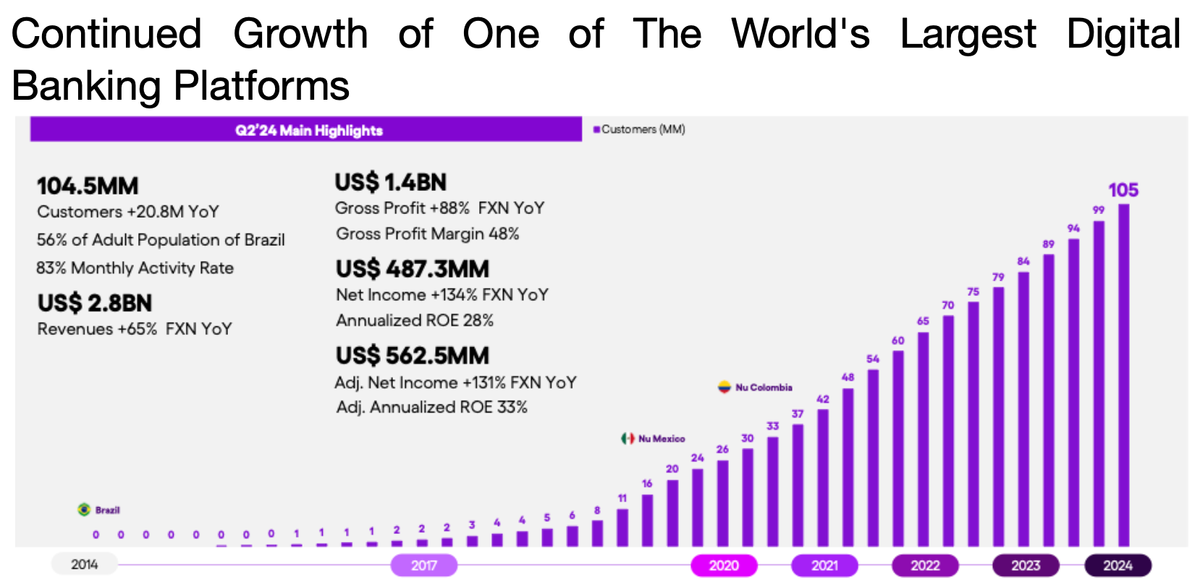

Nubank Hits 105M Customers and Doubles Income in Q2 2024

Hey FinTech Fanatic!

Nubank has once again delivered outstanding results in Q2 2024, reinforcing its position as a leading global digital financial platform.

The company reached an impressive milestone of 105 million customers by June 30, 2024, adding 5.2 million new users in the quarter alone.

This represents a 25% year-over-year increase, surpassing the customer growth of the top five Brazilian banks combined 🤯

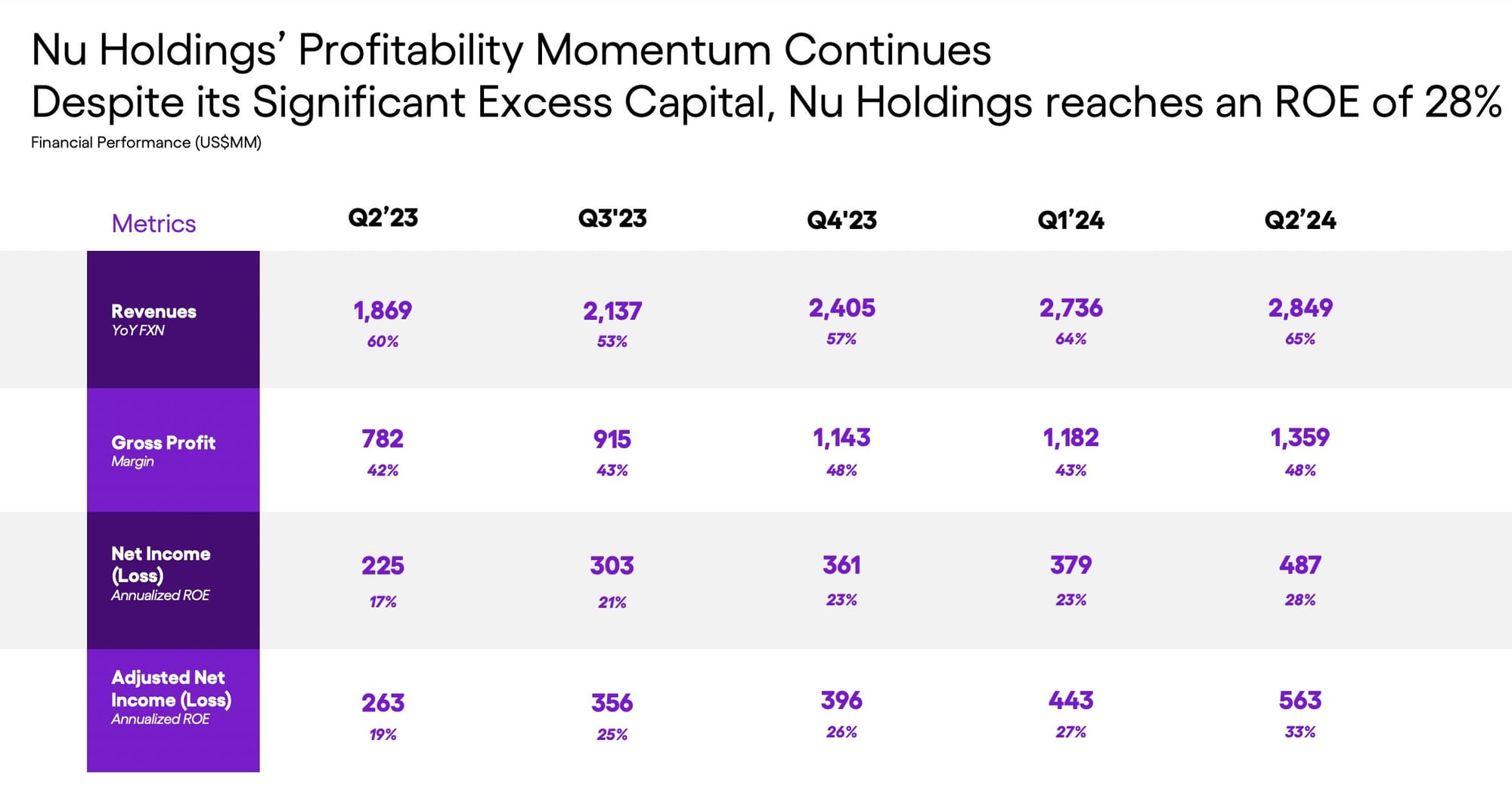

Efficiency and Profitability at New Heights

Nubank’s efficiency ratio improved to 32%, making it one of the most efficient financial services companies globally. The company reported a net income of $487 million, with an adjusted net income of $563 million, achieving an annualized ROE of 28% and 33%, respectively.

This was accomplished while maintaining $2.4 billion in excess capital and continuing to invest in growth and innovation.

Record-Breaking Revenue and Gross Profit

Nubank's revenue soared 65% YoY to $2.8 billion, with gross profit up 88% to $1.4 billion, reflecting a 48% gross profit margin.

Net interest income surged 77% to $1.7 billion, driven by the expansion of credit card and lending portfolios, with the net interest margin improving to 19.8%.

Dominance in Brazil and International Expansion

In Brazil, Nubank’s customer base reached 95.5 million, making it the fourth-largest financial institution by customer count.

Internationally, Nubank continued to expand, with 7.8 million customers in Mexico and nearly 1.3 million in Colombia by the end of Q2 2024.

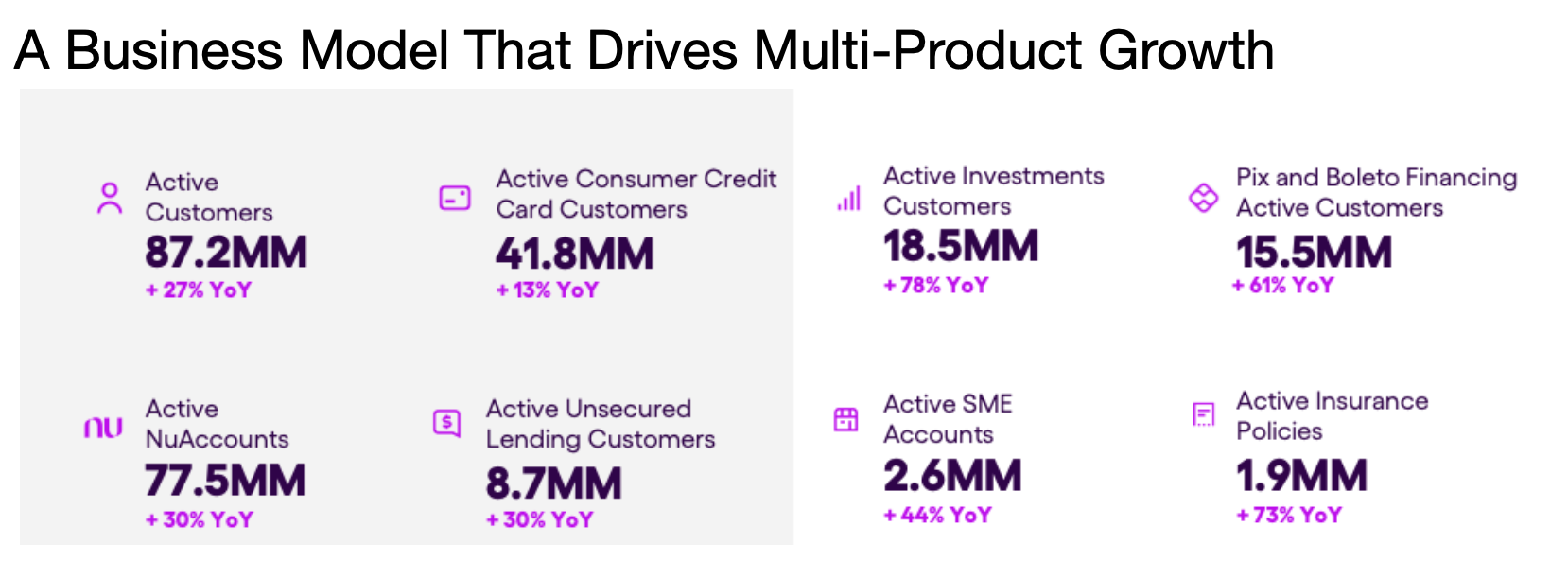

Multi-Product Platform Success

Nubank’s core products saw substantial engagement, with 42 million credit card users, 78 million NuAccount users, and 9 million active personal loan customers.

Its insurance and investment products also gained traction, with nearly 2 million active insurance policies and over 18 million investment users.

Conclusion: A Stellar Quarter

Nubank's Q2 2024 results showcase its exceptional growth, efficiency, and profitability. As the company continues to expand its global footprint, its trajectory points to even more significant achievements ahead.

Nubank is not just leading in digital banking; it’s redefining the financial services landscape.

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

BREAKING NEWS

🚨 Apple opens up NFC transactions to developers, but says there will be ‘associated fees.’ Amid growing regulatory scrutiny, Apple has announced plans to open its NFC (Near Field Communication) capabilities to third-party developers, a move that marks a significant shift in the tech giant's approach to mobile payments.

#FINTECHREPORT

📊 In FinTech, a paradigm shift is emerging that transforms the traditional Buy Now Pay Later (BNPL) model into a more sustainable and financially empowering approach known as Save Now Buy Later (SNBL). Read all about it in this #fintechreport by AGPAYTECH LTD.

FINTECH NEWS

🇭🇰 Hong Kong launches generative AI Sandbox for finance sector. Hong Kong GenAI sandbox is a platform to test AI’s potential applications in finance, including risk management, anti-fraud, customer services and process re-engineering.

PAYMENTS NEWS

🇮🇪 PTSB, a full-service bank headquartered in Dublin, Ireland, has expanded its relationship with merchant acquirer Worldpay to extend a suite of additional merchant services to its commercial customers. The expanded partnership will provide PTSB with access to additional Worldpay solutions.

🇬🇧 Cardstream partners with PayPoint. The partnership sees PayPoint integrating Cardstream’s Gateway Connectivity into their MultiPay digital payments platform, which will allow it to continue to build a robust and scalable solution for clients.

🇳🇴 IDEX Biometrics and TaluCard bring inclusive biometric payment solutions to market in Europe. This initiative is set to transform payment solutions with a strong focus on accessibility and security for all users, including those with visual impairments and members of the aging community.

🇸🇬 New NETS Solution turns Android Phones into payment terminals, offering a more cost-effective and flexible payment option. With the NETS SoftPOS app, available on the Google Play Store, merchants can accept payments via cards, QR codes, and mobile payment methods.

🇺🇸 Tekmetric and Affirm enable auto repair payments in installments. Auto repair shops that use Tekmetric’s platform can add Affirm as a payment option with a few clicks, according to a press release. Read the full piece

OPEN BANKING NEWS

🇺🇸 Mastercard debuts enhancements to open banking program. The new features, recently announced, lets Mastercard offer income and employment coverage to the estimated 95% of the U.S. workforce who are paid through direct deposit.

🇦🇺 Adatree unveils Australia’s first CDR-powered account verification, to tackle fraud and streamline operations. The product is set to make a significant impact in Australia, especially in the fight against financial fraud and scams. Read on

🇬🇧 Finance app Cheddar unveils spending tracker tool. Users of Cheddar will be able to allocate funds to upcoming purchases with a “prepaid format” that aims to help individuals maintain budgets and track their spending.

🇨🇴 Credibanco and Sensedia have launched a solution that consolidates all the information from various participants in the financial industry into a single platform, enabling swift and secure data exchange. Explore the full article

🇬🇧 Abound partners with D•One for open banking services. Abound will take open banking data for prospective borrowers from D•One so that it can use that data to assess affordability for ClearScore users as soon as they search for a loan.

🇷🇸 Serbia amends payment services regulations to allow open banking services. The Serbian Parliament has approved the amendments to the Payment Services Act (“PSA“) which are meant to mirror PSD2 and introduce open banking driven services to Serbian market. The amendments will begin to apply from 6 May 2025.

DIGITAL BANKING NEWS

🇪🇺 Banks face tough new security standards in the EU — their tech suppliers are under scrutiny, too. By January 2025, banks and their technology suppliers will have to comply with a new EU law known as DORA. It could help prevent major IT disruptions in future.

🇬🇧 UK start-up Sync Savings to make market debut next month. The UK-founded start-up aims to provide banks, building societies and credit unions with a solution to embed their savings accounts into untapped third-party channels. More here

🇬🇧 HSBC UK follows Nationwide and Lloyds as they join forces with OPDA for a more streamlined mortgage process. HSBC has joined the Open Property Data Association in a bid to improve the homebuying process for customers through data sharing after two of it’s competitors signed with the trade association earlier this year.

BLOCKCHAIN/CRYPTO NEWS

🇪🇺 MetaMask, Mastercard, and Baanx (Crypto Life) have launched the pilot of MetaMask Card. Eligible users can now make everyday purchases with their crypto anywhere Mastercard is accepted. This pilot is available to a limited group of users in the EU and UK only.

🇫🇷 Ledger announced that Revolut will join Ledger Live as a buy provider. This collaboration aims to further our mission of complete self-custody for people’s financial assets and make buying crypto easier and more accessible than ever.

🇸🇬 DBS tokenizes treasury management for Ant International. Singapore's DBS is collaborating with Ant International on a blockchain-based tokenization project for 24/7 intra-group treasury and liquidity management. Read on

🇦🇺 Easy Crypto launches new Australian 'beginner wallet' aimed at first-time crypto investors. The Easy Crypto Wallet has been designed to deliver the simplest and the safest experience for anyone looking to manage their own cryptocurrency.

DONEDEAL FUNDING NEWS

🇬🇧 Sling Money raises $15 million series A to transform global payments. With Sling Money, users can easily send money instantly across 50+ countries across Europe and Africa to other users, between their own accounts, or even to non-Sling users with a Sling Link.

🇸🇬 Singaporean investment app Syfe pulls in $27M to hasten growth in Asia Pacific. “This funding will enable us to reach more customers and help them grow their wealth for a better future,” Syfe CEO and founder Dhruv Arora said.

🇮🇳 Vayana raises $20 million in funding round led by SMBC Asia. Trade finance platform Vayana has raised $20.5 million from investors led by Sumitomo Mitsui Banking Corporation (SMBC) Asia Rising Fund to fuel its plan to introduce new products.

🇺🇸 Setpoint announced a $31 Million Series B funding round. This funding allows Setpoint to continue to double down on areas of impact: leveraging machine learning and large language models (LLMs) to enhance the verification of asset data and calculations, driving further innovation in the credit infrastructure space.

🇺🇸 Kiavi announced it closed a $400 million rated securitization of residential transition loans (“RTLs”). Due to significant interest from a broad set of institutional investors, including several first-time investors, the transaction was upsized by $100 million and oversubscribed by multiple times.

🇩🇪 Fulfin receives a bolt-on investment of €6.6 million. The provider of B2B financing solutions for online SMBs, has secured a total of 6.6 million euros with two capital raises in December 2023 and July 2024. Read the full piece

🇨🇿 Czech company Patron GO has raised a total of 25 million CZK (approx 1 Million euros) in its fourth investment round, with a significant portion coming from the Slovak fund Venture to Future Fund. The startup plans to expand into Poland and grow its team by 50 new members.

M&A

🇺🇸 Experian, a global data and technology company, acquired NeuroID, a company which specializes in behavioral analytics. The combined offerings deliver behavioral analytics with Experian’s extensive fraud detection capabilities to combat AI-enabled fraud.

🇦🇺 Cloudfloat announces the strategic acquisition of Incomee. The acquisition aligns with Cloudfloat’s ongoing mission to enhance and simplify financial management for businesses, positioning the company to deliver a more comprehensive suite of financial solutions to its business customers.

MOVERS & SHAKERS

🇧🇷 Nathan Marion, formerly with Yuno, joins Nubank to strengthen B2B business. The goal is to enhance Nubank's presence in the B2B market, particularly in payment and e-commerce products, according to the executive. Continue reading

🇺🇸 Corrie DeCamp joins Billtrust as chief product officer. DeCamp has over 30 years of experience managing enterprise solutions and will lead Billtrust’s product strategy and vision. She will report to Chief Technology Officer Joe Eng.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()