Rapyd Faces Major Valuation Cut in Latest Funding Talks

Hey FinTech Fanatic!

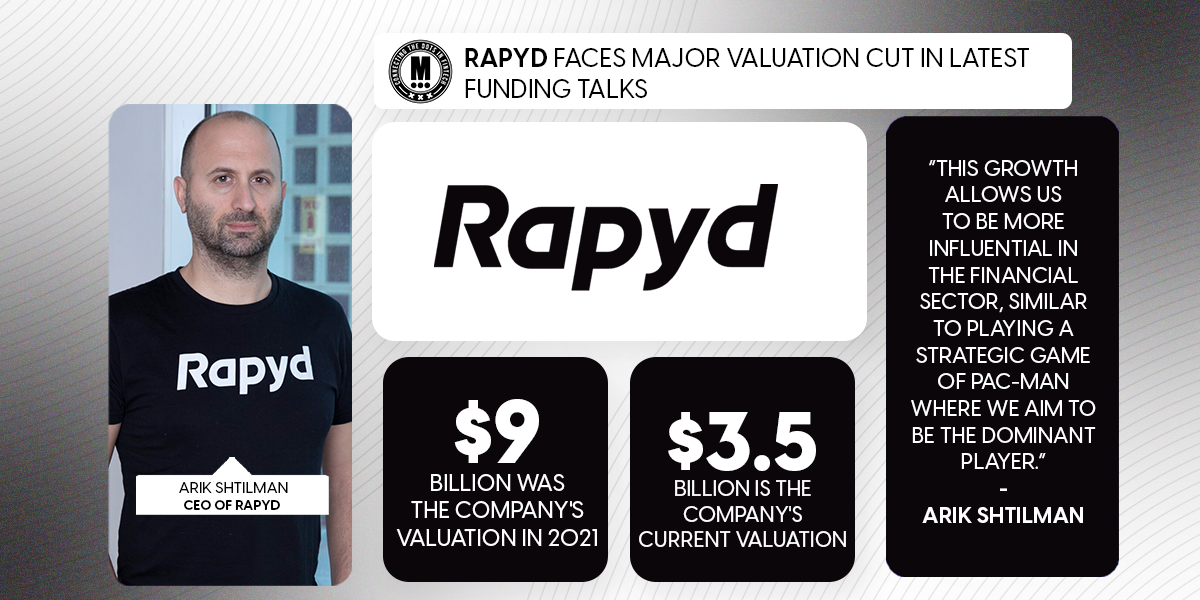

Rapyd, the Stripe competitor known for its bold acquisition strategy, is facing a sharp valuation cut as it looks to raise $300 million. Once valued at $9 billion in 2021, the company is now in talks with investors at a significantly lower $3.5 billion valuation. This move comes as startups across the FinTech sector navigate a challenging funding landscape.

Despite the downturn, Rapyd isn’t slowing down. The company plans to use the fresh capital for yet another acquisition, further cementing its position in the payments space. CEO Arik Shtilman compared their strategy to Pac-Man, stating at last year’s Dubai FinTech Summit: “This growth allows us to be more influential in the financial sector, similar to playing a strategic game of Pac-Man where we aim to be the dominant player.”

Rapyd’s aggressive expansion has seen it acquire companies like PayU’s payment units, Neat, and Valitor. However, with down rounds making up 27% of all deals in early 2024—the highest in over a decade—Rapyd is not alone in facing valuation cuts. Will its next move keep it ahead of the competition? Stay tuned.

Read more global FinTech updates below 👇 and I'll be back tomorrow!

Cheers,

Join the FinTech Running Club in your city to connect with top FinTech leaders and have fun! Check out the exciting events happening in the coming weeks!

POST OF THE DAY

Klarna is getting into Crypto 🤯

Any suggestions for Sebastian Siemiatkowski?

FINTECH NEWS

🇺🇸 Ramp lands Eagles’ Saquon Barkley as investor and Super Bowl commercial star. Interestingly, Barkley reached out to Ramp about investing. He chose it after some mutual investor friends gave Ramp “strong” recommendations. Continue reading

🇺🇸 Affirm soars as strong holiday shopping powers BNPL lender's surprise profit. Gross merchandise volume (GMV) - the total dollar amount of all transactions on the Affirm platform - jumped 35% to $10.1 billion in the second quarter ended Dec. 31, exceeding analysts' estimates of $9.57 billion.

PAYMENTS NEWS

🇦🇷 Takenos & Pomelo: Introducing the Spicy Card for global workers. The card is designed for freelancers, entrepreneurs, and remote workers who need to use their foreign earnings locally. This is a prepaid card, available in both physical and virtual versions.

🇪🇺 Monite launches iFrame to optimise AP/AR adoption for global B2Bs. iFrame is designed to integrate invoicing and billing capabilities into any platform in less than two hours. Through this, Monite intends to serve the needs of the industry by providing speed, security, and flexibility.

🇮🇹 NCR Atleos’ Cashzone Network expands into Italy, providing easy access to cash for both residents and tourists. Consumers will be able to withdraw cash at premier retail locations across the country. This marks the thirteenth country worldwide in which Atleos has an ATM network presence.

OPEN BANKING NEWS

🇧🇷 Decentralization of credit will benefit Brazil, says Pomelo. This year will be a defining moment for FinTechs in Brazil. According to Rafael Goulart, Country Manager at Pomelo, financial technology companies are set to advance in an environment of credit decentralization, Open Finance, and the use of Artificial Intelligence (AI).

Additionally, regulatory innovations proposed by the Central Bank of Brazil (BC) aim to enhance security, transparency, and fraud prevention measures, benefiting the overall market.

🇺🇸 Trustly teams up with Spreedly. This collaboration is set to drive improved conversion rates and payment efficiency while expanding the reach of Trustly’s services across US markets. Businesses leveraging Spreedly’s range of payment gateways will gain access to Trustly’s Pay by Bank capabilities.

REGTECH NEWS

🇮🇳 Auquan launches AI agent for financial services sustainability teams. Sustainability Agent is Auquan's AI tool that was purpose-built to liberate sustainability teams from tedious and time-consuming manual work. Read more

DIGITAL BANKING NEWS

🇮🇹 Revolut Business has announced a record-breaking growth in the Italian travel sector, which reported a 74% increase in new customer acquisitions in 2024. Among Travel and Hospitality companies 57% faced disruptions due to payment processing issues with traditional banks. 79% noted that FinTech providers helped reduce administrative tasks.

🇦🇷 Ualá announced its conversational AI platform, aimed at transforming customer service powered by OpenAI’s GPT-4 model. According to the company, this technology not only understands user inquiries but also proactively offers personalized solutions, significantly improving the customer experience.

🌏 Standard Chartered launches AI-powered FX insight videos. The bank is using AI to create short videos giving its retail customers in Asia the latest foreign exchange insights. The service will help investors stay abreast of the rapidly changing FX market in an interactive and accessible way.

🇬🇧 UK consumers increasingly moving towards FinTechs and Neobanks for primary bank cards. Digital-only financial providers expanded their overall reach from 16% of adults back in 2018 to a significant 50% in 2024 according to research from RFI Global, the data and insights firm focusing on financial services.

🌎 Banking platform Moneythor lands in Latin America. Regional operations will be led by Enrique Ramos O’Reilly, Moneythor’s President Americas, a 25-year banking and FinTech veteran. The platform helps global financial institutions build deeper, more durable, and valuable relationships with their customers.

🇺🇸 Azura Credit Union modernizes technology infrastructure with Jack Henry. This will empower each local branch to enhance operational efficiencies and gain deeper insights into the unique needs of their communities, enabling the delivery of meaningful solutions.

🇿🇦 FirstRand Group selects Fiserv to accelerate growth and innovation. It will also power its digital transformation and support the broader innovation initiative and growth objectives of its customer franchises FNB (Retail and commercial banking) and RMB (Corporate and investment banking).

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Gemini is reportedly considering an initial public offering (𝗜𝗣𝗢) this year, joining Bullish Global, Kraken, and eToro in exploring public listings. The surge in IPO interest comes as regulatory sentiment shifts, with industry leaders betting on a more favorable landscape.

🇳🇬 Nigeria’s SEC to fast-track crypto licencing in 2025. Nigeria’s Securities and Exchange Commission (SEC) plans to accelerate the issuance of crypto licences in 2025 as part of its efforts to regulate the cryptocurrency market and protect consumers.

🇸🇻 Tether revs up deal machine after its embrace by ‘establishment’. “We have been hugged by the establishment... Now they have embraced us. Now what are we going to do?” Paolo Ardoino asked. The CEO of $140 billion stablecoin giant Tether Holdings Ltd., had a triumphant message for the crypto faithful gathered in San Salvador, where Tether is now based.

🇺🇸 Trump Media files to trademark investment products targeting bitcoin and US industries. The trademarks include Truth.Fi Bitcoin Plus ETF, Truth.Fi Made in America ETF, and Truth.Fi U.S. Energy Independence ETF. It is also looking to launch three separately managed accounts (SMAs) focused on these assets.

🇺🇸 Crypto’s ‘Debanking’ debate takes center stage in Washington. Crypto executives recently testified before Congress, arguing that “Operation Chokepoint 2.0” had unfairly targeted crypto companies during the Biden administration by pressuring banks to cut ties with them.

🇺🇸 Ondo Finance unveils integrated infrastructure suite to bring US financial markets onto the blockchain. The products are designed to bring capital markets onchain, bringing the transparency, efficiency, and accessibility enabled by blockchain technology to institutional-grade finance.

PARTNERSHIPS

🇳🇱 Backbase and Feedzai partner to launch deeply integrated financial crime prevention in the engagement banking platform. The strategic partnership with Feedzai aims to empower banks to tackle the growing challenge of digital fraud while maintaining seamless customer experiences.

🇺🇸 Vantage Bank chooses Finzly to modernize payment operations. The implementation will enable Vantage Bank to meet evolving customer demands while strengthening its core payment capabilities through a fully ISO 20022 native platform.

🇺🇸 P2P launches digital finance platform powered by Mbanq. The P2P app helps users handle their finances in the U.S. and send money to family in Brazil. The financial services provided by the app include U.S. dollar accounts, physical and virtual debit cards, secure money transfers and 24/7 access to financial tools.

DONEDEAL FUNDING NEWS

🇬🇧 Rapyd faces steep valuation cut in new deal talks. The company, which offers a digital platform for cross-border financial transactions is in talks to raise $300 million from investors at a $3.5 billion valuation and intends to use the funding in part to acquire a payment processing startup.

🇺🇸 Superlogic raises $13.7M at a $200M valuation to help consumers use reward points toward cool ‘experiences’. Its platform plugs directly into existing loyalty programs for credit card companies, airlines, and retailers. Read more

M&A

🇬🇧 Paysafe weighs sale after getting takeover interest. The firm, which is backed by Blackstone Inc. and CVC Capital Partners, is working with a financial adviser as it explores options. It is also studying the potential disposal of non-core assets that could take place before the sale of the company.

MOVERS AND SHAKERS

🇨🇳 Ant International appoints CIO to Spearhead AI-Driven Digitalisation Strategy. Jiang-Ming Yang will be responsible for driving investments in and synergy between product and technology teams. The CIO Organisation will be created to drive continuous innovation across payments, digitalisation and embedded finance businesses.

🇺🇸 Broadridge appoints Larry Conover as VP. Conover will focus on creating new ways to add value for clients within the Broadridge network and provide a client perspective on the company’s product and service development. He will also support industry initiatives, including end-to-end confirmation for proxy contests.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()