Redefining SME Banking: A Deep Dive into OakNorth's Success Story

In the realm of SME banking, few names have become as significant in recent years as OakNorth. This institution, by leveraging digital advances and a unique ethos, has redefined what it means to be a contemporary bank in this age of digitization.

In the realm of SME banking, few names have become as significant in recent years as OakNorth.

This institution, by leveraging digital advances and a unique ethos, has redefined what it means to be a contemporary bank in this age of digitization.

C-innovation published a very interesting report about Oaknorth and I had the pleasure to have early access. Here is my review of OakNorth and the report:

A Brief History and Notable Achievements

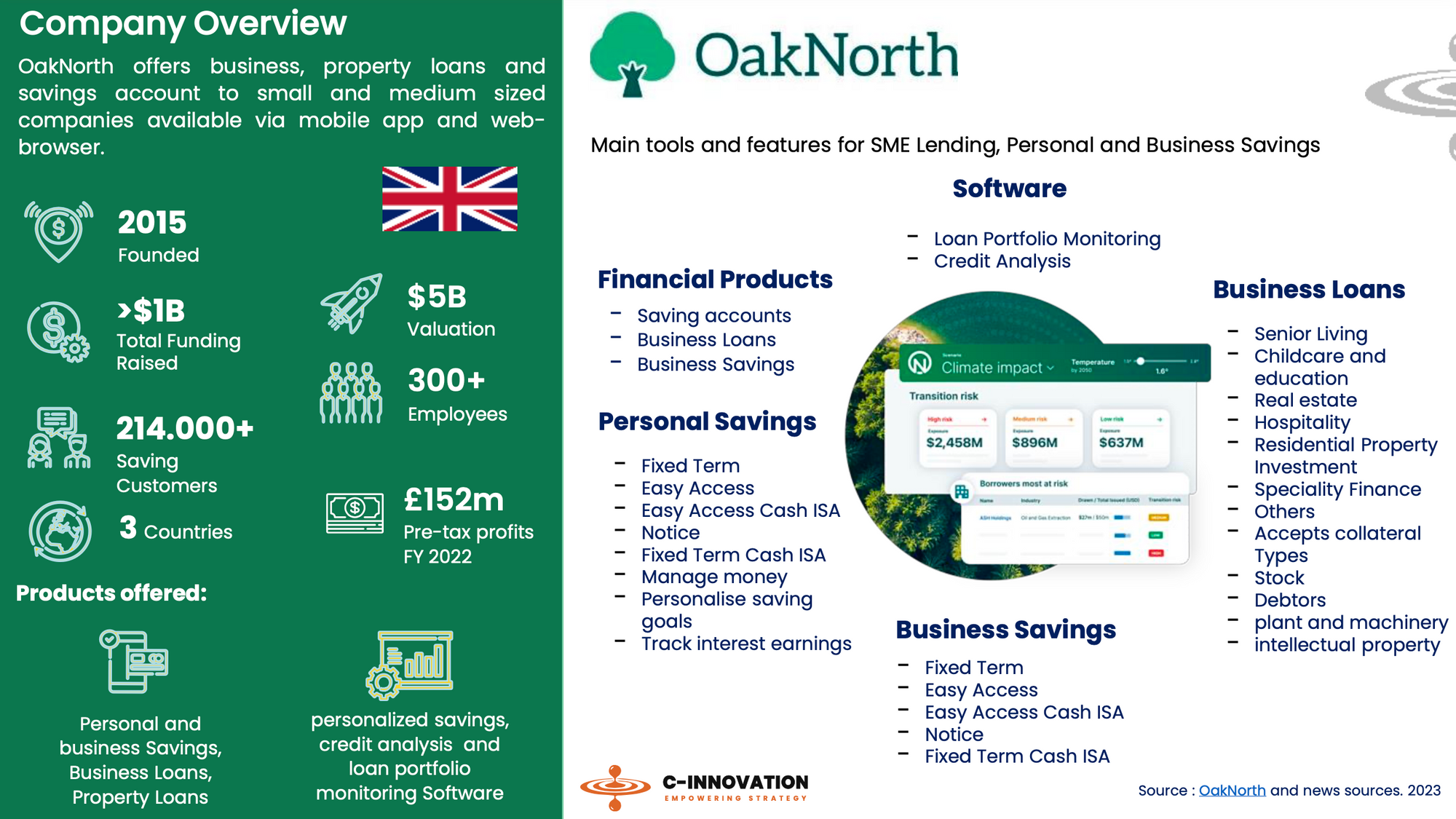

Founded in 2015 by Joel Pearlman and Rishi Khosla, OakNorth's mission was clear from its inception: to revolutionize SME lending.

Within the same year of its establishment, OakNorth secured its UK banking license under the FCA protection, marking its commitment to safeguarding customers' interests.

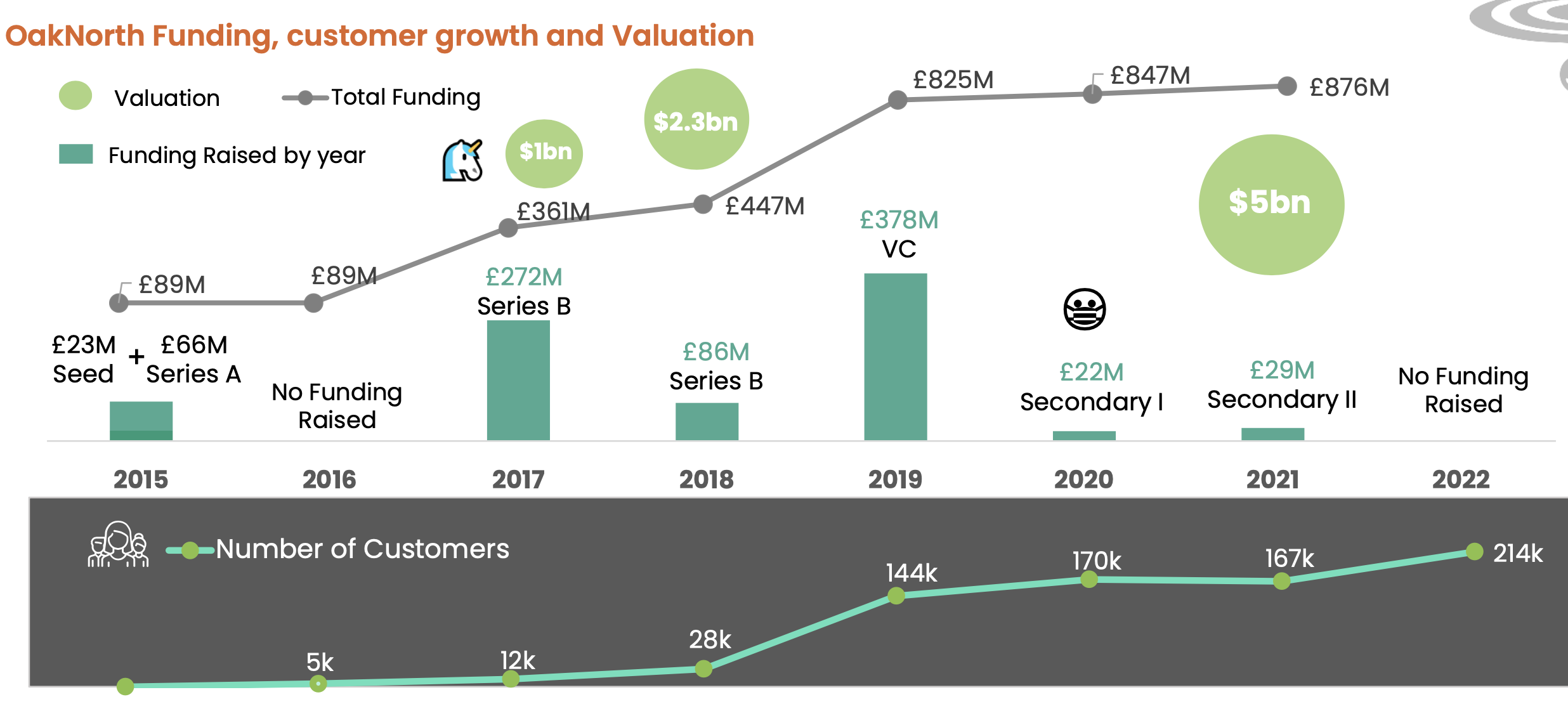

By 2017, the bank had ascended to the esteemed 'unicorn' status, a testament to its meteoric rise and market value.

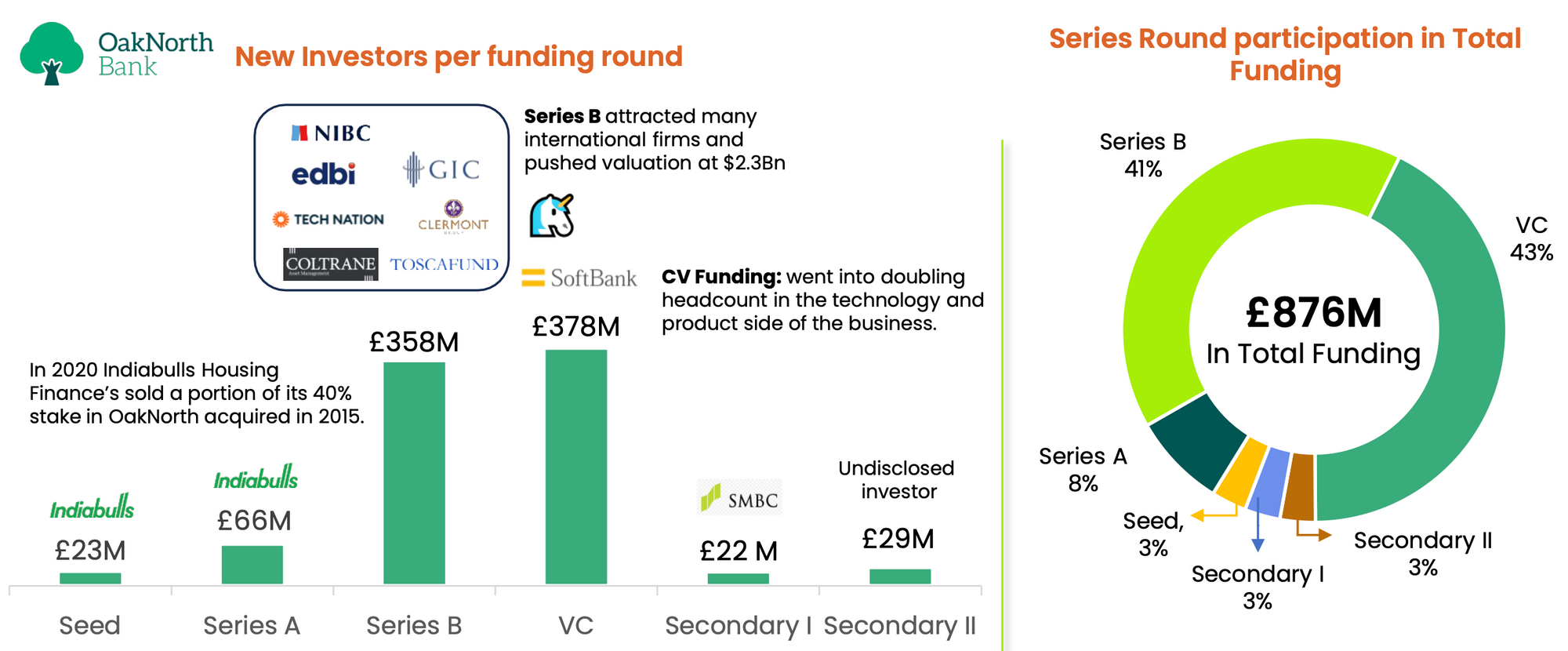

Indiabulls supported OakNorth in its early days, while SoftBank's investment in 2019 enabled substantial growth for the technology and product teams.

Understanding OakNorth’s Unique Position

OakNorth's strategy stands out primarily because of its emphasis on the "Missing Middle".

Unlike traditional financial institutions that offer generic solutions, OakNorth prides itself on delivering bespoke services and products tailored to the unique needs of SMEs.

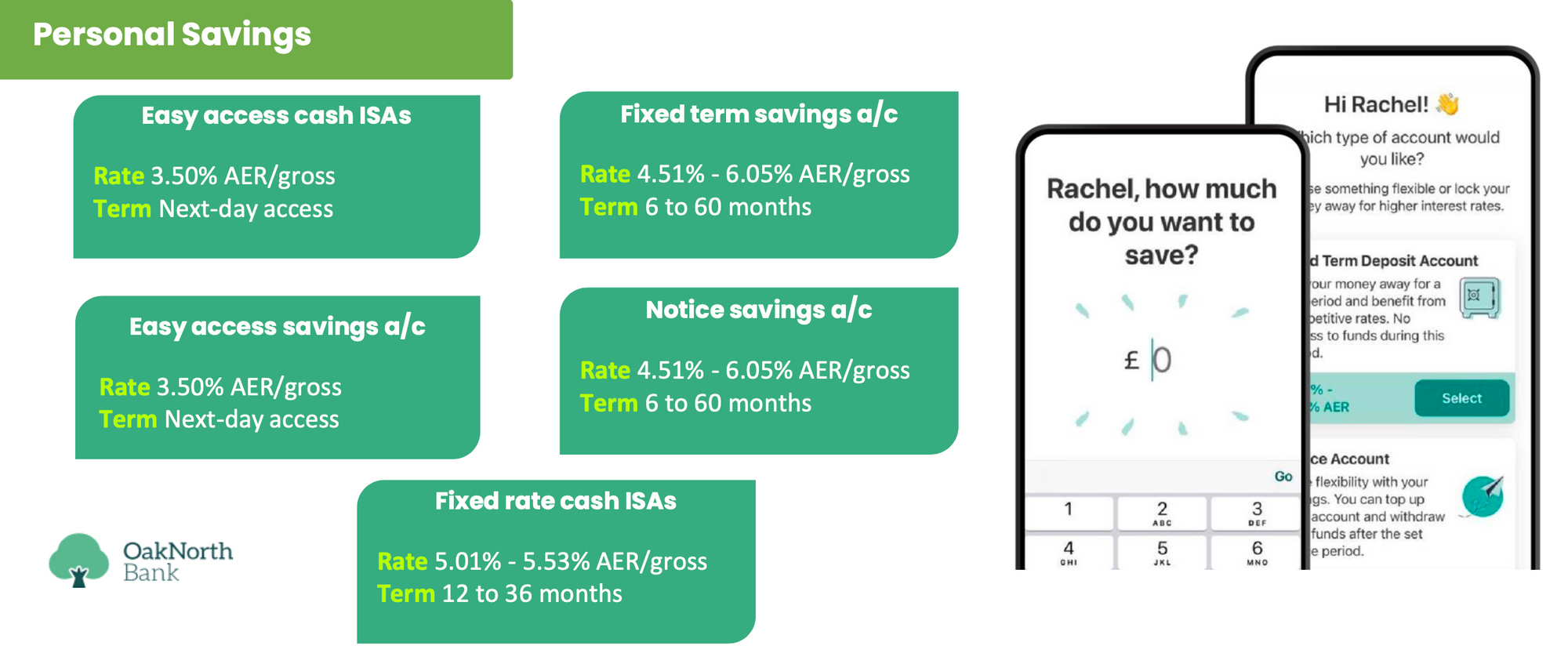

This includes offering competitive savings products with attractive online and app-based interest rates.

At the heart of this strategy is the ON Credit Intelligence suite, a potent mix of advanced technology and extensive commercial loan data, allowing OakNorth to make granular and proactive decisions.

The Secret Sauce: OakNorth’s Growth Blueprint

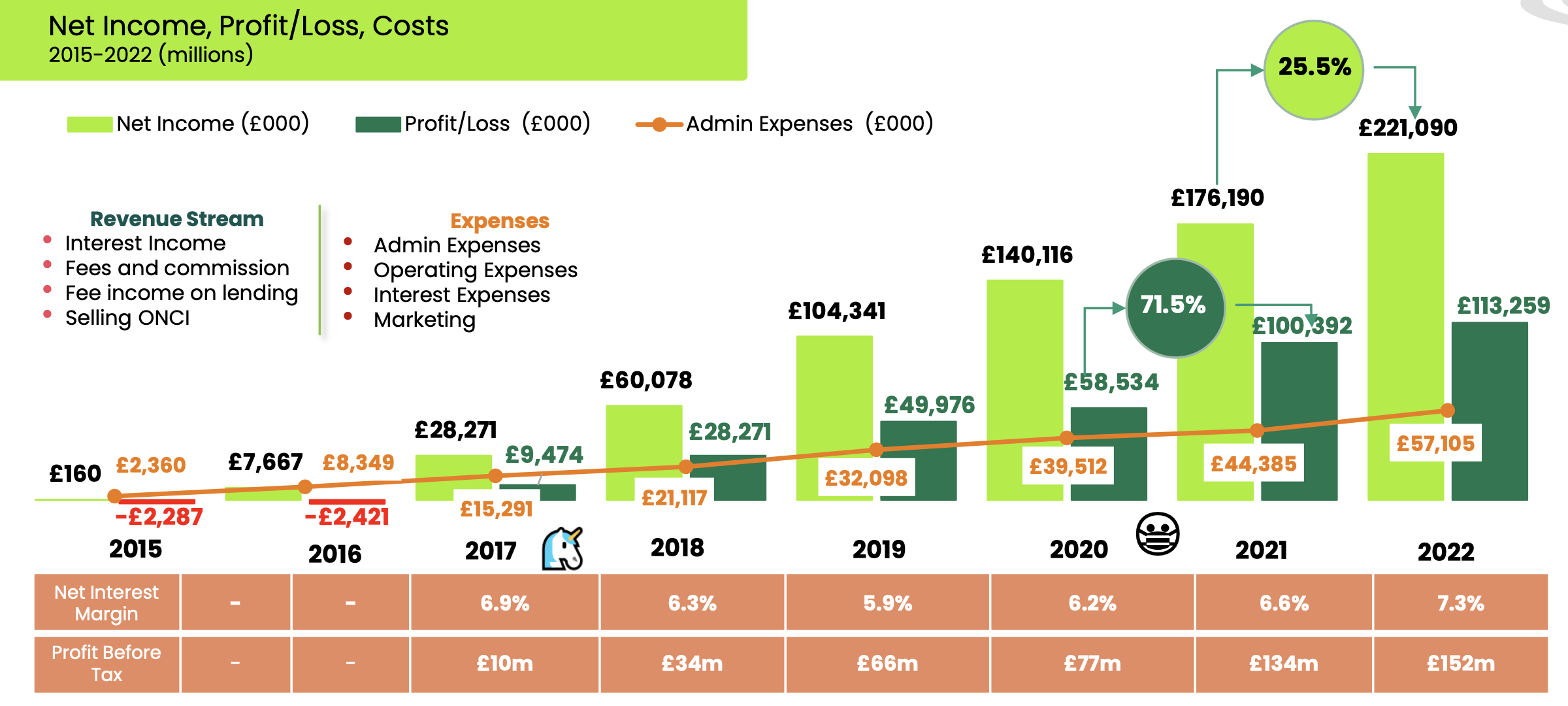

Achieving profitability within two years of operation is no mean feat. OakNorth managed this by rapidly establishing trust among global investors and adopting a dual approach.

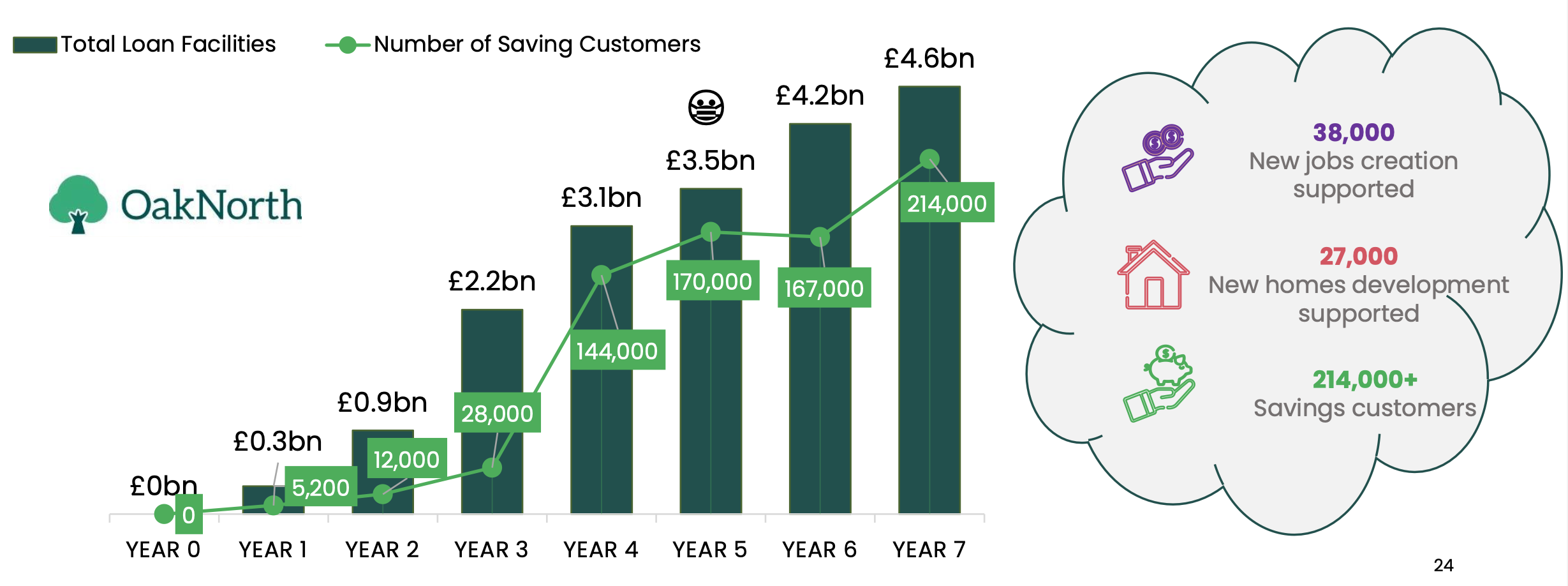

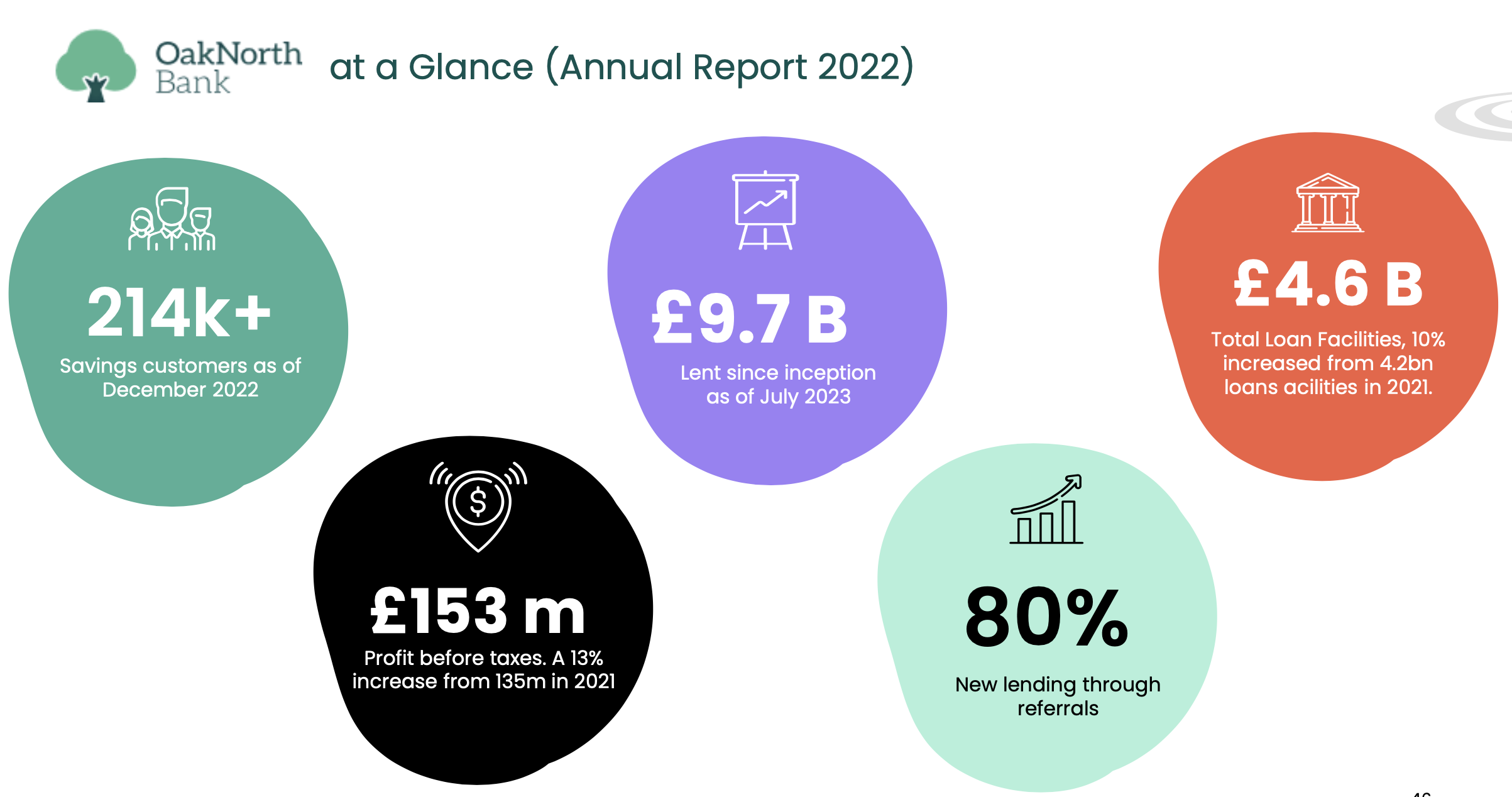

They launched their Bank and ONCI soon after obtaining the necessary licenses. With an impressive 214k+ organic savings customers under their belt, OakNorth has been keen to expand its reach.

Collaborations with digital banks and platforms have facilitated this, while the deployment of ONCI in the US market shows their ambition to go global.

Furthermore, their approach to lending stands out. Eschewing the one-size-fits-all model that many banks adopt, OakNorth offers bespoke loan solutions.

Their data-driven analytical framework covers an astonishing 270+ industries.

So far, their approach seems to have paid off with finances for loans exceeding £9.7B.

Sustainability and Future Endeavours

Unlike many Neo-banks that chase rapid growth, OakNorth is a proponent of the 'slow and steady' philosophy.

This approach, coupled with its tech-first, customer-centric model, ensured that the bank continued to flourish even during the trying pandemic times, attracting funds and boosting customer confidence.

As for what the future holds? OakNorth is looking to cast its net even wider.

Plans to expand its ONCI technology on a global scale are in the works, with murmurs of a possible IPO in the offing.

Additionally, mergers and acquisitions with firms that share its ethos are being considered as part of its growth strategy.

Conclusion

OakNorth’s journey is a testament to what's achievable when innovation meets a deep understanding of customer needs.

Through its unique offerings, steady growth strategy, and commitment to sustainability, OakNorth sets a compelling template for neo-banks globally.

The next few years promise to be exciting as this institution continues its upward trajectory in the world of SME banking.

Last but not least: I highly recommend reading the complete source report by C-Innovation for more info, stats, and figures about OakNorth.

Comments ()