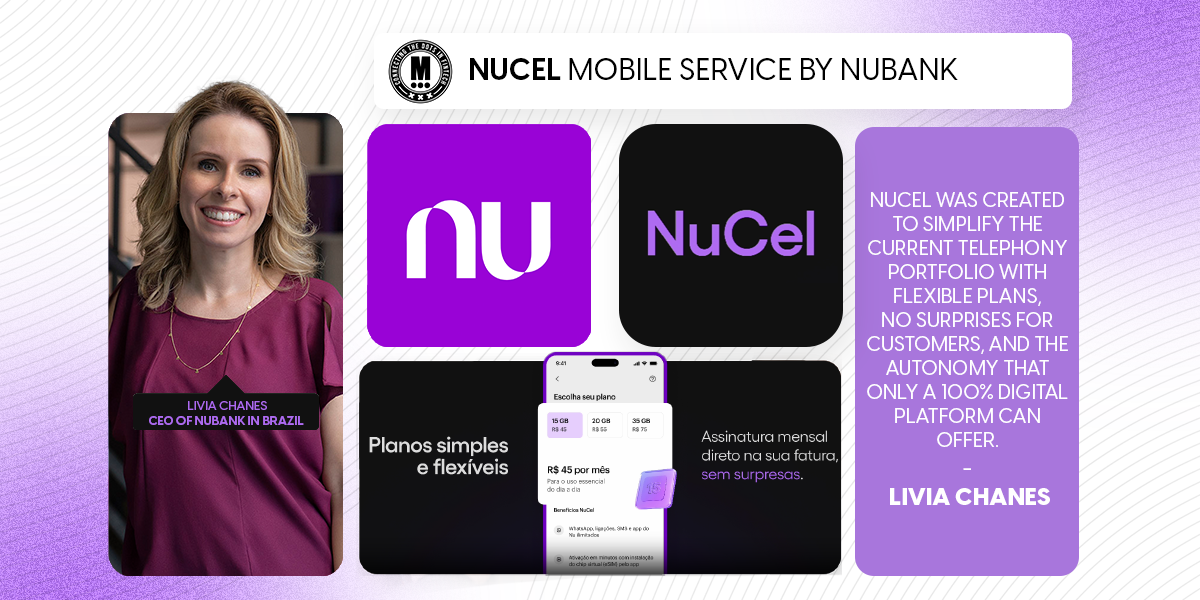

NuCel, a New Mobile Service by Nubank

Hey FinTech Fanatic!

This week, Nubank is diving into new territory, unveiling NuCel, a mobile phone service that’s set to redefine connectivity in Brazil and expand the company’s portfolio beyond Financial Services.

The product was developed to simplify users’ lives with flexible and no-commitment plans. Additionally, NuCel customers will have benefits that are part of the Nubank ecosystem, such as “Caixinhas Turbo”, a tool that allows users to save money with a personalized return of 120% of the CDI.

Ultravioleta and Nubank+ customers will automatically receive extra gigabytes if their data allowance is exceeded.

NuCel will be gradually rolled out over the coming months, initially available only for devices with eSIM, with fast and 100% digital activation.

“NuCel was created to simplify the current telephony portfolio with flexible plans, no surprises for customers, and the autonomy that only a 100% digital platform can offer. Our philosophy remains the same: we know that the best product always wins. We are on day one of this journey, but we are working to ensure the experience, customer care, and quality of Nu’s service in this new product. And of course, this service, within an increasingly comprehensive ecosystem of solutions, brings even more benefits and gains by integrating offers to the customer,” says Livia Chanes, CEO of Nubank in Brazil.

NuCel was developed under the MVNO (Mobile Virtual Network Operator) model, regulated by Anatel in the country.

With NuCel, Nubank is stepping beyond traditional financial services and further solidifying its place as a versatile player in the lives of Brazilian consumers, keep scrolling to read more global FinTech industry updates below👇 and I'll be back tomorrow!

Cheers,

#FINTECHREPORT

📊 ACI Worldwide study reveals real-time payments to boost global GDP by $285.8 billion, create 167 million new bank account holders by 2028. ACI’s second Real-Time Payments: Economic Impact and Financial Inclusion report leverages data from 40 countries and reveals—for the first time—an empirical link between real-time payments and financial inclusion.

INSIGHTS

📲 The highest earning Finance Apps (in 2022)👇

FINTECH NEWS

🇸🇦 Checkout.com pulls in $2 million extra revenue for MENA FinTech unicorn Tamara. Partnering with Checkout.com, Tamara drastically reduced failed transactions and improved payment collection, adding $2 million in revenue during a pilot phase. Learn more

🇵🇪 Yape Peru's Supper App and TerraPay join forces to accelerate digital inclusion. The collaboration allows TerraPay Global network partners to send instant international transfers to Yape users, giving them immediate access to funds and financial services within the app.

🇮🇳 Razorpay ‘s FY24 income grows after new products. The Tiger Global-backed Indian FinTech unicorn’s net income jumped 360% to 340 million rupees ($4 million) for the fiscal year ended March 31 compared with the previous year, according to a press release on Tuesday.

🇮🇳 FinSecureLabs and LeoCompare partnership brings new remittance and payment products marketplace to India. The collaboration is set to enhance the experience of Indian consumers by providing a seamless and transparent solution for outbound remittance services and payment products.

🇲🇽 Finastra accelerates its international growth with new office in Guadalajara. The new office hosts 40 employees across technology, marketing, and sales, with plans to double the workforce by tapping into the area's talent and innovation.

PAYMENTS NEWS

🇺🇸 Viably and Airwallex launch cross-border payment solution for eCommerce businesses. The Viably Global Account, powered by Airwallex, allows sellers to pay vendors and suppliers around the world, collect payouts from marketplaces and manage all financial aspects of their business, the companies said in a recent press release.

🇸🇬 Thunes and Circle to launch stablecoin-powered liquidity management solution. This collaboration enables Thunes’ network members to use USDC for faster, seven-day cross-border transactions, improving liquidity, reducing capital costs, and offering growth opportunities through cost-effective payments.

🇿🇦 Standard Bank partners with Volante to revolutionize payment systems across Africa. The partnership, now live in South Africa, uses Volante’s Payments as a Service (PaaS) and Embedded Preprocessing to centralize multiple payment formats and standards into a single system, working alongside existing infrastructure.

🇬🇧 PayPoint announces new partnership with Leeds Credit Union. The partnership allows LCU customers to access their cash and savings at any of PayPoint's 29,000 UK retailers, expanding access beyond LCU’s four branches for the first time.

🇪🇺 Tap to Pay on iPhone expands to more countries. Apple announced the expansion of Tap to Pay on iPhone to five new European markets: Austria, Czech Republic, Ireland, Romania, and Sweden with new payment partners that include Adyen, SumUp, and Viva.

🇺🇸 PayPal's revenue forecast fails to impress as profit push puts growth behind. PayPal raises its annual profit forecast as spending remains strong, but shares fall 5% after a weak Q4 revenue outlook. The company is moderating growth in Braintree and other low-margin businesses, shifting its focus to high-margin opportunities.

🇮🇳 Cashfree Payments gains regulatory approval to operate as a PPI provider. This enables the firm to issue prepaid payment instruments, such as cards or digital wallets, and opens up new opportunities for innovation in the payments landscape. Read on

🇭🇰 Tribe Payments partners with PhotonPay for issuer processing. As a trusted payments solution provider, Tribe meets PhotonPay's needs for flexibility, scalability, and customization. Tribe’s developer-led APIs allowed PhotonPay to launch a pilot in weeks, making Tribe a key partner for global deployment.

🇮🇳 Amazon Pay India loss narrows as sales rise, expenses decline. Amazon Pay India’s loss narrowed almost 40% from the previous year to 9.1 billion rupees ($108 million), according to company filings sourced through Tofler. Keep reading

🇸🇦 Orange Middle East and Africa and Mastercard partner to digitize payments for millions across Africa by 2025. This collaboration, one of the largest in the region, will enable millions of Orange Money users to access digital payments via Mastercard’s global network by 2025, starting in seven countries.

🇨🇦 Tappy launches payments and fitness ring. The ring can be tokenized with users' debit, credit, and prepaid cards. It has been designed for fitness enthusiasts and tech-savvy consumers, providing an alternative to traditional trackers.

DIGITAL BANKING NEWS

🇬🇧 Visa and ClearBank form real-time payments partnership. By leveraging ClearBank’s cloud-native banking infrastructure, Visa aims to benefit from real-time payment processing, improved transaction visibility, and streamlined reconciliation. Read more

🇬🇧 Afin Bank partners with Thought Machine to launch a New Digital Bank for Africans in the UK. Afin Bank’s services will include savings accounts, residential mortgages, and buy-to-let (BTL) mortgages for Africans in the UK, as well as BTL mortgages for those abroad looking to invest in UK property.

🇺🇸 Citi and Google Cloud announce strategic agreement to modernize Citi’s technology infrastructure and drive innovation. Through the collaboration, Citi will migrate multiple workloads and applications to Google Cloud's secure and scalable infrastructure.

🇺🇸 SoFi CEO pushes back on bearish speculation about capital raise. The company shares fell despite a profit forecast and third-quarter earnings beat, unable to sustain a 40% rally over the past month. CEO Anthony Noto stated, “I think we’re seeing some of that being taken off the table,” in an interview on Bloomberg TV Tuesday.

🇺🇸 JPMorgan begins suing customers who allegedly stole thousands of dollars in ‘infinite money glitch.’ The bank on Monday filed lawsuits in at least three federal courts, taking aim at some of the people who withdrew the highest amounts in the so-called infinite money glitch that went viral on TikTok and other social media platforms in late August.

🇩🇪 Paysafe partners with Deutsche Bank to provide private customers with easy access to cash services. Paysafecash (branded "viacash" in Germany) will allow banking customers in Germany to deposit and withdraw cash from their accounts. The service starts with Postbank in November with plans to expand to Deutsche Bank in late 2025.

🇪🇸 Santander CEO says more than 1,400 UK bank jobs are being cut. CEO Hector Grisi confirmed a reduction of 1,425 positions but did not provide a timeline for the previously announced layoffs. This redundancy plan reflects the global shift towards online banking and heightened competition in Britain's mortgage market.

BLOCKCHAIN/CRYPTO NEWS

Binance unveils 'Binance Wealth' for elite customers. The service allows private client managers to onboard high-net-worth individuals to the exchange with ease, offering a wide range of digital assets. Initially, the focus will be on Asia and Latin America, Binance said.

🇭🇰 Hong Kong’s ZA Bank begins sandbox pilot of crypto trading service. The Bank said that its trial initiative seeks to meet growing demand in Hong Kong, where a recent survey by the Hong Kong Investment Funds Association revealed that 75% of retail investors are interested in trading crypto.

DONEDEAL FUNDING NEWS

🦄 Moniepoint gets $1 billion valuation in new funding round led by DPI. The new financing round will almost triple the company’s valuation, which was around $400 million in a 2022 funding round in which it raised $50 million. That post-money valuation means Moniepoint, founded in 2015, will become the continent’s eighth unicorn.

🇮🇩 Finfra raises US$2.5M, partners with Tyme for embedded lending in Indonesia. The investment will help Finfra scale its embedded lending solutions to support the country's digital SME ecosystem. Through the partnership, Tyme will use Finfra’s tools to launch embedded lending options, such as merchant cash advances, across Indonesia.

M&A

🇨🇦 PSP Services Inc. announces agreement to acquire the NCR Atleos debit card Production and Transaction Processing Business in Canada. The company views this acquisition as strengthening its leadership in the Canadian FinTech industry and enabling credit unions and financial institutions using the acquired assets to access new payment solutions.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()