New UK Regulations on 'Buy Now, Pay Later' Firms

Hey FinTech Fanatic!

The U.K. government will soon announce new regulations for "buy now, pay later" (BNPL) firms like Klarna and Afterpay, following repeated delays.

Tulip Siddiq, the new economic secretary to the U.K. Treasury, highlighted the need for regulation to protect consumers and provide sector certainty.

Initially proposed in 2021, these regulations faced setbacks due to political instability and industry lobbying.

BNPL plans allow consumers to make purchases and pay off the debt later, but varying service models and rising consumer debt have prompted calls for stricter oversight.

The Financial Conduct Authority may introduce regulations within two years.

Have a great start to the week and I'll be back in your inbox with more industry updates tomorrow!

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

ARTICLE OF THE DAY

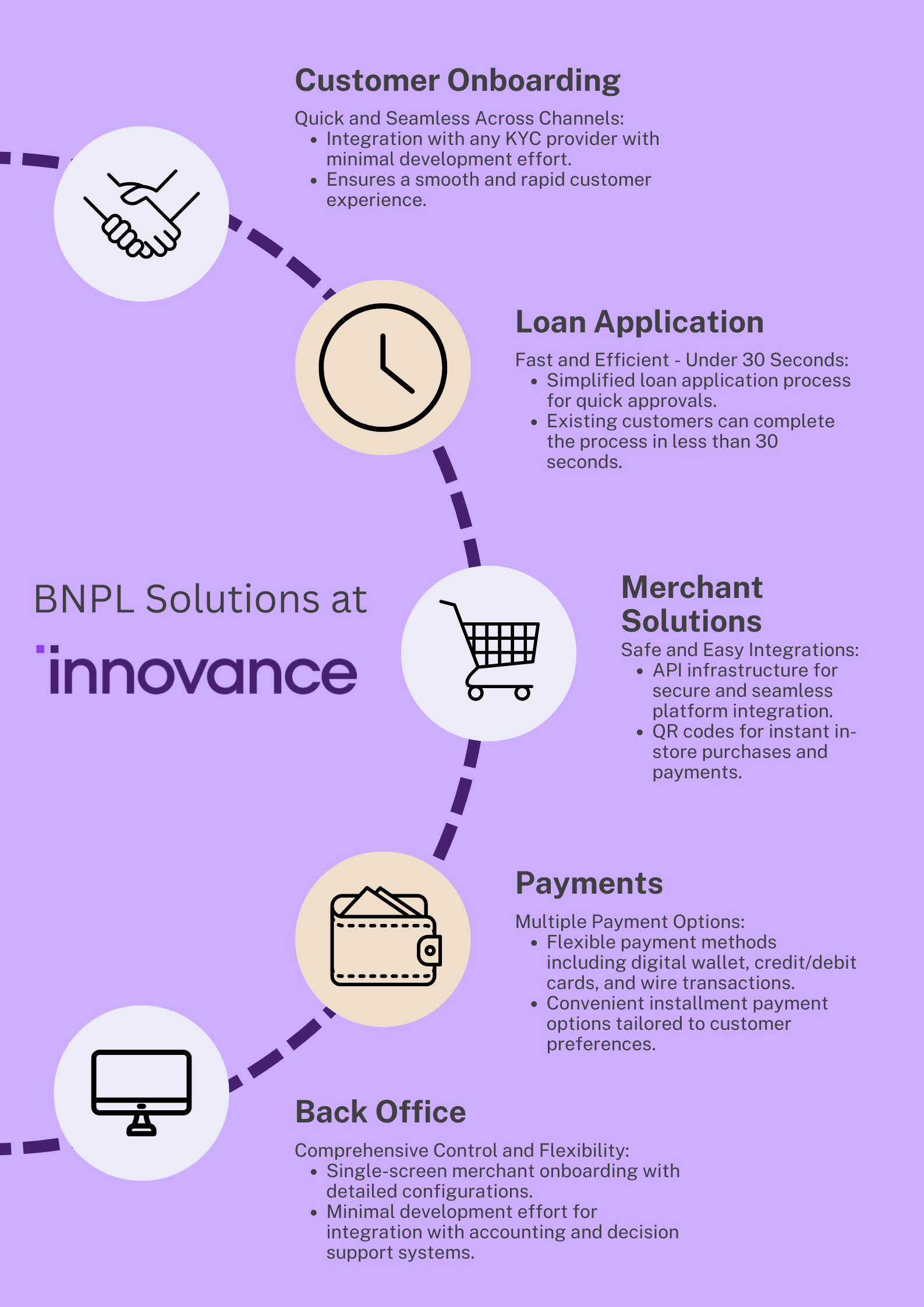

📲 What is BNPL?

FEATURED NEWS

💳 Global payment giant Mastercard has entered into a multi-year sponsorship agreement with Formula 1's McLaren Racing. Starting later in the 2024 season, Mastercard's branding will predominantly feature on McLaren's cars and team apparel and joins Airwallex as a sponsor to the Formula 1 team.

FINTECH NEWS

🇱🇹 Bank of Lithuania appoints interim representative, imposes restrictions on Kevin. Due to the rising threat to safe and reliable operations of kevin, UAB's operations and consumer interests, the Bank of Lithuania appointed an interim representative and imposed business restrictions.

🇨🇱 Klap partners with FinTech R2 to finance 7,000 SMEs in two years. The strategic alliance will facilitate access to credit for small and medium-sized enterprises, using advanced technology and data analysis to promote financial inclusion.

🇧🇷 alt.bank migrates card operations to Pismo. The FinTech has chosen Pismo's cloud-native platform to boost its operations and expand the range of services available to its customers via the Visa credentials.

🇺🇸 Robinhood launches Joint Investing Accounts, allowing customers to seamlessly manage investments with their partner while keeping their shared assets in one place. Continue reading

PAYMENTS NEWS

🇵🇱 PayEye and Worldline partner to develop and launch payment services based on biometric technology. This combines iris and facial biometrics for the first time. When making a payment at the eyepos terminal for the first time, a unique code is generated in real-time based on the user's biometric features.

🇳🇱 PayU GPO appoints Simona Covaliu as Chief Risk Officer. At PayU GPO, Simona will be working with the Privacy, Compliance, Risk, and Security teams to enhance transparency and support informed product development decisions, reducing risks for SMBs and enterprises.

🇺🇸 Kasheesh introduces Multi Use Card: Split payments across multiple cards for flexibility, convenience, and credit optimization. The feature offers one reusable card that can split purchases across up to five debit, credit cards, and gift cards by choosing a percentage for each.

🇺🇸 Swivel unveils Apple Pay® integration to enhance loan payment performance for community financial institutions. SWIVEL’s integration with Apple Pay features a proactive capability that automatically filters cards loaded within a consumer’s Apple Pay wallet and presents only the cards that can be used as acceptable payment options for an individual loan.

OPEN BANKING NEWS

🇮🇳 HSBC has partnered with business payments platform Open Financial Technologies to simplify payment processes for its business customers in India. The collaboration will see the launch of HSBC’s FinConnect offering in the country.

🇬🇧 Bankzy Open Banking launches new feature in the UK. Through this move, Bankzy is set to enable merchants to issue payment requests to customers, either individually or in bulk. In addition, clients can leverage their merchant portal to issue payment requests through WhatsApp, SMS text, or email.

DIGITAL BANKING NEWS

🇨🇦 Airwallex partners with Float to deliver fast, cost-effective bill payments to Canadian businesses. Float’s Bill Pay product, powered by Airwallex, introduces payouts – including bank transfers, EFT, wire, and ACH – as part of Float’s unified business finance platform for Canadian companies.

🇬🇧 Revolut customers in the UK can now deposit cash directly into their accounts. The service, which will be provided in partnership with Paysafe, is launching in over 12,000 locations in the UK, and will roll out to other markets in EEA progressively.

🇺🇸 BofA’s CashPro® App surpasses $500 billion in payment approvals as of the middle of this year – up nearly 40% compared to the middle of last year – and is on pace to reach a trillion dollars by the end of 2024. Read on

🇮🇳 CRED launches CRED Money, a personal finance manager for India’s affluent. CRED Money consolidates users’ financial data from all their bank accounts, enabling them to track their bank transactions and recurring payments (including SIP investments, rent and staff salaries) on one dashboard.

🇬🇧 NatWest buys Metro Bank’s £2.4 billion mortgage portfolio. The Bank will acquire the portfolio of prime UK residential mortgages, expecting to gain around 10,000 customer accounts who will continue to be serviced by Metro Bank.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Coinbase UK unit fined for breaching financial crime requirements. The FCA stated that CB Payments Limited (CBPL), part of the global Coinbase Group, agreed in October 2020 to improve its financial crime controls and not accept new high-risk customers until issues were addressed. Despite this, CBPL provided e-money services to 13,416 high-risk customers, with nearly a third depositing $24.9 million.

🇺🇸 Stripe now supports the Avalanche C-Chain. Retail users can purchase AVAX directly “through Stripe, removing the need to go through an exchange.” Available to U.S. Stripe’s fiat-to-crypto onramp is “a customizable widget embedded into Avalanche dApps, such as DEXes, NFT platforms, and digital wallets.”

DONEDEAL FUNDING NEWS

🇺🇸 Financial transactions database TigerBeetle has raised $24 million in a Series A funding round led by Spark Capital general partner Natalie Vais. According to the firm’s CEO, they have decided to bring the raise forward to invest in engineering, go-to-market, and TigerBeetle’s cloud platform, which is under development.

🇦🇺 Fundabl secures $3.2m to bridge funding gaps for Australian businesses. This funding milestone is accompanied by the establishment of an enhanced debt facility. The company addresses a crucial need in the funding ecosystem by targeting businesses that are often bypassed by traditional financial institutions.

🇦🇪 UAE-based FinTech Mamo raises $3.4M, eyes regional expansion and aims to boost financial services for SMEs. Additionally, Mamo will use the funds to begin testing its innovative product lines in Saudi Arabia, further extending its regional footprint.

M&A

🇺🇸 Payments giant Stripe has acquired a four-year-old competitor, Lemon Squeezy to help build a global merchant of record solution. Terms of the deal were not disclosed. Read the full article

🇹🇷 MNT-Halan expands into Turkey with the 100% acquisition of market-leading finance company Tam Finans. With ample growth opportunities for the banking sector, MNT-Halan’s digital financial solutions promise to be transformative for businesses and individuals.

MOVERS & SHAKERS

🇬🇧 Online investing and savings service Wealthify introduces its new Chief Executive Officer Richard Ambrose. He will succeed Andy Russell, who has served as CEO of the company for the past four years. Click here to learn more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()