New Chapter in Apple's Financial Saga and Robinhood's Crypto Ambitions Conquer the EU

TGIF!😉

Almost ready for the weekend, but first a new chapter in the Apple Pay-Goldman Saga.

AMEX seemed to be the front runner in replacing Goldman as Apple’s partner for financial services. But, American Express’s “premium” card designation doesn’t always match with potential issuing partners, CEO Steve Squeri said Tuesday at an investor event, responding to a question that alluded to reports that Amex may replace Goldman Sachs as Apple’s credit card partner.

“The premium card base is one of the biggest impediments,” as far as co-branded partnerships that Amex walks away from, Squeri said Tuesday during an appearance at the Goldman Sachs U.S. Financial Services Conference in New York. “Because sometimes the partner wants to reach into everybody, and that’s just not who we are,” he said.

It seems we can take AMEX from the shortlist of options for Apple.

Meanwhile, Robinhood has accelerated its international growth with a significant move into the European market.

The company announced that its cryptocurrency trading application is now accessible to all qualified users across the European Union. This strategic expansion follows closely on the heels of Robinhood's recent launch in the United Kingdom.

The expansion into Europe distinguishes Robinhood's offerings: the firm has introduced its cryptocurrency trading services to EU nations, while currently limiting its brokerage services to the U.K. market alone.

“The EU has developed one of the world’s most comprehensive policies for crypto asset regulation, which is why we chose the region to anchor Robinhood Crypto’s international expansion plans,” Johann Kerbrat, general manager of Robinhood Crypto, said in a statement.

The European Union has been proactive in establishing regulatory frameworks for cryptocurrencies, primarily aimed at enhancing traceability to combat money laundering and safeguarding consumers from the volatility inherent in these markets.

A key element of these regulatory efforts is the Markets in Crypto-Assets (MiCA) legislation. MiCA, particularly noted for its focus on stablecoin oversight, is regarded as one of the most comprehensive legal frameworks for cryptocurrency assets globally.

Enjoy your weekend! But before you do that, check out the curated selection of news I listed for you below👇

Cheers,

P.S. Stay informed, stay ahead. Join my Telegram channel for real-time updates, and remember, in the world of FinTech, knowledge isn't just power - it's profit.

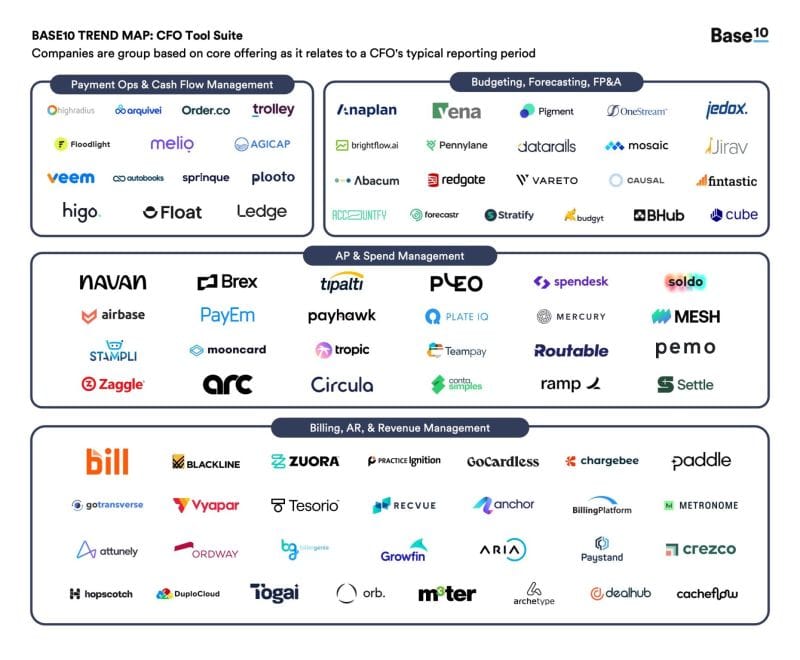

POST OF THE DAY

Luci F. is excited about the rapidly evolving landscape of tools supporting CFOs in Billing, Accounts Receivable, and Revenue Management. I couldn’t agree more.

Which tools for CFO’s are you most excited about?

FEATURED NEWS

💸The Top 10 FinTech Funding Deals from Europe in November. This article delves into the latest trends and insights from these figures, comparing them with the previous year's data to gauge the sector's trajectory. Read the complete article to learn more

#FINTECHREPORT

The World Cloud Financial Services Report is out. More than 80% of the financial services industry executives surveyed for this report agree that firms can overcome business challenges and unleash growth through superior customer experience and operational excellence. Download and read the full report here

FINTECH NEWS

🇺🇸 Flutterwave secures 13 new money transmission licences in the US. The company has announced its acquisition of money transfer licenses for 13 U.S. states to enable faster, more affordable, and secure transfer of money from the United States to Africa and back.

🇨🇱 Chilean FinTech Fapro is making bold moves by expanding its reach into Peru and Mexico, aiming to revolutionize the financing, insurance, and credit sectors in these regions. Fapro provides access, automation, and processing of specialized data in financing services.

🇨🇦 Brim Financial, a Credit-Card-as-a-Service company, announced a strategic partnership with Mastercard, designed to power innovation in credit card platforms in the U.S. Brim will also embed Mastercard’s open banking capabilities across its end-to-end platform.

🇺🇸 Spade digs into credit card fraud detection intelligence. Earlier this year, the company raised $5 million to decipher the string of numbers and letters that card issuers use to authorize transactions in seconds. Read more

🇬🇧 Samsung pushes mobile wallet take-up with Mastercard partnership. This collaboration aims to simplify the process for banks and card issuers in the UK, allowing them to provide their customers the electronic giant's own multi-faceted mobile wallet offering.

PAYMENTS NEWS

‘Buy Now, Pay(Pal) Later.’ According to FIS’ Global Payments Report 2023, BNPL accounted for 5 percent of global e-commerce transaction volume last year and is expected to grow at a CAGR of 16 percent between 2022 and 2026.

OPEN BANKING NEWS

Belvo achieves milestone with over 10 million accounts connected through Open Finance in Latin America. This increase has been reinforced by the growing interest in employment data as a means to provide credit access to more people in Mexico.

🇨🇱 CMF announces creation of Open Finance System Forum, which aims to assist the CMF about issues and proposals related to an adequate functioning of the Open Finance System (OFS) set forth in Title III of Law No. 21,521, also known as the Fintech Act.

REGTECH NEWS

🇺🇸 Treasury Prime announces partnership with Effectiv to bring fraud detection to enterprises and banks. Customers can now leverage Effectiv’s Transaction Monitoring solution to detect fraudulent behaviors, reducing the risk of financial loss and reputational damage.

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 Crypto platform operator Cake Group’s co-founder files bid to wind up firm amid shareholder dispute. Cake Group co-founder Chua U-Zyn filed for the company to be wound up, but another co-founder Julian Hosp said the group will seek to dismiss the case. Read on

DONEDEAL FUNDING NEWS

🇩🇪 Scalable Capital, a prominent digital wealth manager, has successfully raised €60 million. Firm CEO Erik Podzuweit wants to use the new funds as a capital buffer and for investments.

🇬🇧 Liberis lands $112m in debt funding round led by HSBC Innovation Banking. The embedded finance platform will use the cash for new country launches in Canada, Germany and Poland in 2024. More here

🇲🇽 Mexican Fintech firm Solvento secures $50M investment to boost logistics sector growth and launch AI-powered software. The funds will be allocated to further develop Solvento's product and expand business efforts to meet the growing needs of the $200 billion USD freight transport market in LatAm.

🇳🇬 Nigerian fintech, Bujeti secures $2 million seed round, led by YC. This investment enables Bujeti to accelerate growth, boost market share, and expand product offerings. The Fintech says it will focus on introducing credit lines for SMBs and developing new products tailored to enterprise needs.

🇳🇬 Seven Nigerian startups that have announced they will be shutting down operations this year, will cost investors $79.15 million in funding deals, BusinessDay can report. In 2023, the country experienced an unusual shutdown of startups, with around eight exiting the tech ecosystem due to operational challenges.

🇨🇦 $86-million Series D extension has Koho targeting growth and profitability. The funding will fuel Koho's growth and new product development, with plans for expanded credit offerings, in-app bill splitting, and access to government benefits, expected in Q1.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()