Norwegian FinTech Settle Acquired by Sokin

Hey FinTech Fanatic!

UK-based payments company Sokin has acquired Norwegian FinTech Settle Group AS (Settle) for an undisclosed amount. This acquisition comes at a pivotal time, following Sokin's substantial $31M funding round from Morgan Stanley Expansion Capital, highlighting the company's commitment to aggressive expansion.

Settle, launched in 2010, brings valuable assets to the table with its robust payments infrastructure that enables instant money transfers for both consumers and businesses across all EU countries.

The integration of Settle's technology will enhance Sokin Pay's capabilities, while the acquisition of Settle's European EMI license positions Sokin for stronger market penetration across the region.

Vroon Modgill, CEO & Founder of Sokin, emphasizes the strategic importance of this move: "The acquisition of Settle is a game-changer for Sokin, unlocking new technological capabilities and enabling us to expand our presence in key markets."

This acquisition appears to be just the beginning of Sokin's expansion strategy. The company has indicated plans for further strategic FinTech acquisitions to accelerate its growth, suggesting a broader consolidation play in the European payments sector.

What a week it's been! After an incredibly packed schedule, I'm looking forward to returning Monday with fresh FinTech insights to share.

Cheers,

FEATURED NEWS

👉 85% of Latin American consumers prefer biometrics over passwords, and Mastercard is leading the way with Mastercard Payment Passkey Service which debuts in Latin America in January 2025 with Sympla and Yuno.

#FINTECH REPORT

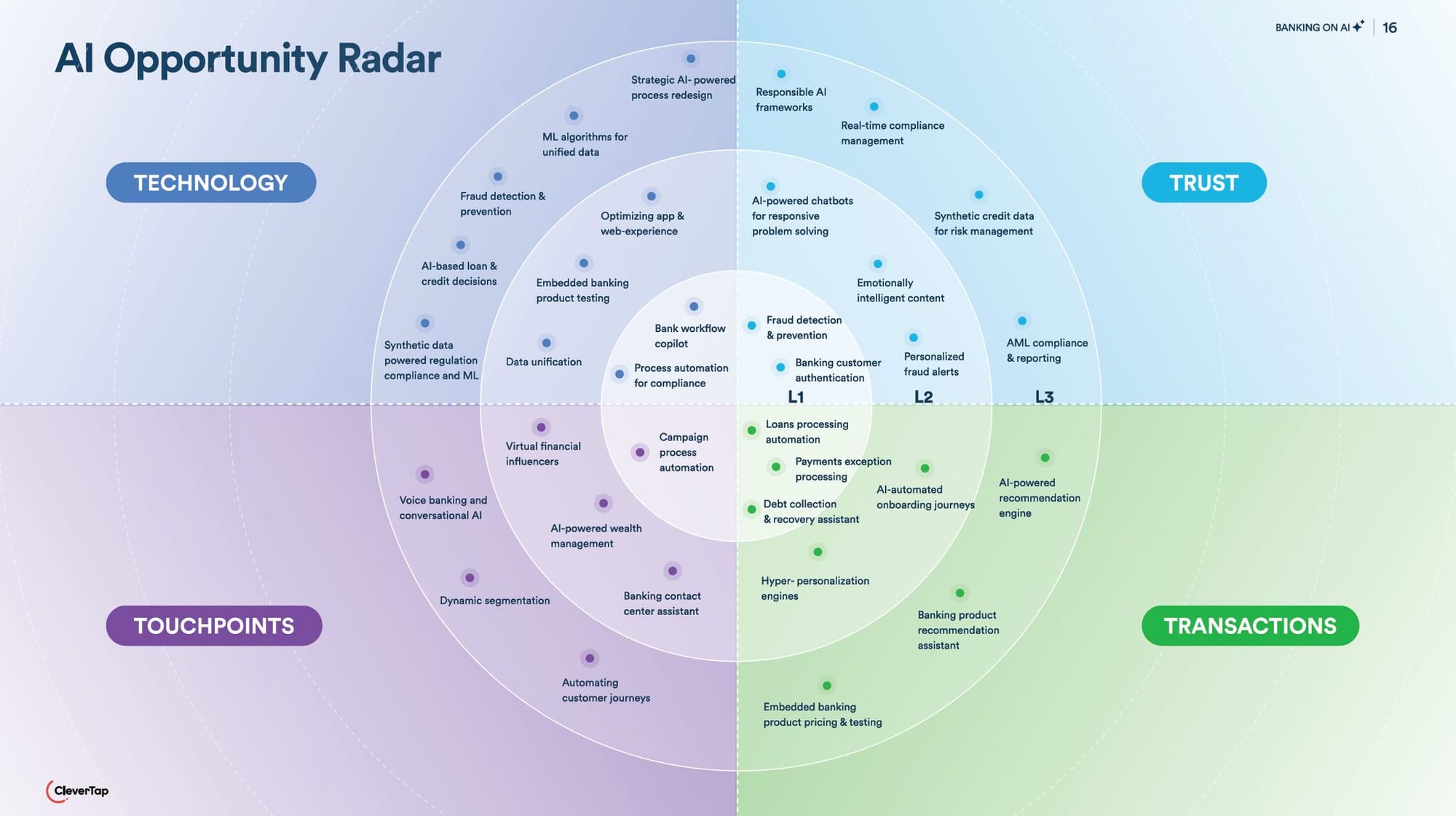

📊 Where Are the AI Opportunities for Banks?

Explore how you can embrace AI with CleverTap’s core four—Trust, Technology, Transactions, and Touchpoints 👇

FINTECH NEWS

🇸🇬 Robinhood to launch in Asia in 2025 with Singapore HQ. Robinhood’s move into Asia aligns with the international expansions of competitors like Tiger Brokers and Futu Holdings, which are shifting focus from their home market after regulatory crackdowns. That could intensify competition in the industry, which is already struggling with rising costs.

🇺🇸 FinTech unicorn Stash laid off 40% of its workforce after CEO left. Stash was also restructuring, and 40% of its approximately 220-person workforce, including at least three of its executives, were out of a job, according to three people familiar with the matter and confirmed by Stash. It was the second major layoff at Stash this year.

🇺🇸 nCino sees vendor fatigue as Tailwind for multi-solution growth. “Vendor consolidation is a key consideration for many institutions we speak with,” said the company’s chairman and CEO. The risks associated with vendor supply chain failure are particularly significant for security-critical businesses like financial institutions (FIs).

🇬🇧 FullCircl launches unified onboarding platform for companies and their directors. SmartOnboard is a compliance platform that streamlines customer verification, including KYB, PEPs, sanctions, adverse media, KYC, email risk, and document checks. It simplifies the onboarding process, ensuring a smooth corporate experience.

🇮🇱 Justt launches AI-Powered Platform Upgrade. The new release introduces centralized chargeback approval and multilingual dispute management, empowering businesses to navigate global chargebacks with greater efficiency and control.

🇪🇬 Mid Takseet rebrands as MOGO, increases capital to $4.51mln. The rebranding aims to boost market share and attract new customers, aligning with Egypt’s Vision 2030 goals for digital transformation and financial inclusion. Continue reading

🇺🇸 Trump taps Fiserv CEO Frank Bisignano for Social Security Chief. If confirmed, Bisignano would lead the agency managing Social Security, a retirement trust fund facing a budget shortfall and political risk due to its importance to older American voters. Find out more

PAYMENTS NEWS

🇰🇪 Premier Bank and Mastercard launch Shari'ah-compliant cards in Kenya. This initiative aims to improve secure and accessible financial services tailored to meet the diverse needs of Kenya’s population and its growing digital economy.

🇦🇺 Tyro’s embedded payments driving new future for POS payments in Australia. Tyro has launched the first Australian-developed embedded payments solution, enabling businesses to accept tap-to-pay payments via any device and point-of-sale (POS) system.

🇸🇬 Singapore to launch two new e-Payment solutions in Mid-2025 to phase out cheques. The Electronic Deferred Payment (EDP) and EDP+ solutions will offer businesses and individuals more convenient ways to make payments while phasing out the use of cheques.

🇦🇹 IXOPAY merges with Aperia to bolster payment compliance. This partnership creates a secure, compliant, and scalable payment solution to address rising cyber threats and complex regulations, meeting the demand for enhanced transaction security and streamlined operations.

dLocal and Spreedly strengthen partnership to expand global payment access in emerging markets. This renewed partnership will focus on enabling Spreedly customers to enhance capabilities and coverage in Africa and APAC, where dLocal has established a strong payments presence.

REGTECH NEWS

🇺🇸 Trump's top SEC Chair pick Paul Atkins reluctant to take job. President-elect Donald Trump has interviewed former SEC Commissioner Paul Atkins to lead the U.S. Securities and Exchange Commission. Atkins, however, is hesitant to leave his consulting firm to manage what he perceives as a bloated agency.

🇺🇸 FDIC looks to more FinTech tracking after Synapse collapse. The FDIC is now closely tracking FinTech companies partnering with U.S. banks to better anticipate potential vulnerabilities before they impact banks, according to sources familiar with the regulator's operations.

DIGITAL BANKING NEWS

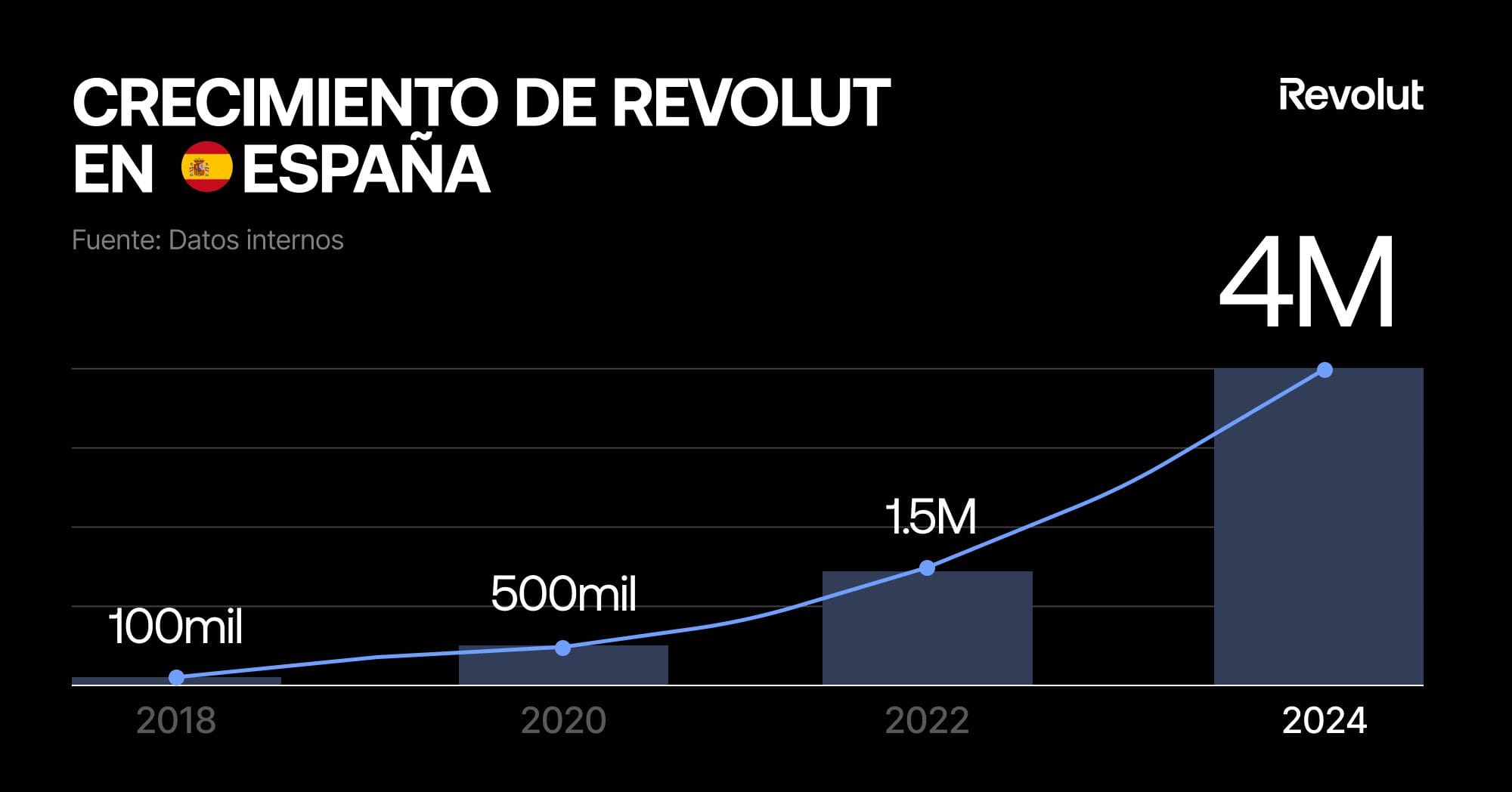

🇪🇸 Revolut just reached 4 million customers in Spain, an increase of 60% or about 1.5M over the year. About the same number as it managed to attract in the first 5 years in. Now Spain ranks as the 3rd fastest growing market for Revolut, behind the UK and France.

🇬🇧 Revolut partners with Metomic to strengthen SaaS data security, gaining visibility and control to foster innovation while ensuring data protection. This collaboration aims to enhance Revolut's security and reduce risks across its SaaS environment.

🇺🇸 American Airlines chooses Citi as sole credit card partner, drops Barclays. American Airlines expects annual payments from its co-branded credit card and other partners to grow 10%. In the year through Sept. 30, these deals generated $5.6 billion.

🇪🇸 Santander launches online pension that offers up to £1,000 cashback. The bank has introduced a self-invested personal pension (SIPP) with up to £1,000 cashback for investments made by April 25, 2025. The SIPP offers customers greater control over pension savings, with an advisory service planned for next year.

🇺🇸 Wells Fargo to sell longtime San Francisco Financial District headquarters. The expected move will be a part of the company’s multiyear strategy to streamline operations. Despite the move, the bank emphasized its commitment to maintaining a presence in San Francisco, according to spokesperson Edith Robles.

BLOCKCHAIN/CRYPTO NEWS

🇨🇦 Nuvei launches comprehensive blockchain payment solution. In partnership with Rain, BitGo, and Visa, Nuvei offers LATAM merchants a secure blockchain payment solution that empowers them to use their physical or virtual card to make payments using stablecoins from a digital asset wallet anywhere Visa is accepted.

🇺🇸 Coinbase One just hit 600,000 members across 42 countries, offering benefits like zero trading fees, boosted rewards, and free gas on Base. A new premium tier introduces unlimited fee-free trading and enhanced perks to cater to diverse trader needs.

🇬🇧 The Digital Pound Foundation to Join the Innovate Finance Community to Drive Forward the UK’s Vision for Digital Money. By bringing the DPF within the Innovate Finance community, the two organisations will advance a shared vision for developing the UK as the leading global centre for digital assets and digital money.

🇺🇸 Bitcoin crosses $100K threshold on news of Trump’s SEC pick. The popular cryptocurrency was at a little over $103,000 Thursday (Dec. 5) morning, one day after President-elect Donald Trump said he would nominate a crypto advocate to lead the Securities and Exchange Commission (SEC).

🇺🇸 Stablecoin issuer Circle Internet Financial makes some job cuts. The job losses represent less than 6% of Circle’s workforce, a spokesperson said in a statement adding the firm continues to invest in geographical growth, efficiency and productivity powered by artificial intelligence. Back in June, Circle said the company had 882 employees.

PARTNERSHIPS

🇬🇧 Valu-Trac selects Temenos Multifonds SaaS to scale fund administration and transfer agency business in the UK. With the implementation of Temenos Multifonds, Valu-Trac can introduce automated workflows with exception-based management, significantly enhancing the efficiency of their fund operations.

🇬🇧 Marygold taps Moneyhub for new money management app. Set to launch in early 2025, Marygold's app aims to simplify saving without requiring customers to switch banks, aiming to radically streamline financial management. Continue reading

DONEDEAL FUNDING NEWS

🇬🇧 Early Revolut crowdfunders are in line for 𝟰𝟬𝟬𝘅 return on investment 🤯 Shares bought at $2.14 in 2016, now worth $865.42. The British start-up’s early backers, including participants in two crowdfunding rounds, have been offered the chance to sell down their holdings in a secondary share sale.

M&A

🇬🇧 British payments firm Sokin has announced its acquisition of Norwegian FinTech Settle Group AS for an undisclosed sum. Sokin's acquisition strengthens its technological capabilities and supports its growth strategy, enhancing its flagship product, Sokin Pay, while advancing its vision to transform international payments.

🇳🇱 Mambu acquires payment technology provider Numeral, bolstering its market position to target new growth opportunities. Mambu’s acquisition of Numeral supports its strategic aim to enhance payment capabilities, drive market expansion, and align with long-term growth plans.

MOVERS & SHAKERS

🇺🇸 Chainalysis co-founder Jonathan Levin replaces Michael Gronager as CEO of blockchain analytics firm. This leadership shakeup at Chainalysis follows Gronager’s extended absence at the analytics company and his departure comes amid growing competition in the crypto analytics space.

🇵🇹 xMoney Global names Greg Siourounis as co-founder and CEO. His immediate focus will be on “partnerships, regulatory alignment and market expansion”, according to a company statement, including the launch of a blockchain-as-a-service module and stablecoin programme.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()