PayPal’s Next Moves: PayPal Open, Venmo, Fastlane, and Verifone

Hey FinTech Fanatic!

At its Investor Day, PayPal outlined its vision for the future, unveiling strategic initiatives to drive user engagement, broaden merchant services, and maintain competitiveness as the digital payments landscape continues to evolve.

In the U.S., it launched PayPal Open, a unified platform for payments, financial services, and risk solutions, with plans to expand into Europe next year. To compete with Cash App, Zelle, and Apple Pay, PayPal is also strengthening Venmo, enhancing in-store payments, and driving “Pay With Venmo” adoption through partnerships with DoorDash and Starbucks. CEO Alex Chriss expects Venmo to surpass $2 billion in revenue by 2027.

In Europe, PayPal and J.P. Morgan Payments are launching Fastlane after its success in the U.S., boosting merchant conversion rates by 51%. Additionally, PayPal is expanding merchant acquiring in the UK and Europe while leveraging J.P. Morgan’s commerce infrastructure.

Globally, PayPal is teaming up with Verifone to integrate payment hardware with its enterprise processing and Braintree capabilities, creating a seamless omnichannel solution for merchants.

PayPal’s latest moves reinforce its commitment to innovation and global digital commerce.

Read more global FinTech industry updates below 👇 and I'll be back tomorrow!

Cheers,

Ready to transform your financial products? Meet Ingo Payments at FinTech Meetup in Las Vegas to explore embedded banking. Stop by for drinks and a conversation—reserve your time now!

INSIGHTS

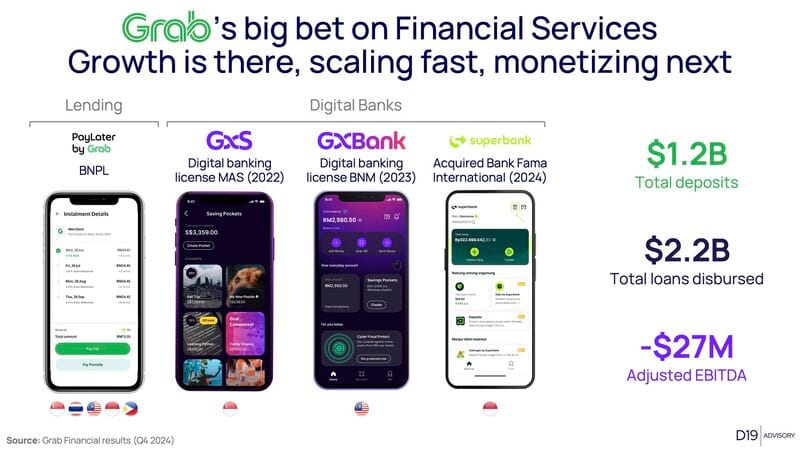

➡️ Many still see Grab as just a ridehailing and food delivery Giant. But there’s something much bigger happening behind the scenes 👇

FINTECH NEWS

🇰🇷 Naver Pay, Kakao Pay, and Toss Pay expand overseas payments. Korean major mobile app payment providers have scrambled to enter global markets as they face increasingly fierce competition from credit card companies in domestic markets.

🇮🇳 Tata Capital to go public in one of India’s top IPOs of year. The financial unit of the Tata Group plans to sell 230 million new shares in the IPO and tack on a rights offering for existing shareholders. MoneyControl has reported that Tata Capital was planning to raise at least 150 billion rupees via an IPO.

🇧🇷 Nubank is looking to grow by increasing revenue per customer in Brazil. With 60% of the Brazilian adult population already using Nubank, the digital bank’s strategy is to offer more products and services to increase the average revenue per customer. Continue reading

🌏 Asia to capture 47% of global FinTech market, hitting $19tn in 2025. Asia’s FinTech industry is experiencing unprecedented growth, with total transaction volumes projected to reach $18.9 trillion by the end of 2025, according to UnaFinancial’s latest research.

🇬🇧 New Zopa HQ to double London footprint. Digital bank with more than 1.4m customers to relocate to 20 Water Street in Canary Wharf after stellar 2024. The office will feature two outdoor terraces, a workspace tailored for dynamic teamwork and innovation, and an outstanding BREEAM sustainability rating.

🇩🇪 FINOM unveils autonomous AI Accounting Agent to revolutionize financial management for SMEs and Freelancers. The AI agent will first launch in Germany, with plans to expand across the EU throughout 2025. It automatically categorizes transactions, and provides timely notifications about tax obligations and deadlines, while ensuring users maintain control over final submissions.

PAYMENTS NEWS

🇮🇳 Google Pay adds convenience fee for bill payments in India. Google Pay’s move aligns with its competitors, which already impose processing fees for card payments on bill transactions and recharges. These fees are a response to the rising costs FinTech firms incur when processing transactions on UPI.

🇮🇹 Nexi and Klarna partner to boost merchant growth. Nexi will enable its merchant customers across Europe to seamlessly offer Klarna’s payment method to their shoppers. Klarna will be automatically enabled as a default option in the Nexi check-out offering, helping merchants drive incremental revenue growth.

🇨🇳 American Express joins Alipay digital payment system in China. The initiative not only simplifies transactions for travellers but also provides local businesses with greater opportunities to attract international customers, the companies said.

🇪🇺 Is Wero an ‘existential threat’ to Europe’s payments startups? Backed by a consortium of 14 banks under the European Payments Initiative (EPI), France and Belgium, Wero is a digital wallet enabling consumer peer-to-peer transfers in under ten seconds.

🇺🇸 PayPal’s growth plan for earnings, Venmo expansion and new Merchant Platform. PayPal forecasts adjusted earnings per share to grow in the low teens by 2027 and 20% over the long term as it streamlines operations. A key part of this strategy is Venmo’s expansion, with CEO Alex Chriss aiming for the platform to hit $2 billion in revenue by 2027. To support businesses, the payments company has introduced PayPal Open, a unified platform that simplifies access to its merchant services.

🇸🇦 Telr partners with Bank AlJazira to enhance digital payments in Saudi. This collaboration aims to support the country’s transition towards a cashless economy by improving transaction efficiency, security, and accessibility. Businesses can access payment links, recurring payments, e-invoicing, and BNPL.

DIGITAL BANKING NEWS

🌎 Ualá seeks more banking licenses in other countries in LATAM. The founder and CEO of the Argentine bank prioritizes its business in Mexico, a market where it plans to reach 10 million users. Read more

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 OKX settles U.S. DOJ charges and pays over $500m penalty and forfeiture. OKX settled with U.S. authorities over failing to obtain a license to operate as a money transmitter, they announced. The settlement resolved allegations of fraudulent and non-compliant activities at the exchange that took place in past years.

🇳🇬 Coinbase and Onboard Global partner to offer crypto P2P payments to Nigerians. With the partnership, merchants who sell crypto via Onboard will gain the opportunity to reach a larger audience on Coinbase. This integration instantly makes Coinbase a whale in the ocean and could shake up the competition in the industry among foreign crypto exchanges.

🇨🇭 Taurus launches private token standard for banks. The standard, developed in partnership with the Aztec Foundation, will enable banks to issue tokenised versions of financial instruments on public or permisisonless blockchains while also providing some privacy for users in compliance with securities regulations.

🇦🇪 Stablecoin payments at POS terminals coming to UAE via AFS and Ternoa. As part of the partnership arrangement, Ternoa will introduce Athar, a decentralized consumer finance protocol. Athar makes cryptocurrency payments easier and more accessible for everyday transactions.

PARTNERSHIPS

🇨🇳 Vistra collaborates with Airwallex to empower global borderless business. This strategic partnership sees Vistra integrating Airwallex’s Business Account and Embedded Finance products into its platform, providing clients with unparalleled convenience and efficiency in managing their global operations.

🌎 PayPal is expanding its partnerships to enhance digital commerce globally. In the UK and Europe, it is working with J.P. Morgan Payments to scale Fastlane and strengthen merchant acquiring. Meanwhile, in the U.S., it has teamed up with Verifone to create an omnichannel platform that streamlines checkout for large retailers, restaurants, and global merchants by integrating data, security, and processing across online and in-store sales.

🇬🇧 Holiday rental platform Travelnest picks Mangopay's payments solution. Mangopay will provide payment integration, including multi-currency support, to meet Travelnest’s complex requirements. The solution will optimise the funds flow from both booking platforms and guests.

🇲🇾 Temu partners with Atome for flexible payments in Malaysia. The addition of Atome aims to enhance shopping convenience for Temu users. New Atome users will also receive discount vouchers for their first purchase with Temu. Read more

🇬🇧 FinTech Firenze and Monument Bank forge £160M strategic partnership. The partnership will enable Firenze to expand its Lombard loan offering to a broader segment of wealth management clients. Historically, Lombard loans were largely restricted to private banking clients.

DONEDEAL FUNDING NEWS

🇬🇧 HSBC Innovation Banking bets £30m on FinTech Clearscore. The funding will enable ClearScore to expand both its product offerings and the channels through which it reaches users. The bank has been recognized as a crucial strategic partner in helping ClearScore scale quickly and establish itself as one of the leading FinTech brands in the UK.

🇪🇺 BitDCA raises €7.6 million to bring Bitcoin to the masses one purchase at a time. The company plans to use the funds to expand globally, starting with the EU, and later into LATAM and ASEAN regions. Read more

🇬🇧 Dodo Payments raises $1.1 million pre-seed funding. The company plans to use the funds to strengthen its technological infrastructure by introducing modules for subscriptions, billing, fraud detection, and risk management. It also aims to establish local payment rails in over 30 countries.

🇬🇧 Kani Payments secures Investment from Maven Capital Partners. The combined investment will be used to further develop Kani’s highly scalable platform, grow its team, and support international expansion with increasing digitisation in financial services, alongside greater global safeguarding regulations.

🇺🇸 Metronome, usage-based billing startup, raises $50 million Series C. This round brings the company’s total capital raised to $128 million. The company plans to use the investment to expand its billing solutions for SaaS (Software as a Service) businesses.

M&A

🇬🇧 Embat acquires Necto, strengthening its leadership in global corporate banking connectivity through APIs. This acquisition further strengthens Embat’s cloud-based platform, designed for finance teams within mid-sized and large enterprises. The solution centralises receivables, payments, and cash flow forecasting, automating accounting and bank reconciliation through AI.

🇮🇩 Kredivo said to acquire Indonesia FinTech GajiGesa. The sale was reportedly driven by shareholder pressure due to difficulties in securing additional funding, potentially leading to investor losses. Continue reading

MOVERS AND SHAKERS

🇹🇭 Digital payment firm 2C2P has appointed Worachat Luxkanalode as its new CEO. In this position, Worachat will manage the company’s operations and oversee its expansion in Southeast Asia. He will particularly focus on serving small and medium-sized enterprises.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()