More Layoffs in FinTech

Hey FinTech Fanatic!

Yesterday we learned about the latest layoffs at PayPal, today Block, with subsidiaries such as Square, Cash App, and Afterpay, is reducing its workforce during a challenging period for employees in the (Fin-)Tech sector.

This information comes from a confidential memo by CEO Jack Dorsey, initially acquired by Business Insider. The memo reveals that "the expansion of [Block] has significantly exceeded the growth in … business and revenue."

The job cuts were carried out today, impacting employees in the Cash App, foundational, and Square divisions of Block. It is reported that approximately 1,000 individuals, which is about 10% of Block's total workforce, were affected.

You can read more (more positive 😀) FinTech industry updates below👇, and I'll be back in your inbox tomorrow!

Cheers,

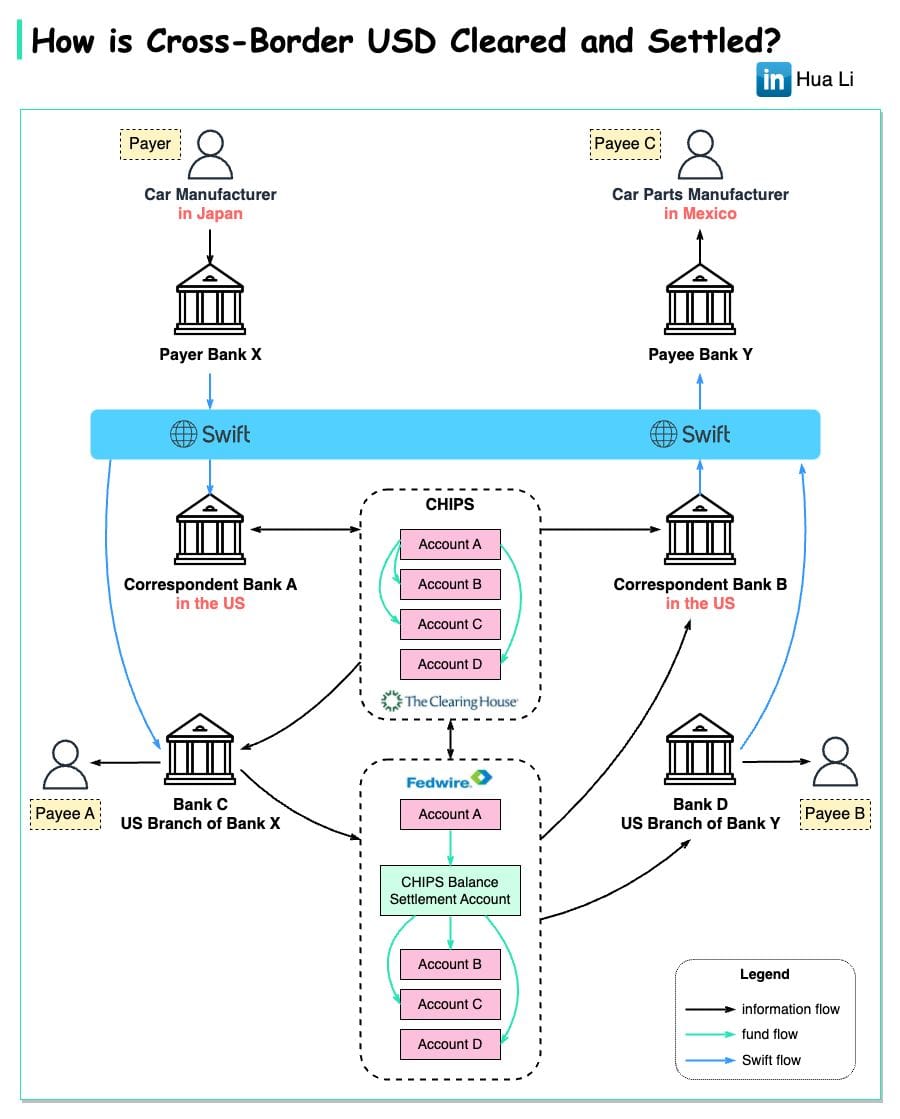

POST OF THE DAY

How is USD cleared and settled in cross-border payments?

#FINTECHREPORT

🇺🇸 Uplinq Financial Technologies, the first global credit decisioning support platform for small business lenders, today announced the publication of “Fair and Accessible Credit for Small Businesses: A Guidebook for Financial Institutions,” a white paper that blueprints how banks and credit unions can leverage AI technology and alternative data to expand lending opportunities for small businesses.

INSIGHTS

Klarna CEO on subscription service: It further accelerates the growth of the business:

FINTECH NEWS

🇺🇸 Lendica and CSG Forte partnership ushers in New Era of embedded business lending. The companies have announced a strategic partnership to deliver an embedded business credit solution to small and medium sized US companies. The offering, called the iBranch, enables SMBs to borrow money from their software vendors instead of traditional financial institutions.

🇬🇧 Super app startup Paysme shuts up shop. The fintech startup aiming to build a financial super app for small businesses in the UK, is winding down. Read the full article for more info

🇺🇸 SellersFi, a global e-commerce financing and financial services company, announced a financing solution with Amazon that will provide eligible Amazon sellers with access to credit lines of up to $10 million through Amazon Lending. This announcement bolsters SellersFi’s expansion as a financial services platform.

🇵🇰 Mastercard and BOK Financial Corporation announce expanded payments agreement. Mastercard and BOK Financial will leverage Mastercard’s network, technology, and services to deliver trust, increase financial access, accelerate innovation, connect consumers with Priceless benefits and experiences and empower small businesses.

OPEN BANKING NEWS

🇦🇪 Fintech Galaxy has announced the launch of its FINX Comply services in the United Arab Emirates. The platform provides swift, cost-effective, and robust Open Banking and Open Finance compliance solutions for financial institutions, including banks and insurance companies.

Open Finance in Latin America. In LatAm, the adoption of Open Finance varies significantly. Countries such as Brazil and Mexico are leading the way with advanced regulations, while others are still exploring their potential. Download the full report for further info.

REGTECH NEWS

Plumery has selected Sumsub as its technological partner to bring a new generation of digital onboarding solution to market. Specifically, Plumery has integrated Sumsub’s capabilities into its new-generation ‘Headless’ digital banking engagement platform.

New Alloy integration expands Cable’s streamlined data integration offerings. For businesses using Alloy, this enhancement means that Cable can now seamlessly retrieve essential data from Alloy that feeds into Cable’s effectiveness testing checks.

DIGITAL BANKING NEWS

€35bn of customer deposits across Europe now held by Electronic Money Institutions. An independent report, commissioned by ClearBank and produced by leading analyst house Celent, finds that EMIs now hold deposits of €35 billion across Europe—an increase of 84% from 2019—but often struggle to find a banking partner that meets their needs.

🇮🇪 Irish savers pile €1m a day into Bunq to beat low domestic savings rates. Dutch neobank says Ireland is its fastest-growing market as it eyes expansion into the UK and America. The digital bank offers rates dramatically higher than the domestic banks.

🇲🇽 Mexico's Banorte launches digital bank bineo, which will offer savings accounts and personal loans with the aim of adding 2.8 million new clients in the next five years. The launch pits bineo against smaller, all-online banks such as Brazil's Nubank and Argentina's Uala.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Web3 payments firm Transak joins Visa Direct to streamline crypto-to-Fiat conversion. The deal allows the Web3 payments infrastructure provider's users in over 145 countries to easily convert crypto into local currencies.

🇺🇸 FTX plans to repay customers in full, drop exchange relaunch. Customers and creditors of bankrupt crypto exchange FTX who can prove their losses will likely get back all of their money, the company told the judge overseeing the insolvency case. More on that here

MOVERS & SHAKERS

🇬🇧 Tide appoints Rebecca Marriott as Chief Risk Officer. Rebecca will continue to provide the expanding fintech with global oversight of all risk classes, compliance, quality control, and enterprise risk management. She is also Tide’s Money Laundering Reporting Officer.

🇺🇸 Block becomes the latest fintech to lay off workers. The company is laying off staff at a tumultuous time for tech industry workers, according to an internal memo from CEO Jack Dorsey, first obtained by Business Insider, which states that “the growth of [Block] has far outpaced the growth of … business and revenue.”

🇬🇧 Mettle announces new CEO, Michelle Prance to drive next phase of growth. Michelle joins Mettle at a pivotal stage in its growth and her experience will be instrumental in helping Mettle to continue to offer simple and effective banking experiences tailor-made to the self-employed community.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()