Open Banking in UK Hits Major Milestone: 10 Million Users and Growing

Hey FinTech Fanatic!

More than 10 million UK consumers and small businesses are now regularly benefiting from open banking technology.

This milestone, achieved six-and-a-half years after the UK's open banking rollout, has fostered an ecosystem valued at over £4 billion and created approximately 5,000 skilled digital jobs, according to Open Banking Limited (OBL).

Usage of Payment Initiation Services has surged by 61% year-on-year, while Account Information Service users have increased by 27% year-on-year.

Marion King, OBL chair and trustee, stated: “Consumer empowerment is core to open banking and it’s fantastic to see more and more people and small businesses take advantage of the financial opportunities open banking provides.

“From access to cost-effective credit, building a regular savings habit or making more informed financial decisions, open banking is delivering the means for millions of people to improve their financial wellbeing, delivering a true public good.”

OBL highlights that competition has significantly driven growth, as companies that adopt open banking technology often see their competitors quickly follow suit.

This achievement coincides with the government’s recent commitment to implementing smart data powers through a new Digital Information and Smart Data bill. According to OBL, this legislation will establish the groundwork for the future expansion of the open banking ecosystem.

Enjoy more global FinTech updates I listed for you today, and I'll be back with more tomorrow!

Cheers,

Join my Telegram channel for instant access to daily updates and exclusive breaking news from the FinTech industry. Connect with fellow FinTech Fanatics and stay ahead with the latest trends and insights.

BREAKING NEWS

🚨 Revolut is nearing a deal to sell about $𝟱𝟬𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 worth of employee-owned shares at a valuation of $𝟰𝟱 𝗯𝗶𝗹𝗹𝗶𝗼𝗻, according to The Wall Street Journal. Revolut is in talks to sell the shares to new shareholders, including New York-based Coatue Management, and existing investors such as Tiger Global Management.

FEATURED NEWS

🇺🇸 ACI Worldwide, a global leader in mission-critical, real-time payments solutions, and Worldpay, a leading global provider of payment processing solutions, announced an extension of their longstanding partnership. The agreement will see ACI continue to provide critical infrastructure to Worldpay to support merchants worldwide.

FINTECH NEWS

🇦🇺 Refunds from Australian retailers are made smoother with digital ID as Refundid joins ConnectID network. Through ConnectID, Refundid customers can securely and seamlessly verify their identity using an existing trusted source, like their bank.

🇬🇧 Toqio and Visa partner to offer payment solutions to non-financial firms. The partnership will enable Toqio's corporate clients to access and issue Visa commercial cards, directly from its platform, to improve their operational efficiency and generate new growth possibilities.

🇪🇬 Egypt's Banknbox join forces with CSC Jordan to drive financial inclusion. The companies seek to strengthen their position in MENA’s FinTech sector by integrating their customer-facing systems from banks and financial institutions as well as linking applications to provide distinctive regional services to their customers.

🇩🇪 YouLend partners with orderbird to launch flexible financing for hospitality businesses in Germany. The partnership seeks to enhance orderbird’s POS offering by integrating YouLend’s financing seamlessly into their platform. Read on

♻️ Blackhawk Network (BHN) and Mastercard announce global environmental sustainability initiative. The collaboration first went live last year in the US and Canada and has helped reduce the plastic waste created during the traditional card production process.

PAYMENTS NEWS

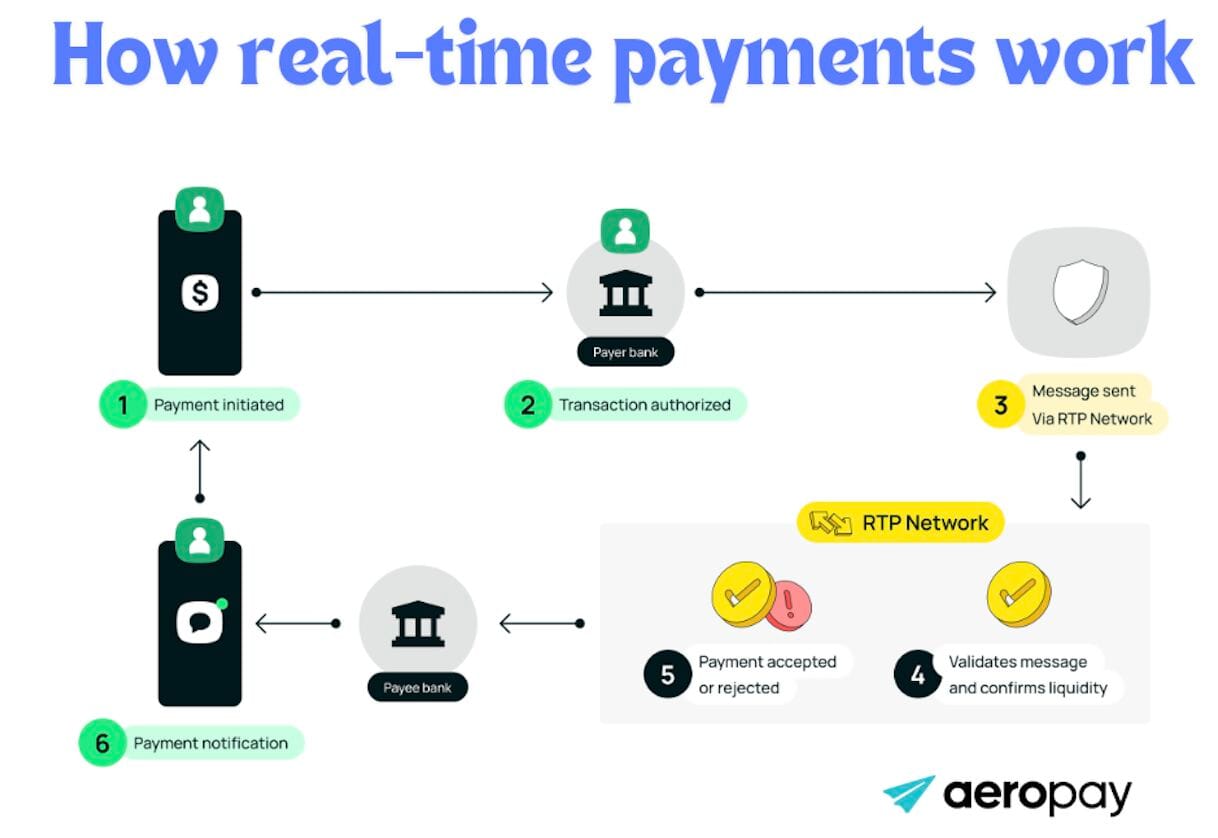

📈 Global real-time transactions are expected to hit 575 billion by 2028 🤯

Here is how Real-Time Payments work:

🇩🇪 Billie becomes the first B2B BNPL payment method live on Stripe. Link here

🇵🇪 ProntoPaga introduces instant payment solution. ProntoPaga, a company specializing in payment collection and distribution services across Latin America, has introduced a new solution that allows for instant payments, cutting wait times by over 90% in Peru.

🇸🇬 Alchemy Pay integrates Volt's real-time payment channels to enhance service offerings in Europe. Through this integration, Alchemy Pay aims to unlock significant growth by expanding its coverage in key European markets, which will further facilitate real-time EURO payouts for users purchasing cryptocurrencies.

🇬🇧 TerraPay enables financial institutions to send international account-to-wallet payments using Swift. Payments initiated over Swift will reach TerraPay's system with speed and efficiency, and with end-to-end transparency from account to wallet, powered by Swift's transaction tracking capabilities.

🇺🇸 Galileo Financial Technologies adds 3D Secure (3DS) to bolster online fraud protection. This enhancement helps clients protect against card-not-present (CNP) debit and credit card fraud, projected to escalate to $28.1 billion globally by 2026—up 40% from 2023.

🇧🇷 Brazil delays launch of recurring Pix payments. The Brazilian central bank has pushed back the addition of recurring payments to its Pix platform from October until next June. More on that here

🇵🇷 XTransfer and EBANX partner to facilitate B2B trade payments in Latin America. This collaboration will empower XTransfer's clients – small and medium-sized enterprises (SMEs) worldwide working with imports and exports – to navigate LatAm's digital economy with greater ease and efficiency.

🇬🇧 OMS integrates GoCardless Instant Bank Pay, GoCardless’ open banking payments feature, directly into its platform, enabling brokers to efficiently request payments from their clients for a variety of services rendered, such as broker fees.

🇮🇳 India-based payments and API banking company Cashfree Payments has obtained a payment aggregator-cross border licence from the RBI. The payment aggregator-cross border (PA-CB) licence allows Cashfree Payments to assist international businesses and entities regulated abroad with payment collections in India.

OPEN BANKING NEWS

🇬🇧 UK open banking hits 10 million users. The milestone comes six-and-a-half years after the rollout of open banking in the UK, building an ecosystem worth more than £4 billion to the economy and creating around 5000 skilled digital jobs, claims Open Banking Limited (OBL).

🇺🇸 GDS Link and Atto partner to power instant credit decisions. This partnership combines GDS Link’s robust risk management technology with Atto’s high quality open banking data and insights to support businesses in making well-informed decisions.

REGTECH NEWS

🇬🇧 Capital on Tap enhances its capabilities through a renewed multi-year deal with GDS Link, utilising their decisioning platform to support and complement Capital on Tap’s proprietary risk models across its UK and US business.

DIGITAL BANKING NEWS

🇮🇹 Revolut launches personal loans in Italy: "IBAN, Credit Cards, and Buy Now Pay Later Coming Soon." The online bank will offer loans ranging from 1,000 to 50,000 euros to its two million users starting this fall. Maurizio Talarico, the head of Branch and Lending Italy at Revolut, mentioned they are also considering mortgages.

🇺🇸 US Bank Mercury to close accounts of startups in 13 African countries after internal compliance changes. The new restrictions will affect users in 37 countries. With the new prohibitions, African startups incorporated in Delaware cannot open Mercury accounts unless the founders live in the U.S.

🇺🇸 MANTL announces integration with Q2’s Digital Banking Platform. This integration offers two key benefits: streamlined online banking enrollment by eliminating redundant data entry and enabling existing customers to open new accounts in under a minute through single sign-on (SSO) integration.

🇧🇭 i2c and Beyon Money launch corporate card partnership. The collaboration will see the firms launch a corporate expense card program for the small to midsize enterprise (SME) sector, targeting businesses in Bahrain before eventually expanding to the Gulf Cooperation Council states.

🇦🇪 UAE-based FinTech start-up myZoi has launched a financial inclusion-focused digital wallet complete with “one-to-many” transfer capabilities. The digital wallet promises to reduce remittance fees for underbanked employees in the UAE by enabling transfers to up to five people for the price of one.

🇳🇱 Rabobank selects Zafin Platform to power digital transformation efforts with optimized product, pricing and billing capabilities. By implementing Zafin platform capabilities, Rabobank’s internal teams will benefit from a consistent view of product, billing, and invoicing information across all channels.

🇱🇺 Banking Circle and Fundcraft partner together on account openings. The partnership means that fund managers will be closely connected to national clearing schemes, thus enabling accounts to be opened more quickly. Read more

🇳🇱 Finom launches Sepa direct debit B2B. This service is now available in all countries where FINOM provides local IBAN accounts through its own EMI license. The new feature complements FINOM’s existing SEPA Direct Debit Core offering, providing a more comprehensive suite of payment options for businesses of all sizes.

🇰🇪 Diamond Trust Bank (DTB) and Network International to collaborate on accelerating digital payment transformation in Kenya. Through this partnership, Network International will offer a variety of payment products and services including debit, credit and prepaid card hosting and processing as well as e-Commerce.

🇬🇧 UK’s Bondsmith teams up with abrdn to launch fully integrated cash savings solution. Bonsdsmith offers deposit aggregation by partnering “with multiple banks to provide savings products through a single channel. Read full article

🇬🇧 PayDo selects ClearBank to enhance service offerings to their UK customers. The partnership with ClearBank will allow PayDo customers to convert their transactions into 12 different currencies and gain access to the faster payments network.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 9 US spot ether ETFs go live after landmark approval. Investors can choose between ETH products by BlackRock, Fidelity, Grayscale, VanEck, Bitwise, 21Shares and Franklin Templeton, as well as one by Invesco and Galaxy Digital. Each ETF is available on either the Cboe, NYSE Arca or Nasdaq exchanges.

DONEDEAL FUNDING NEWS

🇬🇧 Plum raises €19 million Series B, on track for profitability in 2025. The investment was secured following a period of strong performance for the business. The company has seen exceptional growth since launching in 2017, with more than 2 million customers now using the app.

🇨🇦 Legal tech Clio raises $900M at a $3B valuation, plans to double down on AI and FinTech. The company works to simplify law firm management by centralizing client intake, case and document management, and payments, among other things.

🇺🇸 FinTech Fragment eases ledger problems, nabs $9M from Jack Altman, BoxGroup, others. The company plans to use the funding to grow its engineering team and invest in go to market resources. Continue reading

M&A

🇺🇸 Applied Systems acquires Planck. This strategic acquisition will significantly expand Applied’s AI capabilities, accelerating its vision for the next generation of the digital roundtrip of insurance and creating more value at every stage of the insurance lifecycle for the benefit of agencies, carriers and their clients.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()