PayPal Stock Soars on Adyen Partnership

Hey FinTech Fanatic!

PayPal’s stock surged to a 52-week high after announcing a partnership with Dutch payments firm Adyen, which will offer PayPal’s Fastlane checkout tool to its U.S. enterprise customers. Mizuho analyst Dan Dolev, who maintains an outperform rating for PayPal, praised the deal, noting that it highlights the strength of Fastlane, despite Adyen being a competitor.

The partnership news pushed PayPal's stock to $71.89, its highest closing price, with Dolev projecting that wider adoption of Fastlane could add $1 billion to $1.5 billion in transaction margins.

PayPal's Fastlane, launched in August, simplifies online shopping by automatically prefilling customer information, speeding up guest checkout.

Meanwhile, Marcela Torres, manager of Nu Colombia, shared that Nubank’s savings accounts in Colombia reached $2.1 trillion by mid-August 2024, up from $880 billion in June.

This achievement positions Nubank, founded by Colombian billionaire David Vélez, ahead of several traditional banks in savings deposits.

Torres highlighted a record of 35,000 new accounts opened in a single day, with 600,000 savings "boxes" offering a 13% annual yield. As of August 15, Nubank has 1.3 million customers in Colombia.

Nubank also launched the "Dear Future" campaign in Bogotá’s Zona T, allowing visitors to visualize their financial goals.

I had the chance to visit this site last week in Bogotá, and it was truly an incredible experience—definitely worth checking out if you're in the area!

Enjoy your weekend and I'll be back in your inbox before you know it.

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

PODCAST

🎙️ This month, Ingopay CEO Drew Edwards sat down with Nik Milanović for This Week in FinTech’s monthly podcast. Drew discussed his 25+ years of experience in the FinTech industry, where Ingo Payments has been and where it’s going, and more.

FINTECH NEWS

🇬🇧 Molten Ventures said the value of its stake in Revolut has more than doubled after the British FinTech secured a $45bn (£34.9bn) valuation in a share sale by employees. The London-listed VC investor said on Wednesday that Revolut’s announcement last week, which cemented its status as Europe’s most valuable private tech firm, implied an uplift of around £95m in the value of Molten’s holding.

🇧🇷 Clara advances with Pix, invests in AI, and launches batch payments. "We are not just another business account like the ones out there," says the country manager of the FinTech, which serves 4,000 companies in Brazil. Read on

🇬🇧 MoneyRepublic launches in the UK. MoneyRepublic's UK debut offers a user-friendly platform for informed financial decisions, starting with car finance and health insurance quotes, with plans to expand soon.

🇮🇳 Banking Circle and Skydo join forces to streamline cross-border collections for Indian businesses. The collaboration aims to support Indian businesses operating globally by providing them with seamless, efficient and cost-effective payment solutions, enabling them to thrive in international markets.

🇺🇸 Paychex launches digital employee benefits marketplace. Launching with 17 unique products, Paychex Flex Perks includes early access to earned wages, financial wellness solutions, and voluntary lifestyle benefits for the employees of Paychex customers.

🇮🇳 INDmoney, leading stock broking platform, has announced Instant Withdrawals via UPI for its Indian stocks investors. The feature enables users to withdraw their funds into their savings accounts instantly, even if they are trading on the same day.

🇨🇦 Transact365 achieves Canadian licence. The UK-based global payments platform, powering merchants across the globe, has expanded further by growing its offering of solutions with its new Canadian FINTRAC MSB license.

🇮🇳 Indian food delivery and quick commerce company Zomato intends to expand its efforts in the business of helping Indian consumers discover and purchase tickets for movies, sports and events. The company plans to do so by acquiring the entertainment ticketing business of Paytm, an Indian payments and financial services distribution company, Zomato said in a Wednesday (Aug. 21) announcement.

PAYMENTS NEWS

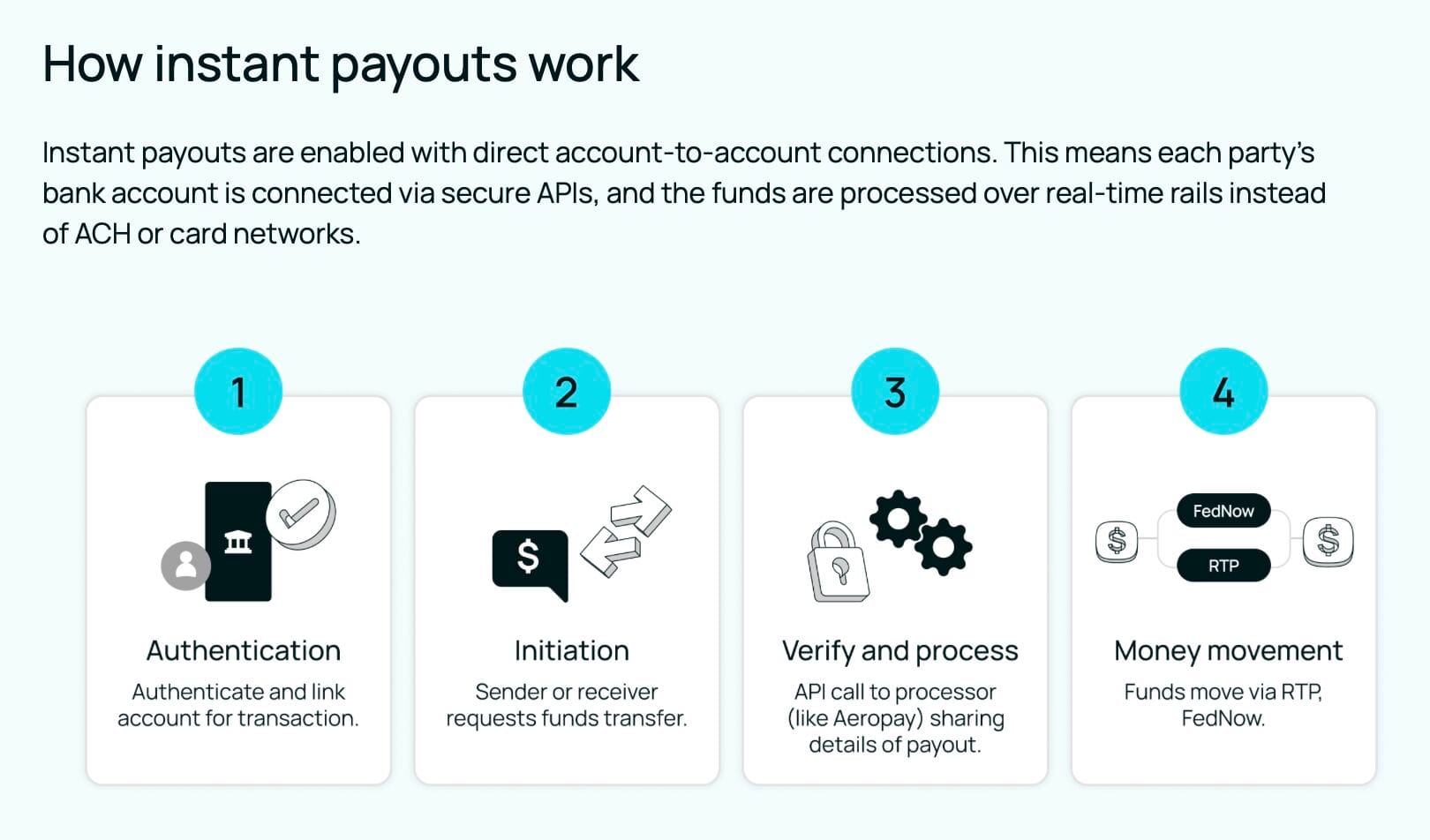

💵 What are instant payouts, and how do they work?

The process involves 4 key steps:

🇺🇸 InvoiceASAP selects Adyen to offer instant payouts, leveraging FedNow certification. The partnership focuses on providing instant access to deposited funds and capital for InvoiceASAP users. Adyen’s certification with the FedNow™ Service will support instant access to funds.

🇬🇧 DNA Payments arrives on Oracle Cloud Marketplace. DNA Payments announced its Pay at Reception, Pay at Counter and Pay at Table solutions are now available on Oracle Cloud Marketplace and can be deployed on Oracle Cloud Infrastructure (OCI).

🇲🇾 India’s UPI and Malaysia’s PayNet to connect for Instant Cross-Border Payments. The move aims to further India’s ongoing efforts to expand its instant payment network globally. PayNet reaffirmed that it is dedicated to enhancing Malaysia’s financial infrastructure through continuous innovation and strategic partnerships.

🇺🇸 Convera, a FinTech in commercial payments, introduced its embedded payments solution for the education industry through its new partnership with Ascent One, an ecosystem purposely built for the education sector. The solution aims to simplify cross-border payments for education agents and international students.

DIGITAL BANKING NEWS

🇧🇷 Nubank has finalized negotiations for seven new agreements to expand the offering of NuConsignado, its 100% digital payroll loan service. The new contracts include the three branches of the Brazilian Armed Forces—the Brazilian Air Force, Navy, and Army—as well as the municipalities of São Paulo, Rio de Janeiro, and Belo Horizonte and the state of Paraná.

🇺🇸 Three executives from Evolve, a crypto-friendly bank that suffered a data leak affecting at least 7.6 million customers, have all reportedly left their jobs. The bank's Chief Credit Officer, Corporate Controller, and Chief Lending Officer-Open Banking have all recently left the bank.

🇸🇬 South East Asian neobank Fingular surpasses four million customers. In July, the neobank hit 4 million registered customers in South and Southeast Asia, making it a serious competitor to both traditional and neobanks in the region and globally, just weeks after achieving profitability in Malaysia within 9 months of launch.

🇨🇦 Equitable Bank launches new financing option to support homeowners and increase urban housing density. The Laneway House Mortgage is the latest addition to the Bank's array of efforts that support housing densification, including lending towards the development and renovation of multi-unit residential projects.

🇬🇭 Kenya’s NCBA delays Ghana digital-banking start to 2025. NCBA Group is postponing plans to roll out digital-banking services in Ghana to 2025 after regulators in the West African nation changed some rules and asked the lender to reapply, Group Chief Executive Officer John Gachora said.

BLOCKCHAIN/CRYPTO NEWS

🇧🇷 MercadoLibre's FinTech launches its own dollar-backed 'stablecoin' in Brazil. The stablecoin, called Meli Dolar, can be traded by all Mercado Pago clients in Brazil through the FinTech's app, the company said in a statement.

DONEDEAL FUNDING NEWS

🇺🇸 Ex-Checkout.com duo raise $4.5m to help platform companies streamline their payments. Fika Ventures led the round for Revenew, which aims to help platform businesses like Uber or Spotify to streamline their payments operations. Dash Fund and TTV Capital also participated in the fundraise.

🇰🇼 Tether invests $3 million in Kuwaiti P2P payments app Kem. This landmark deal is set to improve regional adoption of USD₮, combining Tether’s commitment to expanding access to digital finance systems with Kem’s position as an emerging real-time payments leader in the Gulf region.

🇰🇪 Visa joins $5 million round in African payroll provider Workpay. The raise will support Workpay to reach profitability, a huge milestone for the company, according to Co- Founder Paul Kimani.

🇬🇧 Ex-Monzo staff’s AI startup Gradient Labs secures £2.8m in seed funding. The startup claims its AI agent can resolve up to 80% of customer queries including using actions and account data. Read full article

🇧🇷 Lux Capital made its first investment in Brazil, a $4M seed for AI FinTech Magie. The company, which has raised $5.1 million in total, is creating an AI-powered financial assistant. The current product allows people to send money and pay bills through WhatsApp.

MOVERS & SHAKERS

🇺🇸 Checkout 's Chief Operating Officer, Jenny Hadlow is now at the helm of key operational areas supporting the company’s customer journey, including Revenue Operations, Merchant Operations, and Risk Operations. Find out more about her career path, her advocacy for DEIB, and her vision for the future.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()