Real-time payments are the backbone of modern economies

Central to the thriving FinTech ecosystem are real-time payments, which have rapidly become the gold standard in numerous markets. Governments worldwide are rallying behind the potential economic upliftment facilitated by these immediate transactions.

Central to the thriving FinTech ecosystem are real-time payments, which have rapidly become the gold standard in numerous markets.

Governments worldwide are rallying behind the potential economic upliftment facilitated by these immediate transactions. Consequently, the momentum of real-time payment adoption is growing exponentially.

The data is indeed indicative.

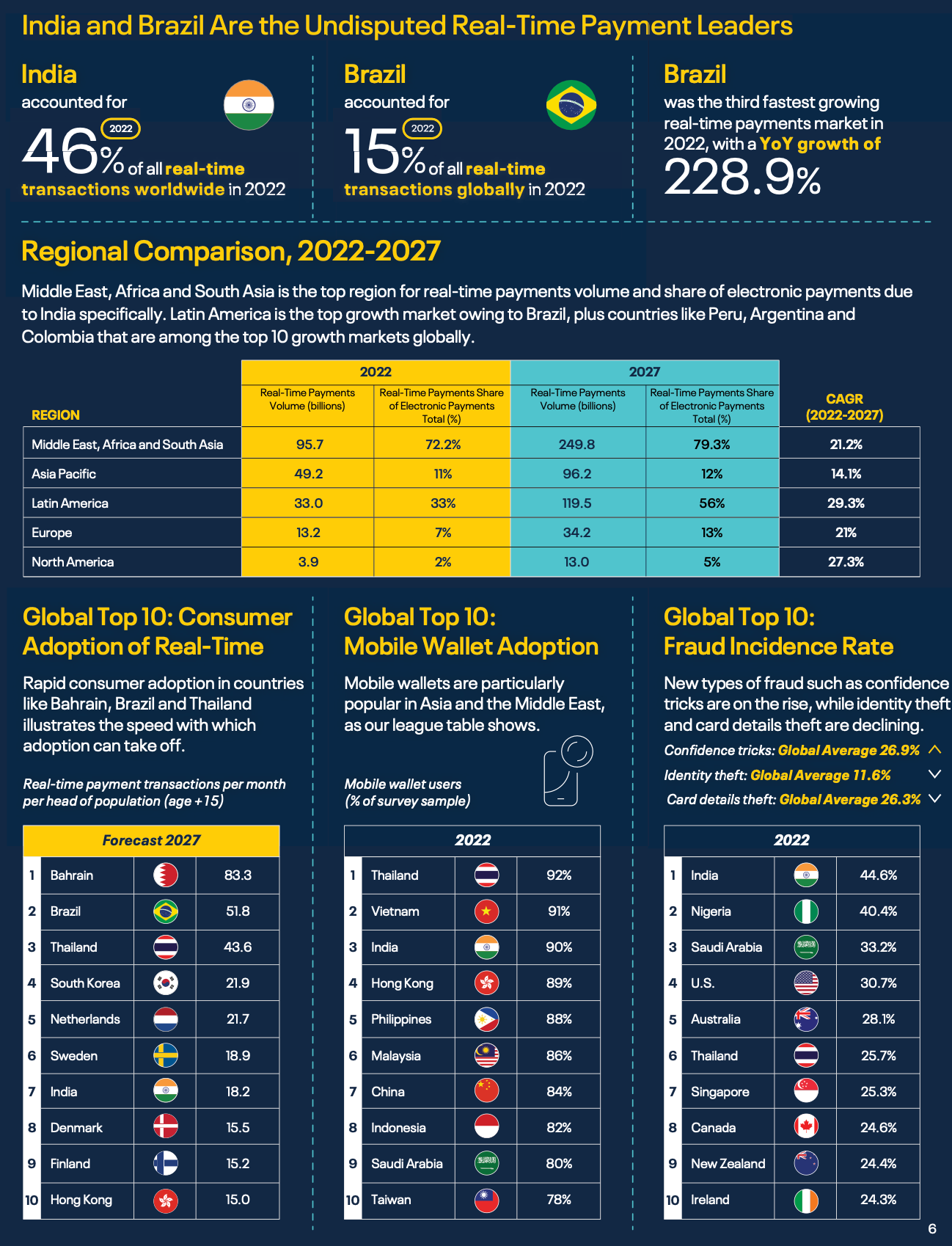

In 2022, global real-time transactions surged by 63.2%, reaching an impressive 195.0 billion.

By 2027, projections estimate 511.7 billion real-time transactions, translating to an annual growth rate of 21.3%. Notably, by that year, about 27.8% of all electronic transactions will be real-time, a significant rise from 18% in 2022.

This mode of payment is no less than the lifeblood of modern-day economies. Countries that have embraced it have witnessed transformational shifts in how consumers, industries, and governments manage finances.

The economies that promote real-time payments are notably more vibrant, mirrored in their enhanced real-time payment growth rates.

ACI Worldwide published the "Prime Time for Real-Time" report in collaboration with GlobalData, offering a comprehensive overview of real-time payment trends across 52 countries. And I used this info, together with recent data, for this deep dive.

The Vanguard of Real-Time Payments

By 2027, the small nation of Bahrain is predicted to lead in per-capita real-time transactions, overshadowing larger economies like Thailand and Brazil.

Conversely, most major Western economies are trailing behind, with countries like Sweden, Denmark, the Netherlands, Thailand, South Korea, India, and Malaysia setting the pace.

The Catalysts Behind Consumer Adoption

The global demand is clear: people and businesses want efficient, cost-effective, and immediate payment solutions.

As the world transitions to a more interconnected payment ecosystem, authorities and enterprises are innovating to enhance the adoption of real-time payments.

The ACI Worldwide report identifies three main accelerants:

- Branding and tailoring use cases to break traditional payment norms.

- Merchant acceptance, which is lured by benefits like increased liquidity, cost-efficiency, and fraud risk reduction.

- Governmental involvement. Countries that incorporate real-time payments into public sector transactions tend to have higher adoption rates.

Government Initiatives Shape the Future

As the importance of real-time payments becomes undeniable, government strategies are evolving.

By drawing inspiration from successful stories such as Brazil's PIX system, regulators are acknowledging the dynamism infused by a progressive payments ecosystem and are strategizing to bolster adoption.

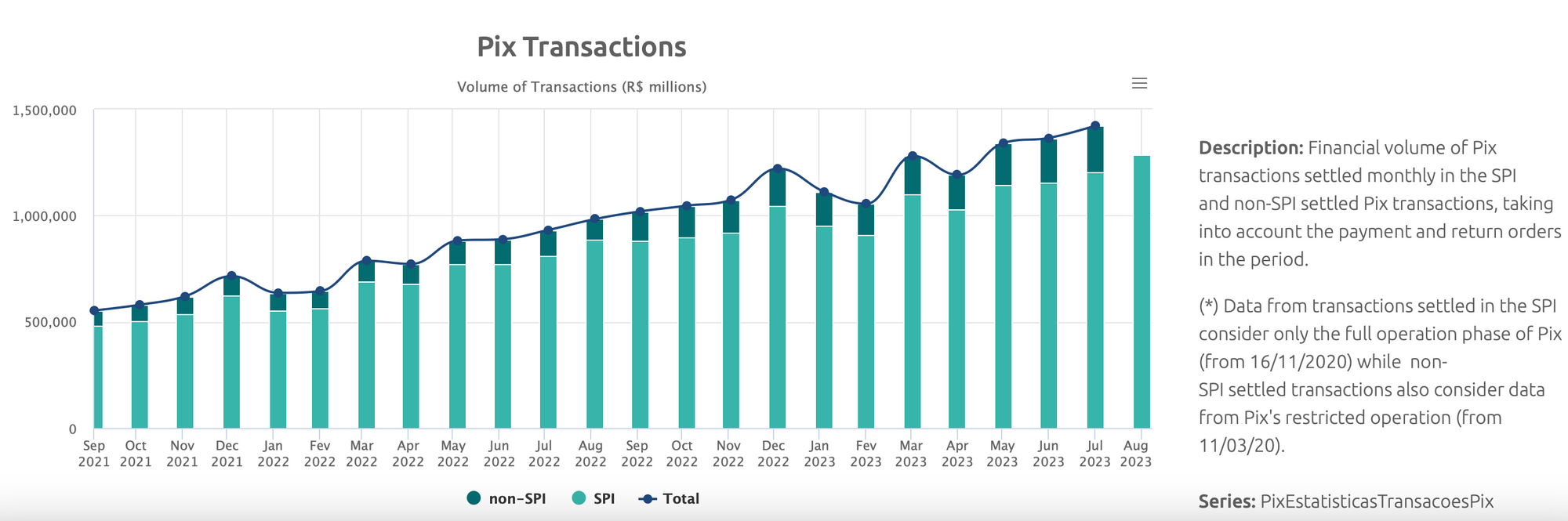

In a record-breaking event on July 7, 2023, PIX carried out 134.8 million operations in one day, the first time transactions exceeded 125 million in 24 hours.

PIX is not just a popular method of payment; it has a significant user base with 146.4 million users, 134.8 million of which are individuals and 11.6 million are businesses.

In another milestone reached in September 2022, the system exceeded the mark of R$1 trillion transactions in a month.

By the first quarter of 2023, PIX had become the primary payment instrument in Brazil, accounting for 35% of total transactions.

This widespread adoption attests to the system's importance to the Brazilian economy.

Currently, the EU is mulling over legislation that could disrupt the instant payment market by capping fees. Similarly, in the U.S. the launch of the FedNow system in July 2023, marks a pivotal chapter for real-time payments.

Asian and Middle Eastern nations too are formulating fresh mandates to champion real-time payment adoption.

Lets dive into some interesting markets with info from ACI Worldwide's report:

Bahrain

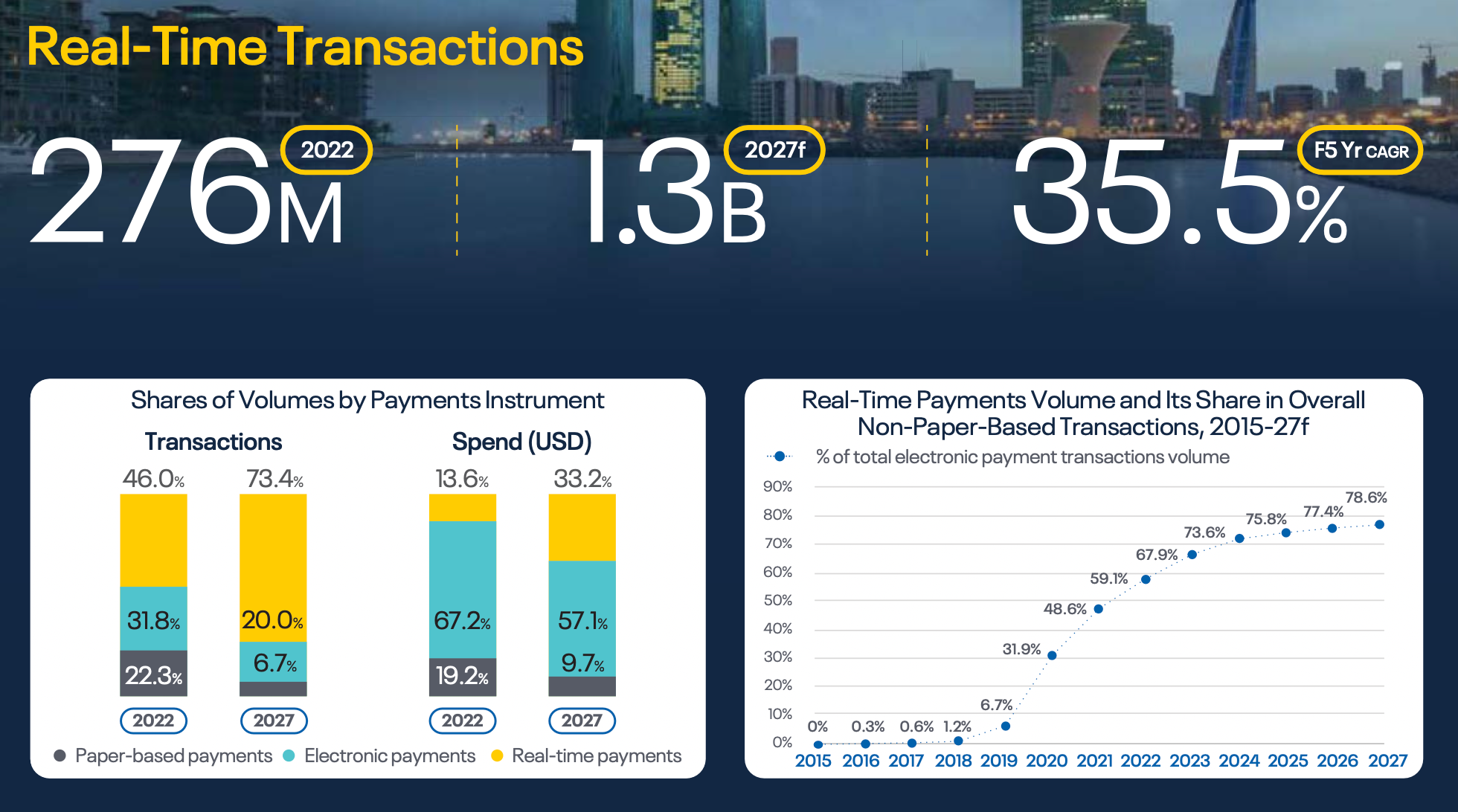

Bahrain is one of the larger real-time payment markets in the MEASA region (not counting India), with instant payments accounting for 46% of total payments volume in the country, and the majority of all electronic payments.

Real-time payments are thus a major component of the overall market, following a major upswing in its usage during 2020. Previously, Bahrain was a cash-dominated market.

The future for real-time payments also looks positive for the market, with the share of overall payments volume accounted for by these services expected to reach 73.4% of all transactions in the market by 2027.

This makes Bahrain one of the most established real-time payment markets in the region, if not the largest by volume.

Brazil

Brazil has two real-time payment infrastructures in operation: SITRAF and PIX. S

ITRAF was the first to be introduced in 2002 and PIX, a mobile-based real-time payments service, was introduced in 2020. SITRAF only operates during banking hours, which limits the volume of activities the platform can manage.

PIX (more recent stats mentioned earlier in this article), by contrast, is a real-time payments system that operates 24 hours a day, seven days a week, 365 days a year. Since its launch in 2020, PIX already surpassed SITRAF’s adoption among participants, as it is available to the customers of 790 financial institutions, whereas SITRAF only had 104 participants.

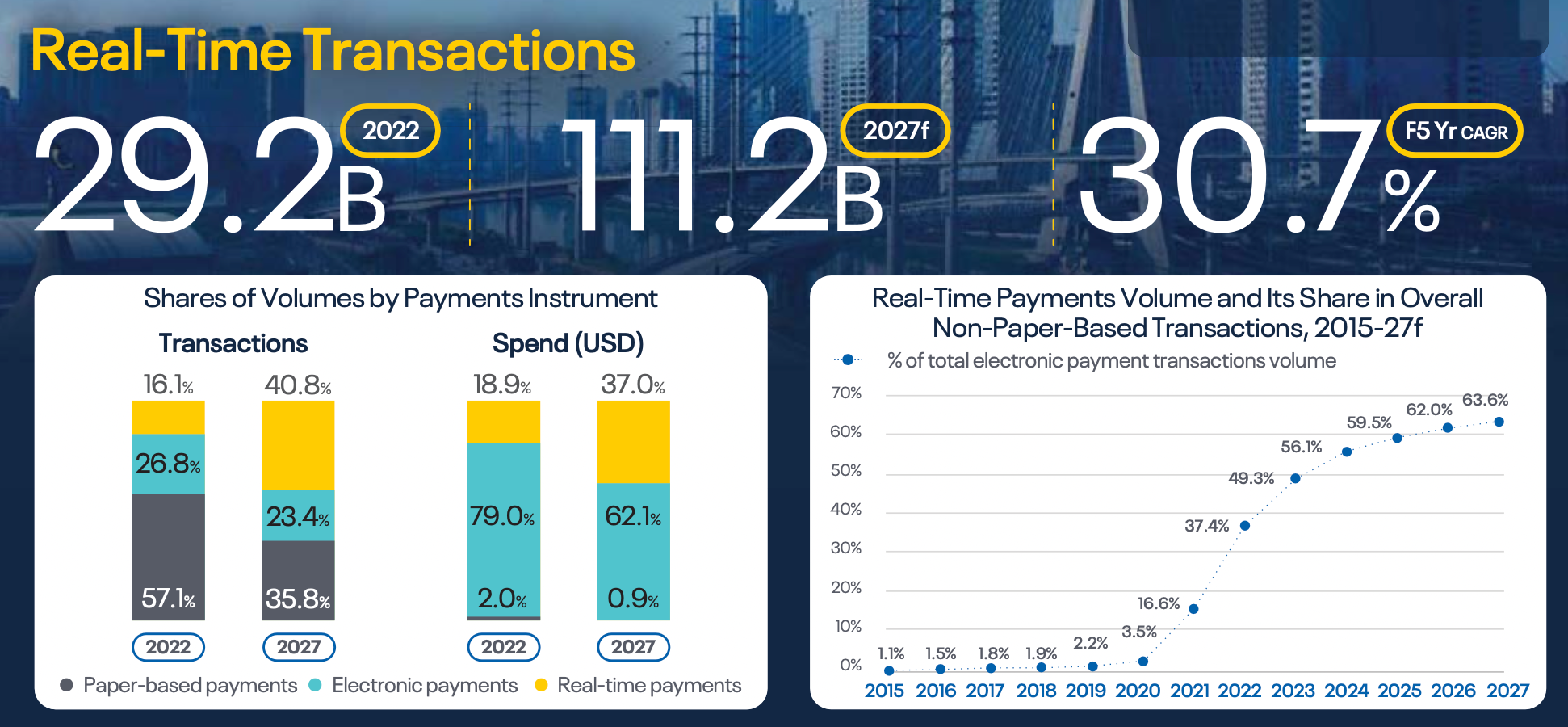

In 2022, Brazil was the second biggest and most developed real-time payments market in the world, behind only India.

Its real-time payment systems represented a 16.1% share of total payments volume in 2022, behind non-real-time electronic payments and paper-based transactions, which were at 26.8% and 57.1%, respectively.

But its market share is expected to grow significantly by 2027, when it is forecasted to reach a 40.8% share of payments volume, overpassing electronic payments (excluding real-time payments) which will decrease to 23.4% and even paper-based transactions, which will be at 35.8%.

This rapid growth of real-time payment transactions is due to the widespread adoption of PIX by consumers and merchants for daily expenditures, which itself owes a lot to its strong support from the Brazilian government, as well as introducing a mobile-based payments service to an otherwise cash-dependent (rather than cash-preferring) populace.

China

China launched its real-time payments system, called the Internet Banking Payment System (IBPS), in 2010 to strengthen its banking infrastructures and boost non-cash payments.

In 2022, it was ranked as the third country in the world in terms of volume of real-time payment transactions, processing a 21.5 billion volume of transactions in 2022 — but this is solely due to the sheer size of the Chinese market; it is still far behind the market leader India which processed 166 billion in volume of transactions.

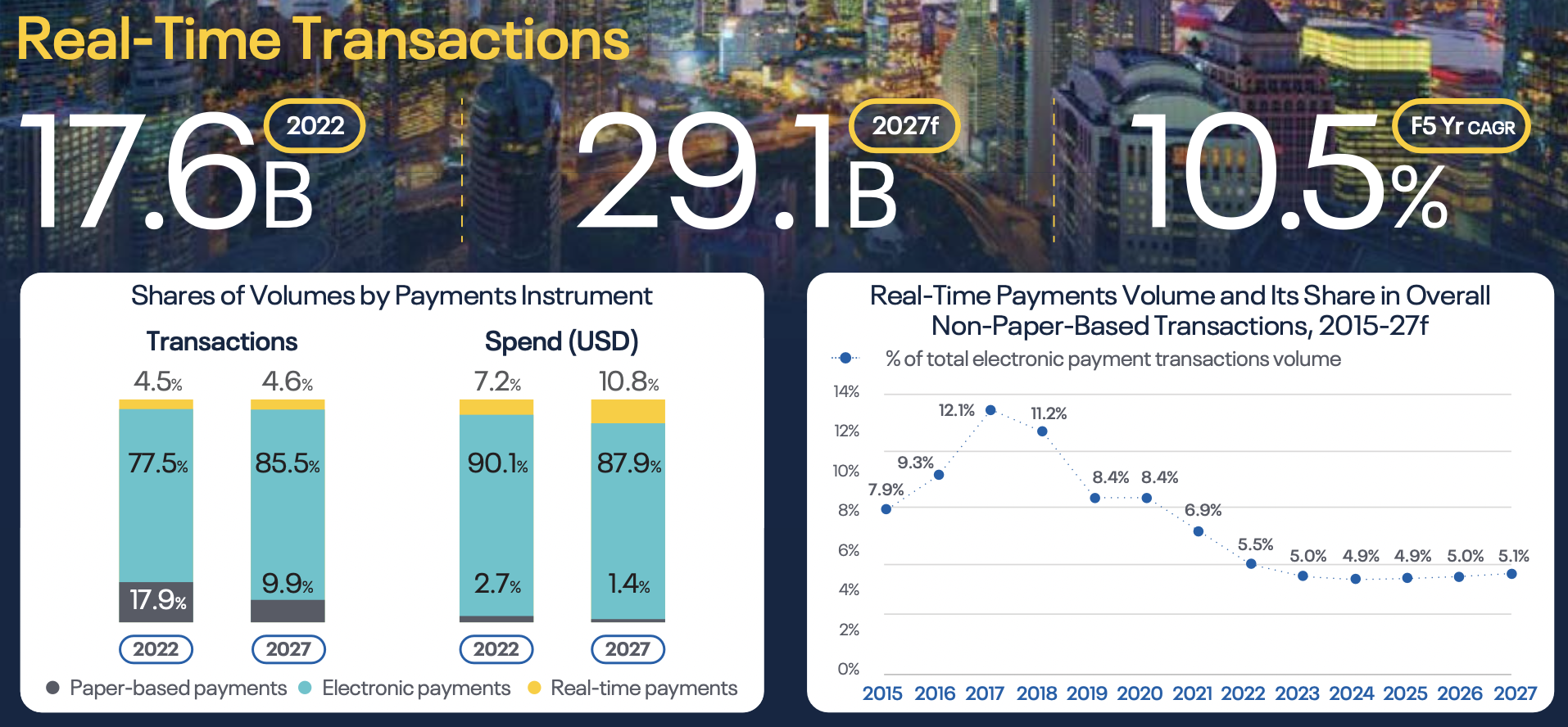

In 2022, real-time payments represented only a 4.5% share of total payments volume, with a 7.2% share of total payments spend. 2027 projections are expecting real-time payments to barely grow its market share in volume of transactions, as it is expected to slightly increase to 4.6%, increasing at a CAGR of 10.5%.

France

France adopted SCT Inst in 2018, implementing real-time payments into its domestic network. SCT Inst was developed by the EPC with the aim to create a real-time payments network within the eurozone — though so far, the development towards a truly pan-regional, real-time payments network within the EU has been very slow.

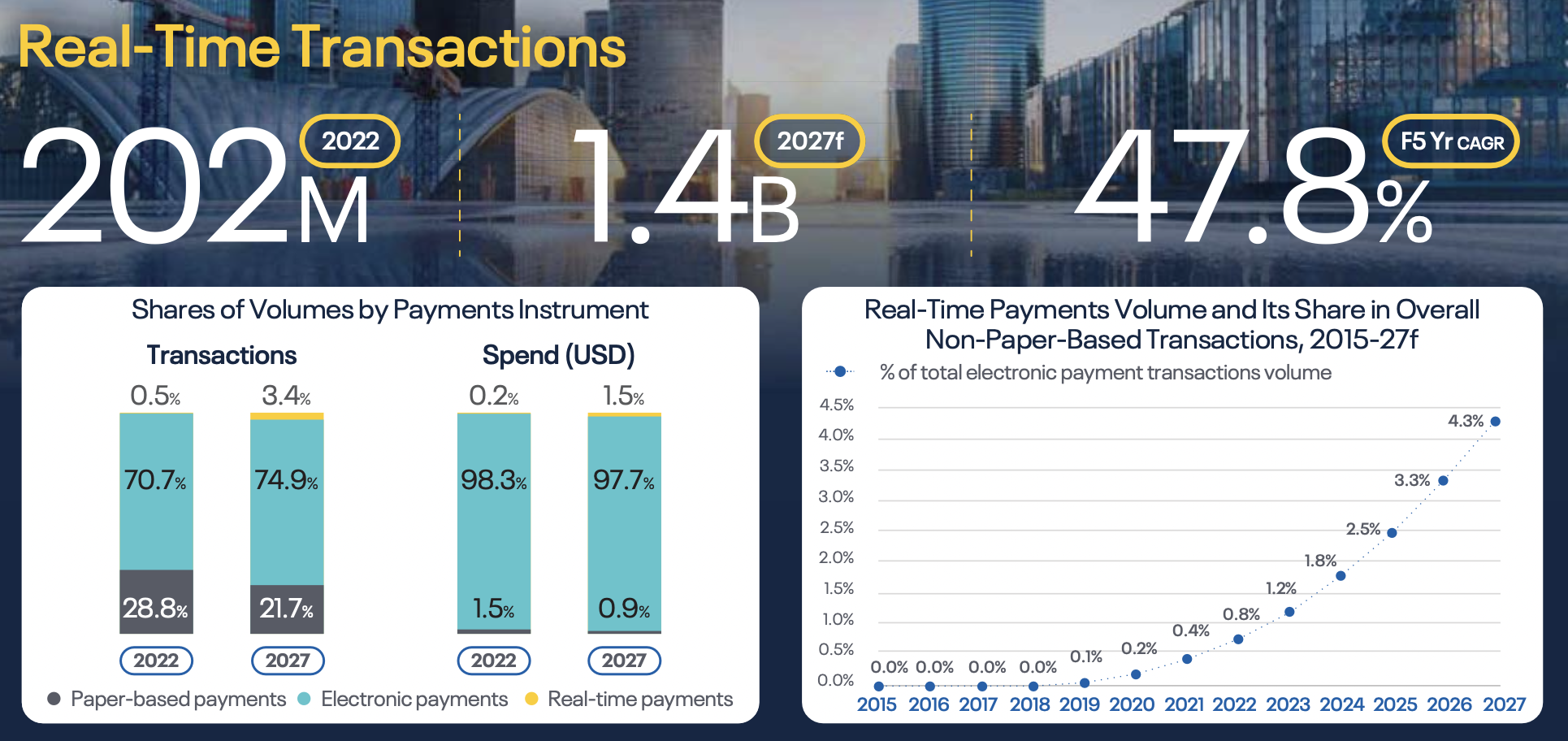

Real-time payments have very small usage in France, representing a 0.5% share of total payments volume in 2022.

There is, however, an EU regulation in the works that will require all payment service providers to make instant payments available to all their customers at standardized, low prices while ensuring security in the transactions.

The payments industry in France is heavily dominated by card and “slow” transfer payments, but paper-based payments still represent an almost 30% share of total payments volume in the market.

Under current market conditions, by 2027 it is projected that real-time payments volume market share in France will reach 3.4%, with the market growing at an impressive CAGR of 47.8%.

This growth will be attributed to the new eInvoicing regulation and a decline in paper-based payments whose share is expected to decrease from 28.8% to 21.7% by 2027 — though card-based payments will be the biggest beneficiary of this drop.

Germany

Germany adopted the pan-European SCT Inst payments scheme in 2017. By integrating it, it gained access to the European instant payments scheme, today providing real-time transfers not only among participating financial institutions in Germany, but also with any participating financial institution in any other country in the eurozone.

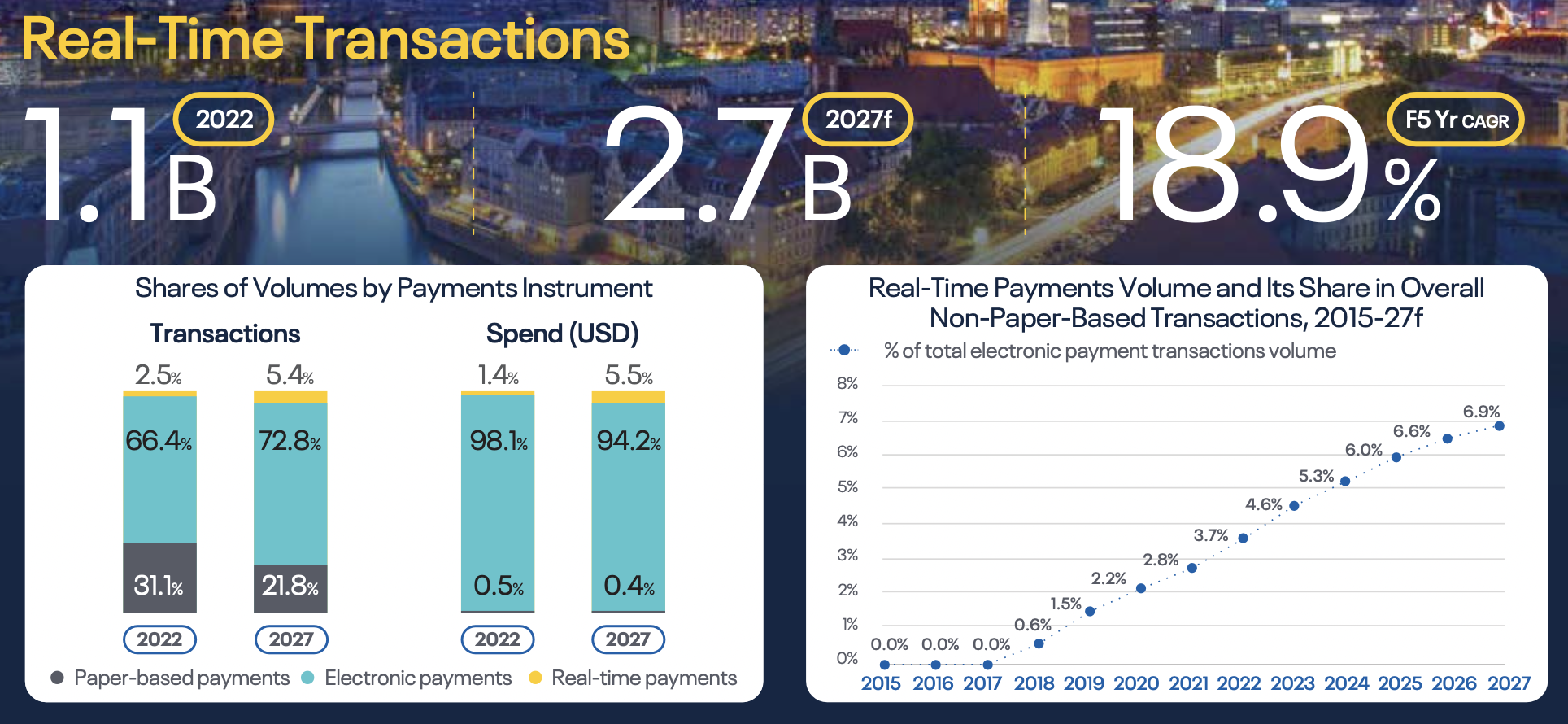

Despite this regional link being in place, real-time payments represent only a small part of total payments volume and spending in Germany.

In 2022, real-time payments volume was 2.5% of total payments volume, whereas other forms of electronic payments represented 66.4% and paper-based payments represented 31.1%.

The Netherlands

The Netherlands introduced a real-time payments infrastructure when banks adopted SCT Inst in 2017. SCT Inst is a pan-European real-time payments scheme that was developed by the European Payments Commission. It provides instant payment transfers within any countries that are part of the eurozone.

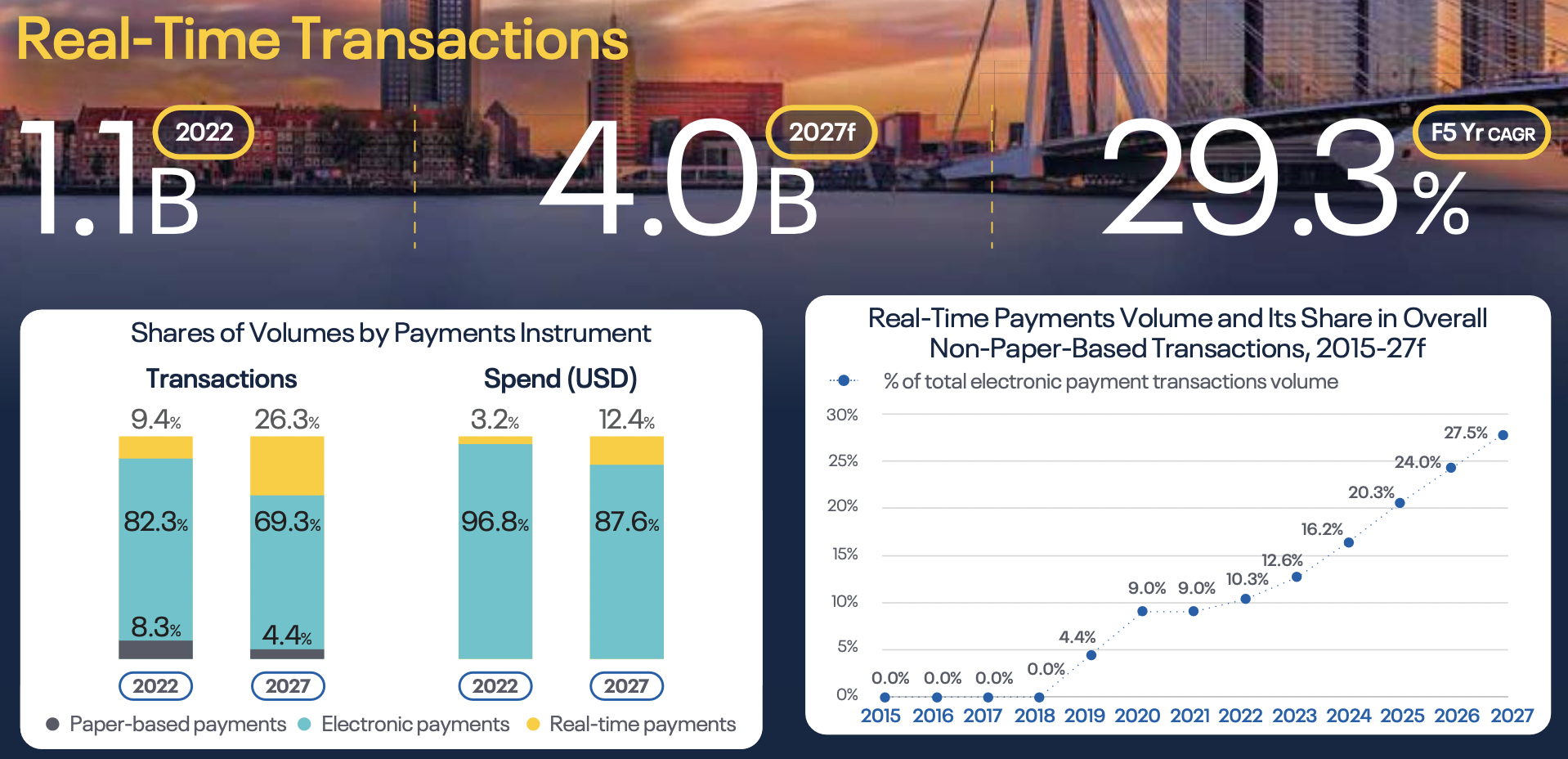

In 2022, real-time payments market share of total payments volume reached 9.4%, overtaking paper-based transactions, which had an 8.3% share of total payments volume.

However, this is still far from the share of non-real-time payment electronic payments, which had 82.3% share of total payments volume.

By 2027, real-time payments are expected to have a 26.3% share of total payments volume, growing at a CAGR of 29.3%, while both electronic payments (excluding real-time payments) and paper-based payments will respectively decline to 69.3% and 4.4% share of total payments volume.

The Netherlands is thus a market to watch for the future and will become a European leader in real-time in the coming years — even independently of the boost real-time payments will likely gain from the proposed new pan-European regulation requiring PSPs to offer real-time payments to all consumers.

U.K.

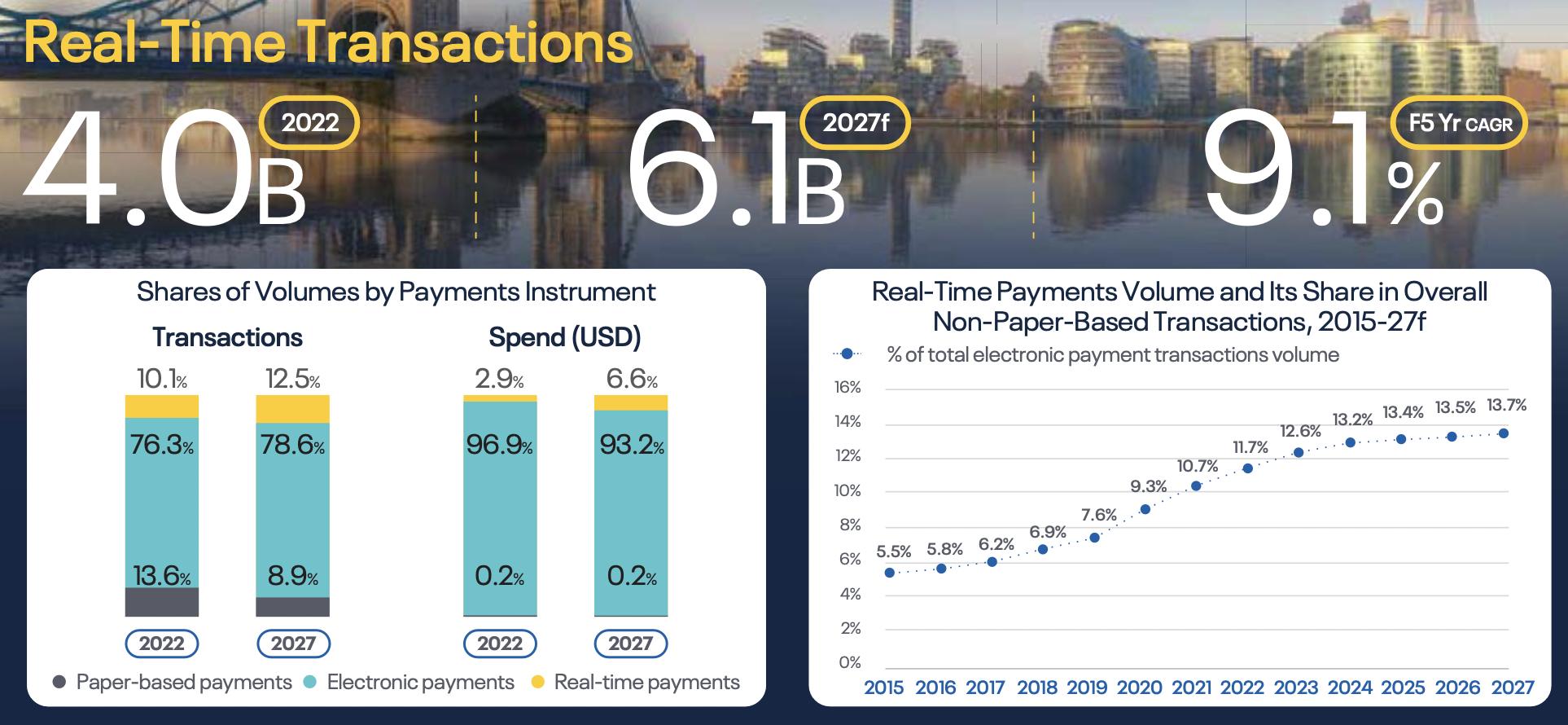

The payments industry in the U.K. is strongly tied to card payments infrastructure. Real-time payments in the U.K. are expected to represent a 10.1% share of total payments volume in 2022, which is above the regional average.

However, considering the U.K.’s Faster Payments system was a regional pioneer launched in 2008, its position in the region is not as strong as might be expected, with Sweden and Denmark notably ahead in terms of real-time payments’ share of overall payments volume.

However, this should change with the planned launch of the New Payments Architecture (NPA) in 2025, which will replace the aging 17-year-old Faster Payments scheme with a modern infrastructure designed to improve access, innovation and efficiency.

Supporting an extensive payments message based on the ISO 20022 financial messaging standard deployed by the most modern payment systems worldwide, NPA will allow for interoperability across both domestic — the U.K. high-value payments system CHAPS is moving to ISO 20022 in June — and international payment schemes.

By 2027, real-time payments will have overtaken paper-based payment transactions, reaching 12.5% share of total payments volume, while electronic payments and paper-based payments will be at 78.6% and 8.9%, respectively.

This speaks more to the rapid decline of cash in the market than the growth of real-time payments, though — the U.K. remains a card-dominated market.

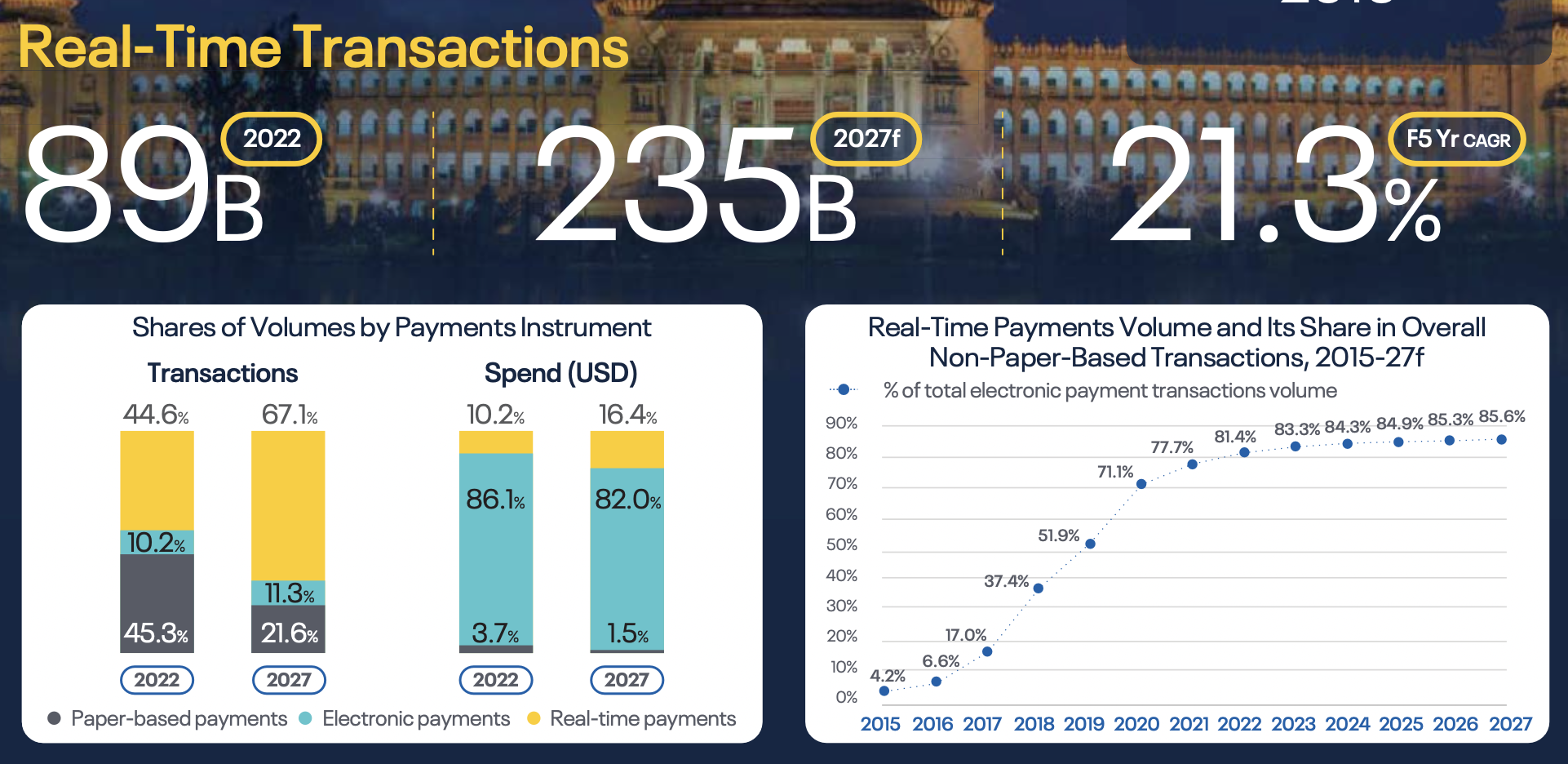

India

The Indian real-time payments market is the most advanced in the world by far, ahead of developed and developing markets alike. Real-time payments were available in India since the launch of Immediate Payment Service (IMPS) in November 2010.

However, the Unified Payments Interface (an overlay payments system launched in April 2016 based on IMPS) is the one which disrupted the payments space in the country, enabling real-time payments using QR codes, mobile numbers and virtual IDs.

The wider adoption of UPI-based mobile payment apps, growing acceptance of QR-code payments among merchants and increasing preference for digital payments amid the COVID-19 pandemic all contributed to real-time payments accounting for a 44.6% share of total payments transaction volume in 2022.

With consumers increasingly shifting from cash to mobile-based real-time payments, skipping payment cards, the share of real-time payments of total payments volume is forecasted to rise to 67.1% in 2027.

Next Steps for Banks

For banks situated in regions primed for real-time payment adoption, our report serves as a vital blueprint. Even though credit card transactions remain resilient, governments are veering towards embedding real-time payments into their long-term economic blueprints.

I highly recommend downloading and reading the complete source report "Prime Time for Real-Time Global Payments Report" by ACI Worldwide for more interesting info, stats and figures!

Comments ()