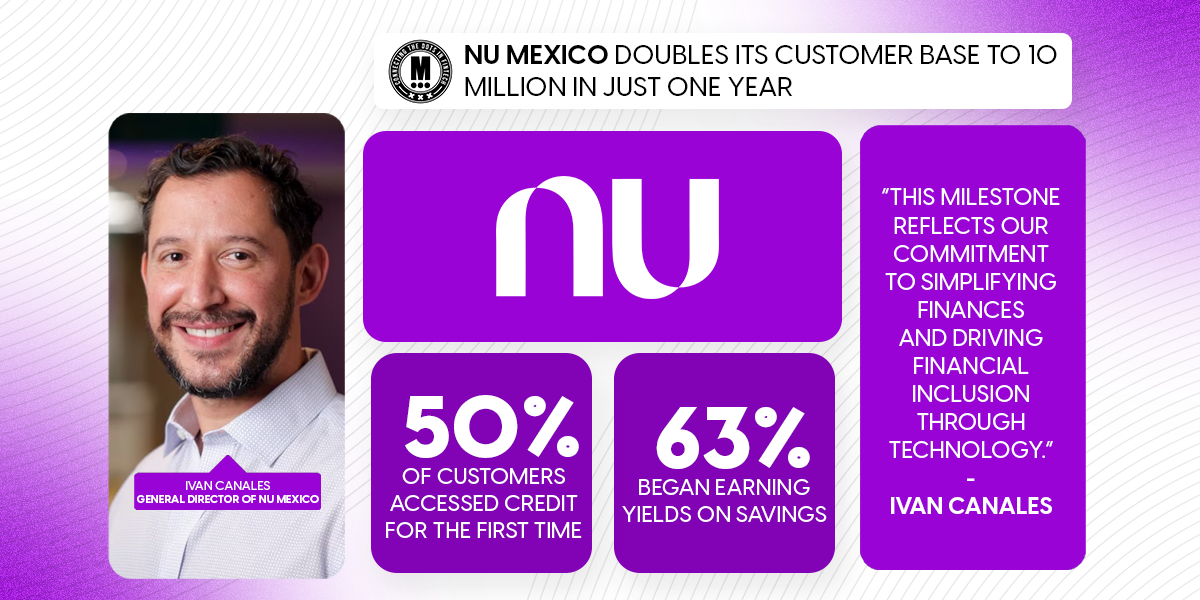

Nu Mexico Doubles Its Customer Base to 10 Million in Just One Year

Hey FinTech Fanatic!

Nu Mexico has hit a major milestone—reaching 10 million customers, doubling its base in the last year. Since launching in 2019, Nu has expanded from a simple credit card to a full suite of financial products, including savings accounts, debit cards, and personal loans, serving nearly 12% of the adult population.

Nu’s 100% digital approach has transformed financial access, reaching 98% of Mexico’s municipalities—even those without traditional bank branches. To meet local needs, Nu built a cash network with over 30,000 contact points, including OXXO stores.

Country Manager Ivan Canales shared, “This milestone reflects our commitment to simplifying finances and driving financial inclusion through technology.” Nu’s impact is clear: 50% of customers accessed credit for the first time, and 63% began earning yields on savings, per the Nu Impact study.

Nu’s success isn’t just customer-focused—it’s business-driven too. With $3.8 billion in deposits and $1.4 billion invested locally, the company continues to grow. In October 2023, Nu began pursuing a banking license to further expand its offerings, including payroll accounts and new credit options.

To celebrate, Nu launched the “10 million customers, 10 million stories” campaign, running through March.

Catch more FinTech news below👇 Until next time!

Cheers,

Navigate Europe’s evolving FinTech landscape. Get the latest insights delivered weekly—subscribe today.

#FINTECHREPORT

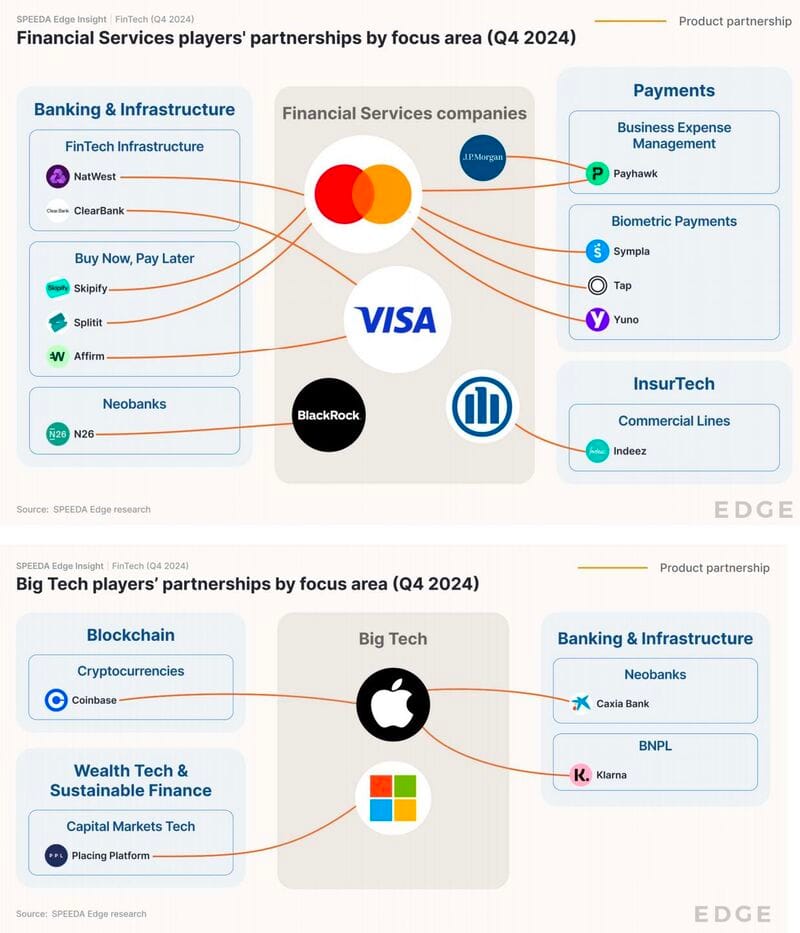

📊The Q4 2024 FinTech Partnerships Summary.

INSIGHTS

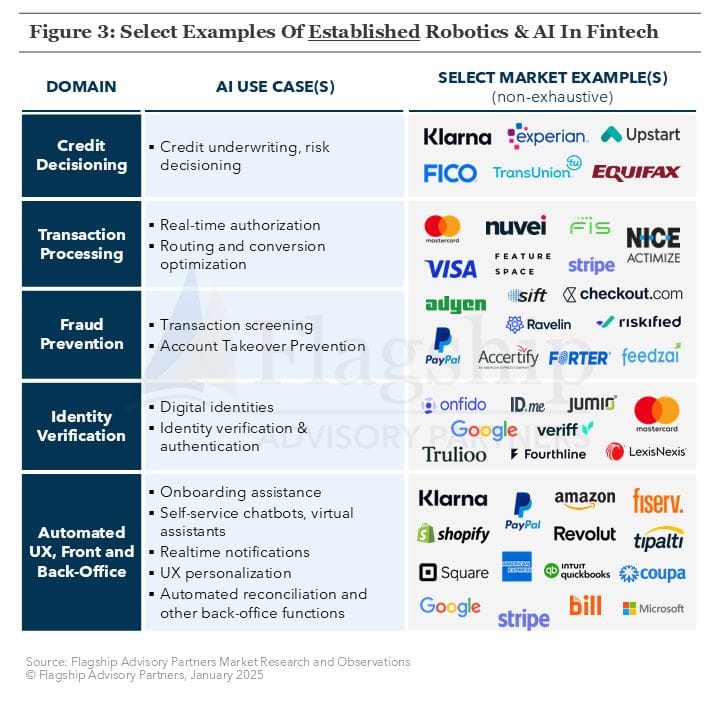

🤯 Artificial Intelligence (AI) and robotics are not new to Financial Services.

FINTECH NEWS

🇺🇸 American Express earnings expand with holiday shopping boost. “We exited the year with increased momentum, with billings growth accelerating to 8% in the fourth quarter, driven by stronger spending from our consumer and commercial customers during the holiday season,” CEO Steve Squeri said.

🇲🇽 Nu Mexico reaches 10 million customers, doubling its customer base in one year. Thanks to its 100% digital model, Nu has reached over 98% of the municipalities in the country, including communities without bank branches, where many had never interacted with the traditional financial system.

🇧🇷 NuCel becomes available for customers. The NuCel tab will appear in the Nu app, and customers in Brazil will receive notifications about the new offer, allowing them to purchase the product directly and transfer their numbers seamlessly—all in a fully digital manner.

🇺🇸 Current joins American FinTech Council (AFC) to expand consumer access to innovative, affordable, and responsible financial services. The platform aims to create a safer and more inclusive financial system. Continue reading

🇲🇽 Clara becomes a SOFOM to strengthen financial solutions for businesses. Clara has officially been authorized as a Multiple Purpose Financial Institution in Mexico. This milestone enables Clara to provide more competitive payment and financing solutions for its clients.

PAYMENTS NEWS

🇧🇷 PagBrasil received authorization from Brazil’s Central Bank to operate as a regulated Payment Institution (PI). This approval allows the company to act as an electronic money issuer, enabling it to manage prepaid payment accounts. With this license PagBrasil plans to roll out new products and features.

🇺🇸 Mastercard and Visa failed to stop payments for child sex-abuse content on OnlyFans. The complaint was filed in January 2023 with FinCEN, the U.S. Justice and, Homeland Security departments. When the content is child sexual abuse material, the card companies are “directly handling the proceeds of these illicit transactions,” said the complaint.

🇨🇦 Core Payment Solutions launches new POS system for businesses. This system aims to improve operational efficiency and offer businesses real-time insights into their operations. It also includes features such as credit card processing, inventory management, invoicing, and sales tracking.

🇺🇸 Discover’s card charge-offs improve and delinquencies show stability. “Over the past several quarters, payment rates have stabilized,” said the CFO, adding that card sales were lower by 3%, due to “credit tightening actions.” The net charge-off rate on card loans were 5%, down from 5.3% in the third quarter.

🇺🇸 PayPal’s New York penalty highlights cybersecurity’s payments significance. The DFS states that the firm did not use qualified personnel to manage key cybersecurity functions and failed to provide adequate training to address cybersecurity failures.

🇺🇸 JetBlue announced it is the first airline to accept Venmo, offering customers an easy and secure payment option when booking flights directly with JetBlue online. U.S. customers can conveniently purchase flights using their Venmo balance or linked bank accounts, debit cards, or credit cards when booking travel.

DIGITAL BANKING NEWS

🇨🇦 Central 1 announces the transfer of digital banking operations to Intellect Design Arena. Public website and mobile applications and products, along with digital banking engineering and service teams will be transferred. Central 1 will continue to provide the technology infrastructure and related services under the agreement.

🇷🇴 Banca AideXa selects Trustfull to strengthen KYB and fraud prevention for SMEs. This collaboration reinforces Banca AideXa’s mission to provide fast, secure, and customer-centric financial services to micro, small, and medium enterprises (SMEs). Read more

🇺🇸 Alkami launches first-to-market Business Banking Digital Maturity Assessment. Built only for financial institutions, this offers a comprehensive framework for banks and credit unions to assess their current digital capabilities and identify opportunities to align with the demands of business clients.

🇬🇧 The Bank of London fails to file accounts. The bank was handed a winding up order by UK tax authorities over unpaid bills just days after founder Anthony Watson stepped down as CEO. The UK clearing bank insisted that the failed payment was due to an 'administrative error' and that Watson's decision to step aside was unrelated.

🇦🇺 Revolut closing in on Australian banking licence. This is a move that would fuel its next phase of growth following a strong 2024. It applied for an Authorised Deposit-taking Institution (ADI) licence from the Australian Prudential Regulation Authority (APRA) last year.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Wall Street regulator revokes accounting guidance on crypto assets. The SEC said the 2022 guidance known as Staff Accounting Bulletin 121, which then-President Biden blocked lawmakers from cancelling, had been revoked. Former SEC Chair had maintained that this was necessary to protect investors in the case of bankruptcies.

🌍 dtcpay partners with BNB Chain. Through this integration, dtcpay will enable businesses and merchants to accept payments via the BNB Chain network, opening up new opportunities for users to pay with stablecoins like USDT and USDC on BNB Smart Chain (BSC) and opBNB.

🌍 B2BINPAY welcomes TON, opening the door to scalable and affordable crypto payment solutions. With this integration, B2BINPAY, which already supports USDC on 10 blockchains and USDT on 10, now adds support for Toncoin (TON) and USDT-TON, enabling businesses to leverage TON's speed, efficiency, and scalability.

🇬🇧 ECB pitches digital euro as response to Trump's crypto push. Trump said he would "promote the development and growth of lawful and legitimate dollar-backed stablecoins worldwide" as part of a broader crypto strategy that he sketched out in an executive order issued.

🇺🇸 Trump orders formation of working group to evaluate crypto stockpile. Trump’s order also protects individuals’ rights to access, use, develop, and transact on public blockchain. This would formally protect blockchain activities as lawful. Continue reading

PARTNERSHIPS

🇨🇳 Fusion Bank enters commercial cooperation with WeBank. Through this agreement, Fusion Bank is set to be able to leverage WeBank Technology Services’ digital banking technology for its solutions. These include retail deposits, retail loans, corporate deposits, corporate loans, and foreign exchange services.

🇮🇱 eToro Partners with Stocktwits. eToro will integrate content and insights from Stocktwits into the relevant assets pages on the eToro platform and “launch a ‘share’ button, enabling eToro’s users from around the world to share content from eToro directly to Stocktwits.”

DONEDEAL FUNDING NEWS

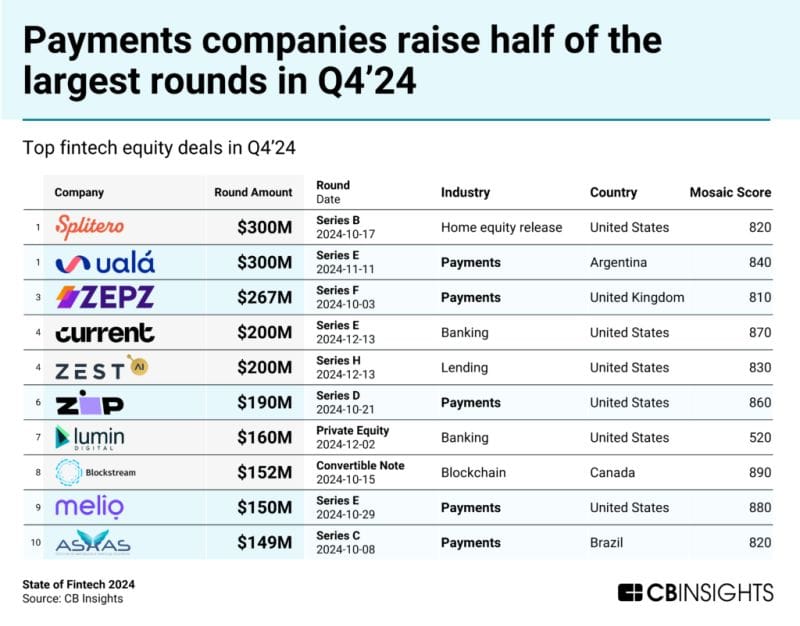

➡️ Five of the 10 biggest FinTech deals in Q4’24 went to 𝗣𝗮𝘆𝗺𝗲𝗻𝘁𝘀 companies, capping a relatively strong quarter for the sector. More info

🇺🇸 Affirm gets big financing check from Liberty Mutual. Affirm has lined up $𝟳𝟱𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 in funding, the asset-management unit of insurer Liberty Mutual, bringing in additional capital to fuel its consumer-lending activities. Liberty’s new commitment to buy Affirm loans runs through June 2027.

🌍 SC Ventures and Yabx invest $10M in Furaha. “This partnership marks our first step into the education financing space. The long-term impact of a partnership like this is huge, and we’re excited to work with Furaha as they positively impact education outcomes in Uganda and other African countries in the coming months,” said Yabx CEO.

🇮🇳 Clutch raises $65m to propel credit unions into the FinTech era. This new capital will support Clutch’s ambitious growth plans and product innovation including investments in AI and expanded platform capabilities to help credit unions compete more effectively for today’s digital-first consumers.

🇬🇧 Andreessen Horowitz closes UK office, pivots back to US crypto market. The VC firm was pulling back from the UK to focus on the US crypto market in the wake of Donald Trump’s election. The newly inaugurated president signed an executive order designed to “strengthen American leadership” in cryptocurrencies.

M&A

🇸🇬 Singapore’s Tokenize Xchange acquires Coinseeker, in a deal valued at US$30 million. Titan Lab, the creator of Titan Chain (the blockchain infrastructure on which Tokenize operates), plans to integrate Coinseeker’s AI-powered analytics, ratings, and other insights into its operations.

🇨🇦 Caseware acquires Aussie financial document processing start-up Extractly.ai. The deal will see Extractly.ai CEO and the entire Australia-based team join Caseware, and comes only weeks after Caseware snapped up LeaseJava, a SaaS accounting solution for business lease management.

MOVERS AND SHAKERS

🇺🇸 Fiserv appoints Michael P. Lyons as President and CEO-Elect. Frank Bisignano, Chairman, President and CEO of Fiserv, said, “His relentless work ethic, deep understanding of our business, and record of driving growth and quality, make him an excellent choice to lead Fiserv through the next chapter. I look forward to working closely with him during this transition period.”

🇸🇬 SG digibank Anext names new CEO. Kai Qiu, the bank’s deputy CEO and chief technology officer, has been with Anext Bank in a senior leadership role, where he worked closely with both public and private sector partners.

🇺🇸 Upgrade appoints new COO. Jeffrey Meiler, former founder and CEO of Best Egg, has joined the FinTech to apply his decades of experience in lending cards and payments. Continue reading

🇺🇸 Wealth-tech Envestnet appoints Chris Todd as new CEO. Under his leadership, the company seeks to enhance its influence within the wealth management ecosystem, improve the advisor experience, and roll out advanced solutions that address the changing demands of financial advisors.

🇺🇸 FinTech Trailblazer DoubleCheck appoints New CEO. Ashwin Rangan brings a wealth of experience in innovation, artificial intelligence (AI), and scaling businesses to DoubleCheck, an award-winning financial technology platform that benefits credit unions, banks and their customers.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()