PayPal to Shock The World on January 25

Hey FinTech Fanatic!

On Thursday, PayPal is preparing to hold an online event to highlight their new artificial intelligence-led advancements scheduled for release in 2024. This event is planned just before the release of PYPL's fourth-quarter earnings report, which is expected on February 7.

Alex Chriss, the newly appointed Chief Executive, revealed plans for this innovation showcase during a CNBC interview last week stating "we will shock the world".

Both Chriss and Jamie Miller, PayPal's newly appointed Chief Financial Officer, are poised to provide a prudent forecast for 2024 on February 7.

Analysts from Wall Street are currently evaluating the potential impact of this innovation-focused event.

What do you think will be PayPal's great reveal that will shock the world?

Let me know in the comments below👇

Cheers,

SPONSORED CONTENT

POST OF THE DAY

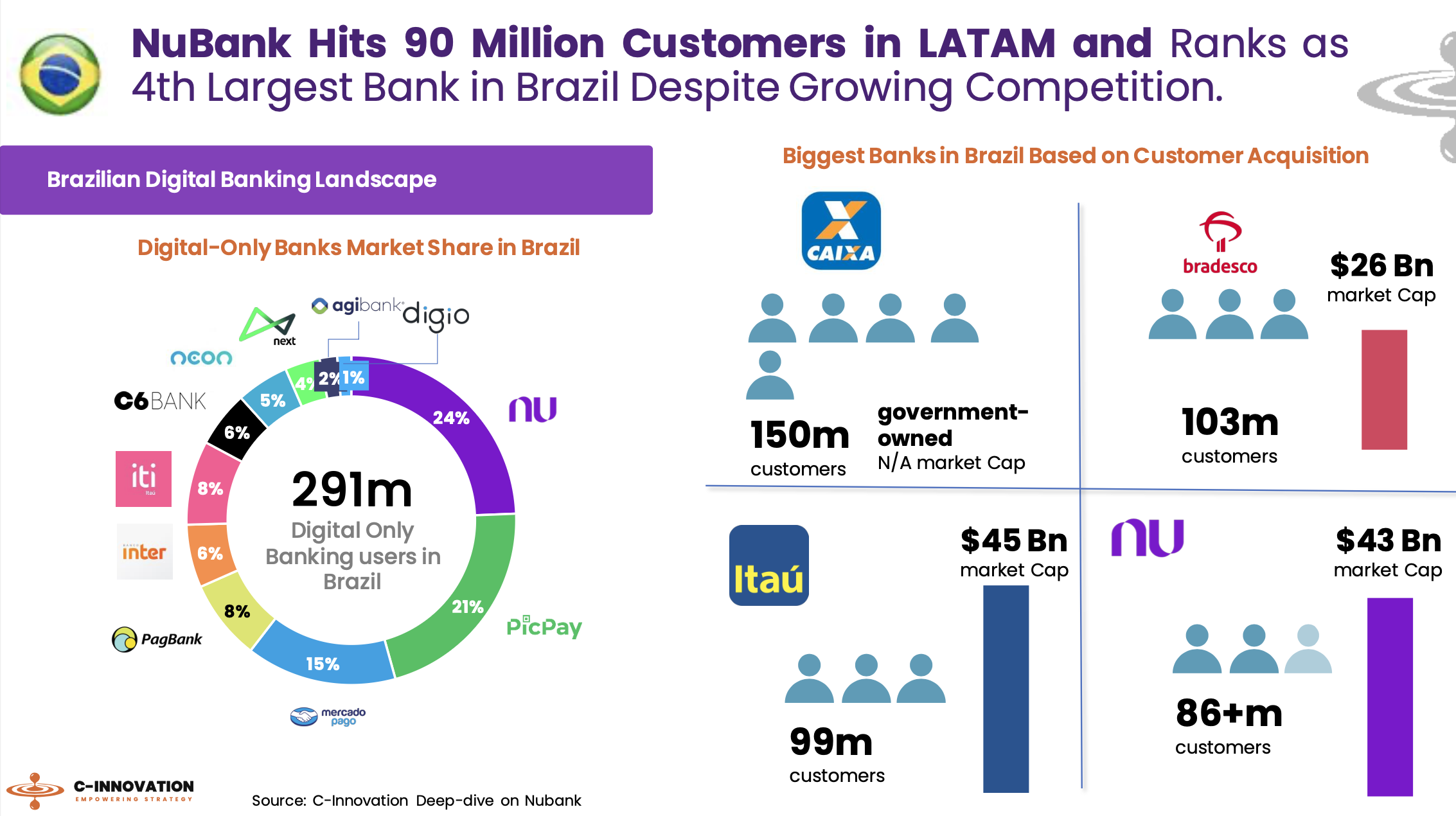

Nubank boasts over 90+ million customers across Latin America, serving clients in Brazil, Colombia, and Mexico 🤯

FEATURED NEWS

Klarna CEO Siemiatkowski says the company is likely to IPO very soon.

FINTECH NEWS

'No big fintech is going to IPO soon,’ says top European fintech investor. Sifted recently sat down with Simon Schmincke. They covered the biggest challenge fintechs will face in 2024, the likelihood of fintech IPOs, the rise of M&A and why AI might be facing the same problems as fintechs today in five years’ time. Read the full interview

🇺🇸 SEC charges Future Fintech CEO with fraud and disclosure failures. The regulator charged Shanchun Huang with manipulative trading in the stock of Future FinTech Group Inc., using an offshore account shortly before he became Future FinTech’s CEO in 2020.

🇨🇦 Visa to support Plug and Play entry to Canada. As a founding sponsor, Visa will support Plug and Play’s entrance into the Canadian fintech market and together, establish a platform to enable fintechs to flourish. Through this collaboration, fintechs will access the power, scale, trust, and security of Visa’s global network.

🇺🇸 Brex burned an average of about $17 million a month in cash in the fourth quarter. Brex has enough cash to last through March 2026. This is according to the data given to employees in early January, although CFO Benjamin Gammell emphasized to staff at the all-hands meeting that the company had to continue reducing its cash burn.

OPEN BANKING NEWS

🇬🇧 Moneyhub first to add Co-op Bank, Smile Bank and Kroo Bank Open Banking Connections. Moneyhub is a global provider of Open Banking account connectivity. In the UK alone it provides connections to thousands of institutions. Over 150m people have access to Moneyhub’s technology through their partners.

Plannix and Salt Edge collaborate to optimise personal finance through open banking. By integrating with the Salt Edge Partner Program, Plannix customers will benefit from enhanced account information and data aggregation resources, leading to more accurate financial tracking and analysis.

REGTECH NEWS

🇬🇧 Onfido launches compliance suite, an all-in-one identity verification solution that empowers fast-growth businesses to expand seamlessly into new markets and meet local regulatory needs for customer onboarding. Through Compliance Suite, Onfido can help customers securely conduct high-risk agreements.

DIGITAL BANKING NEWS

Revolut hits back at Allianz lawsuit citing service level failures. Revolut has countered Allianz's £10.4m lawsuit, denying breach of contract and blaming Allianz for subpar claims service. The dispute stems from a 2021 agreement where Allianz provided travel insurance to Revolut's premium customers.

🇿🇦 Bank Zero increasingly gains ‘primary bank account’ status. Bank Zero says its business model, based on the “segment-agnostic” approach of not offering entry-level accounts and “zero banking fees,” has seen it garner an increasing number of customers since inception.

🇰🇷 Korean internet-only banks see 70% surge in mortgage loans. The combined outstanding balance of mortgage loans at South Korea’s top three internet-only banks—KakaoBank Corp., Kbank, and Viva Republica Inc.’s Toss—surged by over 11 trillion won ($8.2 billion) in 2023 compared to the previous year, according to recent data.

🇦🇺 Judo bumps up profit outlook as margin lifts on new loans. Judo Bank has lifted pre-tax profits 24 per cent to $67m for the first half, thanks to low losses and higher lending margins. Read the complete article here

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Options on bitcoin ETFs could come soon, offering hedging tool for institutions. The SEC said it is set to seek public feedbacks on proposals by Cboe, Nasdaq and NYSE to list such financial instruments. Read on

🇺🇸 SEC says a "SIM swap" attack was to blame for the hack on its X account earlier this month. The watchdog says that, working with its telecom carrier, it has determined that someone obtained control of the SEC cell phone number associated with the account in an apparent SIM swap attack.

🇧🇷 FitBank and goBlockchain, two prominent players in the fintech sector, have announced a partnership aimed at tokenizing financial assets and structured projects in Brazil. This alliance is focused on facilitating business for companies interested in or already working with crypto technology solutions.

DONEDEAL FUNDING NEWS

🇮🇹 Italian FinTech deal activity holds steady in 2023 in contrast to EU market. Check out the Key Italian FinTech investment stats in 2023. Link here

🇬🇧 Ozone API raises £8.5m to go global. The company plans to use the investment to build its team as it works to support all emerging standards and provide the tools for banks to monetise open APIs. More on that here

MOVERS & SHAKERS

🇬🇧 Mangopay appoints Liz Oakes as Non-Executive Director. Liz brings a wealth of experience and insight from a long career in the payments industry. She joins at a period of growth for the company as it scales across Europe to address the needs of the rapidly growing B2C and B2B marketplace industries.

🇬🇧 Seedrs lays off 15% of its European workforce. As part of the restructuring, the company will leave the Spanish and Swedish markets. The layoffs come after a difficult period for the venture scene, according to a spokesperson at Seedrs.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()