Monzo Hits 10 Million UK Customers as Kuda's Revenue Triples

Hey FinTech Fanatic!

Monzo has reached a significant milestone, surpassing 10 million personal customers in the UK. This achievement comes after Monzo's first full year of profitability, a major funding round, and several new product launches.

With this growth, Monzo now serves 1 in 5 UK adults and over 450,000 business customers.

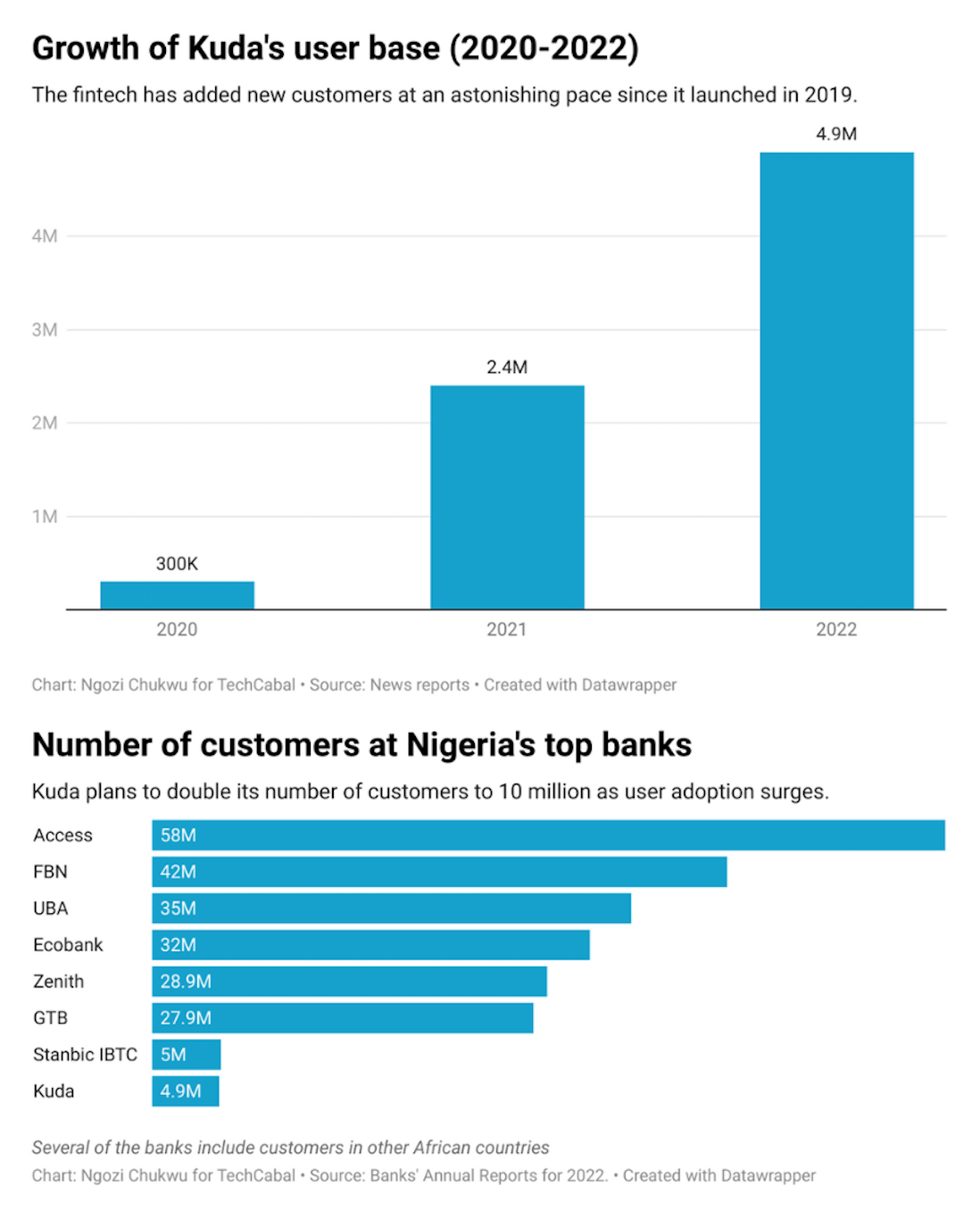

In Africa, Kuda, a neobank focused on Nigeria and backed by Target Global, has also made significant strides.

Kuda's revenue tripled, growing by 190% to $22 million in 2022. The user base doubled from 2.4 million to 4.9 million. Based in the UK, Kuda operates primarily in Nigeria through Kuda MFB, a microfinance banking subsidiary.

Kuda has launched new products like international remittances and is expanding into markets such as the UK, Canada, Ghana, Tanzania, and Uganda.

By January, Kuda had reached 7 million users. Total deposits surged from $41 million in 2021 to $100 million in 2022, with business deposits increasing dramatically.

Kuda's total assets grew by 30% to $154 million, with most assets tied to its Nigerian operations. The company is diversifying its revenue streams, earning $3.5 million from treasury investments in Nigeria. Kuda's focus on treasury investments grew as the Central Bank of Nigeria raised interest rates.

Despite this growth, Kuda’s losses have increased, posting a net loss of $32 million in 2022, doubling from the previous year due to higher staffing and operating costs.

Kuda has reduced its marketing spend to manage its financial resources better.

The neobank, last valued at $500 million, has raised $74 million and had $33 million in cash at the start of last year.

Although Kuda's losses are significant, CFO Frederic Bidet stated that the company is making progress towards breakeven and does not need immediate fundraising.

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

POST OF THE DAY

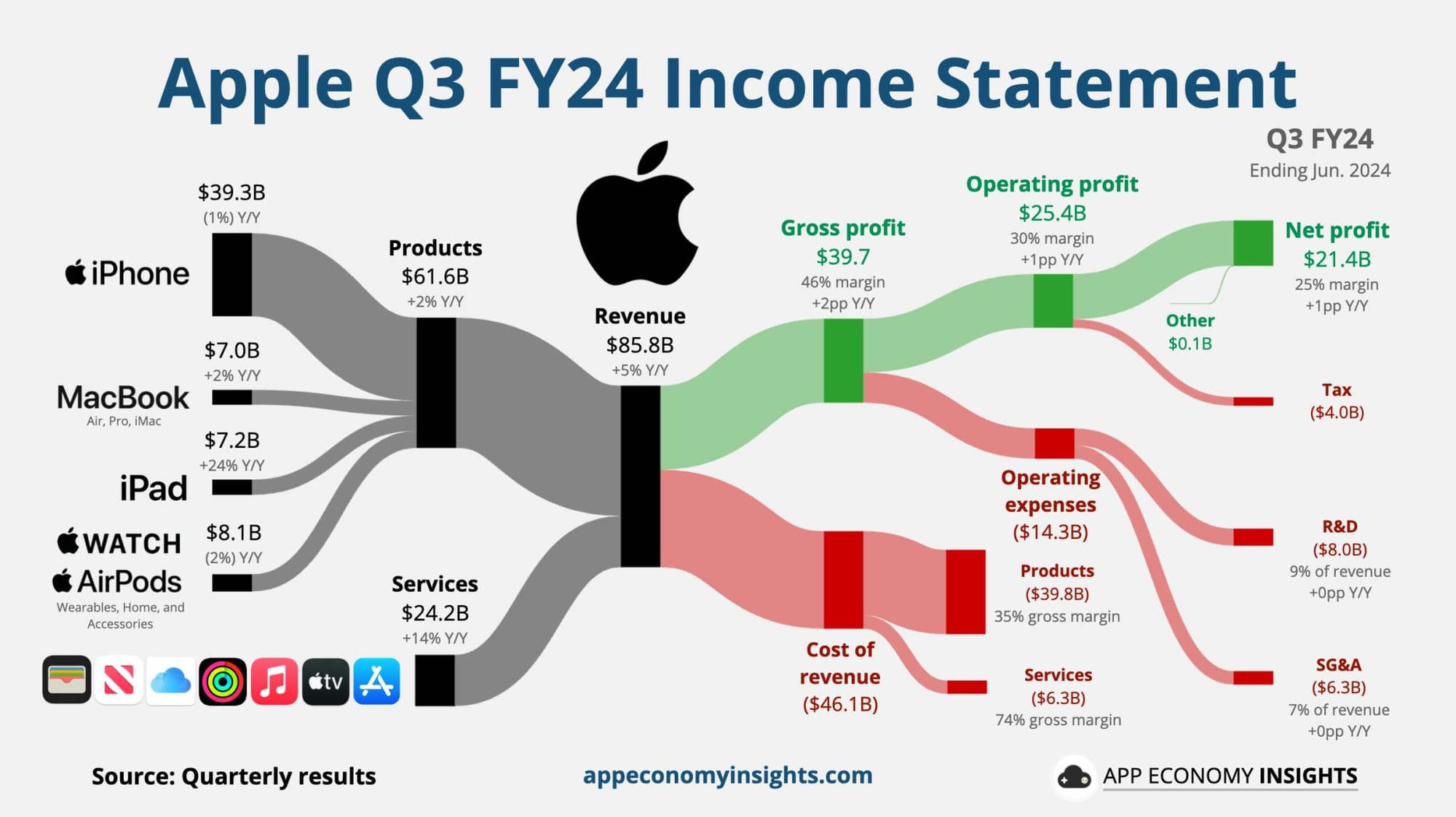

📈 Apple's services revenue reached a record $𝟮𝟰.𝟮 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 for the latest quarter, marking a 14% year-over-year increase, boosted by the expansion of Apple Pay features.

FEATURED NEWS

📜 Two more former Wirecard executives charged in sprawling criminal investigation. Ex-finance chief and former chief product officer accused of having failed to fulfil legal obligations to now-collapsed group. Click here to learn more

INSIGHTS

Why did crypto markets have such a horrible Monday? That's the big question after the weekend. Over the past days, global stocks have plunged, volatility has soared, and investors are fleeing to havens like bonds.

Ethereum plummeted 23% to around $2,250, while Bitcoin crashed 16% to around $51,000. It briefly fell below $50,000 for the first time since February before it recovered.

So what's going on? DL News explains: Access the full article

FINTECH NEWS

🇺🇸 Papaya Global, the ultimate workforce payroll and payments platform, and Cegid, a European leader in cloud management solutions for professionals in the finance (treasury, tax, ERP), human resources (payroll, talent management), accountancy, retail and entrepreneurship sectors, today announced their partnership offering clients a holistic solution for hiring, managing, and paying their global workforce.

🇵🇭 Billionaire Jack Ma and one of the richest clans in the Philippines both notched wins as the company running the most popular e-wallet service in the archipelago raised new funds at a $5 billion valuation. Read on

🇺🇸 Wall Street expects Robinhood's revenue to hit record highs in the second quarter as retail investors flock to its commission-free app to trade so-called 'meme stocks' and cryptocurrencies. The return of influencer Keith Gill, aka "Roaring Kitty", rekindled investor appetite for retail favorites like GameStop, luring mom-and-pop investors back to Robinhood.

🇫🇷 India-based JioFinance has launched in Paris, France to facilitate international transactions for Indian visitors during the Olympic Games. Specifically, JioFinance will facilitate international transactions for Indian visitors.

🇨🇳 Online brokerages Futu, UP FinTech suspend night trading of U.S. stocks. Futu Holdings and UP FinTech Holding, known for helping Chinese investors buy global stocks, have told clients that night trading of U.S. shares would be suspended on Tuesday after a surge in global market volatility.

PAYMENTS NEWS

🇺🇸 J.P. Morgan Payments announced an expanded relationship with PopID to deploy in-store biometric payments to pilot merchants across the United States. The pay-by-face biometric payment solution allows shoppers to complete transactions more seamlessly, removing the need for customers to pull out their phones or credit cards.

🇪🇺 Vodeno and Aion Bank to offer BLIK-as-a-service to financial institutions across Europe. This cooperation will enable both Vodeno and Aion Bank, which participates in the BLIK system as an issuer, to offer FinTechs, banks and other financial institutions access to BLIK services.

🇮🇪 Translink completes rollout of contactless payments. The transport provider said that passengers could now use contactless on all bus and train journeys. Some Ulsterbus and Goldliner services were the last to receive the update, which was first introduced to some Translink services in March 2022.

DIGITAL BANKING NEWS

🇬🇧 Monzo announces that it has surpassed 10 million personal customers in the UK. The milestone follows Monzo’s first full year of profitability, a bumper funding round and multiple product announcements. Monzo now serves more than 10m personal customers - 1 in 5 adults in the UK - and more than 450,000 business customers in the UK.

🇺🇸 A US Senate investigation is shedding light on just how often America’s big banks refuse to reimburse victims of fraud. The Permanent Subcommittee on Investigations says JPMorgan Chase, Wells Fargo and Bank of America collectively refused to reimburse $880 million in Zelle transactions that customers reported as fraud between 2021 and 2023.

🇺🇸 Marqeta signs five-year deal with Varo Bank to become exclusive issuer processor in the US. This partnership with Marqeta enables Varo to offer cutting-edge card issuing technology, giving their customers enhanced ability to view and manage their transactions efficiently.

🇸🇬 Revolut has launched Revolut Business in Singapore, first market in Asia. Businesses will get full financial control with corporate cards, custom spending rules and automated accounting on the B2B payments platform, says Revolut.

🇫🇷 France doesn’t have a consumer neobank. That might be about to change. With both French legacy banks and overseas neobanks competing, the race to become the go-to consumer neobank in France is heating up. Read the complete analysis here

🇳🇬 Kuda, the Target Global-backed challenger bank, tripled revenue to $22 million in 2022. Over the last two years, the company has focused on launching new products, such as international remittances, and is expanding to new markets, including the U.K., Canada, Ghana, Tanzania, and Uganda.

🇺🇸 Totem, a neobank designed to serve Native American communities, is shutting down due to funding difficulties. Despite its mission to provide financial services to an underserved population, Totem faced insurmountable financial challenges that led to this decision.

🇺🇸 Arizona-based Vantage West Credit Union has introduced a new digital banking start-up designed for freelancers, HUSTL Financial. With this, HUSTL supports a wide array of banking services, including high-yield savings and interest-earning checking accounts, and certificates of deposit (CDs).

BLOCKCHAIN/CRYPTO NEWS

🇩🇪 IOTA, an open-source distributed ledger technology (DLT) for Web3 applications and digital economies, announces that the IOTA token is Shari’a-compliant. This certification by the Cambridge Institute of Islamic Finance states that the IOTA token fulfills all accepted Shari’a principles and standards.

DONEDEAL FUNDING NEWS

🇲🇽 Mexico FinTech Stori closed a new funding round worth $𝟮𝟭𝟮 𝗺𝗶𝗹𝗹𝗶𝗼𝗻, in a mix of equity and debt financing that includes Goldman Sachs Group Inc., to boost investments and expansion to other markets. The investment will allow the company to move forward with a plan to invest 7 billion pesos (about $𝟯𝟲𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻) in Mexico over the next two years.

🇪🇬 Egypt-based FinTech Qardy has raised a USD seven-figure pre-Seed round, invested by White Field Ventures, Vastly Valuable Ventures, along with other angel investors. The infusion of new capital will enable Qardy to further enhance its platform capabilities, expand its service offerings to other MENA countries.

🇨🇦 Layer2 raises over $10 million for cross-border B2B payments offerings. The new funding will allow Layer2 to enhance its infrastructure, which uses fiat and digital currencies to securely move billions of dollars per year. Read on

🇪🇬 Cartona has raised $8.1 million in a Series A extension fundraise to continue growing the product rollout, verticals and offerings of its B2B platform for businesses in Egypt and, in the future, other markets in the Middle East and North Africa (MENA) region.

🇬🇧 New figures, published by KPMG, show that the UK had a near tripling of FinTech investment to $7.3bn in the first half of 2024 but global FinTech investment fell by 17 per cent period-on-period. The figures show the UK FinTech sector seeing signs of recovery, compared to the giddy heights of 2021.

M&A

🇺🇸 NCR Voyix enters definitive agreement to sell digital banking to Veritas Capital for $2.45 billion purchase price. The transaction has been approved by NCR Voyix’s Board of Directors and is expected to close by year-end, subject to customary closing conditions, including regulatory approvals.

MOVERS & SHAKERS

🇺🇸 Los Angeles-based investment bank Houlihan Lokey has hired Andrew Atherton, a former partner at Union Square Advisors, as a managing director in its FinTech group. Atherton will be based out of San Francisco and will “cover multiple FinTech sectors as well as FinTech-adjacent enterprise software companies” as part of his new remit.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()