PayPal and UKG Partner to Streamline Payroll Access for U.S. Employees

Hey FinTech Fanatic!

PayPal and UKG, a prominent provider of HR and payroll solutions, have announced a strategic collaboration aimed at simplifying payroll access for U.S. employees.

Through this partnership, employees whose pay is processed via UKG Pro can now effortlessly set up a PayPal Balance account and opt for PayPal Direct Deposit directly through their employer's payroll portal.

This integration eliminates the need for manual entry of routing or account numbers, allowing employees to seamlessly direct some or all of their paycheck into their PayPal account. Additionally, employees may benefit from early access to their payroll funds—potentially up to two days in advance.

Beyond direct deposit, employees can take advantage of PayPal’s extensive suite of financial services, including the PayPal Debit Mastercard, which offers cashback on eligible purchases. Other features include the ability to send money to friends and family, earn rewards, and access high-yield savings accounts.

This collaboration marks a significant step in the digital wallet space, aligning with the growing consumer preference for quick, secure payment options. With over 200 million active PayPal accounts in the U.S., this partnership is poised to enhance financial management for a large segment of the workforce.

Enjoy more FinTech industry updates I listed for you below and I'll be back in your inbox tomorrow same time, same place!

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

#FINTECHREPORT

📱 Stripe’s payments APIs: The first 10 years

Michelle Bu breaks it down for us:

🔸 Supporting card payments in the US (2011-2015)

🔸 Adding ACH and Bitcoin (2015)

🔸 Seeking a simpler payments API (2015 - 2017)

🔸 Designing a unified payments API (late 2017 - early 2018)

🔸 Introducing PaymentIntents and PaymentMethods (2018)

🔸 Launching PaymentIntents and PaymentMethods (2018 - 2020)

Explore the complete story here

INSIGHTS

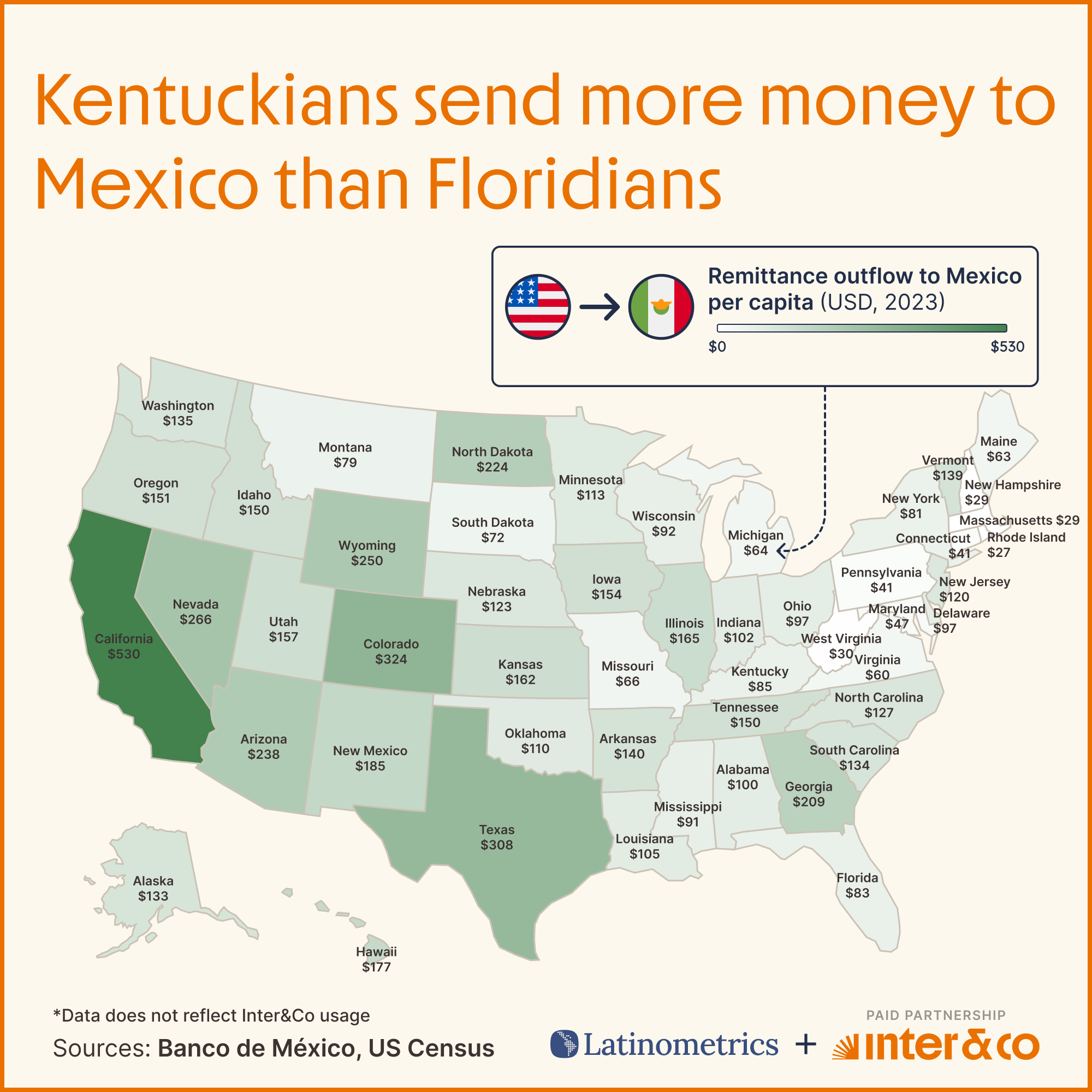

➡️ Mexicans 🇲🇽 across the US 🇺🇸 send lots of money back home.

The states where they're at may surprise you:

PAYMENTS NEWS

🌐 D24 partners with Yuno to drive cross-border ecommerce. UK-based payment solutions provider D24 has joined forces with payments orchestrator Yuno to drive digital payments for cross-border businesses in LATAM, Asia, and Africa.

🇦🇺 Limepay, the recently acquired company of Spenda, has executed a master services agreement with Lessn to acquire and process its entire payment volume, utilising Limepay’s transaction processing gateway. The agreement immediately lifts Limepay’s payment volumes by around 40% to about $167 million per annum, and further underpins Spenda’s strategic rationale in acquiring the Limepay business.

🇺🇸 D-Tools launches embedded payments solution for D-Tools Cloud. D-Tools Payments, free for D-Tools Cloud users, offers a seamless, secure, and compliant payment system with intuitive onboarding, transparent transaction fees, and faster ACH payments.

OPEN BANKING NEWS

🇧🇷 Lina Open X, a company specializing in infrastructure solutions for the Open Finance ecosystem, has received authorization to operate as a Payment Transaction Initiator (ITP) via Pix within Open Finance. With the approval of the infrastructure company, the number of Payment Initiators (ITPs) enabled in Open Finance has reached 33.

REGTECH NEWS

🇺🇸 Unit21 unveils new anti-fraud feature bundle for Automated Clearing House (ACH) transactions. These features use Generative AI (GenAI) and machine learning (ML) to help banks, credit unions, payments companies, and FinTechs proactively detect and block risky transactions.

DIGITAL BANKING NEWS

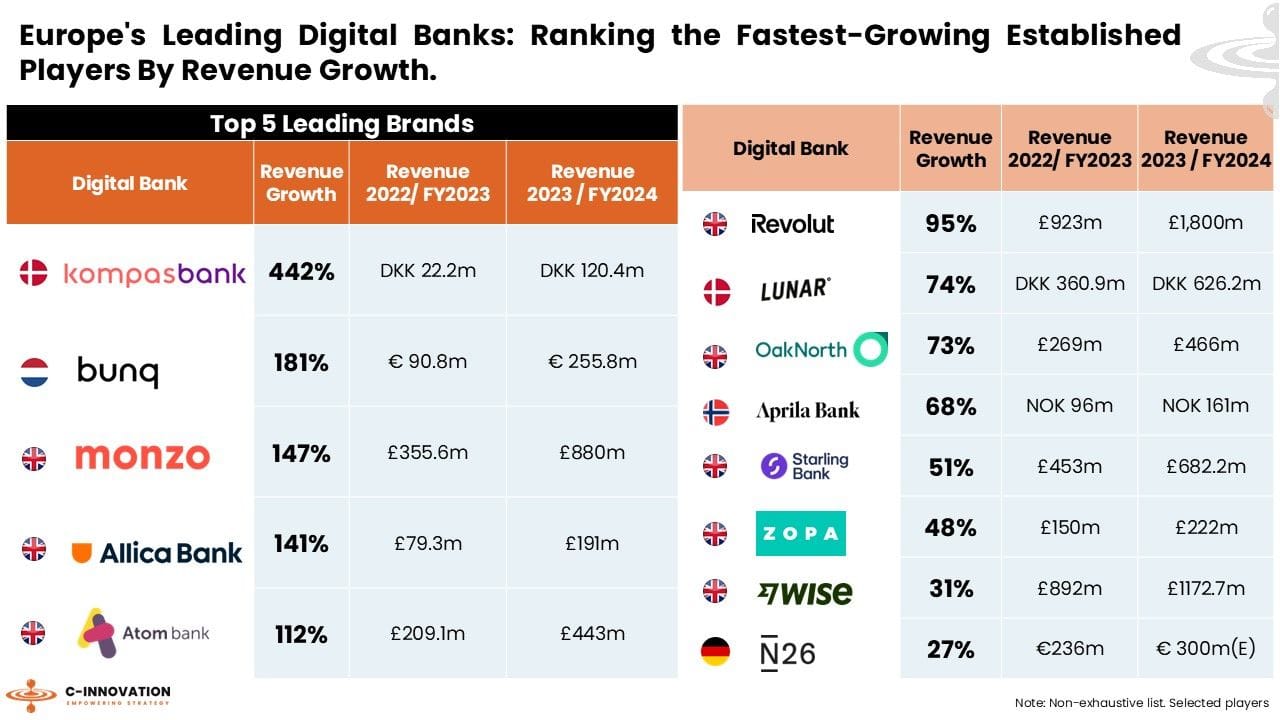

📊 C-Innovation Ranked the Fastest-Growing Digital Banks In Europe👇

BLOCKCHAIN/CRYPTO NEWS

🇹🇷 Crypto exchanges flocking towards Turkey: Coinbase, KuCoin apply for licence. A total of 76 companies have been included in the list published by the country's Capital Markets Board. The names appeared when cryptocurrency regulations in Turkey were in a state of flux.

🇦🇪 Dubai’s RAKBANK teams up with Bitpanda to offer crypto to UAE residents. Per an Aug. 19 press release, the partnership aims to provide UAE residents with a platform to manage crypto holdings, marking Bitpanda’s first agreement in the region.

DONEDEAL FUNDING NEWS

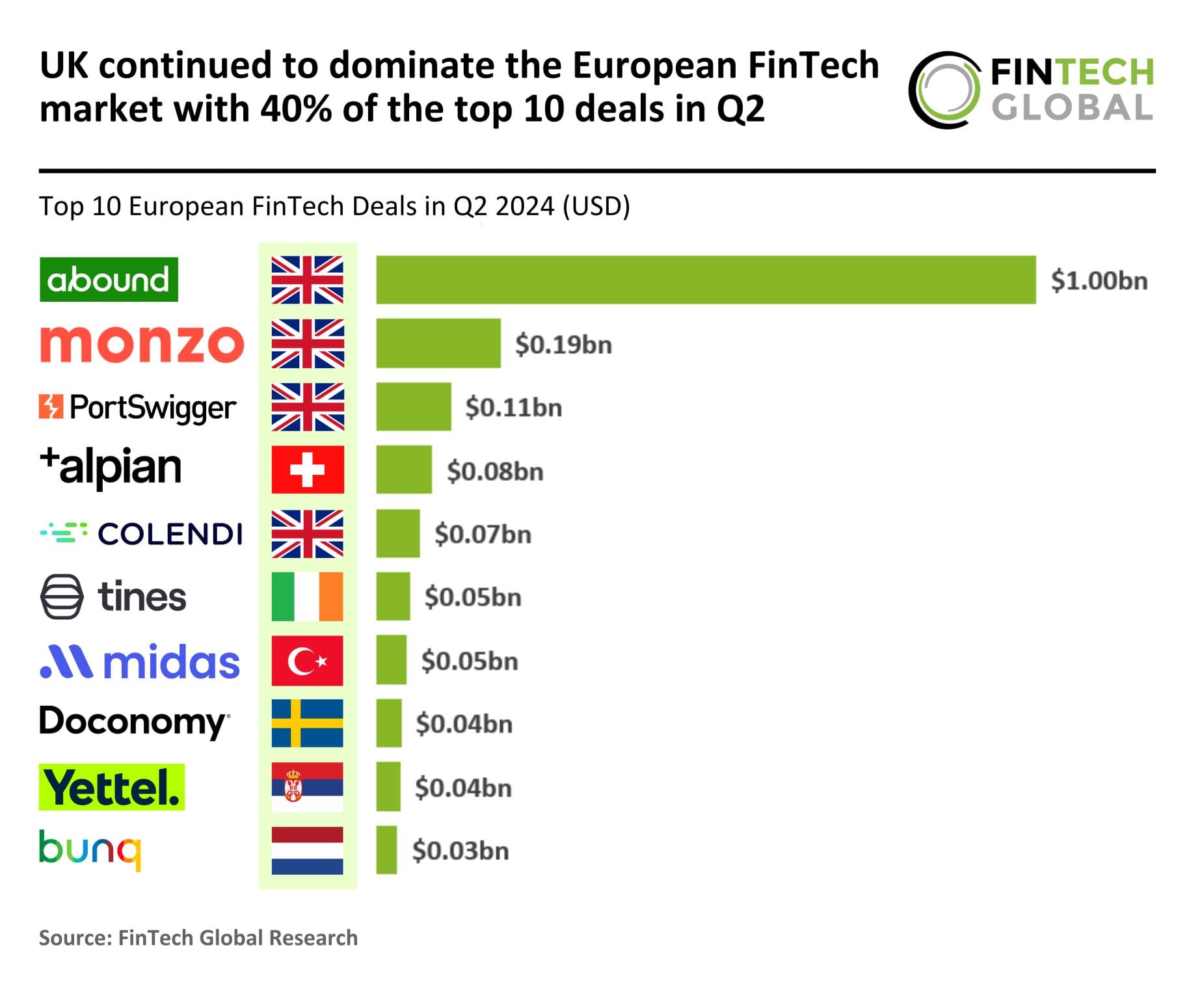

🇬🇧 UK continued to dominate the European FinTech market with 40% of the top 10 deals in Q2.

Other Key European FinTech Investment Stats:

🇳🇬 Waza, a Nigerian Y Combinator-backed B2B payment and liquidity platform has secured $8 million in equity and debt funding to expand into new markets. This significant capital injection is expected to bolster Waza’s efforts in expanding its operations and enhancing its platform.

🇺🇸 FinTech solutions provider NYMBUS secures onvestment from Gesa Credit Union. This investment will fuel Nymbus’ ongoing mission “to help credit unions create sustainable growth in an increasingly competitive market dominated by megabanks and FinTech organizations.”

M&A

🇦🇹 Bitwise makes European play with ETC Group acquisition. The acquisition brings Bitwise’s total assets under management above $4.5 billion and comes in a busy year for the firm, which was one of 10 firms to get the green light to launch a Bitcoin ETF in the US.

MOVERS & SHAKERS

🇪🇸 Mangopay announced its new VP for Global Sales: Tristan Torres. Torres will assume the new position from the FinTech's offices in Madrid and his main mission will be to identify and leverage new business growth opportunities, while building and strengthening customer relationships, ensuring their permanence over time.

🇦🇺 Katie Wilson appointed new Head of Policy at FinTech Australia. Wilson’s responsibilities in her new position will include facilitating industry relations with the government, leading policy submissions, and collaborating with FinTech Australia members to shape the organisation’s stance on various regulatory matters.

💼 These FinTech companies are hiring, despite a rough market in 2024:

🇺🇸 Mastercard plans to cut 3% of staff worldwide amid overhaul. That would work out to about 1,000 people, based on its reported employee count at the end of last year. Read the full article for further information

🇬🇧 Volt’s co-founder and Chief Growth Officer Jordan Lawrence steps down. In a LinkedIn post, Lawrence announced his decision to step down from his role to focus on family and explore new opportunities.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()