Monzo’s Next Move: New York or London? What’s Your Bet? 👇

Hey FinTech Fanatic!

Monzo Bank is preparing for a potential IPO, with plans to be "IPO ready" by the end of this year, but faces internal discussions about the listing location. TS Anil, Chief Executive, is reportedly favoring a US listing, while the board prefers the London market where Monzo has over 10 million customers.

The digital bank, valued at $5 billion last year and backed by Alphabet's CapitalG and Tencent, is currently in preliminary discussions with bankers. The discussions are in early stages with no final decisions made, according to people familiar with the plans.

The choice of listing venue for digital banks has become a key topic, with Nik Storonsky, Revolut's CEO, previously expressing preference for a US listing. Monzo, along with Revolut and Starling, is among the FinTech companies expected to boost London's market with potential listings in coming years.

I've created a poll on LinkedIn about where Monzo should list - US or UK market. Head over there to cast your vote and share your thoughts in the comments!

Read more global FinTech industry updates below 👇 and I'll be back tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily Digital Banking updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

#FINTECHREPORT

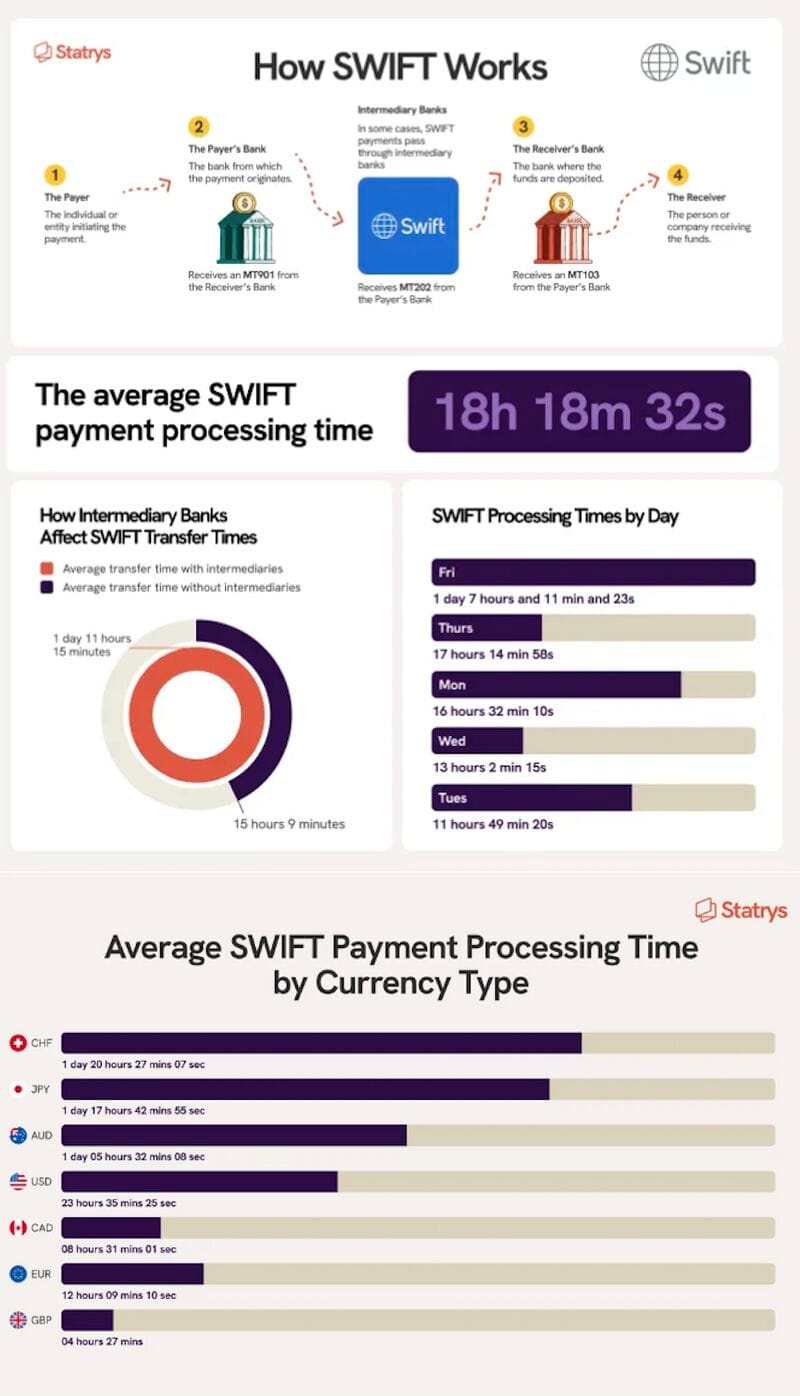

📊 What is a 𝗦𝗪𝗜𝗙𝗧 𝗣𝗮𝘆𝗺𝗲𝗻𝘁? And how long do SWIFT Payments take?

FINTECH NEWS

🇺🇸 Monzo looks to US as board debates where to float. Chief Executive is leaning towards New York listing, while board favours home market of London. The discussions were in the early stages, sources said, and no decisions had been taken.

🇺🇸 Goldman Sachs rolls out an AI assistant for its employees. The program has been called GS AI, with the goal that all the company’s knowledge workers will have it this year. It will initially help with tasks including summarizing or proofreading emails or translating code from one language to another.

🇸🇬 Standard Chartered has introduced SC PrismFX. This offers FI and NBFI clients the convenience of a single provider with an extensive suite of FX currencies and upfront rate transparency, enabling full control over margins and rates for their customers.

🇮🇪 Bank of Ireland shares rise as UK government weighs in on car finance crisis. The UK Chancellor of the Exchequer Rachel Reeves has launched a bid to protect motor finance providers from multibillion-pound payouts that could flow from a landmark supreme court case.

🌏 Maybank Islamic taps audax, AWS for digital banking push. This partnership aims to provide customers with enhanced, user-friendly digital banking experiences built on AWS’ secure cloud infrastructure. The first product launch is anticipated in 2025.

🇳🇱 Plumery launches Digital Lending to fast-track loan disbursements. This offers speed with banks, digital lenders and other financial institutions who can launch their new lending products in as little as 18 weeks, allowing firms to triple their loan portfolio and capacity while maintaining the same staffing levels.

🇬🇧 Gala Technology launches SOTpay Connect to streamline payment processes. The platform is a comprehensive payment gateway that caters to a variety of channels, including open banking, direct debits, omni-channel transactions, and even social media-based payments via text, email, or WhatsApp.

🇵🇭 Philippines’ GCash builds up business beyond payments before IPO. “We’re looking to expand further our lending business and investing platforms that will support our AI work,” GCash President and CEO Martha Sazon said. GCash is in discussions with banks for the potential public offering that will depend on market conditions.

🇮🇩 Amid losses and market decline, can Superbank justify an IPO? The bank is reportedly looking to raise between $200 and $300 million this year. This might seem risky, since the digital bank is still a new entity (launched in June 2024), loss-making, and seeking a valuation that is at a premium to its competitors.

PAYMENTS NEWS

🇫🇷 Mollie is introducing Alma, a buy now, pay later leader in France and Belgium. Alma enables businesses to offer their customers a flexible, seamless payment solution while ensuring secure cash flow and maintaining brand integrity. Find out more

🇪🇬 Visa has introduced Apple Pay to its customers in Egypt, enabling secure and convenient digital payments across various platforms. Apple Pay allows users to make contactless payments in-store by double-clicking the side button on their iPhone or Apple Watch and holding it near a payment terminal.

🇺🇸 Stripe accidentally sent an image of a duck when notifying some employees they were getting laid off. The company laid off 300 staff, equivalent to about 3.5% of its workforce. Those roles were primarily in product, engineering, and operations. The firm also sent impacted staff an incorrect date for the date of termination in an email.

🇧🇷 Appmax, a FinTech specializing in payment solutions for e-commerce and digital businesses, has received authorization from the Central Bank of Brazil (BC) to operate as a regulated Payment Institution (PI). With its own license, the company hopes to hook new customer profiles.

REGTECH NEWS

🇺🇸 Tech Industry sues CFPB over ‘chilling’ effect on digital wallets. The suit focused on the rule which was finalized last November and took effect last month, through which the CFPB has sought to regulate companies tied to payments of more than 50 million transactions on an annual basis.

🇺🇸 Central banks' green push hits a hurdle as Fed drops out. The U.S. Federal Reserve said it would quit the Network for Greening the Financial System (NGFS) because it had "broadened in scope, covering a wider range of issues that are outside of the (Fed's) statutory mandate".

🇲🇹 Gemini selects Malta as MiCA Hub. This strategic decision underscores the dedication to enhancing regulatory compliance and European growth. The company received the Virtual Financial Assets (VFA) Service Licence in Malta in December 2024, and the move will enable it to empower the next era of financial, creative, and personal freedom.

DIGITAL BANKING NEWS

🇺🇸 Nubank CEO considers moving domicile to Britain, expanding in US. David Velez said President Donald Trump's new U.S. administration, which has signalled a likely embrace of regulation for digital assets such as cryptocurrencies, should create a more favourable environment for Nubank to consider entering that market.

🇦🇺 HSBC said to explore options for consumer banking in Australia including a potential sale as the bank looks to further slim down its operations. The consumer banking business could attract other major banks in the country. Continue reading

🇳🇱 De Volksbank renews Ohpen Core Banking contract for investments and loans. Ohpen’s SaaS core banking platform has enabled the financial institution to build, deploy, and measure the impact of innovative new tools and products, such as sustainable investments.

BLOCKCHAIN/CRYPTO NEWS

🇳🇴 Lunar launches crypto in Norway. Lunar Block allows users to buy and sell digital crypto assets securely and transparently directly through the Lunar app. The launch provides Norwegians with an easy, user-friendly way to explore the crypto world while managing their traditional financial services, all in one place.

🇺🇸 Trump effect on crypto undeniable, will lure investment, Coinbase CEO says at Davos. "The Trump effect cannot be denied. To have the leader of the largest GDP country in the world come out undeniably and say that he wants to be the first crypto president," said Brian Armstrong, CEO of Coinbase.

🇺🇸 MicroStrategy buys $1.1 Billion of bitcoin before share vote. The company has been funding Bitcoin purchases through at-the-market stock sales and convertible debt offerings. MicroStrategy plans to raise $42 billion of capital with these offerings through 2027.

🇫🇮 Ovoro launched AI-powered crypto trading platform. The startup is said to be the first fully automated crypto investing app, promising simplicity, safety, and transparency in an industry often overshadowed by volatility and scams. This app lets investors track investments in real time, transfer funds, and withdraw anytime.

🌎 Depay and Satoshi Tango launch QR code to facilitate cryptocurrency transactions in Latin America. This collaboration introduces a system where consumers in Argentina, Brazil, Colombia, and Peru can now use QR codes to make payments in retail outlets, significantly advancing the adoption of cryptocurrency in the region.

PARTNERSHIPS

🌍 Visa strikes multi-year relationship with Disney Europe. The alliance with Disney will bring exciting opportunities for Visa’s customers in the region, including unique benefits and offers across Disney's products and services, access to pre-sales and priority bookings, and invitations to tailor-made events and experiences.

🇵🇰 Mastercard collaborates with Foodpanda to fuel the growth of Pakistan’s digital economy. The partnership introduces initiatives designed to encourage the use of digital payment methods over cash on delivery. Mastercard will drive awareness and usage of secure, rewarding payment options for millions of consumers across the country.

🇬🇧 Omnea partners with Thought Machine to transform procurement governance. The partnership allows Thought Machine to consolidate legacy vendors and unify its third-party risk management processes, procurement intake and approvals, and supplier management processes within a single platform.

🇨🇦 MuchBetter partners with Peoples Group to expand services into Canada . MuchBetter’s latest move aims to bring stylish, cutting-edge wearable tech and to disrupt established industries and product lines. This is part of its rapid growth and expansion plans.

🌍 Worldline teams up with Wix to scale commerce and payment solutions. Through this collaboration, Wix merges its platform to create and manage an online presence and commerce tools with Worldline’s integrated payment acceptance enabled by localised acquiring features to equip merchants with an all-in-one solution.

DONEDEAL FUNDING NEWS

🇮🇹 Qomodo raises $13.9M to expand BNPL for Italy’s main-street retailers. Qomodo claims to now serve 2,500 physical merchants. The idea is to let small businesses improve their cash flow and increase revenue with a BNPL solution that lets consumers make flexible, interest-free installments on items purchased in-store.

🇪🇬 MoneyHash banks $5.2M. The pre-Series A comes around a year after its last funding, when it announced a $4.5 million seed round in February 2024. In total, MoneyHash has raised over $12 million since Nader Abdelrazik and Mustafa Eid launched the Egyptian FinTech in early 2021.

🇫🇷 Karmen secures $9.4 million for its revenue-based financing products. The startup has secured a small funding round so it can improve its instant financing products. The company offers short-term loans to small companies facing a working capital crunch. Read more

🇪🇨 PayMon raises $600K pre-seed round led by Magma Partners. PayMon will use the funds to expand operations in Mexico and Ecuador and add additional payment solutions, including digitizing payments to suppliers and ticket purchases for events, as well as handling payments related to students.

M&A

🇫🇷 myPOS acquires Toporder. myPOS says the acquisition will enable the company to expand its presence in the French “retail, food and beverage sectors by providing integrated payment and cash register solutions tailored to streamline operations, improve efficiency and drive growth”.

🇺🇸 Circle-Hashnote deal looks to ease movement between cash, yield. The Hashnote deal is essentially part of the broader goal of taking the benefits of crypto — constant, globally available market infrastructure — and bringing that over to the TradFi world, lowering costs and boosting efficiency.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()