PayPal Introduces Money Pooling for Family and Friends

Hey FinTech Fanatic!

PayPal has introduced a new feature that allows customers to easily pool money with friends and family for group gifts, travel, special events, or other shared expenses.

Launching globally across the US, Germany, Italy, and Spain, this feature enables users to create a money pool within the PayPal app or online, invite friends and family to contribute, monitor group contributions, and transfer the collected funds to their PayPal balance for spending or withdrawal.

"Everyday life is all about connections, whether it's chipping in for a group gift or planning a trip with friends and family. PayPal understands this and aims to make those moments easier," said John Anderson, GM, SVP of Consumer at PayPal.

Customers can create a money pool for free in the PayPal app and contribute to an existing pool at no charge using their PayPal balance or linked bank account.

Pool organizers can invite any friends or family members to contribute, even if they don’t have a PayPal account. Additionally, organizers can transfer the collected funds to their PayPal balance, allowing them to spend instantly with PayPal or move the funds to a linked bank account.

What do you think about this new feature? Let's discuss this in the comments!

Cheers,

P.S. Want to boost your brand's visibility in the digital banking, FinTech, and payments sectors? Join us as a partner and connect with a highly engaged audience eager for industry-leading insights. This is a unique opportunity. to showcase your brand directly to decision-makers and innovators in the space.

Ready to make an impact? Sign up here, and let's take your brand to the next level!

#FINTECHREPORT

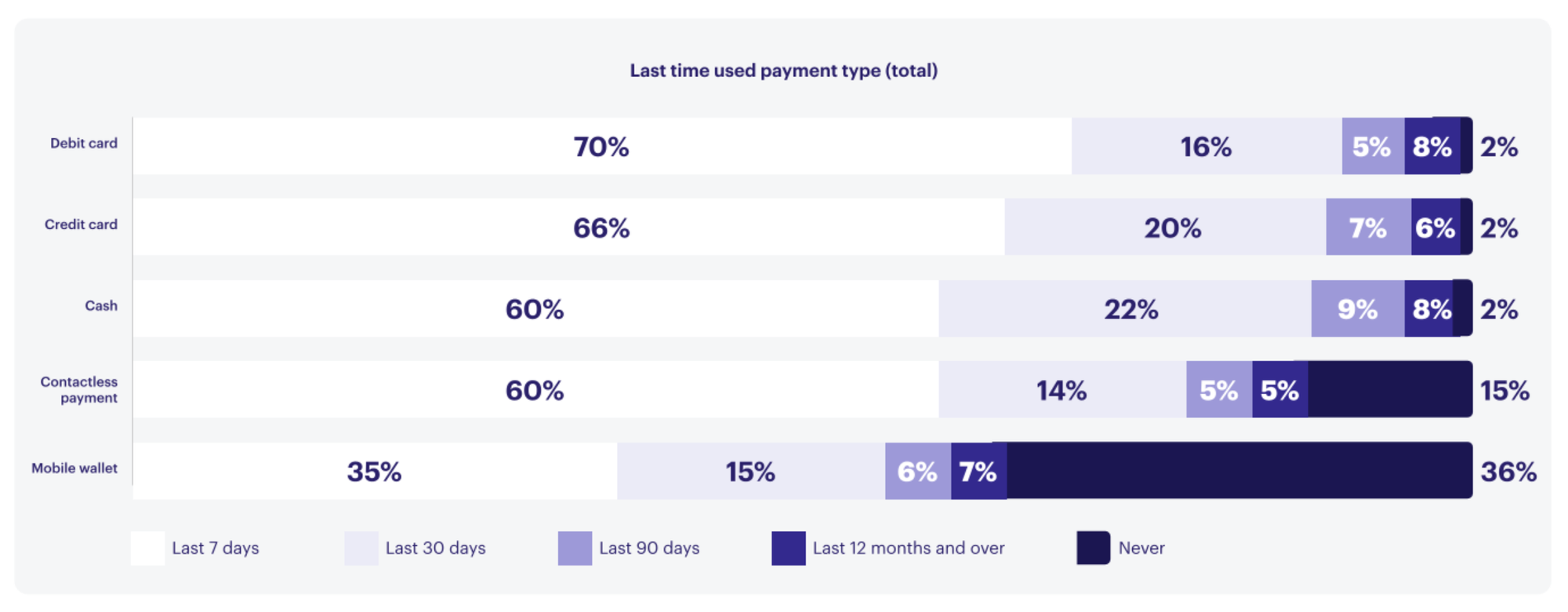

📊 Check out the State of Payments 2024 by Marqeta 👇

PODCAST

🎙️ In this podcast episode, Jason Mikula sits down with Max Levchin, cofounder and CEO of Affirm and PayPal Mafia member. They had the chance to discuss how Affirm manages third-party risks, selects compliant bank partners, adjusts to political and regulatory changes, and more. Listen to the full podcast episode

FINTECHNEWS

🇺🇸 SoFi announces robo-advisor platform, expanding firm’s automated investment offering. The robo offering comes on the heels of SoFi’s 2024 “launch of alternative investment funds.” The product provides always-on automation for a 0.25% annual fee, allowing members to tailor taxable and non-taxable portfolios to their needs.

🇯🇵 Rakuten Card and Mizuho Bank to Launch Co-Branded "Mizuho Rakuten Card." With this new card, customers can designate Mizuho Bank as their withdrawal account. The card, featuring preferred banking benefits, aims to make daily life more convenient and rewarding for customers.

🇧🇷 Hunter Pay, the FinTech arm of the car rental company Hunter, is entering a new phase. Starting next year, it plans to raise investments through a Credit Rights Investment Fund (FIDC). This move aims to solidify its business model, which connects app drivers with investors looking for returns through vehicle rentals.

🇺🇸 Sales tax automation startup Kintsugi doubled its valuation this year. Kintsugi raised a $6M Series A round earlier this year that valued it at a $40M post valuation in April. The company has since reopened its Series A round, taken on additional $4M in capital, and doubled its valuation to $80M.

🇺🇸 Rapid Finance expands availability of rapid access prepaid Mastercard® to all business line of credit clients. The Rapid Access Card offers small business clients quick and flexible access to their Business LOC funds, providing greater convenience in managing their finances.

🇺🇸 Viamericas enhances money transfer options with real-time domestic cash-to-account. This new service revolutionizes how customers can make and receive cash transfers within the United States by leveraging the speed and efficiency of both the FedNow service and the Real-Time Payment (RTP) network.

PAYMENTS NEWS

🇮🇹 Mollie expands into Italy with local payment solutions for businesses. The expansion will provide Italian businesses with a single platform to streamline payment processing, reporting, and fraud prevention. Mollie’s entry into Italy marks a strategic move into the fourth-largest eCommerce market in Europe.

🇳🇱 Adyen and Zalando strengthen partnership to enhance seamless payments for millions of European shoppers. This collaboration strengthens Adyen's role as one of Zalando's payment partners across 15 European markets and makes it the exclusive partner for local payment methods like Cartes Bancaires in France and Bancontact in Belgium.

🇺🇸 Payfinia launches CUSO with Star One Credit Union. The Credit Union Service Organization (CUSO) aims to support payments modernization solutions and embedded fraud controls through an open payments platform for credit unions and industry partners.

🇺🇸 ConnexPay receives patent for Unified Payments Platform. “We are thrilled to receive this patent, which represents years of hard work and innovation by our talented Product and Technology teams,” said Ben Peters, ConnexPay CEO. Read on

🇲🇽 Unlimit and Pagaloop partner to simplify expenses for SMBs in Mexico. The partnership enables Pagaloop to leverage Unlimit’s acquiring network and accept payments from all major card providers, including Visa and Mastercard, to provide Mexican SMBs with immediate cash flow support, allowing them to focus on growth.

🇭🇰 FTS.Money has announced its partnership with 2Cimple’s Nano. This collaboration aims to integrate eco-friendly initiatives into financial technology, creating a robust ecosystem that promotes sustainable behaviour, provides seamless payment solutions, and strengthens community engagement.

🇬🇧 Digital Wallet and eCommerce growth drive Paysafe Merchant Solution sales. Shares of Paysafe slumped 25% Nov. 13 in the wake of earnings that missed Wall Street forecasts. But the company’s materials and management commentary revealed growth in core segments, gains in average transactions per active users of digital wallets and expanding reach in Europe

🇺🇸 Stripe launched a SDK built for AI agents. These automations can translate prompts into sequences of programmatic actions to interact with other systems. These agents are built using new frameworks that blend prompting and function calling. Click here to learn more

🪙 Mastercard to phase out passwords by 2030 with biometrics, tokenisation. The payment giant’s proposed system would allow for seamless authentication across devices while keeping personal data secure and on-device. This approach aims to reduce the 25% cart abandonment rate caused by lengthy checkouts.

DIGITAL BANKING NEWS

🇧🇷 Nubank has reached 𝟭𝟬𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 customers in Brazil, a number that represents 57% of the adult population in the country 🤯 In the third quarter of 2024, Nu’s business model once again demonstrated its capability of combining growth and profitability. Click here to learn more

🇧🇷 Wise Platform Announces Partnership with Grupo Travelex Confidence in Brazil. Through this collaboration, Travelex Confidence will now offer a global account through its app, using Wise Platform’s infrastructure to provide a simpler and more cost-effective global financial experience for its Brazilian customers.

🇺🇸 PayPal unveils innovative Money Pooling feature, simplifying group expenses between family and friends. Launching across the US, Germany, Italy, and Spain, the new feature lets customers create a pool in the PayPal app or online, invite contributions from friends and family, track totals, and transfer funds to their PayPal balance.

🇬🇧 Flexys integrates debt management software with 10x's core banking system. The partnership combines Flexys' advanced debt management with 10x Banking’s next-gen core technology, offering financial institutions a cloud-based solution that modernizes debt collection and enables personalized, real-time customer interactions.

🇺🇸 FinCEN warns US banks about AI deepfake frauds. The Treasury Department’s Financial Crimes Enforcement Network (FinCEN) issued an alert on Nov. 13 to help financial institutions spot scams associated with the use of deepfake media created using generative artificial intelligence (GenAI).

🇬🇧 Zopa aims to double profit this year as it eyes 2025 current account launch. The company currently provides credit cards, personal loans, and savings accounts exclusively through a mobile app, much like other digital banks such as Monzo and Revolut that operate without physical branches.

BLOCKCHAIN/CRYPTO NEWS

🇧🇷 Nubank launches cryptocurrency swap tool in its app. Nubank customers will soon find this feature in the app's cryptocurrency section under the "Trocar" (Swap) button, allowing exchanges of additional token pairs over the coming months.

MoonPay turns non-custodial crypto wallets into primary bank accounts. The company has launched MoonPay Balance, a payment solution that enables users to hold and spend fiat balances within the decentralized crypto ecosystem through direct integration with non-custodial wallets and exchanges.

PARTNERSHIPS

🇲🇲 Wave Money taps Amdocs to enhance financial services operations. This collaboration with Amdocs enables Wave Money to expand its financial tools for both urban and rural users, contributing to financial inclusion across Myanmar. Read on

DONEDEAL FUNDING NEWS

🇪🇸 SeQura sets new record of €410 Million in funding. This milestone highlights the confidence of some of Europe’s top investors in seQura’s business model and vision. With the new funds, seQura is set to enter four new international markets, including the US, UK, and Germany, aiming to triple its business volume by 2027.

🇬🇧 Revolut facing potential legal action in battle with Crowdfunding platform after a years-long battle over the sale of its shares by early investors. The row is currently at a flashpoint as the British banking company resists a US private equity investor’s efforts to snap up shares at a heavy discount through start-up investment platform Republic Europe.

M&A

🇺🇸 Bitwise acquires $4 billion institutional-grade Ethereum staking provider Attestant and announces launch of Bitwise Onchain Solutions. The acquisition adds professional non-custodial staking to Bitwise’s range of solutions, including ETPs, hedge funds, private funds, and managed accounts.

MOVERS & SHAKERS

🇺🇸 PayQuicker announces Kevin Zeman’s promotion to Vice President of Banking Operations. Since joining in 2016, Kevin has contributed to the company's global growth, overseeing multiple departments and strengthening banking partnerships. His leadership will continue to support PayQuicker's expanding network.

🇺🇸 Payouts Network announced the appointment of industry veteran Garen Staglin to its Board of Directors. This addition strengthens the company's leadership team and positions it for continued growth and success in the rapidly evolving payments landscape.

🇦🇺 EML Payments focusses on growth with the appointment of three global Executives. Bryan Lewis has been appointed as Global Chief Operating Officer, Shabab Muhaddes as Chief Revenue Officer, and Tom Cronin as Chief Product Officer. These strategic appointments are part of the company’s ongoing transformation.

🇺🇸 Obligo names FinTech risk management expert and former PayPal, BlueVine Vet Gil Rosenthal as VP of Risk. Rosenthal will enhance Obligo's IP development, fortify risk management processes and help scale collection operations as the company experiences a period of rapid growth.

🇬🇧 Jeremy Nicholds steps down as CEO of UK paytech Judopay. In a statement posted to LinkedIn, Nicholds says, 'It’s time for me to turn the page and start a new chapter.' He also stated that, while he is eager for future opportunities, he will always value the lessons and experiences gained at Judopay.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()