Nubank surpasses 100 million customers 🤯

Hey FinTech Fanatic!

Nubank announced that it has surpassed 100 million customers in Brazil, Mexico, and Colombia, making it the first digital banking platform to reach this milestone outside of Asia.

The achievement comes on the heels of record 2023 financial results, with over US$1 billion in net profit and over US$8 billion in revenues, which attest to the solidity, efficiency, and scalability of Nubank’s business model.

Currently, Nubank serves more than 92 million customers in Brazil, over 7 million in Mexico, and close to 1 million in Colombia, with record satisfaction levels.

Also, combined Brazilian Banking App downloads almost reached 𝟭𝗯𝗻 (❗️) from 2017 - March 2024, according to FinTech Global:

Combined Brazilian banking app downloads reached a total of 860m since January 2017 with incumbent banks having a slight edge over challengers with 441m installs, a 51% share.

Neobanks saw a total of 418m, a 49% share over the same period. Incumbent banks saw a 16% increase in downloads from March 2023 – March 2024 whilst neobanks saw a 26% increase over the same period.

Based on this it is likely that neobanks will outpace incumbent banks’ total downloads mid-way through 2025.

These numbers are really impressive and together with the recent positive news around Monzo, Dave, Moneylion, and several other digital banking apps around the globe, it's clear that Neobanks are NOT dead.

I'm heading to Lombok to catch some waves 🏄🏻♂️ Hope you have a fantastic weekend as well!

Cheers,

#FINTECHREPORT

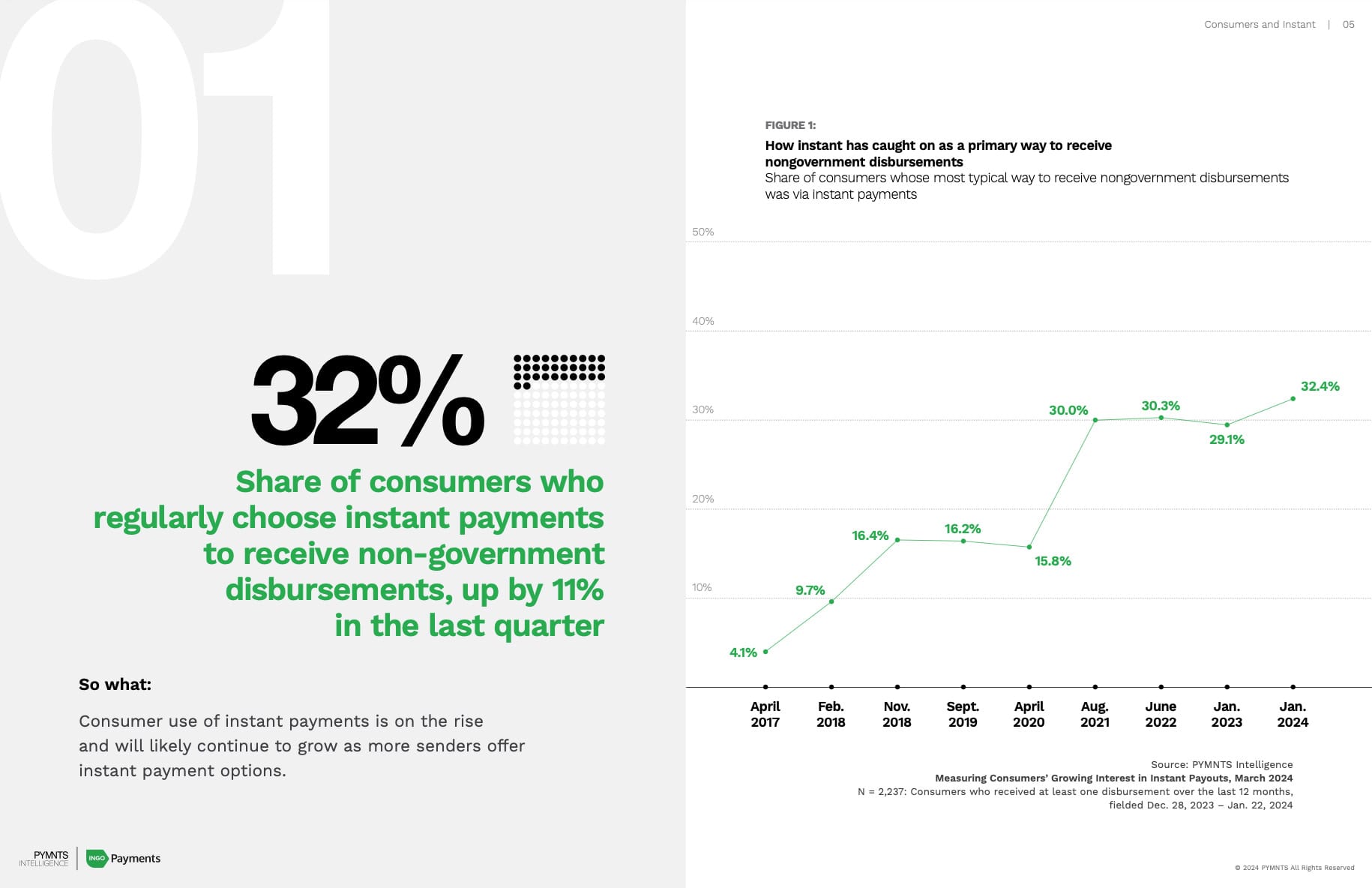

📊 I highly recommend downloading this FinTech report by Ingo Payments to find 12 charts that tell the story of Instant Payments: Click here to download

📈 By 2027 wallets are projected to account for more than $𝟮𝟱 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻 in global transaction value (49%) across e-commerce (the fastest growing e-commerce payment method) and POS. Download the complete report by Worldpay for more interesting info and stats.

INSIGHTS

💵 In LatAm, Bolivia and Ecuador continue to rely heavily on cash, while Chile and Brazil lead in digital payments. Around 27% of people aged 15+ in the region are excluded from formal financial services, compared to 3% in high-income nations. Despite digital payment growth, significant cash remains in circulation. In Bolivia, only 22% of adults use digital payments.

FINTECH NEWS

🇵🇭 Thunes, a global money movement innovator, has joined forces with Pomelo, a pioneering credit-powered remittance company and credit card issuer, to introduce a groundbreaking international money transfer solution from the US to the Philippines. This strategic partnership transforms the way remittances are handled via Thunes’ digital wallet integration, reducing costs and connecting families in new ways.

🇮🇳 Google has launched the Google Wallet app for Android users in India, partnering with a slew of ecommerce and ticketing partners, and FinTech players such as Flipkart and Pine Labs. It must be noted that Google Wallet is a separate product from Google Pay in India, whereas it’s offered with payments features in other markets.

🇺🇸 Startup neobank Mercury is taking on Brex and Ramp with new bill pay, spend management software. Mercury is layering software onto its bank accounts, giving its business customers the ability to pay bills, invoice customers and reimburse employees, the company has told TechCrunch exclusively.

🇨🇴 Anzi, based in Madrid and Bogotá, marks a milestone in the financial world by introducing its innovative solution of tokenized guarantees specifically designed for FinTechs focused on the SME segment. This pioneering solution aims to mitigate lenders' credit risk, improve cash flow predictability, and enhance global access to financing for micro, small, and medium-sized enterprises.

🇮🇳 Ebanx partners YES Bank. YES Bank, a private sector bank in India, and Ebanx, a global FinTech company specialized in payment solutions for emerging markets, announced a strategic partnership for payment processing in India, for the global digital economy. Read more

🇺🇸 FinTech lender Upstart Holdings Inc. has been subpoenaed by Wall Street’s main regulator about disclosures, including its artificial intelligence models and loans, the company said Wednesday. Upstart said it is cooperating with the SEC after having received the subpoena on Nov. 17. The company is “unable to predict the outcome of this matter,” they said in a securities filing.

🇧🇷 Brazilian FinTech accounts surge 77%, surpassing population count. A Zetta survey reveals Brazilian FinTechs now manage over 251 million individual accounts, driven by diverse consumer benefits. The growth reflects consumers opening accounts with multiple FinTechs to access discounts and early event access.

PAYMENTS NEWS

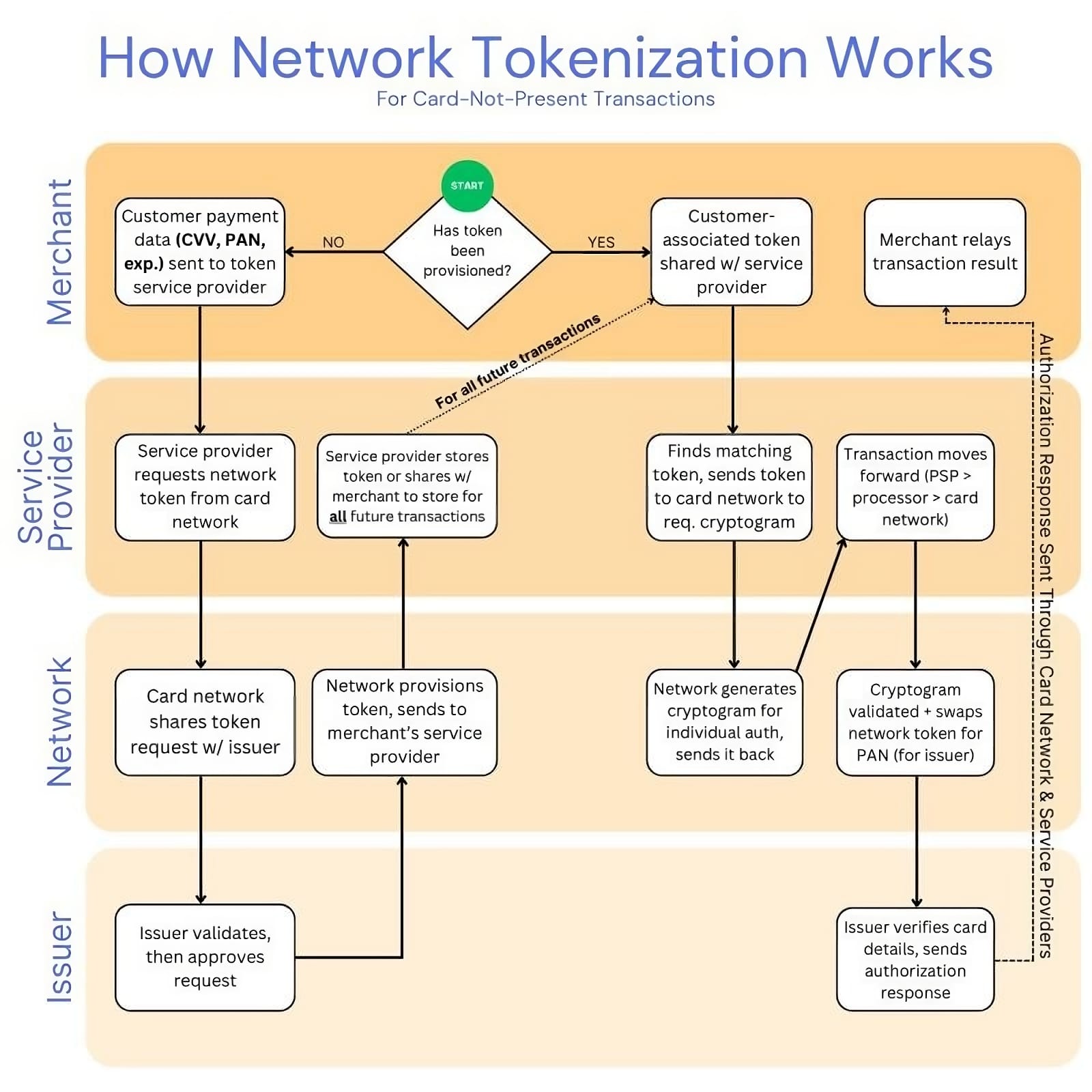

Here is how Network Tokenization works for Card Not Present Transactions👇

🇬🇧 Checkout.com, a leading global digital payments provider, launched its latest product designed for global enterprises: Flow is a clever bit of code that helps you boost conversions, stay compliant, and enter new markets fast. Click here to learn more

🇮🇹 Rome offers open loop transit payments to UnionPay cardholders. Boarding public transport and paying the fare by simply tapping with a contactless payment card or mobile phone on turnstiles or authorized readers: Rome is the first city in Europe to offer this contactless payment service to cardmembers from international schemes UnionPay.

🇺🇸 Fractal, a new FinTech platform exclusively servicing SaaS companies, announces the launch of the most efficient payment processing services in the U.S. Founded by industry veterans, Fractal is taking household names in the payments industry head-on by offering simpler service with up to 30% savings.

🇦🇪 Nium partners with Emirates NBD, a banking group in the MENAT region, to provide customers with a global payments solution. The partnership seeks to elevate the remittance experience with seamless, instantaneous cross-border transfers between the UAE and countries worldwide.

🇺🇸 A 47% increase in Same Day ACH volume helped lead the way as the ACH Network began 2024 by handling 8.2 billion payments in the first quarter. There were 273.7 million Same Day ACH payments in the first quarter. The value of those payments was $719 billion, up 27.2% from a year earlier.

DIGITAL BANKING NEWS

🇮🇹 Revolut has become the most downloaded financial app in Italy, surpassing local players like PostePay and Intesa Sanpaolo. They have acquired more than 300,000 customers (post-KYC) in the first four months of the year. This is an increase of +85% annually for the same period.

🇺🇸 When Revolut needed a new bank after Metropolitan cut off its FinTech customers, it found CFSB, a tiny bank whose only branch sits beneath an elevated subway line an hour’s ride from Manhattan, squeezed between a shuttered Rite Aid and a children’s events space that moonlights as a venue for $10 adult Zumba dance classes. A plastic banner fastened to the shop front bears the lender’s name: Community Federal Savings Bank.

🇺🇸 Grasshopper Bank begins rollout of SBA lending strategy. The New York-based digital bank launched its digital application for Small Business Administration (SBA) loans in April with more to come. Explore the full article here

🇬🇧 Pockit releases credit builder product. Pockit, the UK FinTech providing vital financial services to people whose needs aren’t met by the traditional banking system, announces the official launch of its ‘Fast Track to Credit’ product.

The AI market gears up for exponential growth from $244 billion in 2025 to $827 billion by 2030. More on that here

🇬🇧 Ecology Building Society to adopt Monument Bank's core banking platform. Having signed Heads Of Terms, following an extensive selection process, the two parties expect the building society to adopt Monument’s banking platform next year, subject to contract and regulatory approval.

DONEDEAL FUNDING NEWS

🇲🇽 FinTech platform Plata Card secures $100M credit line to enhance personal finance services accessibility in Mexico. The credit was granted by Fasanara Capital Ltd., a global asset manager with approximately USD 4 billion in assets under management and a market leader in the FinTech lending space.

M&A

🇿🇦 Lesaka Technologies is buying payments platform Adumo for R1.6-billion in cash and shares, pending approvals. The cash component of the deal amounts to some R232-million, funding by internal cash resources and external financing. Continue reading

🇺🇸 Corporate payments company Corpay is set to buy account payable automation outfit Paymerang. Financial terms have not been disclosed. The deal, set to close in Q2, also expands Corpay's presence in education, healthcare, hospitality and manufacturing.

🇫🇷 Gallant Capital Partners has acquired payments consultancy and testing specialist Fime as well as the UL Solutions payments testing business and merged the two. Gallant says that operating under the Fime brand, the combined business will be a global leader in payments, smart mobility and digital identity.

MOVERS & SHAKERS

🇬🇧 Thredd announces the expansion of its product and delivery teams with four recent senior appointments: Amit Bhargava as Global Head of Issuer Solutions, Ryan Dew as Global Head of Product Solutions, Cindy Custers assumes the newly created role of VP Network Partnerships & Money Movement, and Yash Piplani, appointed as Head of Technical Product Management. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()