Nasdaq Expands Digital Banking in Latin America

Hey FinTech Fanatic!

In today's news, Nasdaq is making big moves in Latin America, expanding its partnership with Nubank, the digital bank powerhouse serving over 100 million customers in Brazil, Mexico, and Colombia.

Nasdaq has agreed to supply Nubank with its AxiomSL regulatory reporting solution, building on their existing collaboration. This new agreement extends their support beyond treasury operations, now covering regulatory reporting in Colombia too.

The company highlights the rising demand for third-party FinTech solutions in Latin America, fueled by the rapid growth of digital banking and the need for fast market entry for new products and services.

Nasdaq supports over 50 banking and payment service clients in the region, spanning digital and traditional banks, local and regional institutions, and leading global banks.

Ed Probst, Senior Vice President, Regulatory Technology at Nasdaq said, “Digital banking services in Latin America are experiencing a period of extraordinary development, with online marketplaces, open banking and innovative technology combining to empower a new generation of consumers. Nasdaq’s technology is helping to underpin the maturation of the industry, with proven regulatory solutions substantially reducing time to market and providing a competitive advantage in such a fast-paced industry.”

Stay tuned as we continue to explore the trends and technologies shaping the future of finance in different parts of the world!

PS. I'm heading to Barcelona now for Checkout's Thrive event and to take part in the inaugural FinTech Running Club run. Will I see you there?

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

FINTECH NEWS

🇹🇷 Fibabanka launches Turkey's first BaaS offering by partnering with GetirFinans. This is a significant step in Fibabanka’s broader strategy to expand its BaaS platform, providing non-banking businesses with the infrastructure to offer tailored financial services to their customers efficiently.

🇩🇪 European embedded finance platform Solaris to discontinue parts of Electronic Money Institution Business (formerly known as Contis). Solaris is reshaping into a stronger, “more resilient and agile organization that leads the market with innovative financial solutions.”

🇬🇧 FCA asks banks to report WhatsApp breaches after US watchdog fines. Banks have been asked to turn over details of staff breaching their policies on encrypted messaging apps as UK regulators probe how the likes of WhatsApp, Signal and Telegram are used in the City.

🇭🇰 Hong Kong advances digital currency innovation with a new phase of e-HKD Pilot. This new phase focuses on expanding digital currencies like e-HKD and tokenized deposits. The goal is to build a strong digital money ecosystem with significant benefits for both consumers and businesses.

PAYMENTS NEWS

🇬🇧 Ecommpay underlines ESG credentials at industry events.

Ecommpay, the inclusive global payments platform has underlined its commitment to ESG with the commissioning of a new exhibition stand that reflects its sustainability goals.

Ecommpay launched a new brand identity in September 2024, demonstrating its focus on accessibility, inclusivity and sustainability. As part of the brand refresh, a new exhibition stand was commissioned for use across industry events over the coming years.

Already featured at Seamless and eCommerce Expo, the stand was designed and produced by Pie Factory, a member of 1% for the Planet 2024. It has been created from a lightweight modular frame system moulded from infinitely recyclable aluminium.

Miranda McLean, Chief Marketing Officer at Ecommpay commented: “Ecommpay is wholly committed to delivering inclusive and sustainable payment solutions and it is crucial that we ‘walk the talk’ in every aspect of our operations, including our presence at industry events. The partnership with Pie Factory means that we are having as low an impact on the environment as possible in our event activity."

🇬🇧 McLaren Racing enters payments fast lane with Airwallex partnership. With Airwallex’s platform, McLaren now manages payments through a batch system, using a customised approval process. This has reduced the time required for payment runs to under an hour, saving the finance team half a day of work each month.

🇬🇧 Wise Business launches a free professional invoicing tool to simplify global payments for SMBs. The free-to-use service simplifies the process of generating invoices, making, and receiving payments, and tracking finances — all within the Wise Business account.

🇬🇧 Global FinTech Wise and Swift to expand cross-border payments options. This will enable their customers to benefit from the speed and convenience of Wise, and the breadth of Swift “without needing to implement any major changes to their systems.”

🇬🇧 DailyPay announces international expansion into the United Kingdom. Beginning this fall, DailyPay will have an EWA offering available in the United Kingdom, marking the company's first foray outside the U.S. More here

🇸🇬 Singapore orders Qoo10 to suspend payment services under the Payment Services Act 2019 (PS Act) effective immediately. This directive follows numerous customer complaints about delayed payments to merchants on Qoo10’s e-commerce platform.

DIGITAL BANKING NEWS

🇺🇸 Nasdaq expands digital bank presence in Latin America. Nubank has chosen Nasdaq’s AxiomSL regulatory reporting system for its operations in Latin America. This expands their existing partnership, with Nasdaq already providing technology support for Nubank’s treasury, fixed income, and money market activities.

🇹🇭 Five applicants officially submit bids for Thai virtual bank licenses, says Central Bank. The submission window, which closed on 19 September 2024, followed a call from the Ministry of Finance and the BOT for interested parties to apply. Read more

🇩🇪 BNP Paribas to buy HSBC’s German private banking arm aiming to expand its presence among wealthy entrepreneurs in Europe’s largest economy. While financial terms remain undisclosed, the bank plans to double its wealth assets under management in Germany to over €40 billion, with the deal expected to close next year.

🇮🇳 Axis Bank launches digital solutions for Retail & Wholesale Banking. The bank launched ‘UPIATM’, an integrated Android Cash Recycler with Unified Payments Interface (UPI) technology for cardless cash withdrawals and deposits. Read on

🏦 BIS’ Project Agorá to commence design phase with private sector participants confirmed. Convened by the Institute of International Finance (IIF), the participants set to take part in the project include industry heavyweights such as Standard Chartered, Lloyds Banking Group, Mastercard, Euroclear, BNP Paribas and JP Morgan Chase.

🇬🇧 Santander banking app is back online following a three-hour outage that left thousands unable to access their accounts. According to Down Detector, the problems started around 07:00 BST on Monday, and affected customers across the UK. Santander has apologized for the outage, stating that it has been resolved.

🇺🇸 Goldman’s old headquarters turned into $4,000-a-month apartments. The financial sector's presence in the neighborhood has diminished, accelerated by the pandemic. Today, anyone with $4,000 a month can live where Goldman Sachs once cemented its trading legacy.

🇺🇸 Financial Institutions, Inc. (FII), the parent company of Five Star Bank and Courier Capital, says it is to commence an “orderly wind down” of the BaaS offerings it operates through Five Star. The company says the decision follows “a careful review” conducted by FII’s executive management and board of directors.

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 Alchemy Pay launches Google Pay integration for crypto payments. The firm has updated its Virtual Card to integrate with Google Pay, enabling seamless crypto payments for everyday transactions. This update marks another step in Alchemy Pay's mission to offer innovative financial solutions for crypto users.

🇩🇪 German authorities shut down 47 cryptocurrency exchanges in major anti-money laundering operation. The Federal Criminal Police Office and the Central Office for Combating Internet Crime led the operation, targeting platforms that allowed users to exchange conventional currencies and cryptocurrencies without verifying their identities.

PARTNERSHIPS

🇸🇪 Avarda partners with Checkout.com to boost payment performance and further global expansion. The new agreement will enhance Avarda's payment performance by improving the checkout experience for card payments, simplifying the process, boosting customer loyalty, and reducing friction, which ultimately decreases cart abandonment.

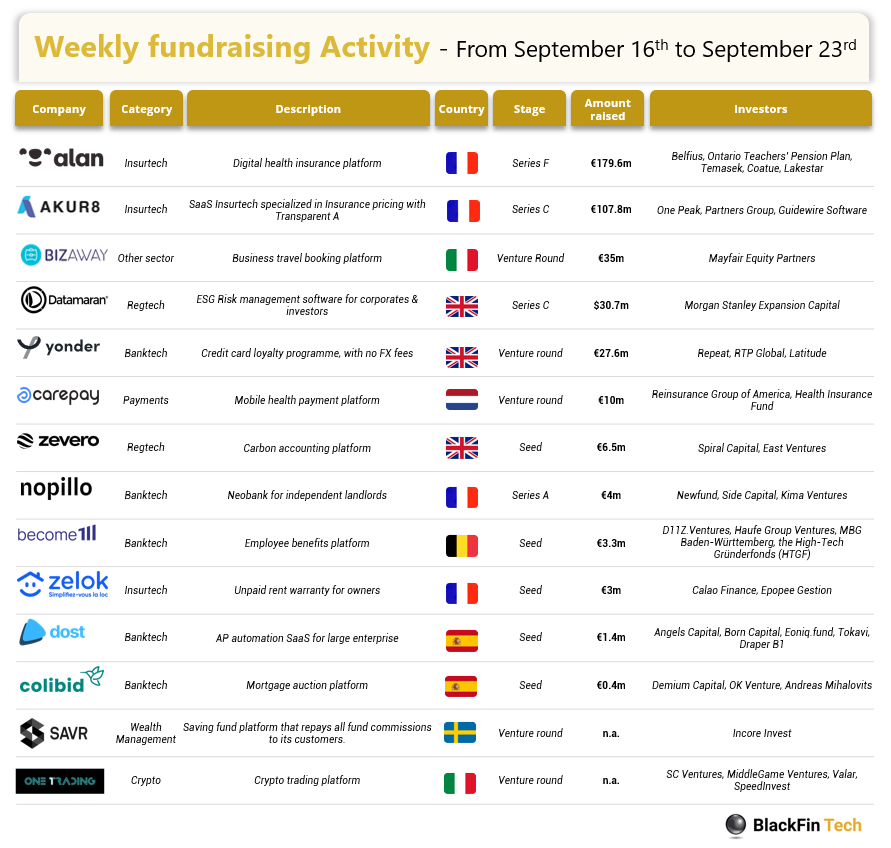

DONEDEAL FUNDING NEWS

💰 Last week, we saw 14 official FinTech deals in Europe, raising a total of €409.3 million, with 4 deals in France, 3 deals in the UK, 2 deals in Spain, 2 deals in Italy, 1 deal in Sweden, 1 deal in Germany, and 1 in the Netherlands. Check out the complete BlackFin Tech overview article

🇪🇬 Egypt's SETTLE raises $2 Million pre-seed to revolutionize B2B payments. The investment, led by Shorooq Partners, will fuel the company’s expansion and platform enhancements. SETTLE aims to streamline financial operations for businesses by providing real-time insights and automating payment processes.

🇺🇸 PayPal Ventures reinforces support of Chaos Labs with additional investment. Chaos Labs' recent launch of Edge, a new decentralized oracle protocol, has garnered significant attention within the industry. PayPal Ventures' investment aligns with PayPal's ongoing commitment to the blockchain ecosystem.

🇦🇷 Mercado Libre secures $250M credit line from JPMorgan. The transaction includes JPMorgan’s acquisition of personal and business loans from Mercado Libre’s credit portfolio. Mercado Libre will use the funds to expand credit offerings for SMEs and personal loans in Mexico through its FinTech arm, Mercado Pago.

🇧🇪 French InsurTech Alan raises $193m to bolster tech and growth in Belgium. The new funds will drive Alan’s growth, particularly in the Belgian market, by enhancing its product offerings and expanding its local team by over 25 members. The firm aims for profitability by 2026, with a focus on financial autonomy and sustainable growth.

MOVERS & SHAKERS

🇺🇸 Marqeta announced the appointment of Fouzi Husaini as Chief Artificial Intelligence Officer. Husaini will play a pivotal role in scaling Marqeta’s AI organization to help increase purchasing power for all by reducing risk and improving consumer and commercial rewards, while also helping accelerate pace of innovation.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()