Portugal's FinTech Surge: Opportunities in a Time of Global Economic Strain

Happy Monday!

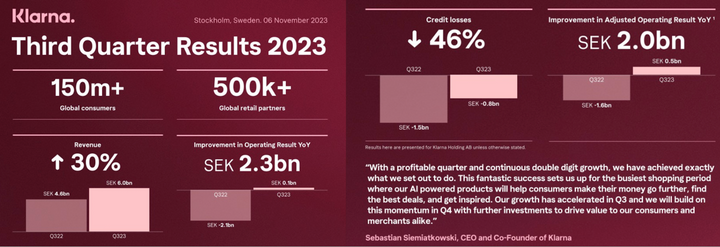

Despite the challenges posed by volatile geopolitics and an economic recession, the 2023 FinTech ecosystem is looking bright.

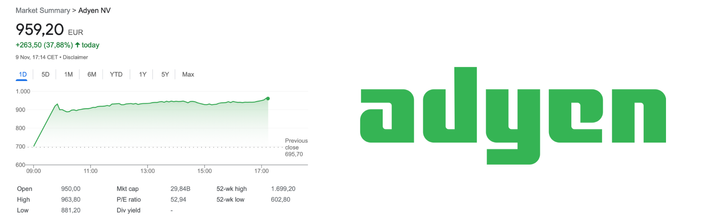

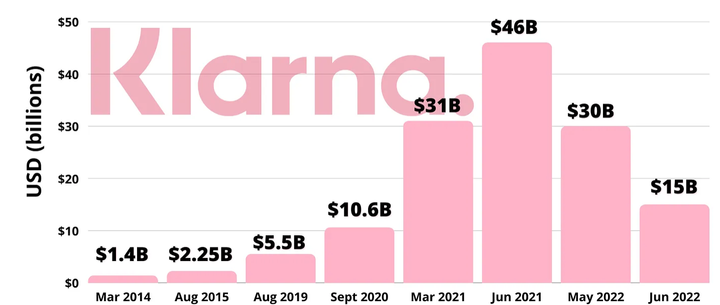

Financial resilience prevailed despite Europe’s tough FinTech funding landscape. High inflation led to restrictive policies and rising interest rates, impacting valuations. Bank failures in the US and Europe added