Nubank and Burger King Team Up for a Fresh Take on Branding

Hey FinTech Fanatic!

In an innovative retail partnership, Nubank has completely transformed Burger King's flagship restaurant, bringing its distinctive purple branding to every corner of the space. According to Juliana Roschel, the digital bank has reimagined everything from the inside and out, from the storefront to the self-service kiosks.

The partnership introduces exclusive perks for Nubank customers, including a special "Nu coffee" provided with all menu purchases. Diners who pay with their Nubank physical cards can also enjoy complimentary fries or unlimited soda when ordering two sandwiches.

This retail collaboration showcases how the digital bank is creating new ways to connect with customers beyond traditional financial services.

Now that's what I call creative branding 👌

And speaking of creativity in FinTech, how do you feel about running and networking?

Last year, I promised to organize pop-up runs with the FinTech Running Club, and we’re making it happen! I’m also joining some of them myself—last week in Amsterdam was a perfect example: flat roads, great company, and just the right amount of post-run FinTech talk.

Now, I’m gearing up for San Francisco next Monday—a city that, unlike Amsterdam, comes with a few more ups and downs (literally). If you’re up for the challenge, I’d love to see you there!

Expect great company, a solid run, and the chance to connect with amazing people while keeping the FinTech community moving

Sign up here and get all the details here. See you there! 🌉👟

Cheers,

Subscribe to my Spanish Daily FinTech Newsletter for daily updates and analysis on the evolving world of financial technology—entirely in Spanish. Join now and stay in the loop!

POST OF THE DAY

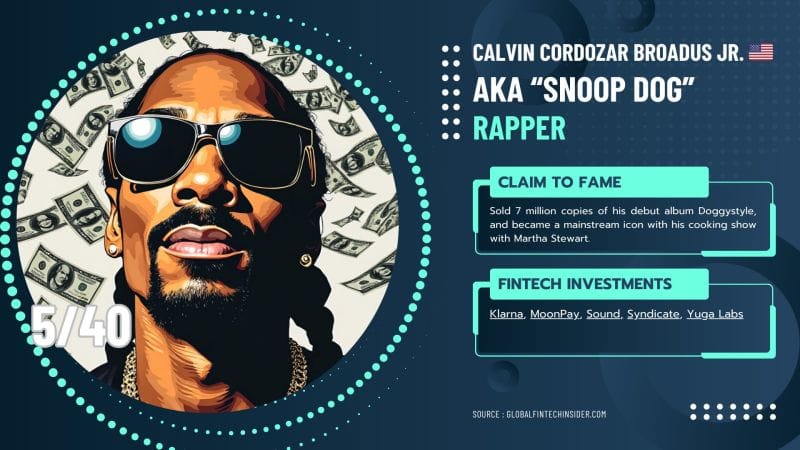

FinTech has become the it spot for celebrities to invest their cash and clout. From legendary NBA MVPs to chart-topping rappers. Here is my personal favorite celebrity from the 𝗧𝗼𝗽 𝟰𝟬 𝗖𝗲𝗹𝗲𝗯𝗿𝗶𝘁𝘆 𝗙𝗶𝗻𝗧𝗲𝗰𝗵 𝗜𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀:

Snoop Dogg (nr. 5 on the list)👇

BREAKING NEWS

➡️ Stripe merchant of record is coming - According to JR Farr: "The wait is almost over. The next iteration with Stripe is coming." Read more

INSIGHTS

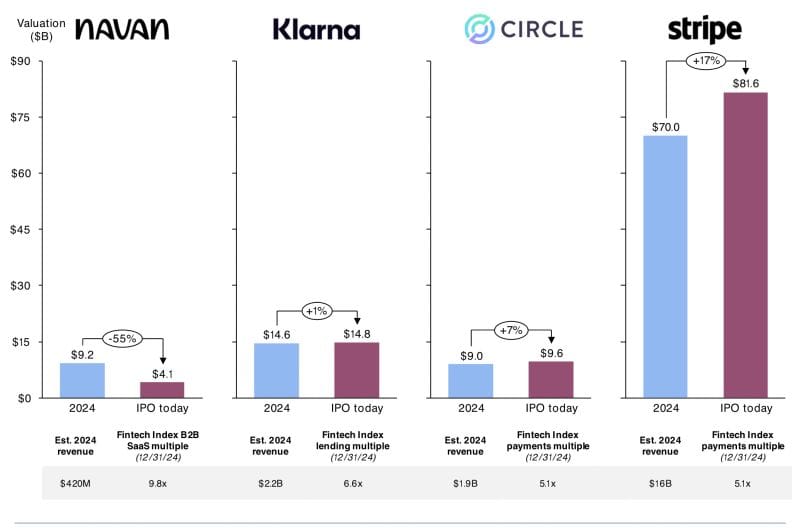

📰 What kind of valuation might this year’s IPO candidates reach in the public markets if they were to go public based on 2024 year-end revenue estimates?

FINTECH NEWS

🇺🇸 FinTech Stash gets a boost from its AI assistant. Stash’s Money Coach, an AI-powered financial advising tool, has seen a favorable impact on its financials, with the company seeing deposits surpass its withdrawals. Every month, Stash helps 1.3 million subscribers and has nearly $4.3 billion in assets under management.

🇦🇪 ADX-listed stocks now available on eToro. eToro’s users can now invest in over 30 companies listed on ADX. The launch follows an agreement signed last year between ADX and eToro, aimed at broadening investor access to the UAE’s stock market.

🇬🇧 eToro introduces AI-powered daily audio recap My Market Minutes. My Market Minutes is a personalized, AI-powered daily audio recap of one’s portfolio performance and latest market movements. The advantages of the service include: Quick & Convenient, Tailored to You, Listen Anywhere, and Easy Access.

🇩🇪 N26 Metal customers will benefit from interest rates directly linked to the ECB rate. This will be valid only for new N26 Metal customers who joined N26 starting on February 19. For existing customers, N26 Instant Savings account interest rates are based on your main N26 plan, for both personal and business accounts.

🇬🇧 Crowdcube has reportedly returned to growth in 2024. Crowdcube’s financials for FY2024 revealed: £10.1m of annual revenue (+33% YoY), profitable for the entire second half of 2024, delivered just under £1m EBITDA in the fourth quarter.

🇧🇷 Nubank took over Burger King’s flagship store with its signature purple—inside and out, from the storefront to the self-service kiosks. There’s even Nu coffee. As part of this exclusive partnership, the store’s interior, exterior, and self-service kiosks are fully customized with Nubank’s branding.

PAYMENTS NEWS

🇺🇸 Athia, DEUNA’s Aware AI, Presents Payment Optimization: Maximizing Bottom-Line Impact in Real Time. The unified platform to simplify global payments & power next-gen commerce, presents a feature that optimizes merchants' payment strategy in real time by enabling merchants to optimize payment acceptance with dynamic routing, supporting region-specific payment methods for higher conversion, and implementing adaptive fraud prevention.

"The complexity of global payment systems requires a smarter, more adaptive approach," said Matias Rodriguez, General Manager and Global VP of Sales at DEUNA. "With Athia, we are enabling merchants to optimize their payment strategies in real-time, ensuring transactions are routed efficiently, fraud is proactively mitigated, and revenue potential is maximized."

🇧🇪 ING Belgium and Mastercard introduce 'Click to Pay'. The new payment solution allows online shoppers to use their payment cards without the need to manually enter their 16-digit card number or remember passwords. Read more

🇨🇳 Adyen and Eats365 partner to streamline payment solutions for F&B businesses. This collaboration will simplify operations for Eats365 merchants and users throughout the supported regions. It will also introduce a consolidated financial reporting system for F&B establishments.

🇵🇹 Eupago has seen an impressive growth of 2000%, just 2 months after giving access to the Bizum platform in Portugal. Currently, 75% of Eupago's transactions via Bizum come from Portuguese merchants. This success boosts Bizum's popularity and solidifies its role as a key payment method.

🇹🇼 Thunes expands real-time payments network to Taiwan. This expansion provides a real-time alternative to traditional cross-border transfers. It also strengthens Thunes‘ global network by establishing direct connections with banks, enabling faster and efficient transactions.

🇺🇸 Remitly reports fourth quarter and full year 2024 results. “We delivered an exceptional fourth quarter and full year, exceeding expectations, as our product strength and customer loyalty drove durable growth and improving profitability,” said Matt Oppenheimer, co-founder and CEO, Remitly.

🇺🇸 Affirm and Shopify have announced an expanded global agreement. The renewed multi-year partnership cements Affirm’s position as the exclusive pay-over-time provider for Shop Pay Installments. It also extends this exclusivity into Shopify’s home market of Canada and enables the partnership to continue growing into new markets worldwide.

DIGITAL BANKING NEWS

🇦🇺 Zeller targets startups with new digital banking solution. The new service addresses the need to juggle multiple financial platforms alongside their primary bank account, a common frustration among Australian tech companies. A key feature lets founders create accounts for projects or expansions.

🇬🇧 Revolut sticks with hybrid working and bucking London’s office push. CEO Nik Storonsky offered a preview of how the new office will look. The firm announced last year it would be moving into four floors in the YY London building in May, a move that will increase its office footprint by 40% to 113,000 square feet.

🇲🇽 Banco Santander announces over $2 billion investment in Mexico in three years. The company's Executive Chair Ana Botin made the announcement during an event in Mexico's capital detailing that the amount will be designated to Openbank, Santander Bank itself, and other items.

🇬🇧 Flowbank bankruptcy will see just 70%-80% refund to third class claims. The neobank has issued an update to former clients and creditors of the company, providing more insight and data from its efforts to return client and creditor funds and deal with some of Flowbank’s assets.

BLOCKCHAIN/CRYPTO NEWS

🇦🇹 KuCoin EU files MiCAR application in Austria to ensure compliant EEA operations. The MiCAR license will enable KuCoin EU to serve its customers across all 30 EU and EEA member countries, ensuring consistent access to crypto products and services under a robust regulatory framework.

🇺🇸 Binance.US restores USD deposits. The platform has reintroduced the ability for customers to deposit and withdraw U.S. dollars using ACH bank transfers, following a suspension that lasted nearly two years due to legal action from Gary Gensler's SEC.

🇺🇸 Crypto exchange Deribit still in talks to be acquired by Kraken. The firm could be valued at $4 billion- $5 billion or even more. Deribit is an appealing takeover target because it’s the overwhelming market-leading exchange for digital asset options trading, which Kraken would be looking to add to its trading offering.

🇺🇸 Crypto custody firms BitGo and Copper deliver off-exchange settlement for Deribit. Clients of BitGo and Copper can now trade spot and derivatives on Deribit while assets are secured off-exchange in qualified custody with BitGo Trust, and automatically settled leveraging Copper ClearLoop and the Go Network.

🇺🇸 Google to integrate Bitcoin into its ecosystem via Bitcoin wallet. The plan includes embedding Bitcoin wallets directly into Google accounts, allowing users to access them as seamlessly as any other Google service. The company is also working on making crypto payments as intuitive as existing Web2 payment methods.

🇨🇭 Swiss-regulated Sygnum Bank weighs in on mainstream enthusiasm for crypto ETFs. Max Stuedlein, head of strategic digital asset solutions at Sygnum Bank, commented that ETFs carried limitations that are already staples of traditional financial assets.

🇨🇿 Czech crypto firms to gain banking access under fresh legislation. The Czech National Bank (CNB) has expressed openness to adding Bitcoin to its foreign reserves. The legislation aims to simplify tax rules and aligns with the European Union’s Markets in Crypto-Assets (MiCA) regulations.

PARTNERSHIPS

🇩🇪 Klarna partners with FINN to bring flexible payments to the booming €8.5bn car subscription market. FINN’s German customers can now pay their monthly car subscription fee using Klarna’s innovative “monthly invoice” product and can use Klarna’s payment methods to settle the final invoice when they return the cars.

DONEDEAL FUNDING NEWS

🇳🇬 Kuda Group grew revenue to $32.1 million in 2023 as total losses jumped to $40 million. The bank raised an undisclosed equity round in 2024, securing additional capital after its operational costs spiked losses and led to a decline in cash reserves. These losses were primarily due to increased staffing and operational costs, including $8 million in salaries for 456 employees.

🇬🇧 Capital on tap secures £750 million in Landmark funding facilities to accelerate small business growth. The company has established a £550 million Master Trust facility with BNP Paribas and Citi. This innovative structure will significantly enhance the company’s ability to scale operations and support small business customers.

🇦🇪 Tether leads $10m funding round for cross-border FinTech provider MANSA. With the funding, MANSA wants to expand its services in Latin America and Southeast Asia, where liquidity issues often slow down cross-border payments, the firm explains.

🇪🇪 Ribbit leads $50 million investment in crypto security platform. Blockaid plans to use the money to fund operational growth as well as for research and development, according to the statement. It aims to more than double its current headcount of 70 this year.

MOVERS AND SHAKERS

🇫🇷 FinTech startup Yendo appoints Thibault Fulconis. Fulconis brings more than three decades of leadership and financial experience to Yendo, which will be used to help the company scale. In his new role, he will oversee all financial operations, including strategic planning, capital markets, and financial reporting.

🇫🇷 Alain Bénichou join Shares Financial Assets' Supervisory Board to accelerate the expansion of its investment solutions. Bénichou's appointment strengthens the team and brings valuable expertise in the development of software solutions for the financial sector.

🇺🇸 Mastercard appoints Janet George as EVP of AI. Her responsibilities include developing and improving AI technologies for enhanced, secure, and personalized payment experiences. She will also play a critical role in shaping the technology, tooling, and infrastructure to support Mastercard’s data scientists and AI talent.

🇩🇰 Saxo Bank appoints Christian Gronning as new Global Head of Communications. In this role, Christian will direct PR and Communication efforts across all regions. He has also served as a strategic advisor to several of Scandinavia’s largest financial services companies.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()