Nu México Teams Up with OXXO to Expand Cash Access for 9M Customers

Hey FinTech Fanatic!

Nu México has partnered with retail chain OXXO to expand its cash deposit and withdrawal network, giving its 9 million customers access to over 22,000 OXXO stores nationwide. Cash withdrawals using Nu cards will launch on January 14, 2025, with deposit capabilities following in subsequent months.

Ivan Canales, General Director of Nu Mexico emphasizes: "This agreement with OXXO allows us to promote financial inclusion in areas underserved by traditional financial institutions. It strengthens our commitment to making financial services accessible to more Mexicans and marks a significant step towards simplifying access to the financial system in a country where cash remains crucial for millions of people."

The OXXO partnership adds to Nu's existing network, which includes Soriana, Chedraui, Kiosko, Systienda, and Yastás, creating over 30,000 physical touchpoints across Mexico.

More industry news is listed for you below, including a few very interesting crypto updates that I think are worth checking out.

Cheers,

Marcel

Join the FinTech Running Club in your city to connect with top FinTech leaders and have fun! Check out the exciting events happening in the coming weeks!

#FINTECHREPORT

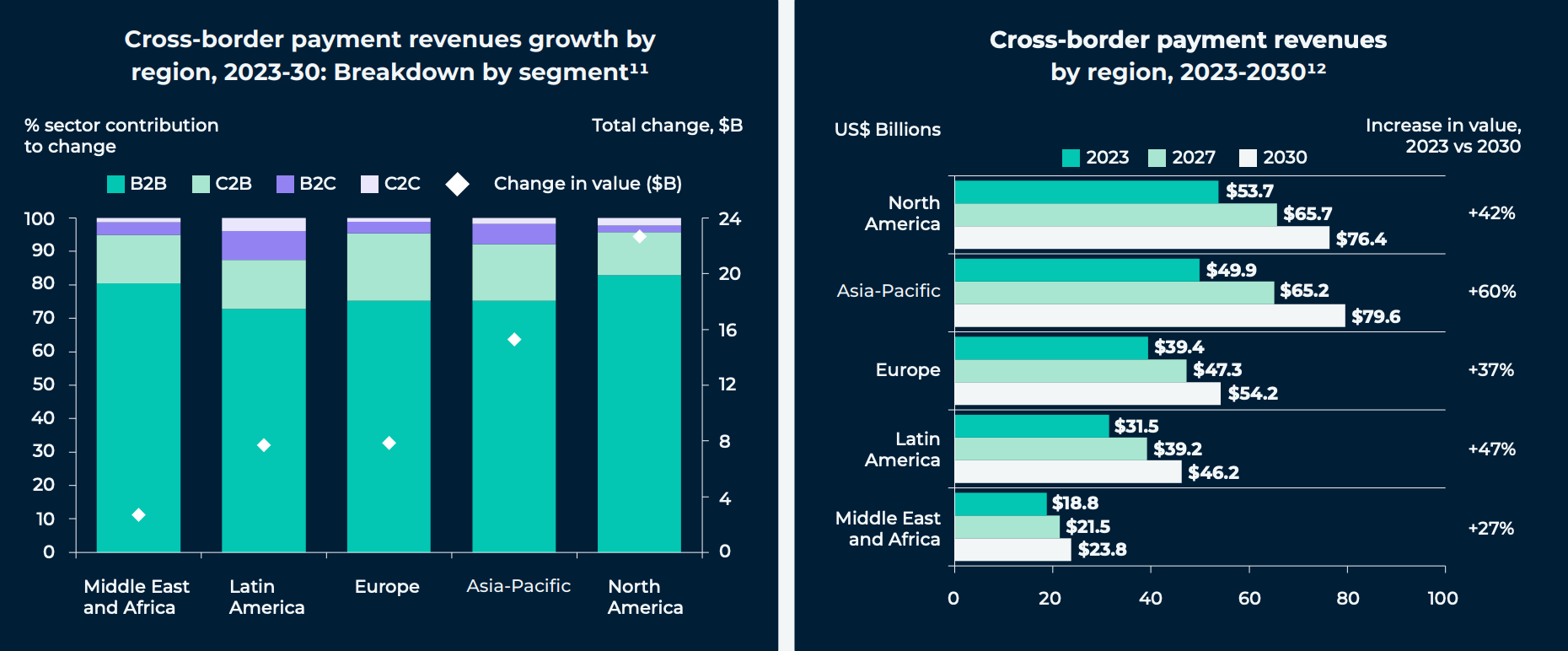

📊 FinTech 2025+ report: Trends, Technology, and Transformation in Global Commerce by Convera.

FINTECH NEWS

🇺🇸 Big US banks set for $31bn quarterly profit as Wall Street business booms. The bumper profit expectations follow a rise in market volatility in the run-up to the November 5 US election. Several big banks, including Citi and JPMorgan, said late last year higher trading activity had boosted their revenues.

🇬🇧 Standard Chartered launches Qatalyst, a due diligence platform for carbon finance markets. Incubated and developed in collaboration with carbon teams from both Engie and Standard Chartered, Qatalyst aims to simplify the identification, due diligence and oversight of carbon abatement projects.

🇮🇳 Groww, India’s biggest trading app, prepares to file for an IPO in the next 10 to 12 months, seeking a valuation between $6 to $8 billion. The startup enables customers to invest in mutual funds and make UPI transactions, shifted its domicile to India from the U.S. last year as part of IPO preparations.

PAYMENTS NEWS

🇬🇭 Mastercard reaffirms commitment to Ghana with new office in Accra. This strategic milestone underscores Mastercard’s commitment to supporting the country's growing digital economy by providing innovative financial products and services tailored to the market.

🇿🇼 Mukuru launches Mukuru Wallet. The wallet has several benefits, including its standout features: two pockets that allow users to send and receive money locally and internationally from mobile phones, safe storage of funds as well as a free cashout on international transfers.

🇺🇸 AIsa unveils payment network for the Trillion-Dollar AI economy. The payment network unlocks vast opportunities across industries, enabling AI agents to pay for resources by the millisecond, access data services with precision, and execute high-frequency trading strategies.

🇺🇸 PXP launches PXP unity. The platform transforms raw real-time transaction data into actionable insights, empowering merchants with intuitive dashboards that present important metrics—such as transaction success rates, payment methods, and scheme performance—offering clear strategic direction.

🇻🇳 TCB Pay launches a new service, ACH payments. TBC Pay’s aim is to offer a payment technology that delivers better flexibility, security and efficiency for businesses managing their own transactions. Besides the new service, TBP Pay also offers real-time analytics and customisable support for its clients.

🇸🇬 Reap gets in-principle approval for Singapore payment license. The approval is a step forward for Reap Singapore, the company’s local entity, as it works toward meeting the conditions required to obtain the full license. Reap intends to allocate necessary resources to support its Singapore operations and strengthen compliance standards.

OPEN BANKING NEWS

🇬🇧 Moneyhub launches savings tool. The company introduced a new API (Application Programming Interface) ‘recipe’ that uses Open Banking to assist users in visualising and reaching their savings objectives, enabling providers to improve their clients’ financial security.

🇬🇧 BR-DGE teams up with TrueLayer. Through the partnership, BR-DGE will add Pay by Bank, which is driven by Open Banking technology, to its suite of payment options. BR-DGE said the partnership recognises the growth in Pay by Bank, particularly in the UK, but also across Europe and further afield.

🇬🇧 Open Banking celebrates seventh anniversary in the UK. The company has transformed the payments and data landscape, powering new ways for consumers and businesses to move, manage and make more of their money. The number of users has shown strong growth over the last seven years.

REGTECH NEWS

🇺🇸 FDIC gives BlackRock new deadline to resolve banking oversight questions. The company had missed a Jan. 10 deadline issued by the Federal Deposit Insurance Corp. (FDIC) and now has until Feb. 10 to resolve an issue related to the firm’s oversight of its banking investments.

DIGITAL BANKING NEWS

🇨🇳 WeLab Bank hit first breakeven in December 2024. The bank recorded a 26% year-on-year increase in net interest income, totaling nearly HK$700 million (around US$89.8 million), and a 50% improvement in net interest margin after the online lending platform WeLend became its wholly owned subsidiary last year.

🇺🇸 nbkc Bank partners with NCR Atleos and Allpoint to expand access to self-service banking. “Our collaboration with Atleos effectively extends our branch network by providing greater access to self-service banking through an expanded ATM network,” said the Chief Deposit and Operations Officer at nbkc bank.

🇲🇽 Nu México signed an agreement with the retail chain OXXO. “This agreement with OXXO allows us to promote financial inclusion in areas underserved by traditional financial institutions. It strengthens our commitment to making financial services accessible,” said the General Director of Nu Mexico.

PARTNERSHIPS

🇬🇧 Zilch Travel powered by lastminute.com. This new partnership will make booking and paying for holidays easier and more rewarding. Customers can earn up to 3% back in rewards on their travel bookings or can opt to spread the cost of their trip with interest-free payments with complete transparency and no hidden fees.

🇩🇪 Deutsche Bank becomes additional banking partner for BISON. The bank will be integrated into the custody of Euro balances as part of BISON’s multi-banking strategy. With Deutsche Bank as an additional banking partner, BISON enhances its foundation for growth and flexibility.

🇲🇽 Kuady launches new Affiliate program. The program provides a full suite of creative assets, such as banners, logos, and landing pages, to help affiliates promote Kuady effectively and drive sign-ups. Participants can track their progress via an easy-to-use dashboard with real-time performance analytics.

🇳🇱 Climate X partners with Triodos Bank. This integration will enable the bank to meet compliance requirements while also providing its SME clients with tailored insights into climate risk exposure. These insights strengthen Triodos Bank’s role in sustainable finance.

🇵🇰 Abhi partners with UAE’s Al Ansari Financial Services. The alliance will provide EWA and SNPL services to complement Al Ansari Financial Services’ existing portfolio from the second quarter of this year, Abhi said. This will help address the varied needs of both unbanked and underbanked communities in the UAE, it added.

🇶🇦 TESS Payments and Alfardan Exchange unite to redefine digital payments. This collaboration aims to deliver revolutionary digital payment channels, allowing both institutions to expand their reach and impact, while also supporting Qatar’s national vision for digital innovation.

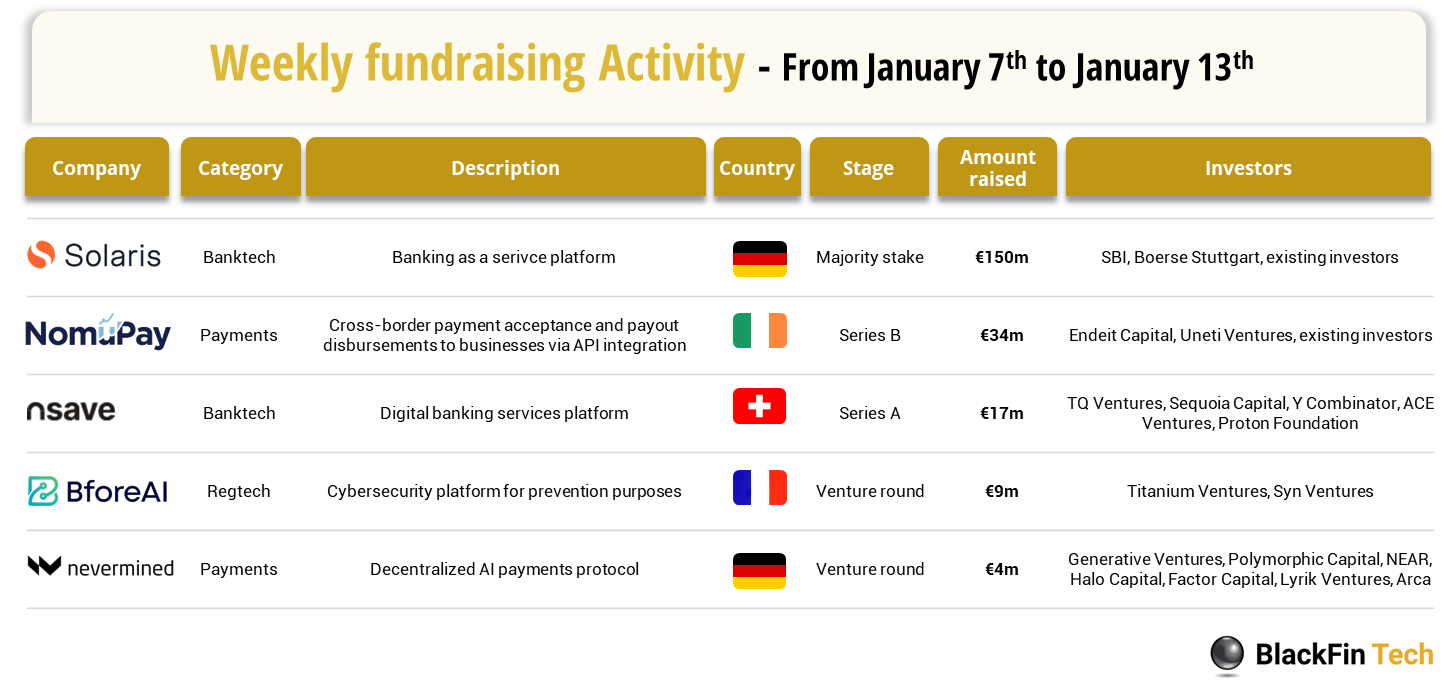

DONEDEAL FUNDING NEWS

💰Over the last week, there were 5 FinTech deals in Europe, raising a total of €213 million, with 2 deals in Germany, 1 deal in France, 1 deal in Switzerland, and 1 deal in Ireland.

🇬🇧 Revolut founder Storonsky lands £350m windfall from the disposal of shares in the FinTech giant after the company extended a deal to allow existing investors to offload part of their holdings. Sources close to Revolut said on Monday that the final proceeds to Mr Storonsky could be even higher once the secondary round closes.

🇨🇦 Float Financial announces $70 million investment round. The company plans to use the new capital to expand its product suite, attract talent, and strengthen its leadership in the Canadian market, also offers expense management software, corporate cards in CAD and USD, high-yield accounts, and next-day fund transfers.

🇺🇸 Brex teams with Citi and TPG Angelo Gordon to accelerate card product growth. The modern corporate card and spend management platform for startups and enterprises announced the closing of a two-year, $235 million revolving credit facility.

🇸🇬 SEA FinTech raises $1.6b, funding drops 23% in 2024. Southeast Asia’s FinTech sector raised US$1.6 billion in 2024. This figure represents a 23% decline from US$2.1 billion in 2023 and a 75% drop from US$6.3 billion in 2022, according to data from Tracxn.

M&A

🇬🇧 MoonPay acquires Helio for $175 million. The acquisition is privately-held MoonPay’s largest to date and will expand its payments infrastructure by integrating Helio’s technology, which enables crypto transactions on certain platforms like Shopify and Discord.

🇦🇺 Banking Circle set to purchase Australian Settlements Limited. This acquisition marks a key step in the bank’s goal of building a global hub for real-time clearing and settlement for all major currencies and accelerating its expansion. The strategy specialises in providing financial infrastructure to banks and payment businesses.

MOVERS AND SHAKERS

🇳🇱 Unit4 appoints Simon Paris as new Chief. Paris brings to the position over 25 years of tech experience, most notably including his six-year tenure as CEO of financial software provider Finastra, which claims to have achieved double-digit Annual Recurring Revenue (ARR) growth under his leadership.

🇬🇧 Barclays sustainability Chief exits in latest bank reshuffle. Barclays group head of sustainability Laura Barlow has stepped down to pursue other opportunities. Barlow was responsible for leading Barclays' efforts to align with the world's goal of limiting climate change and other sustainability objectives.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()