Revolut CEO Confident in UK Bank License as Profits Soar to $545M

Hey FinTech Fanatic!

Revolut’s CEO and co-founder, Nikolay Storonsky, expressed optimism about securing a UK banking license soon, despite delays since their 2021 application.

The FinTech giant reported a record pre-tax profit of $545 million for 2023, driven by user growth and revenue diversification.

Storonsky highlighted that Revolut’s size has prolonged the approval process compared to smaller institutions. A UK banking license would enable Revolut to offer loans, expanding beyond its current capabilities as a licensed electronic money institution. A key hurdle was resolved when Revolut aligned its share structure with regulatory requirements, facilitated by a deal with SoftBank.

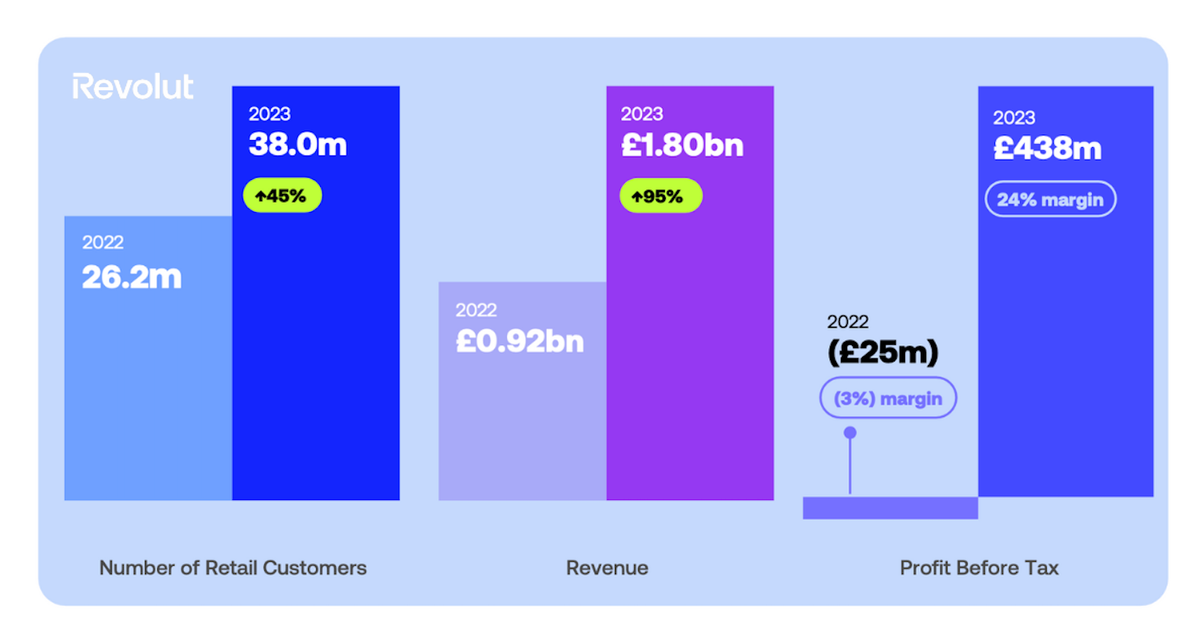

2023 marked a significant year for Revolut, swinging from a pre-tax loss of £25.4 million in 2022 to a profit of £438 million. Revenues surged by 95% to £1.8 billion, attributed to a record 12 million new customers and strong performance in card fees, foreign exchange, wealth, and subscriptions.

CFO Victor Stinga credited this growth to customer expansion, robust revenue lines, and a significant increase in interest income, now comprising 28% of revenues.

Revolut prioritized financial discipline in 2023, maintaining lower administrative expense growth compared to revenues and adopting a "zero-based budgeting" approach. The company invested $300 million in advertising and marketing, with significant focus on business banking solutions, dedicating about 900 employees to B2B sales.

Additionally, board member Martin Gilbert indicated that an IPO might be on the horizon within a year.

This all looks pretty impressive to me. What do you think?

Cheers,

#FINTECHREPORT

📊 CCG Catalyst released a research report on Open Banking 2024 in the US. The report dives into the CFPB’s rule, consumer data access, and the challenges ahead for financial institutions. Download and read the full report

INSIGHTS

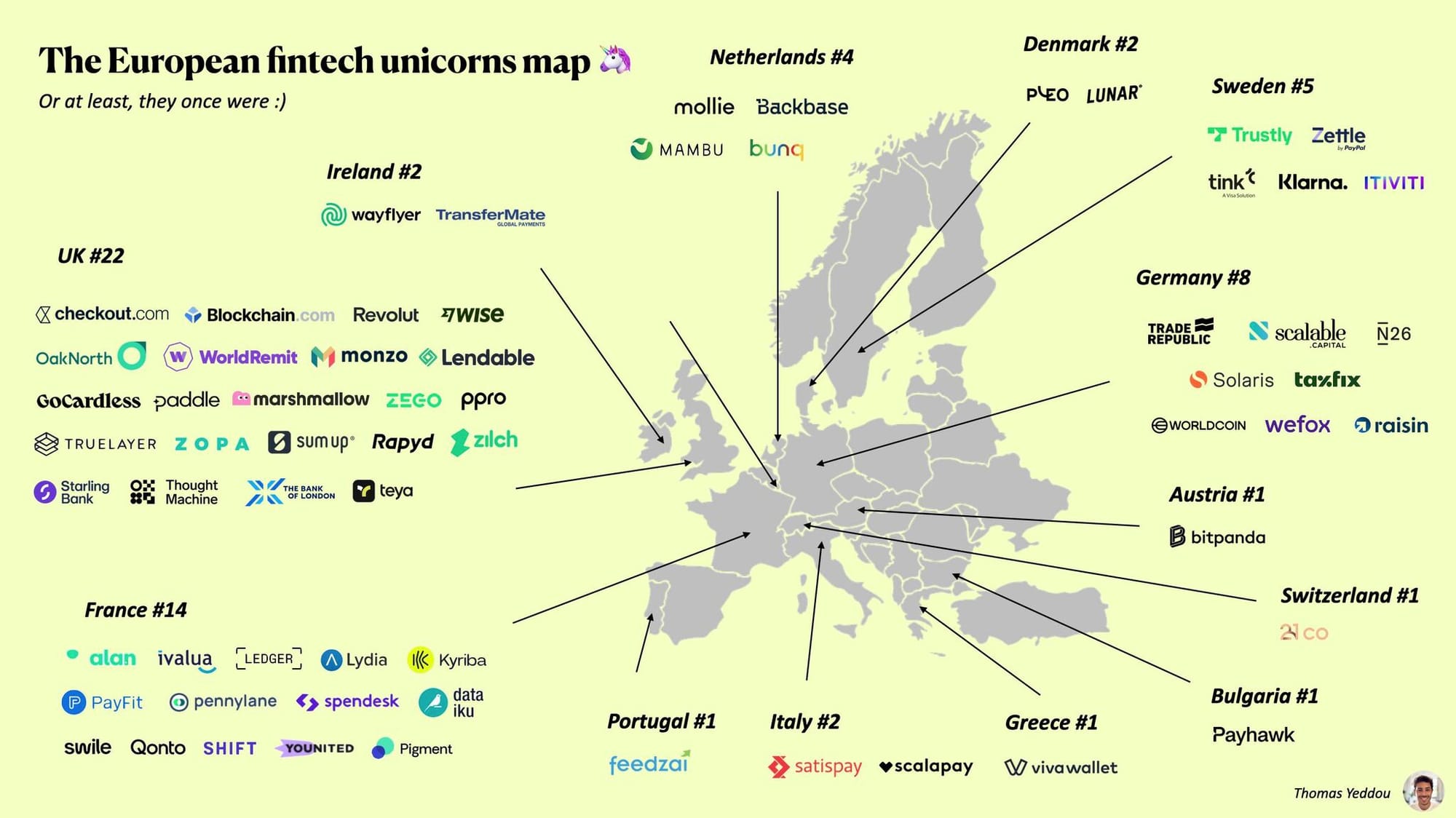

📈 The European FinTech Unicorns 🦄 map by Thomas Yeddou

There are 64 FinTech unicorns in Europe:

FINTECH NEWS

🇬🇧 App scams are the most dangerous type of fraud, according to The Payments Association report. Decision-makers from payments businesses across the UK have identified Authorised Push Payment (APP) fraud as the top threat to their businesses and consumers. Continue reading

PAYMENTS NEWS

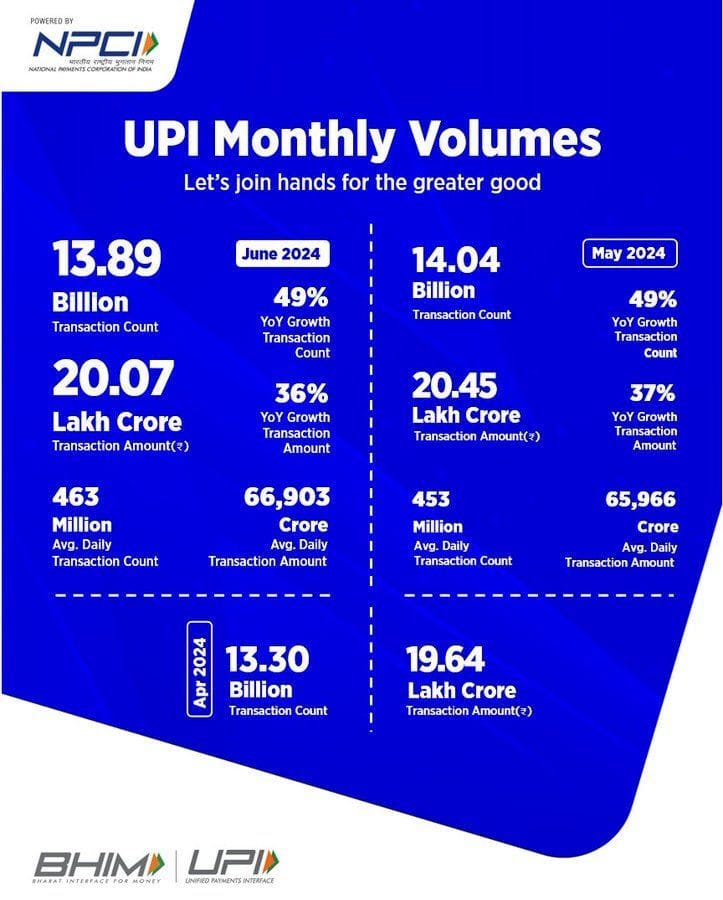

🇮🇳 Here are the latest UPI stats from India:

🇨🇭 Marcus M. Dal Pont announced that Mastercard Click to Pay is now available in Switzerland. Click here for further insights

🇺🇸 Payments platform Qualpay announced that it has entered into a strategic partnership with Aevi, a platform provider for in-person payment orchestration. This integration will enable Qualpay to extend its existing e-commerce focused platform by offering a comprehensive card-present solution to a diverse customer base.

🇬🇧 Cardstream partners with Mastercard to roll out its new service, Click to Pay, to improve online shopping. Click to Pay gives merchants the option to benefit from an embedded and optimised checkout within existing integrations, and is primed to become as ubiquitous as contactless payments.

🇮🇹 Paytech Nexi, has signed a new collaboration with Amazon. it, enabling customers to make purchases using Bancomat Pay. The partnership will also allow Nexi to take another step in supporting the digitization of payments in Italy. Read more

🇿🇦 Absa and Ozow have partnered to offer a payment solution that leverages open banking technology to provide a fast, secure, and user-friendly payment option. Ozow and Absa are committed to enhancing the digital payments landscape through this strategic partnership, which is designed to simplify online payments.

🇲🇽 Stripe and Cemex collaborate to digitize Mexico’s payments in the construction industry. The partnership, announced on June 26, 2024, aims to facilitate the adoption of e-commerce in a sector that has traditionally been slower to adopt technological innovations.

OPEN BANKING NEWS

🇦🇪 UAE Central Bank issues open finance regulation to ensure the soundness and efficiency of open finance services, encourage innovation, enhance competitiveness, achieve consumers’ interests and reinforce the UAE’s status as a leading financial technology hub.

DIGITAL BANKING NEWS

🇬🇧 Revolut surpasses $2.2 billion in revenue and achieves record profits of $545 million in 2023, which marks the third consecutive year of profitability for Revolut. Check out the key highlights of the financial results recently released.

🇧🇷 Data from Nubank reveals: 43% of consumers who obtained first credit card with Nu have also boosted savings. The study focuses on the journey towards a sustainable financial life, revealing that Nubank enabled nearly 21 million Brazilians to access their first credit card by December 2023.

BLOCKCHAIN/CRYPTO NEWS

🇪🇺 Circle snags first stablecoin license under EU's new MiCA crypto rules. Circle Mint France will issue the euro-denominated EURC stablecoin and USDC in the European Union in compliance with MiCA. Read on

🇸🇬 Paxos approved to issue stablecoins in Singapore. The firm has received full approval from the Monetary Authority of Singapore to offer Digital Payment Tokens and has lined up DBS Bank as its primary banking partner for cash management and custody of stablecoin reserves.

🇺🇸 SEC charges Consensys for unregistered sale of securities through its MetaMask Staking service. According to the SEC’s complaint, since at least Jan. 2023, Consensys has allegedly sold tens of thousands of unregistered securities for liquid staking program providers Lido and Rocket Pool, who issue tokens (stETH and rETH) in exchange for staked assets.

🪙 Ant Intl made billions of JPM Coin payments using programmability. JP Morgan revealed that Ant International, the affiliate of China’s Alipay, has processed billions of dollars in transactions using JPM Coin. Ant supports payments for 1.2 billion buyers and 2 million sellers in over 200 countries.

DONEDEAL FUNDING NEWS

🇬🇧 Triver raises further £2.5m to expand instant access to working capital for UK SMEs. In its first year of operation, Triver has successfully funded more than £20m of invoices supporting over 250 UK SMEs and it is providing working capital to small businesses at world record speed.

MOVERS & SHAKERS

🇬🇧 MyPOS appoints Matt Komorowski as Chief Revenue Officer. Matt will lead all aspects of the company's revenue growth and sales strategy, and brings a wealth of payments experience at iconic companies such as PayPal, Groupon and the Boston Consulting Group.

🇬🇧 Christian von Hammel-Bonten appointed as Non-Executive Director to the board of Token Inc. An industry veteran with over 20 years of international experience in the payment sector, Von Hammel-Bonten is an independent consultant for payment and digital transformation.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()