New Regulations Demand Stronger Protections Against APP Fraud in the UK

Hey FinTech Fanatic!

The UK's Payments Services Regulator (PSR) has released new data highlighting the urgency of forthcoming regulations aimed at combatting authorised push payment (APP) fraud.

Starting October 7, UK payment providers will be mandated to reimburse victims of APP fraud for claims up to £415,000, with only limited exceptions. This change is expected to significantly bolster consumer protection against a growing threat.

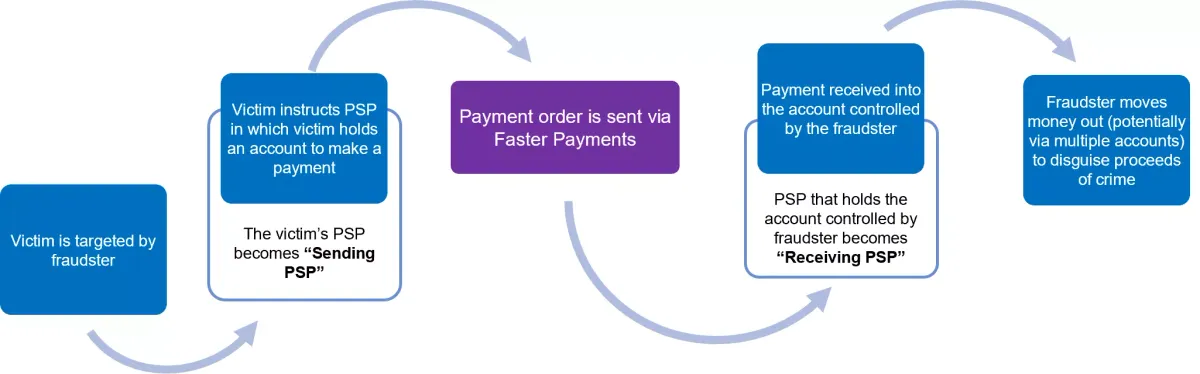

APP fraud involves scammers posing as legitimate payees to deceive victims into transferring money to accounts under their control. The PSR's latest findings reveal that £341 million was lost to such scams last year, with 252,600 reported cases—a 12% increase from the previous year.

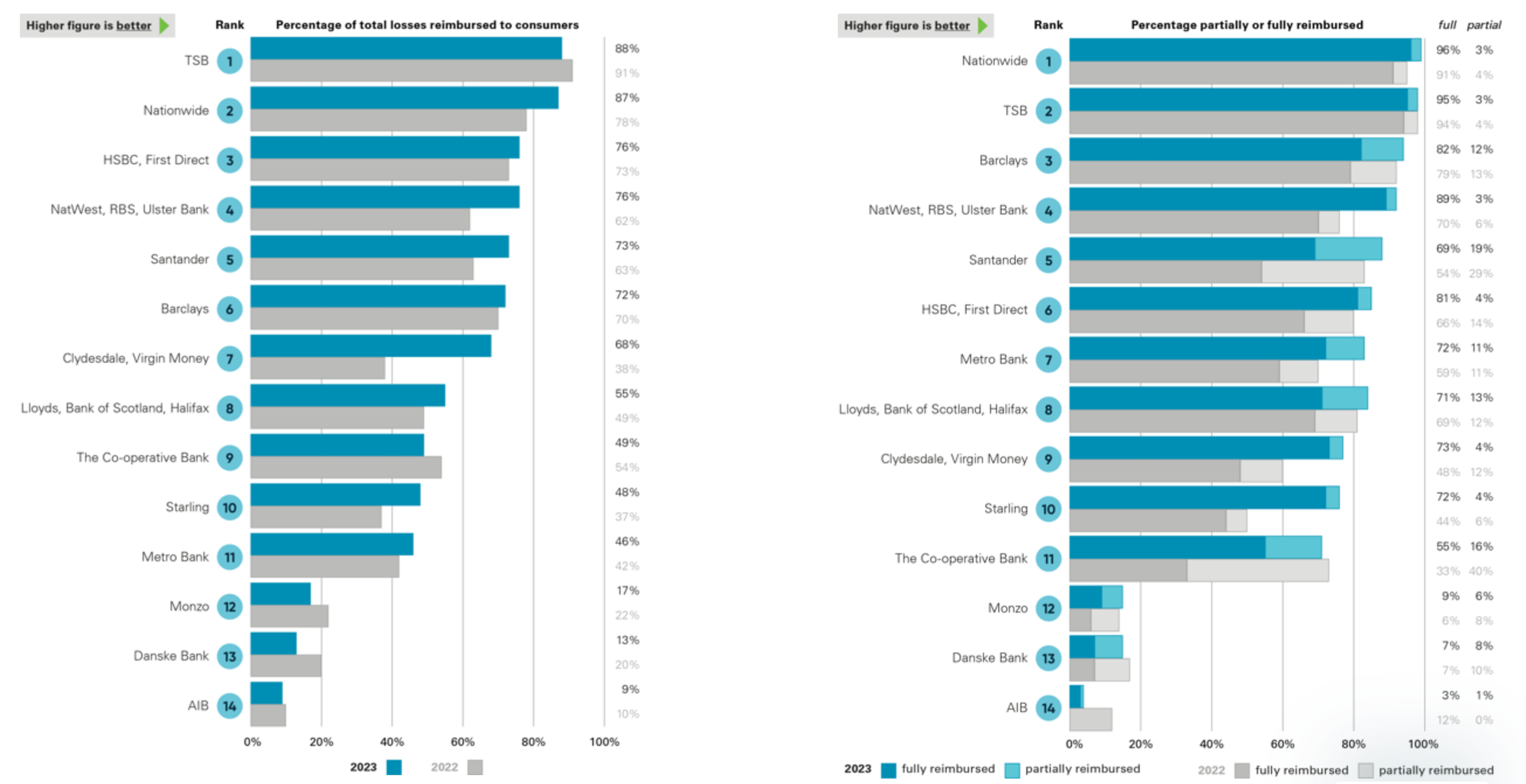

The report included data from the UK's 14 largest banking groups, revealing varying levels of reimbursement.

Among the digital banks, Monzo fully reimbursed only 9% of cases, making it the third lowest in refunds, while Starling Bank reimbursed 72% of claims. Nationwide led with a 96% reimbursement rate for victims.

This disparity in reimbursement rates underscores the need for the upcoming regulatory changes.

Meanwhile in the UK, Revolut is launching a sale of up to $500 million worth of existing shares at a $45 billion valuation, cementing its status as Europe’s most valuable start-up.

Employees were informed on Friday that those who have been with the company for at least a year and are not on gardening leave can sell 20% of their vested share options at $865.42 per share. Former employees are ineligible.

Revolut aims to enable employees to share in its success and plans regular share sales. The deal is expected to close within a month.

Despite a venture capital slowdown, Revolut's valuation has increased from $33 billion, positioning it above UK banks like NatWest, Lloyds, and Barclays.

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

FEATURED NEWS

📜 Revolut tells staff it is launching share sale at $45bn valuation.

Here is what we know: Revolut has told staff it is launching a sale of up to $500mn worth of existing shares at a $45bn valuation, in a move that would cement the FinTech’s status as Europe’s most valuable start-up. Continue reading

FINTECH NEWS

🇦🇷 MercadoLibre Rally Makes It Latin America’s Most Valuable Firm. Shares of MercadoLibre Inc., the giant Latin American e-commerce and payments firm, soared after second quarter earnings blew past analyst estimates, bucking a rout in technology companies and regional peers.

🇬🇧 Share trading app Freetrade to pull out of Swedish market. The company, which launched in 2018 and has just recorded its first profitable half-year, will focus on growing its 750,000-strong UK customer base. Learn more

PAYMENTS NEWS

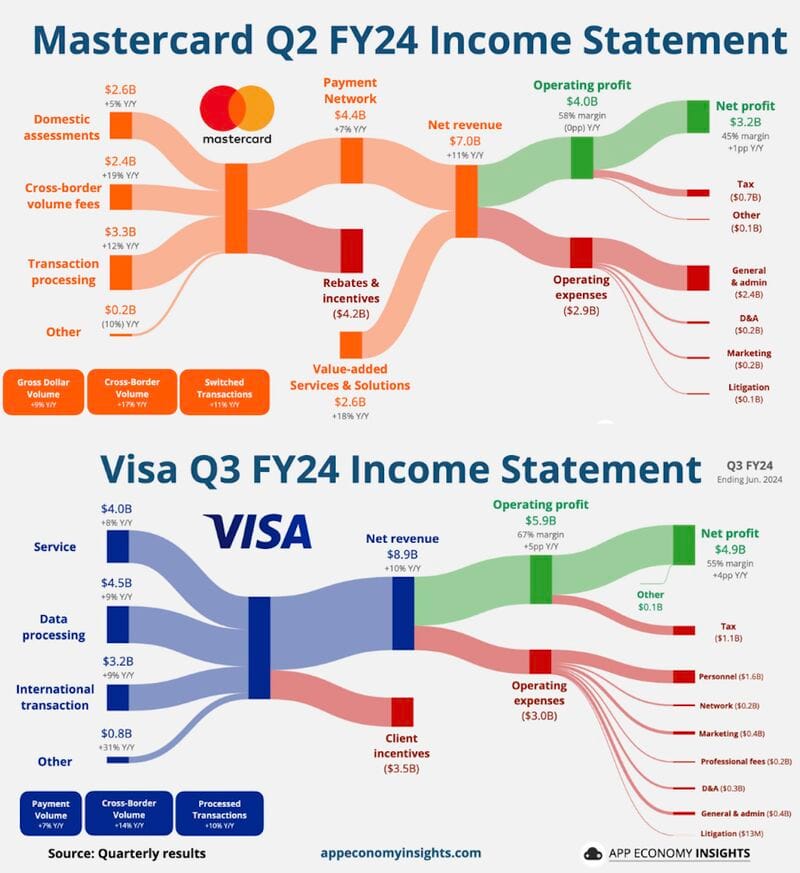

A Comparison of Key Metrics in the Latest Income Statements:

🇺🇸 'It’s the Network, Not the Rail': Ingo Payments CEO Drew Edwards Reflects on FedNow’s First Year and sat down with PYMNTS CEO Karen Webster to touch base on the state of FedNow. Watch video and interview here

🇵🇱 Polish FinTech PayPo, one of the top four companies in the Polish market offering deferred payments, has invited a group of its customers to test the cards it plans to issue. The pilot program is set to start soon, and following its completion, the cards, developed in collaboration with Visa, will be available to all interested customers. PayPo offers deferred payment services, allowing customers to buy (typically in online stores) and pay later without additional costs, usually within 30 days.

🇲🇽 DEUNA, the unified platform to simplify global payments, announced a new strategic partnership alliance with Kount, an Equifax Company, the one-stop fraud prevention system. Read on

OPEN BANKING NEWS

🇺🇸 LenderLogix integrates income, employment verification services from Truv into LiteSpeed mortgage point-of-sale. Lenders can now use Truv's consumer-permissioned data platform through LenderLogix's POS LiteSpeed for direct income and employment verification of mortgage applicants.

DIGITAL BANKING NEWS

🇲🇽 In just six months, Nubank managed to triple its deposit business in Mexico. Surpassing some of the traditional banks operating in the country, amidst a rate war initiated by several institutions. A substantial part of this growth is due to the rate war and the yields offered to individuals. Read more

🇪🇪 Tuum forms partnership with ComplyAdvantage. This partnership uses Tuum’s API-first approach to integrate complementary solutions, allowing financial institutions to meet their unique needs effectively with a modern solution that provides tools to detect and prevent financial crimes.

🇲🇽 A new cross-border payments infrastructure will enable remittances between the US and Mexico via 140 community banks in rural areas. The new corridor is being developed by the Interledger Foundation, an organisation dedicated to the creation of an open, interoperable payment network and the People’s Clearinghouse, which works with community banks and credit unions in Mexico.

BLOCKCHAIN/CRYPTO NEWS

🇩🇪 Hyphe partners with Bitvavo to offer retail trading in Germany. With live testing underway, the partnership aims to offer German retail customers a superior product experience and very competitive trading fees. Read on

🇦🇪 Mansa launches trade finance and cross-border payments for emerging markets. This marks a significant milestone in Mansa’s mission to democratise access to financing for businesses in Africa.

DONEDEAL FUNDING NEWS

🇵🇭 GCash valuation soars to $5 billion. Ayala Corp. and Japan’s biggest bank MUFG invest in Mynt, GCash parent company. The proposed investment is subject to the execution of definitive transaction documents and the satisfaction of customary closing conditions.

🇫🇷 Decentralized finance protocol Morpho Labs has raised $50 million in funding following a recent revamp of its business. Morpho Blue has received more than $1.5 billion in deposits since its introduction nearly six months ago, according to data from Dune Analytics.

🇲🇽 Mexican FinTech Aviva raises $5.5m. The new investment will be used to build out Aviva's product suite, its partnership distribution model, and its network of kiosks in medium and small cities. By the end of the year, it plans to expand to over 50 cities.

🇩🇪 Hawk, a provider of AI-powered technology for fraud prevention and anti-money laundering (AML), announced a further extension of its Series B financing, with Macquarie Capital having agreed to join existing investors Rabobank, BlackFin Capital Partners, Sands Capital, DN, Picus, and Coalition.

M&A

🇬🇧 PayPoint has made a further investment of £10.5 million in Open Banking technology platform Obconnect, following a minority investment in July 2022. The new investment takes PayPoint’s interest to 59.3% of the company, giving it a majority stake in Obconnect.

MOVERS & SHAKERS

🇬🇧 Tribe Payments makes senior appointments. Guy Houghton joins as Tribe’s Chief Revenue Officer, Dusty Miller has joined as Head of European Sales, further strengthening the company’s sales capabilities in the region, and Jo Lawrence joined Tribe as Head of Customer Success in April. More on that here

🇬🇧 Pay.UK names David Morris COO. Morris will oversee Payment Operations, Technology, Standards and Rules, and First Line Risk, and will be supported by a dedicated COO Office. Within the new structure, Pay.UK will recruit two senior executives to join Morris’ leadership team: Director of Payments and Director of Technology.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()