Remote Teams Up with Stripe for Instant, Secure Global Contractor Payments via USDC

Hey FinTech Fanatic!

Remote, a global HR platform operating in 200+ countries, has launched stablecoin payouts for contractors through USDC integration. US-based companies can now pay contractors in nearly 70 countries using this new feature, which operates via the Base Network through Stripe Connect.

The platform aims to address common challenges in global payments by offering faster fund access and stability in earnings through USDC. Contractors can set up a compatible crypto wallet, enabling them to hold, convert, or spend their USDC earnings as needed.

The implementation process is straightforward: contractors need to set up a compatible crypto wallet supporting the Base Network and configure their Stripe Connect account on Remote. They can then select Crypto as a new payout option in the Withdrawal Methods tab, providing a seamless integration with existing payment workflows.

Job van der Voort, CEO of Remote, explains: "By introducing stablecoin payouts via Stripe, we're meeting a top customer request, offering contractors their preferred payment method while ensuring compliance and simplicity."

Enjoy more FinTech industry news below👇 and I'll be back in your inbox tomorrow.

Cheers,

#FINTECHREPORT

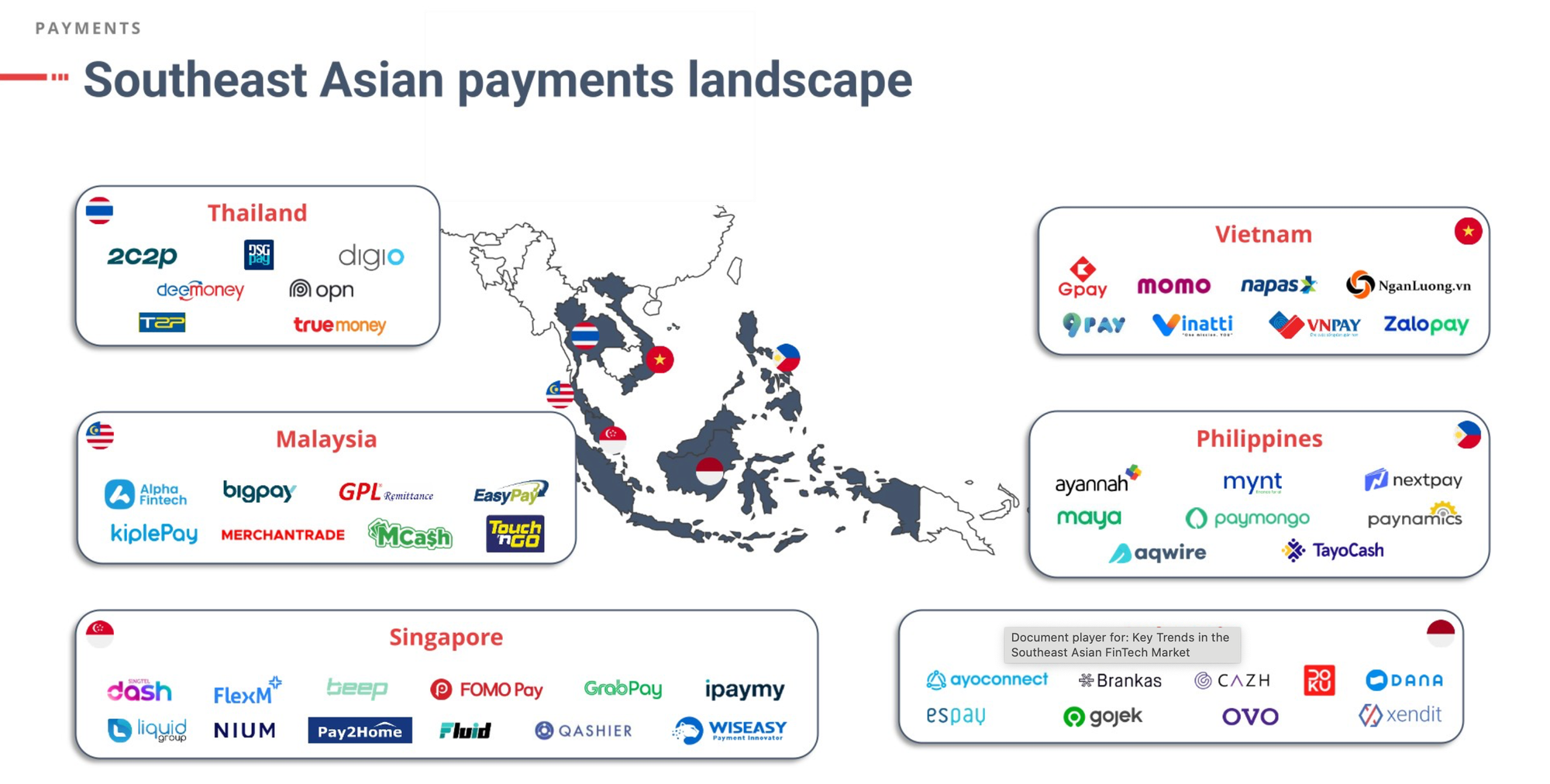

📊 Explore the driving factors and Key Trends in the Southeast Asian FinTech market in this great #fintechreport by Royal Park Partners 👇

INSIGHTS

📈 Revolut experienced remarkable growth in 2024. In Europe, it ranked as number one downloaded financial app in 20 countries and Top 3 in 26 out of 31. Notable achievements include Denmark, France, and Southern Europe, while Germany’s IBAN launch drives success in Western markets.

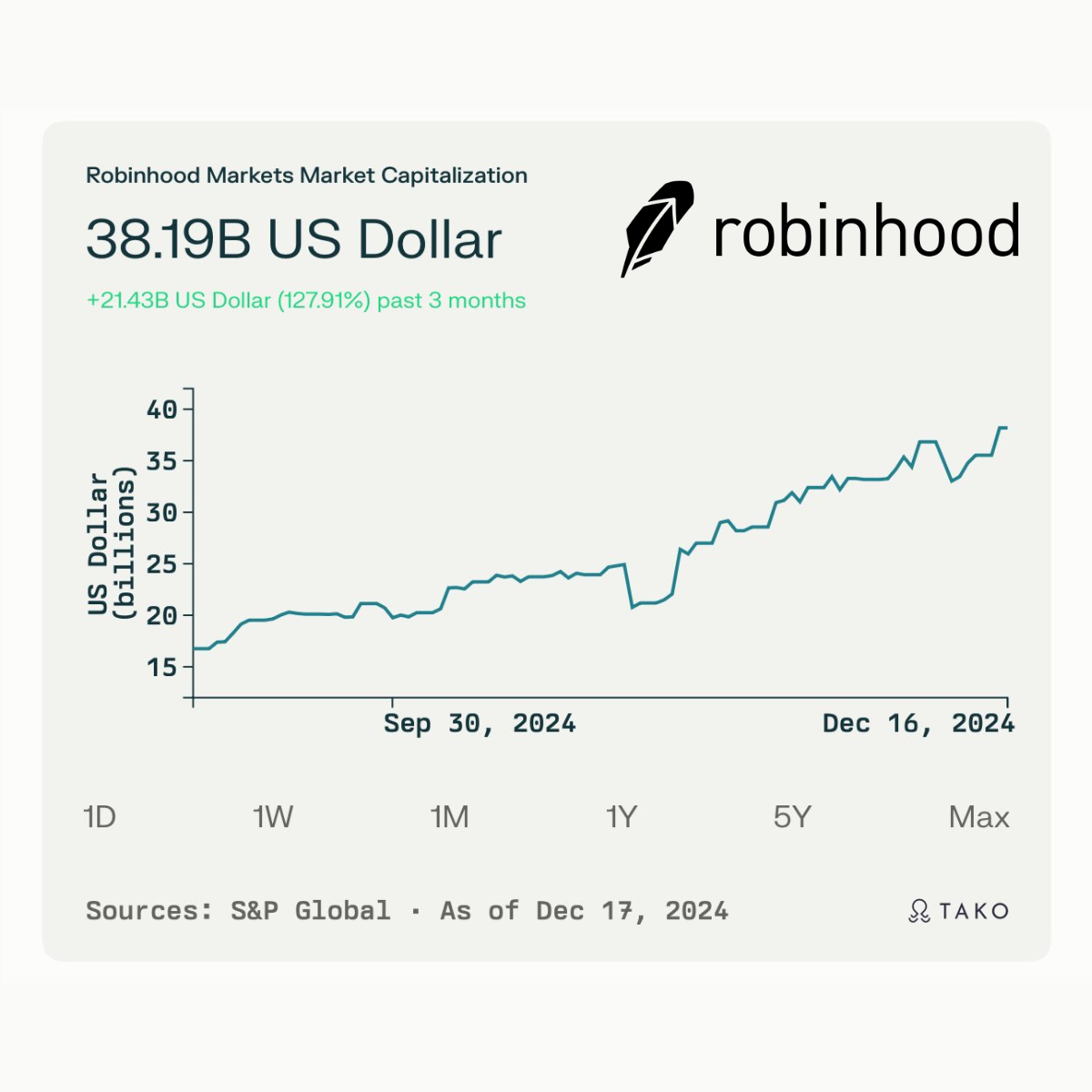

🇺🇸 Robinhood’s market cap at the end of 2023 was 𝟴.𝟬𝟲𝗕. Today, its’s $𝟯𝟳𝗕.

Is Robinhood the big winner of 2024 in (publicly listed-) FinTech?

FINTECH NEWS

🇺🇸 Bamboo secures U.S. License, expanding access to U.S. securities for african investors. The development has made the Nigerian FinTech the first financial organization from the country to achieve such a feat. The company expressed that with the license, corporate clients and licensed brokers can now have access to the US stock market.

🇺🇸 Tech entrepreneur convicted in murder of Cash App founder Bob Lee. Nima Momeni, faces 15 years to life in prison for the crime. After a serious attack in April last year, Lee was found unconscious with stab wounds to the chest in Rincon Hill and later died in the hospital. Continue reading

🇺🇸 E*Trade to offer free funds exclusive to platform users. These funds will be exclusively available to customers with self-directed accounts on the ETrade platform. The initiative aims to offer free investment options while driving platform engagement.

🇮🇳 India’s MobiKwik surges 82% in market debut, The Indian FinTech’s $69 million IPO comes amid fierce competition from larger rivals, and it pushes MobiKwik’s market value to $464 million, well above its initial target of $250 million. Read More

PAYMENTS NEWS

🇺🇸 Visa enhances AI fraud protection for global holiday shopping. This solution, launched earlier this year, leverages generative AI to help prevent account takeovers and other types of fraud across shopping platforms. The company has been proactive in raising awareness among consumers.

🇨🇦 Affirm and Adyen Expand Partnership. The partnership makes Affirm the first Buy Now, Pay Later (BNPL) provider to support Adyen for Platforms, an end-to-end payment solution for platform businesses, and brings more payment options to Adyen merchants in Canada.

REGTECH NEWS

🇺🇸 US watchdog warns credit card issuers not to devalue rewards. The CFPB emphasized that unfair, deceptive, or abusive practices such as altering rewards through hidden terms or technical issues could lead to penalties. This move underscores the agency’s commitment to safeguarding cardholders' rights.

🇦🇺 Australia takes Binance unit to court over consumer protection failures. The regulator said it will be seeking penalties, declarations and adverse publicity orders. Binance did not immediately respond to a request for comment. Continue reading

DIGITAL BANKING NEWS

🇳🇱 Bunq enhances AI & launches Loyalty Program. Bunq upgraded its AI assistant, Finn, to simplify banking and break language barriers. It also introduced bunq Points, rewarding users for spending—1 point per euro for subscribers, double for Elite members, catering to digital nomads and everyday users.

🇸🇦 D360 Bank launches operations in Saudi Arabia. D360 aims to enhance digital banking services, supported by expertise from key financial and investment stakeholders in Saudi Arabia. This marks a significant step in advancing the Kingdom's financial technology landscape.

🇬🇧 Allica Bank passes £3bn in loan balances. The bank highlighted “substantial growth” in recent months. The company’s CEO emphasized the bank’s commitment to serving SMEs, which play a crucial role in the UK economy, contributing a third of employment and GDP.

🇬🇧 Monzo partnered with SignLive to offer customer support via British Sign Language (BSL). This means BSL users can now chat with Monzo’s customer support team through a fully-accredited interpreter, in real time, using video relay services. Continue reading

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Remote launches stablecoin payouts. The stablecoin payouts payments feature enhances Remote’s platform, giving companies a single-dashboard solution to manage all their talent. This new capability is now available to US-based customers, offering companies a secure and near-instant way to pay global contractors.

🇺🇸 Coinbase and BiT Global prepare for their day in court. Coinbase’s filing alleges that wBTC failed to meet its listing standards due to the “unacceptable risk” posed by Justin Sun's involvement and BiT's refusal to disclose ownership details. This dispute highlights concerns over transparency and competitive practices in cryptocurrency exchanges.

🇷🇺 Russia shares CBDC business model as banks push back. Digital ruble transactions will be free until 2025, with the first banks and merchants going live on July 1. While the central bank aims to generate fees long-term, the Association of Russian Banks (ABR) expressed concerns over implementation costs and potential deposit outflows.

🇨🇭 Custody firm Taurus partners with Temenos, bringing crypto wallets to thousands of banks. This integration allows Temenos clients to offer seamless crypto services, including automated transactions, real-time reconciliation, and regulatory reporting, bridging traditional and digital banking.

🇸🇬 Sygnum and Moomoo collaborate to establish a new crypto fund. This partnership will make Moomoo in Singapore the first distribution partner for a Sygnum Singapore asset management product. Click here to learn more

🇬🇧 Tether invests in StablR to promote stablecoin adoption in Europe. The investment highlights Tether’s growing focus on the region, particularly as regulatory frameworks like the EU’s Markets in Crypto-Assets (MiCA) regulation begins to come into force later this month.

🇩🇪 Deutsche Bank tackles blockchain compliance hurdles. The bank is working on a fix for the regulatory challenges financial institutions face when trying to use public blockchains, such as the risk of inadvertently transacting with criminals or sanctioned entities.

PARTNERSHIPS

🇺🇸 Aptia adopts HSBC's Pre-Validation API for payments. This strategic move reinforces Aptia’s commitment to offering its customers the most secure, efficient, and seamless payment processes. By integrating this advanced technology into its operations, Aptia is raising the bar for security and trust in pension fund administration.

🇹🇷 Mastercard partners with Dgpays. This collaboration enables the companies to co-develop advanced payment technologies and loyalty solutions. The initiative will focus on optimising access to digital payments, ensuring secure and practical solutions that build trust among consumers and businesses alike.

Triple-A And Rezo Money partner to enable crypto-based mobile recharges globally. Through this partnership, Rezo customers can now perform mobile recharges, pay bills or other remittances services using cryptocurrency. This collaboration allow them to top up mobile phones for family and friends anywhere in the world using crypto.

DONEDEAL FUNDING NEWS

🇺🇸 Basis raises $34 million to deploy AI Agents for Accountants. Basis was founded to equip accountants with AI agents that can perform tasks, report back with results and free accountants up to focus on higher-level work. Continue reading

🇺🇸 Leap Financial secures $3.5M investment to fuel AI-driven innovation in cross-border payments. Leap’s mission is to dismantle outdated systems, allowing financial and non-financial institutions to participate in money flows efficiently and at a reduced cost.

🇺🇸 Bureau raises $30M Series B as global fraud losses hit $486B. The company has tripled its revenue since its last funding round and will use the funds to expand its AI-powered fraud detection solutions into new markets and use cases. Founder and CEO Ranjan Reddy, aims to transform digital identity verification and fraud detection.

🇨🇭 Swiss VC firm Founderful collaborate with Tiun. Tiun aims to revolutionize how younger audiences pay for media with its streamlined payment solution. The funding will support Tiun's goal of becoming Europe’s preferred payment platform for online media.

M&A

🇺🇾 Uruguay payments provider DLocal explores sale. DLocal is exploring options including a potential sale. It is also working with Morgan Stanley to gauge takeover interest from potential acquirers. Read more

🇦🇺 ANZ Bank eyes buyback of payments unit. Merchant acquiring, a low-margin, tech-intensive sector, was positioned as a strategic partnership to support ANZ's small and institutional clients. This potential buyback signals a shift in ANZ’s approach to the payments market.

MOVERS & SHAKERS

🇺🇸 Damon O'Donnell appointed Director of People & Business Operations at Aeropay. Damon brings a strong background in recruiting and operations, having previously held Chief of Staff roles at prominent companies such as Pinterest and Moët Hennessy.

🇳🇱 Mambu appoints Ivneet Kaur as Chief Product & Technology Officer. Ivneet will strengthen Mambu’s product portfolio and drive its cloud-native platform strategy. As part of the Executive Leadership Team, she will focus on innovation, customer satisfaction, and responsible technology practices.

🇧🇷 QED Investors Names Camila Vieira Partner and Head of Brazil. Camila is part of the early-stage international team with a focus on FinTech investments and is one of 19 investment professionals at QED. The company’s CEO mentioned that Camila is a true asset to their board and that her contributions have been invaluable.

🇸🇪 Northmill appoints Emil Folkesson as CFO. Folkesson brings over 15 years of experience to Northmill, and has previously led “strategic initiatives” in areas such as “capital acquisition, implementation of growth strategies, and financial restructuring,” the company says.

🇬🇧 Samantha Seaton steps down as CEO of Moneyhub. Seaton said: “Leading Moneyhub has been an extraordinary privilege. Our north star has always been enhancing people’s financial wellness not just as a business metric, but as a meaningful societal contribution.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()