individuals on its platform.

🇳🇿 Klarna teams up with Xero for BNPL payments. Klarna will allow Xero customers to pay invoices through its global payments network, getting into the payment button territory of card networks. The intention is to help small businesses by accepting payments from consumers who want a Buy Now Pay Later option.

🇺🇸 Visa faces Justice Department antitrust case on debit cards. The US DOJ plans to sue Visa Inc. for allegedly illegally monopolizing the US debit card market. The antitrust division is set to file the lawsuit in federal court soon, accusing the payments network operator of various anticompetitive practices, according to sources familiar with the matter.

🇵🇭 Fime and BancNet enhance financial inclusion with InstaPay testing in the Philippines. The collaboration between Fime and BancNet is primarily geared towards bolstering the InstaPay service. The partnership enables these institutions to efficiently test and launch their instant payment solutions in compliance with the ISO 20022 standard for financial messaging.

DIGITAL BANKING NEWS

🇧🇷 Nubank signs agreements with RJ and MG States, expands TAM for payroll loans to 70%. With these two new contracts, the company reaches a total of 11 agreements and expands its total addressable market (TAM) for payroll loans from 50% to 70%, once these new contracts are fully integrated and available to its customers.

🇮🇳 FinTech Jupiter in talks to buy a stake in SBM Bank India. The company, backed by Tiger Global and NuBank, is in discussions to buy a 5% to 9.9% stake in SBM India, the local arm of SBM Bank, sources said.

🇦🇪 Mubadala acquires stake in Revolut in a bid to focus its efforts on deploying capital in Europe, having been involved in nearly 28 European deals in the last five years. Through this share sale, Revolut received a minimum of USD 200 million.

🇬🇧 Bud Financial launches agentic AI banking capabilities for financial institutions: a consumer agent that can be embedded in its GenAI and customer-facing products to help individuals optimize their finances. The consumer agent is currently able to move money between accounts, such as current and savings accounts.

PARTNERSHIPS

🇳🇱 Anadolubank Nederland pens five-year deal with Worldline for cloud-based instant payments solution. The collaboration will ensure Anadolubank Nederland complies with new EU instant payments regulations. Additionally, the bank will adopt Worldline’s supplementary services, including stand-in funds checks and customer sanction screening for uninterrupted service.

🇹🇭 dlocal partners with ShopeePay. dLocal merchants can now accept ShopeePay payments in Thailand, Malaysia, Indonesia, and the Philippines, expanding their reach in these emerging markets. Additionally, dLocal and ShopeePay Thailand are introducing merchant payout services.

DONEDEAL FUNDING NEWS

🇮🇳 India’s M2P FinTech reportedly on track to secure $80m funding round. Helios Investment Partners is leading the round, according to a report by The Economic Times, citing sources familiar with the deal. The FinTech operates an API infrastructure that enables businesses to embed FinTech services into their own offerings.

🇵🇰 Pakistan’s BNPL firm Qist Bazaar raises $3.2M Series A from Indus Valley Capital, Gobi Partners. With the recent Series A round, Qist Bazaar is poised to accelerate its growth by expanding its product portfolio, enhancing its technology infrastructure, and scaling operations across Pakistan.

🇺🇸 Oportun secures $306m in warehouse facility extension to bolster financial services growth. The newly secured funds will be managed under a new two-year revolving period. This funding is secured against Oportun’s diverse portfolio, including unsecured and secured personal loan originations.

🇺🇸 FinTech Mesa promises 1% cash back on mortgages, up to 3x on other home needs. Mortgage FinTech Mesa has emerged from stealth on Tuesday with $9.2 million in seed capital and a novel idea for homeowners. It’s offering cash back and rewards on all spending done on the home, including the mortgage itself.

🇦🇺 Aussie debt collection FinTech InDebted bags $41m Series C. The cash injection, which values InDebted at around $240 million (A$350 million), has been earmarked to drive the company’s expansion into new markets, fuel further product development, and help deliver on its M&A strategy.

MOVERS & SHAKERS

🇱🇹 ZEN.COM appoints Michal Boguslawski as CEO Europe to drive global payment innovation and lead the next phase of growth.

This strategic leadership progression highlights Michal’s pivotal contributions since the company's inception and sets the stage for ZEN.COM's next phase of dynamic growth and global expansion.

The appointment of Michal Boguslawski as CEO Europe marks a significant milestone for ZEN.COM. Having played a key role in shaping the company’s strategies since 2019, Michal brings extensive experience from his previous leadership roles in tech and payment giants.

Under Michal’s leadership, the team will focus on enhancing product offerings, strengthening ZEN.COM's presence in Europe, and providing exceptional value to customers. His relocation to Vilnius, Lithuania, underscores his dedication to maintaining a strong regional presence and fostering compliance and regulatory excellence.

🇮🇳 Cashfree Payments appoints Nitin Pulyani as Head of Product and Senior Vice President. In this strategic role, Pulyani will spearhead product innovation and drive initiatives aimed at accelerating the company’s growth. Read more

🇺🇸 Rimes welcomes Gus Macfarlane as Chief Operating Officer. Gus joins the executive team to lead the company's transformation, scale global operations, and enhance client delivery. With extensive experience in FinTech and financial services, he will be pivotal in advancing the company’s strategic vision and operational success.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()