Revolut Aims for $40 Billion Valuation in Employee Share Sale

Hey FinTech Fanatic!

Revolut, founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, is targeting a valuation exceeding $40 billion in an upcoming employee share sale. This move, which involves selling approximately $500 million worth of existing shares with the help of Morgan Stanley, aims to solidify its position as Europe’s most valuable start-up.

The proposed valuation represents a significant increase from the $33 billion achieved during a 2021 fundraising round, placing it on par with major financial institutions like Lloyds Banking Group and surpassing others such as NatWest and Société Générale.

Achieving this ambitious target would be a notable success amid a challenging period for European FinTech companies. For instance, Stockholm-based Klarna experienced a drastic drop in its valuation from $46 billion to $6.7 billion in 2022. Some venture capital investors have similarly reduced their stakes in Revolut due to market conditions.

Revolut’s future is also contingent on its pending application for a UK banking license, submitted over three years ago.

The company now boasts around 40 million global customers, with a significant portion based in the UK, and is moving its headquarters to one of the most prominent buildings in London’s Canary Wharf financial district.

Never a dull moment at Revolut 😉

Cheers,

BREAKING NEWS

🚨 Revolut is targeting a valuation exceeding $𝟰𝟬𝗯𝗻 in a share sale that would cement its status as Europe’s most valuable start-up. The SoftBank-backed company is working with Morgan Stanley to sell about $500mn worth of existing shares, including those held by employees.

#FINTECHREPORT

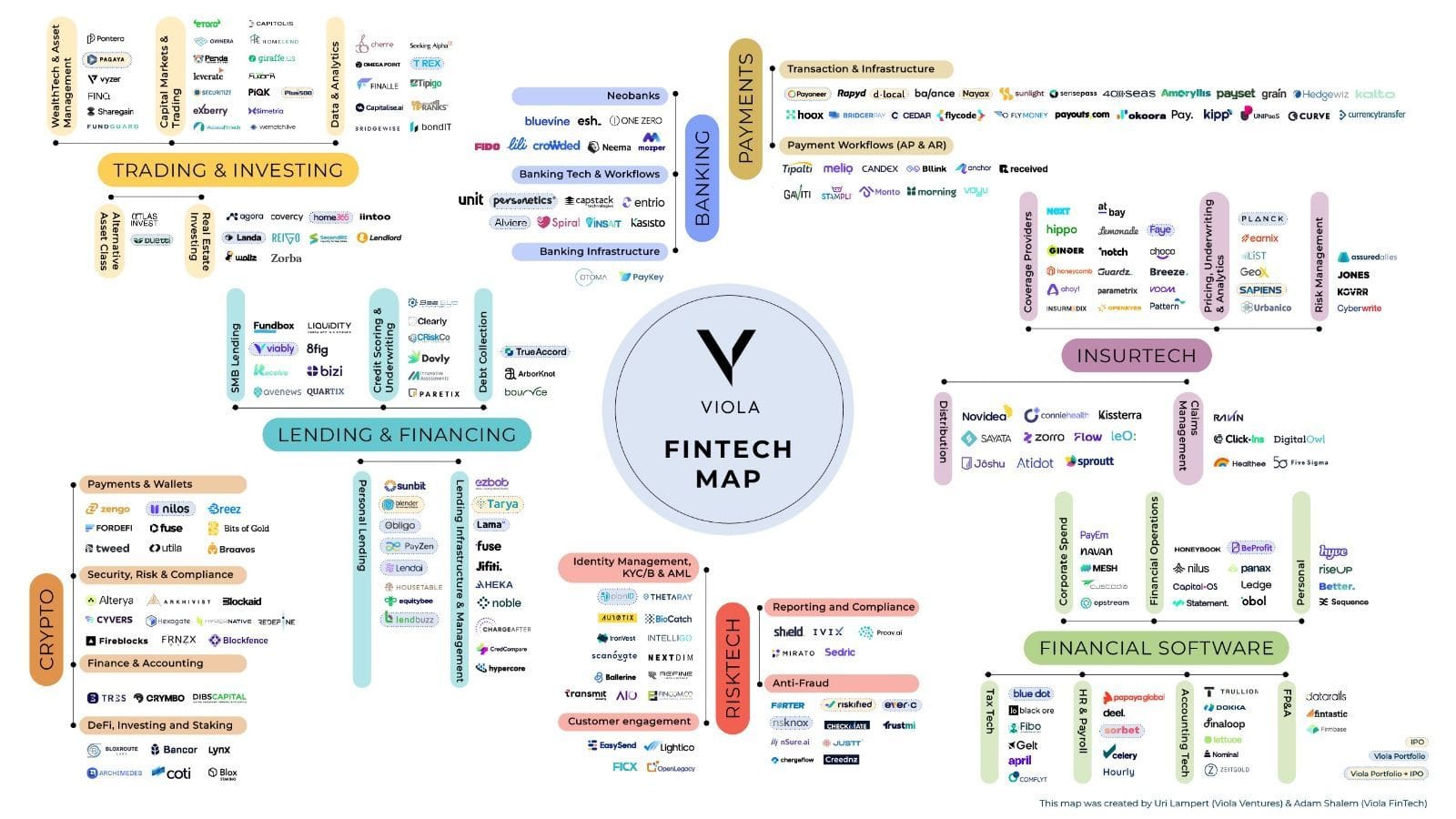

🇮🇱 The FinTech Ecosystem Map Israel

Any FinTech companies missing from the overview?

FINTECH NEWS

🇮🇹 Swan, the FinTech specialized in embedded finance, announces a new office in the Italian FinTech capital: Milan. Swan’s local presence gives Italian companies access to the burgeoning market for embedded finance, projected to be worth $7.2 trillion worldwide by 2030.

🇸🇬 Airwallex for Startups debuts in Singapore to help drive local startup success. The program aims to empower startups to grow and scale their businesses, offering them tips and tools to manage their finances more effectively from the start of their journey and enable them to better connect with the ecosystem.

🇬🇧 In line with its mission to achieve ultimate financial inclusivity for all, Payments Solutions Provider, Ecommpay, is pleased to be supporting Project Nemo for the duration of its 12-month campaign to connect disability inclusion experts with FinTech decision makers who want to accelerate their disability inclusion journey.

🇩🇪 AAZZUR, a FinTech Startup in embedded finance and FinTech orchestration, won the startup pitch event at the Mastercard FinTech Forum 2024. The event, titled "Meet the NextGen Innovators," took place on June 18th at The Factory in Berlin.

🇬🇧 One-third of trading on Robinhood’s UK app outside market hours, says UK boss. In the Tech. eu podcast, Robinhood's UK president Jordan Sinclair gives an update on how the trading app is performing, how he is enjoying the role, and other topical issues.

🇳🇬 Nigerian FinTech Carbon discontinues debit card service nearly 3 years after launch. Ngozi Pascal Dozie, the co-founder and CEO of Carbon, disclosed the latest development in a Substack post published on Wednesday, June 19, 2024. Read on

🇺🇸 Castlelake to buy up to $1.2 bln in consumer loans from Upstart. The deal underscores how investment firms are increasingly pushing into businesses that have traditionally been dominated by banks as high interest rates and the fear of defaults force lenders to hesitate.

PAYMENTS NEWS

🇳🇴 Vipps MobilePay launches P2P payments between Denmark, Norway and Finland. The new service means that Vipps users in Norway and MobilePay customers in Denmark and Finland can ditch Iban numbers for money transfers between the countries.

🇬🇧 SumUp and Adyen partner to bring faster payouts to millions of SMEs globally. The strategic partnership is established to provide a best-in-class payments experience for SMEs across the globe, bringing together two global FinTechs with decades of payments experience.

🇫🇷 Stripe becomes Accor’s primary global payments partner. Accor has a strong ambition to establish a comprehensive ecommerce platform offering a variety of services beyond rooms including spa services, restaurants, and even unique experiences.

🇧🇷 Unlimit and Convera partner to simplify tuition payments for students in developing countries. The partnership will kick off in Brazil, with Convera leveraging Unlimit’s comprehensive alternative payment method (APM) portfolio to enable the seamless payment of cross-border tuition fees via the GlobalPay for Students platform using PIX without any additional charges.

🇨🇭 AMINA Bank, a licensed and FINMA-regulated digital assets bank, has announced the launch of the AMINA Payment Network (APN). Designed to address the needs of the crypto banking world, APN helps to facilitate real-time payments to other APN members.

🇧🇷 Alternative Payments launches DPMaxBrazil. US-based global payment infrastructure provider Alternative Payments has announced the launch of DPMaxBrazil, allowing US merchants to have access to PIX in Brazil, and supporting the expansion of the company’s reach in Latin America.

DIGITAL BANKING NEWS

🇳🇱 Nationale-Nederlanden is planning a big entry into the Dutch banking market dominated by Rabobank, ING, and ABN Amro. The new bank (NN Bank), operating under the strong brand name Nationale-Nederlanden, will position itself between the major banks and so-called challengers and will target Dutch consumers. The bank will be entirely digital, with no branch network.

🇬🇧 Natwest has agreed to acquire Sanisbury's retail banking arm with the supermarket set to PAY Natwest £125m to take on the bank. As part of the deal, Natwest also expects to add roughly one million customer accounts. The transaction is expected to complete in the first half of 2025.

🇩🇰 Danske Bank adds sustainable investment insights to mobile app. The bank has added a new feature to its mobile app that gives customers a clear insight into how many sustainable investments they have in their portfolio. More on that here

🇮🇩 Indonesian digital bank Superbank has officially launched its services on the Grab superapp, enabling users and partners to open bank accounts and utilize them directly for Grab services without needing an additional app. Superbank is now available as a payment method across Grab’s array of services as well.

BLOCKCHAIN/CRYPTO NEWS

🇮🇳 Binance faces $2.25M fine for violating India’s AML laws. The fine against the exchange follows similar regulatory actions in other jurisdictions. The penalty comes with other “specific directions” issued to the exchange. Continue reading

DONEDEAL FUNDING NEWS

🇬🇧 AccessPay secures £350k in first Praetura VCT investment. This funding will enable the company to expand its international presence and further develop its product offerings to meet the needs of its clients worldwide, according to CEO Anish Kapoor.

🇫🇷 French FinTech company HERO has announced a capital raise of €11.3 million from the American investment fund Valar Ventures and its historic investor SquareOne. This new round of funding will enable HERO to provide the most comprehensive and competitive solution to the number one concern of SMEs in Europe: the need for cash flow.

🇰🇷 South Korean-Based FinTech Startup Travel Wallet Raises $10M From Lightspeed. Travel Wallet's innovation extends beyond the B2C sector into the B2B realm. The company is looking forward to leveraging Lightspeed's global network to support their next phase of growth.

🇲🇽 Ximple FinTech secures $2.7M to launch and expand its platform in Mexico. The digital credit distribution company offers unique financial products and will use the funds to launch and expand the innovative Ximple platform and introduce disruptive products to the Mexican market.

M&A

🇺🇸 Global payment company Corpay is set to acquire GPS Capital Markets, a cross-border and treasury management solutions provider primarily focused in the US. The company expects to close the deal in early 2025, subject to regulatory approval.

MOVERS & SHAKERS

🇱🇺 Mangopay announces the appointment of Mark Fleming as Chief Commercial Officer. Mark will join CEO Romain Mazeries’ leadership team to spearhead Mangopay’s international expansion and growth into new client industries, furthering the company’s impact on the platform economy.

🇳🇱 Backbase appoints Chris Shayan as Head of Artifical Intelligence. This strategic move is set to significantly advance Backbase's AI vision and adoption across its tech offering, reinforcing its commitment to re-architecting banking around the customer.

🇺🇸 ConnexPay, an all-in-one payments platform, announced the addition of Kurt Adams to the company’s board of directors. Adams has 25 years of experience in senior leadership roles within the financial services and payments industries, including the role of former CEO at Optum Financial.

🇺🇸 PayPal Names Srini Venkatesan as Chief Technology Officer. In this role, Venkatesan will lead the development and implementation of technology across the entire PayPal ecosystem, including analytics and data science, AI and machine learning, information security, infrastructure operations, and product engineering.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()