Plata Joins Mexico’s FinTech Unicorn Club

Hey FinTech Fanatic!

After Bitso, Clip, Konfío, and Stori—and three years without a new unicorn—Mexico has finally completed its “manita” with a fifth FinTech unicorn: Plata. The company hit a $1.5 billion valuation after closing a $160 million Series A round led by Kora.

Founded in 2023 by Neri Tollardo, a former Tinkoff Bank executive, Plata has already secured $750 million in equity and debt, including a $200 million warehouse facility from London-based Fasanara Capital.

In December, Plata obtained a banking license in Mexico and now serves one million active credit card users, focusing on consumer credit products.

FinTech in Mexico is evolving, with regional players like MercadoLibre’s FinTech arm, Ualá, and Nubank expanding their reach. At the same time, European companies such as Wise and Openbank are strengthening their foothold. As new capital flows in and competition rises, the dynamics of Mexico’s FinTech industry are becoming more interesting.

Read more global FinTech updates below 👇 and I'll be back tomorrow!

Cheers,

FEATURED NEWS

🇺🇸 Papaya Global adds Citi as sponsor bank. This relationship will enable Papaya Global to expand to new geographic regions. It will also keep enhancing its cross-border payments capabilities, encompassing 160 countries and 130 currencies, and serving clients in the U.S., Europe, Latin America and Asia.

INSIGHTS

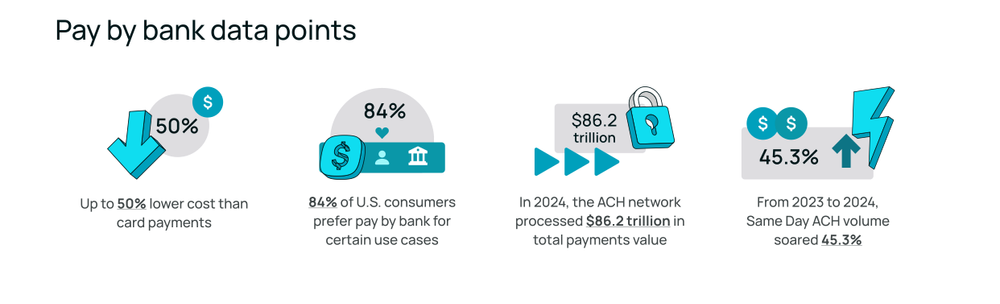

🇺🇸 The insider’s guide to pay by bank in the United States, by Aeropay. This guide compiles insights from dozens of interviews with the experts actively building pay by bank for the U.S. to provide a clear synopsis of the most important and unique details. It's packed with information to clear up confusion and misinformation about accepting pay by bank. Click here to download

FINTECH NEWS

🇺🇸 Conotoxia files complaint against Poland in the US. The firm has notified US law about alleged criminal offenses committed by employees of the Polish financial regulator KNF and various local prosecutor's offices. It claims they abused their power and deliberately acted to harm the international Conotoxia Holding group, causing estimated losses of “at least several billion Polish zlotys.”

🇳🇱 Adyen publishes 2024 annual report, providing stakeholders with an insight into its business performance, strategy, and key milestones from the past year. The report includes its Annual Report and Consolidated Annual Accounts. More on that here

🇺🇸 The British FinTechs hoping to crack America. Revolut and Monzo face steep challenges in a complex regulatory environment and competitive retail banking sector. Revolut’s US Chief Executive, Siddhartha Jajodia, says the country is “critical” for its ambition to be a “global bank.” Monzo Chief Executive TS Anil agrees.

🇺🇸 Digits debuts AI Accounting Tool and welcomes Xero Co-Founder. The new offering is designed to automatically categorize transactions, reconcile accounts, and deliver real-time financial insights. In addition to the new product launch, Digits said it has named Craig Walker to its leadership team.

🇳🇱 BUX faces €1.6 million fine from AFM following expansion of retail IPOs. The fine stems from BUX's practice of paying compensations to existing customers, comparison websites, and finfluencers for introducing new customers. According to the AFM, this method of paying referral fees violated the ban on inducements.

PAYMENTS NEWS

🇬🇭 Flutterwave strengthens Ghana operations. This development further solidifies its commitment to simplifying payments for endless possibilities across Africa. Flutterwave’s latest approval aligns with these developments, ensuring that Ghanaians can benefit from fast, secure, and cost-effective remittance services.

🌍 Eurosystem rolls out Verification of Payee service across SEPA. This initiative, leveraging existing solutions developed by Banco de Portugal and Latvijas Banka, aims to support payment service providers in meeting new regulatory requirements under the EU Instant Payments Regulation.

🇧🇷 Pix in installments grows among MEIs and e-commerce giants, expanding retail credit. Supported by this authorization, banks and FinTechs are seeking to accelerate customer adoption by making the product available through companies of various profiles: from microentrepreneurs to e-commerce businesses of large brands.

🇺🇸 Intuit QuickBooks enables Tap to Pay on iPhone for small and mid-market businesses to accept contactless payments. With this added functionality, QuickBooks customers can access even more ways to seamlessly manage their business finances, get paid faster, and unlock their growth path.

🇨🇴 Yuno introduces Pre-Chargeback Alerts. The feature provides early notifications about potential disputes before they escalate into chargebacks. It also allows merchants to take immediate action, addressing customer concerns, issuing refunds, or disputing invalid claims, before financial losses accumulate.

REGTECH NEWS

🇺🇸 Feedzai launches TRUST framework for responsible GenAI at HumanX. Designed to empower B2B organizations with a comprehensive blueprint for ethical, secure, and high-performing generative AI solutions, the framework ensures that companies can innovate confidently while protecting their reputations in an increasingly competitive market.

DIGITAL BANKING NEWS

🇨🇭 Yuh App turns profitable as accounts surge 48%. Co-developed by Swissquote and PostFinance, the app integrates payments, savings, and investments into a single platform, simplifying financial management for users. It provides access to over 100 popular stocks, cryptocurrencies, thematic investments, and exchange-traded funds (ETFs).

🇩🇰 Lunar branches out into youth banking services with launch of Lunar Youth, a digital banking app through which children between the ages of 7 and 14 can access a full national account and customisable payment cards. The app is linked to parents’ accounts to allow them to maintain oversight.

🇦🇷 Inter, the Brazilian digital bank, will expand into Argentina. Inter is partnering with Grupo Bind in Argentina and plans to begin offering Argentines the ability to invest abroad, hold international credit cards and receive salaries paid outside the country for digital nomads.

🇺🇾 Prometeo launches Borderless Banking Solution to accelerate global business expansion. This product integrates directly with the banking infrastructure in the U.S. and LatAm, providing businesses with a comprehensive solution to manage their financial operations.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase is launching 24/7 and Perpetual Style Futures in the US. 24/7 Bitcoin provides traders with uninterrupted access to manage risk and seize opportunities, similar to the crypto market. The company is also developing a Perpetual-style Futures Contract, addressing a key product that traders have been missing.

🇮🇳 Coinbase secures registration in India. This allows it to offer crypto trading services in the country. The company plans to initially introduce retail services later this year, with intentions to expand into additional investment products subsequently. Keep reading

🇩🇪 Clearstream to launch Bitcoin and Ether institutional custody, to offer crypto custody and settlement services for institutional clients amid increasing demand for regulated digital asset infrastructure. It aims to launch support for other cryptocurrencies and diversified services.

PARTNERSHIPS

🇸🇪 Intergiro and SEON partner to enhance fraud prevention in embedded finance. Through this partnership, Intergiro seamlessly integrates SEON’s anti-fraud and AML technologies, including advanced machine learning algorithms, behavioral analytics, and real-time data enrichment, directly into its embedded finance ecosystem.

🇬🇧 iplicit to bring instant payments to customers with GoCardless. The partnership will bring faster, in-app payment methods to iplicit’s growing customer-base, which spans verticals such as non-profit, recruitment, education, FinTech, SaaS, and multi-academy trusts.

🇳🇴 Coeo Inkasso selects Neonomics to simplify debt collection payments with Nello Pay. Through its partnership with Neonomics, Coeo’s customers can make instant, secure payments directly from their bank accounts, reducing manual entry errors and improving overall payment compliance.

🇦🇪 Mastercard and LikeCard launch family banking solution to make smart spending simpler. The platform empowers parents and children with a seamless and secure digital banking experience, helping families make smarter financial decisions together.

🇹🇭 UnionPay ties up with NITMX to integrate PromptPay. In the initial phase, the partnership will introduce QR code payment solutions tailored for Chinese tourists visiting Thailand. Subsequent phases will enable Thai tourists to utilise the QR codes while in China, with specific launch dates to be announced.

🌍 Klarna launches Gift Card Store in Europe. This launch will give customers the ability to buy gift cards from an extensive selection of national and global brands and pay for them using Klarna’s range of Buy Now, Pay Later products and instant debit option, Pay in Full.

🇮🇹 myPOS partners with Satispay to deliver a versatile and user-friendly payment solution for Italian businesses. By integrating Satispay, merchants gain access to a larger customer base, enabling faster and more secure transactions as well as enhancing customer satisfaction by reducing missed sales opportunities.

🇺🇸 Dwolla partners with Plaid to future-proof pay by bank payments. The payments solution will integrate Plaid's instant account verification into Dwolla's pay by bank platform. This will enable customers to onboard with Plaid through Dwolla’s Open Banking Services, creating a modern A2A payment offering for mid- to enterprise-sized businesses.

🇦🇺 Reece partners with Adyen to optimise customer experience. Adyen's payment collaboration upgrades Reece's online and physical stores by improving customer experiences, ensuring secure transactions, and modernising operational processes.

🇺🇸 Affirm launches BNPL partnership with resale marketplace StockX. The partnership lets shoppers choose Affirm’s biweekly or monthly payment plans at checkout, choosing custom payment plans that meet their needs. Discover more

DONEDEAL FUNDING NEWS

🇪🇪 Estonian FinTech Hoovi raises €8M from Finnish Multitude International Bank. The new funding will support the company’s plans to expand its commercial leasing and integrated financing offerings, to increase its loan portfolio to €15.5 million and capture 30% of the market by the end of 2025.

🇺🇸 Zolve, a neobank for global citizens moving to the US, raises $51M and secures $200M debt. With the funds, it aims to increase these numbers by introducing loans, starting with auto loans and gradually expanding to personal and education loans.

🇲🇽 Mexico FinTech Plata hits unicorn status in $160 million round. The round was led by Kora and saw participation from Moore Strategic Ventures LLC and other US and European investors. Keep reading

🇺🇸 Synctera raised another $15 million in funding, and signs Bolt as a customer. The new funding will, in part, go toward expanding its sales team of three, as well as toward product development. The startup also sees a big opportunity to expand in Latin America.

🇮🇱 Mesh announced it closed a $82 million series B funding round, bringing its total amount raised to over $𝟭𝟮𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻. Now, the company can further accelerate product development and the expansion of its APIs to power hundreds of crypto and payments platforms.

🇺🇸 The sibling founders of Stax Payments are back with a $20M seed raise for their new FinTech, Worth. The company plans to use its new capital primarily to scale its organization, particularly across sales and marketing. Read more

M&A

🇺🇸 MoneyLion to hold special stockholder meeting on proposed acquisition by Gen Digital. The special meeting is to consider and vote on the proposal to adopt the merger agreement in connection with the proposed acquisition. It will be held on April 10, 2025

🇮🇳 Perfios acquires debt management firm CreditNirvana. Following the acquisition, the firm will operate as a wholly owned subsidiary of Perfios, with its team of nearly 100 employees continuing to work independently. Read more

MOVERS AND SHAKERS

🇬🇧 Goldman’s top European IPO banker set to retire after 31 years. Christoph Stanger, one of the longtime leaders in Goldman Sachs Group Inc., will retire at the end of the first quarter. He has been chairman of the equity capital markets business in EMEA since 2022 and was co-head of the business for the 15 years before that.

🇺🇸 Green Dot CEO leaves as firm explores strategic options. The digital bank announced that CEO and President George Gresham has stepped down from his roles and the Board of Directors. William I. Jacobs has been appointed as the interim CEO.

🇦🇷 Former TradingView CEO Oleg Mukhanov joins Dividenz as CFSO. Dizidenz aims to use technology to democratize real estate investing, making top tier real estate investing accessible to “the masses”. Read more

🇬🇧 ClearBank appoints new CEO. The bank appoints CFO Mark Fairless to CEO to guide the business through the next phase of its evolution as an international clearing bank. Meanwhile, Charles McManus will maintain an active role in the organisation as Group Board member.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()