Monzo's American Dream And N26's Profitability Expectations

Hey FinTech Fanatic!

In a significant move signaling its global ambitions, Monzo, the UK-based digital challenger bank, is setting its sights on international markets, with a particular focus on the American financial landscape.

This revelation was made by Monzo's Chief Executive TS Anil during the recent Financial Times’ Global Banking Summit. Anil highlighted the presence of a "huge gap" in the U.S. market, which presents a lucrative opportunity for Monzo's unique banking model.

Anil's confidence in Monzo's global strategy stems from its successful UK operations, where the bank has demonstrated its ability to win customers at scale and prove its business model. "Monzo has earned the right to dream bigger," Anil remarked, alluding to the bank's impressive growth trajectory in the UK.

The U.S. market, Anil believes, is ripe for disruption by a player like Monzo.

"The American customer needs a product like Monzo," he stated, pointing to the market's size and attractive economics. Interestingly, Monzo is not just eyeing market share but is keen on achieving scale in the U.S., where it already boasts tens of thousands of customers.

While Monzo's European expansion plans are still in the early stages, its U.S. strategy is more defined, focusing on tailoring the right products for American consumers. This customer-centric approach could be key in differentiating Monzo in a crowded marketplace.

In a move that could significantly bolster its expansion efforts, Alphabet, Google's parent company, is reportedly in advanced talks to lead a funding round for Monzo, potentially injecting up to £500m.

Anil remained tight-lipped about these negotiations but acknowledged substantial global investor interest in Monzo.

The expectation of Monzo pursuing a public listing looms large, with Anil acknowledging the bank's potential as a public entity. However, he emphasized the current priority is on scaling up the business, without speculating on the timing or location of a potential initial public offering (IPO).

Monzo's growth strategy also includes potential acquisitions, especially in the FinTech sector, where Anil anticipates consolidation. He highlighted Monzo's strong position to capitalize on this trend, given the bank's appeal as a collaborative partner.

Founded in 2015, Monzo has rapidly ascended to become one of Britain’s leading digital banks, attracting a quarter of a million new customers monthly. Despite reporting a £116m loss in the previous fiscal year, the bank is on track to achieve profitability this year, marking a significant turnaround and reinforcing its position as a major player in the digital banking space.

German Neobank N26 shared their profitability expectations and an upcoming trading product. In partnership with Upvest, N26 will launch a new investment product for stocks and ETFs in the first half of 2024.

Meanwhile down under: The Australian Buy Now, Pay Later (BNPL) industry continues to face significant challenges, as evidenced by the recent collapse of Openpay, a major player in the market. Openpay entered into liquidation after efforts to sell or recapitalize the business proved unsuccessful. This development follows a trend in the sector, highlighted by the downfall of another BNPL firm, BizPay on the same day.

Openpay, which had been struggling since its descent into receivership in February 2023, owed over $66.1 million to creditors and had just $1.2 million in cash left. Despite selling its OpyPro B2B SaaS platform for $10 million, the company failed to recover, leading to its removal from the ASX in August. Its failure to turn a profit since its stock market debut is reflective of the broader challenges facing the BNPL industry in Australia.

BizPay, specializing in B2B BNPL services, also succumbed to similar issues, including cash flow problems and inability to attract new investment. The Australian BNPL market has seen a drastic reduction, with only two of the original twelve listed companies surviving. This contraction contrasts with the growth of larger financial entities like Visa and Standard Chartered in the BNPL space, underscoring the difficulties faced by standalone BNPL startups in competing against these giants.

Enjoy more FinTech industry news I listed for you below, and I'll be back for more tomorrow!

Cheers,

POST OF THE DAY

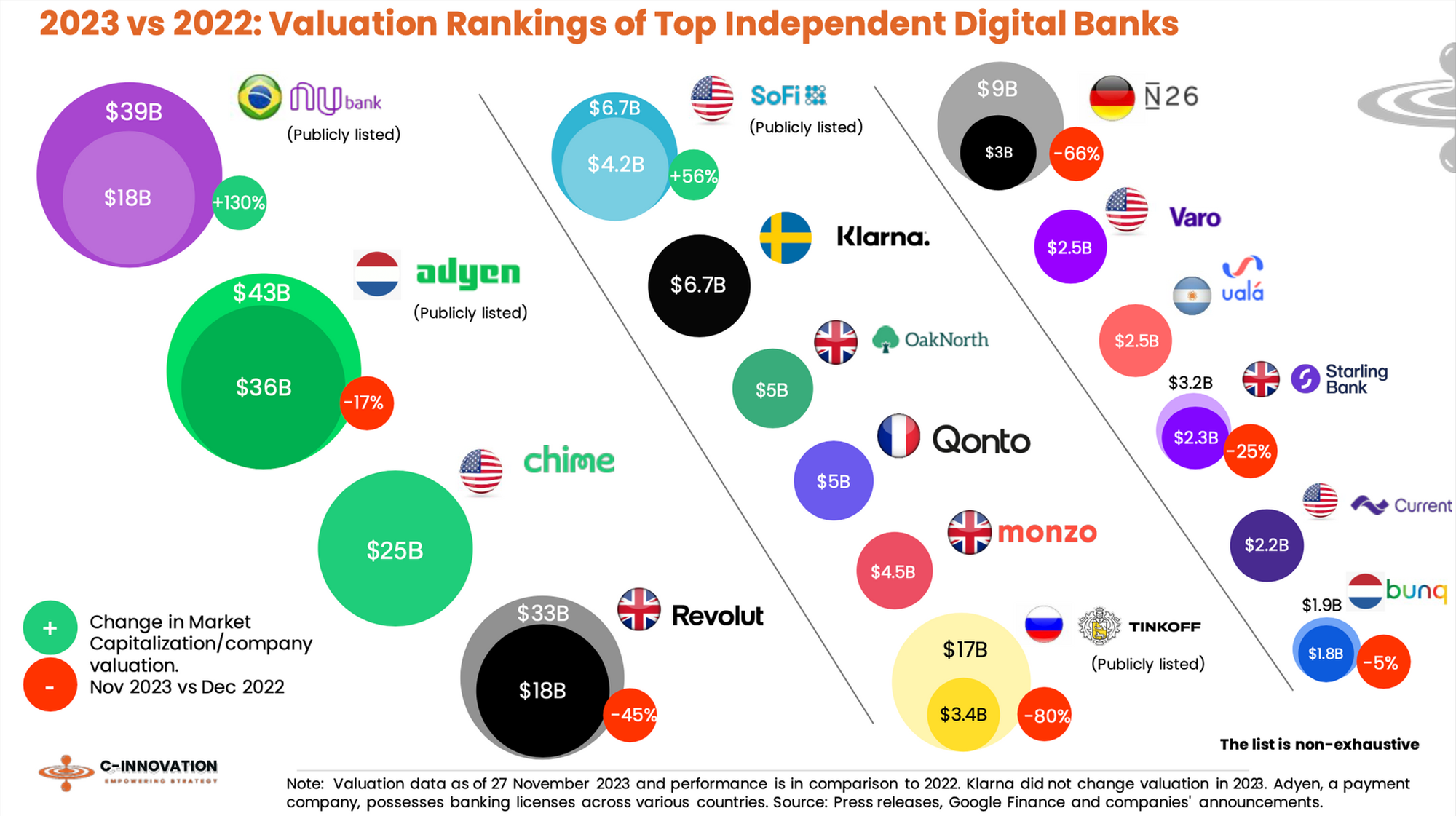

In 2023, the banking sector faced a crisis that significantly affected the market value of many digital banks. Explore the full piece to learn more

FEATURED NEWS

🇧🇷 PayRetailers, a Spanish payment processing company focusing on Latin America, has recently appointed Daniel Moretto as its Country Manager in Brazil. The hiring of the executive aims to expand the company's presence in the local market. Read on

#FINTECHREPORT

Financial Services State of the Nation Survey 2023 shows that Banking as a Service (BaaS), embedded finance, and AI are taking center stage, enabling financial institutions to offer the seamless, personalized experiences that customers increasingly demand. Download full report here

INSIGHTS

Stripe processed more than $18.6 billion over Black Friday and Cyber Monday, being the largest ever four-day period on Stripe with more than 5 million new Stripe Billing subscriptions created, along with other advantages. Explore mind-blowing stats here

FINTECH NEWS

🇦🇪 CredibleX unleashes Next-Generation lending solutions with new ADGM licenses and targets 20,000 companies in 2024. CredibleX is a game-changer for the region as its embedded finance approach enables businesses to provide their SME customers with instant access to lending solutions at scale.

Mastercard and Warply to drive digital transformation in MENA. The ulterior motive of the collaboration remains to infuse greater digitization within diverse sectors of the following MENA countries, Kuwait, Qatar, Oman, the UAE and Pakistan.

🇲🇾 CP Global Fintech Solutions has launched its digital investment platform Airo with the aim to democratise investing in the country by offering services starting from RM50. The platform simplifies investment for beginners and offers advanced options for experienced investors.

🇬🇧 Teya is taking the next step on its path to becoming an all-in-one business solutions provider with the launch of the Teya Business app. The company’s new app is designed to empower business owners with a comprehensive suite of tools. Read more

🇧🇷 Somapay partners with Fortes Tecnologia to introduce FortesPay, a new fintech solution that simplifies payroll management and offers banking services to employees. The solution enables accountants to complete payments and generate data files for client companies.

PAYMENTS NEWS

🇨🇦 Stripe picks Everlink for host-to-host Interac debit processing services. The multi-year agreement supports both contact and contactless debit transactions in Canada. As part of the agreement Everlink will ensure all Stripe devices are current with Interac operating regulations through their device certification services.

Checkout.com appoints Standard Chartered as banking partner in Mena. The partnership leverages advanced technology for seamless payment system integration, empowering Checkout.com's growth in the Middle East.

🇿🇦 Scan to Pay, powered by Ukheshe, the largest QR payment ecosystem in South Africa, is thrilled to announce a significant expansion of its voucher system. This new phase allows South Africans to buy and share Scan to Pay vouchers in the app, providing access to a vast network of 600,000+ locations.

OPEN BANKING NEWS

🇬🇧 ClearScore taps Plend to offer open banking-powered loans. The two fintechs are partnering to help more consumers get access to loans that might typically be turned down because of their credit scores.

DIGITAL BANKING NEWS

🇬🇧 10x banking integrates with Trade Ledger to offer banks and alternative lenders a modern, composable banking proposition that helps banks provide working capital to small to mid-sized enterprises. Read on

🇦🇪 Dubai’s Ajman Bank has initiated a strategic partnership with Mastercard to launch cross-border payment services for person-to-person (P2P) fund transfers through the bank’s Digital Banking application. The collaboration will enable Ajman to provide real-time remittances to over 40 countries via its digital banking platform.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Fintech firm SoFi set to exit cryptocurrency business and has given its customers the option to migrate to UK-based Blockchain.com. The company said it was ending its crypto services on Dec. 19, and starting Wednesday, new SoFi crypto accounts cannot be opened.

🇺🇸 Jack Dorsey spearheads $6.2M investment in revolutionary Bitcoin mining pool OCEAN. The innovative venture is set to redefine the landscape of Bitcoin mining by introducing a non-custodial payout system that directly disburses earnings to miners.

DONEDEAL FUNDING NEWS

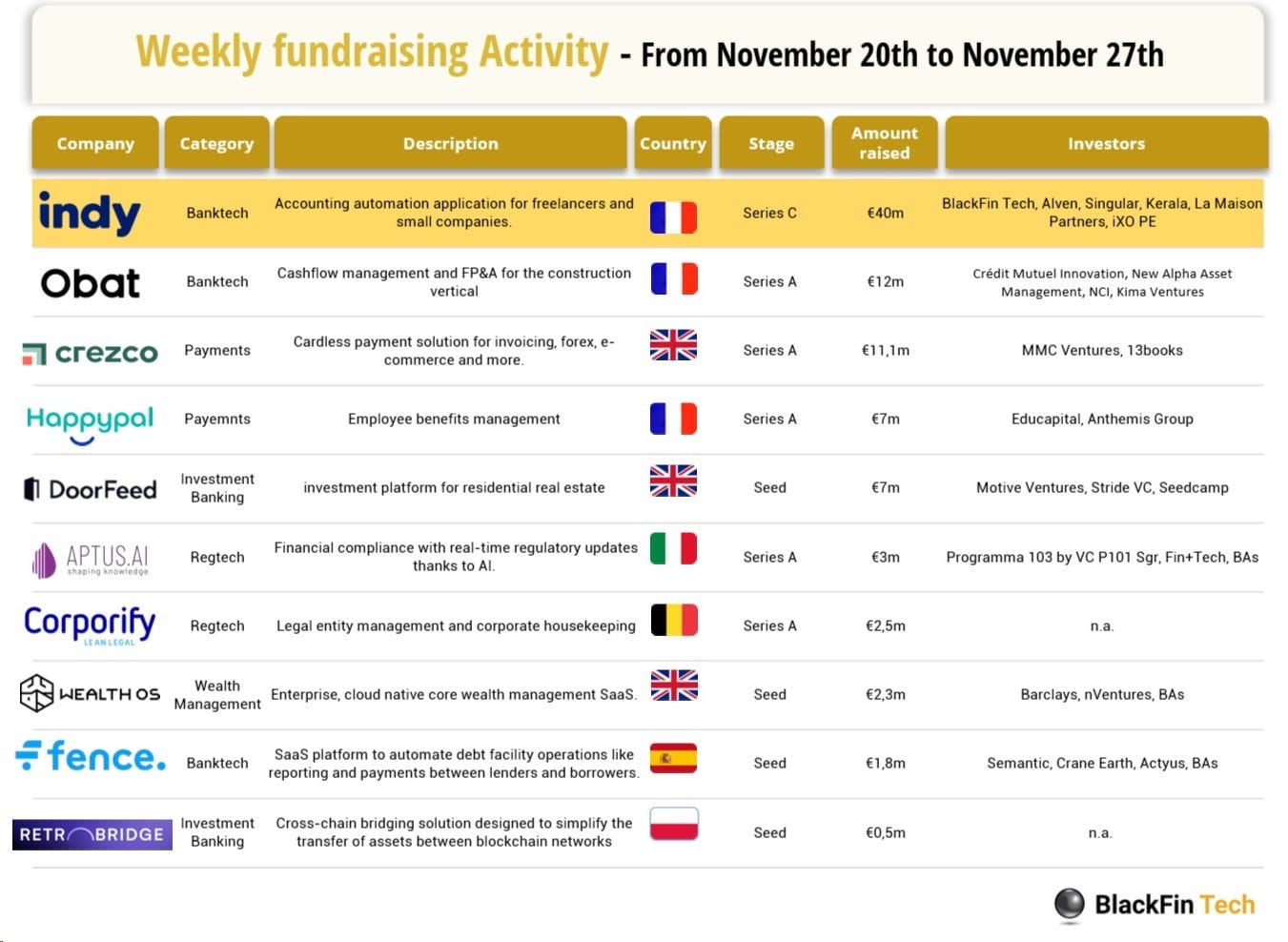

In the past week, we saw 13 deals in Europe for a total amount of €87.9m raised officially with three deals in France, three in the UK, one in Italy, one in Belgium, one in Spain, one in Poland and one in Luxembourg. Link here

🇧🇷 BomConsórcio, a fintech company operating in Brazil's secondary consortium market, successfully raised R$ 96.1 million. The fintech serves major consortiums in the country, including Santander, Itaú, CNP, and others. Read more

🇧🇷 Brazilian Fintech Contbank opens investment round to expand its digital credit platform. With funding from Captable, the company plans to develop and enhance innovative financial solutions, including the expansion of its digital credit platform.

🇸🇻 Cubo raises USD$3.5 million round and arrives in Guatemala after successfully establishing itself in El Salvador and Panama. Cubo connects with 10,000+ businesses in Central America, with 40% led by women, supporting regional financial and technological inclusion goals.

🇬🇧 Paysend, a global fintech leader in international money transfers, has raised $65 million in its latest funding round including strategic investment from Mastercard. Paysend's latest funding builds on its previous Series B round, securing $125 million to further expand its global payments platform.

🇬🇧 Nucleus Commercial Finance lands £200m funding from NatWest. The new funding line from NatWest will help Nucleus lend to another 2000 SMEs using the fintech lender’s AI-powered automated underwriting system.

M&A

🇲🇽 Flink, Mexico's first investment platform, known for its unique offering of commission-free fractional shares in U.S. companies and a promoter of Mexican retail investment, has been acquired by Webull Corporation ("Webull"), a globally recognized trading platform with over 40 million downloads.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()