Monzo Employees Set to Cash in as Valuation Hits to £4.5 Billion

Hey FinTech Fanatic!

Monzo’s valuation is on the rise, now hitting £4.5 billion, and it’s giving hundreds of its employees a chance to profit from the boom.

The digital banking powerhouse announced a secondary share sale backed by some of the world's top tech investors. This sale will allow employees to sell a slice of their stakes as they gear up for the future. This comes just weeks before Chancellor Rachel Reeves is anticipated to hike the capital gains tax rate in her inaugural budget—talk about timing!

With over 10 million customers and a solid profitability track record, Monzo continues to shake up the UK banking scene. But that’s not all—Monzo’s latest moves signal big ambitions. From launching new pension products to rolling out accounts for under-16s, they’re rapidly expanding their reach and influence.

The bank, now one of Britain’s largest by customer count, is eyeing an IPO, and this share sale could just set the stage.

What do you think about this move? Tell me more in the comments!

Have a great weekend and I’ll be back on Monday with more FinTech news!

Cheers,

FEATURED NEWS

🇬🇧 Monzo staff to sell shares as valuation soars again. Hundreds of employees of the digital bank Monzo Bank are being given the opportunity to sell part of their stakes in the company as its valuation soars to £𝟰.𝟱𝗯𝗻. Sky News has learnt that Monzo notified staff on Thursday that it was launching a secondary share sale.

#FINTECHREPORT

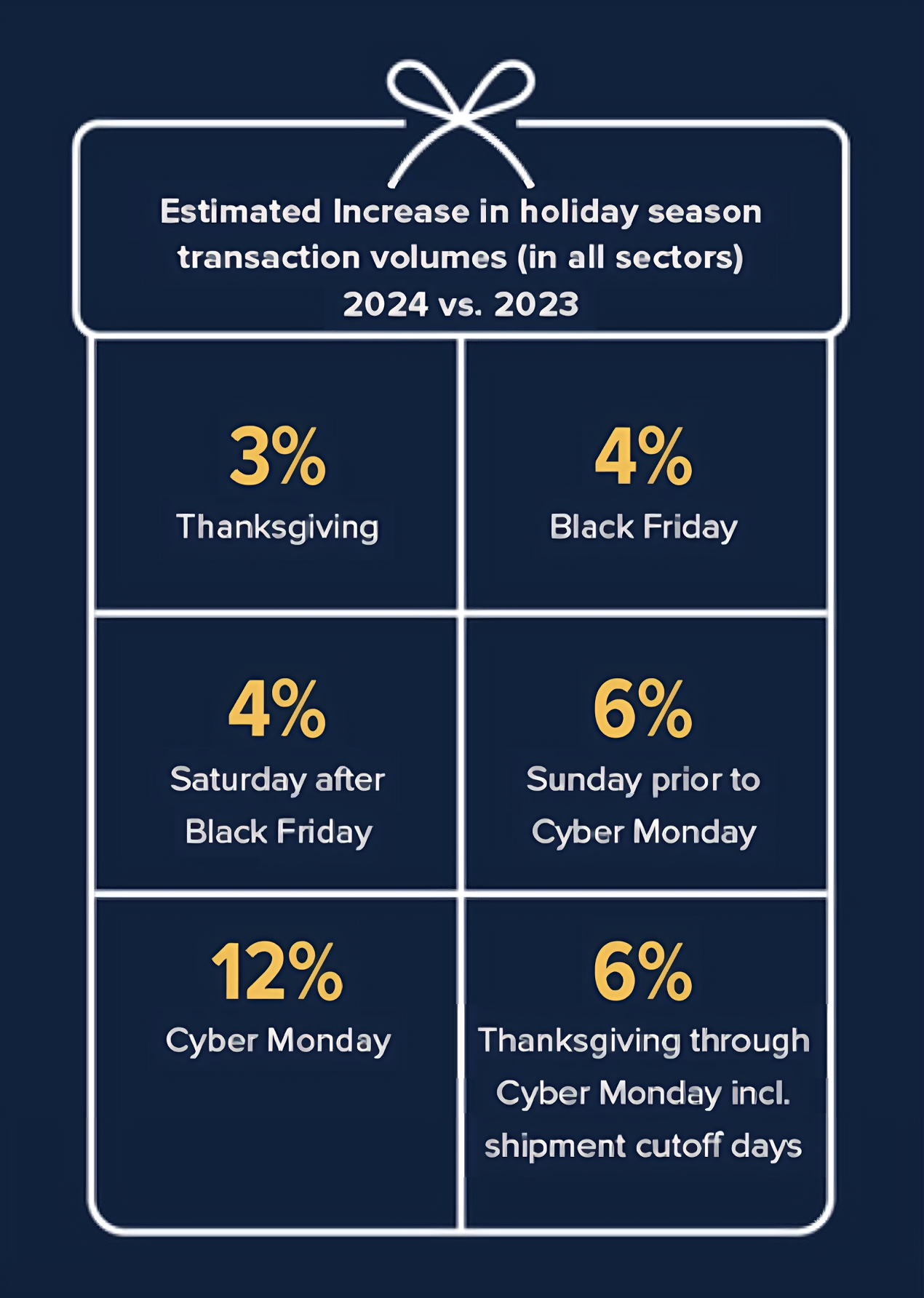

📊 ACI’s Unwrapping Checkout Trends report anticipates a 16% increase in global eCommerce transaction value during the 2024 holiday season, with the travel sector leading the growth. Find out more

INSIGHTS

🇸🇪 Klarna Director, Mikael Walther, says he was ousted over CEO bonus objection. The Klarna board member said his counterparts voted to oust him after challenging governance decisions, including a bonus plan that could give CEO Sebastian Siemiatkowski up to $𝟯𝟱 𝗯𝗶𝗹𝗹𝗶𝗼𝗻.

FINTECH NEWS

🇬🇧 MyGuava teams up with QPR to unveil the MyGuava QPR Card Programme and offer exciting rewards with every purchase. Users can download the MyGuava app, order a QPR Reward Card, and start earning perks like branded merchandise or exclusive fan experiences, including VIP seats and training session visits.

🇬🇧 UK unicorn Zilch plans to boost headcount by 150 to 450 as says on target for full-year profit. The firm currently has around 300 staff in the UK, but the CEO said Zilch plans to grow its headcount in the next 18 months. Hires will include management roles, data scientists and data engineers.

🇺🇸 MoneyGram says hackers stole customer data. MoneyGram confirmed that last month's cyberattack led to the theft of customer data, including bank account numbers, by an unauthorized third party. The breach affected personal information of certain consumers.

🇦🇷 MercadoLibre posts record Argentina sales amid consumer rebound. A record 20 million products were sold on its platform in August, worth the equivalent of $916 million, the company announced Tuesday in a press release. Read on

🇬🇧 Anna Money bids to beat criminals with biometric re-authentication checks for account holders. Anna is one of the first financial institutions in the UK to implement trail-blazing biometric ‘re-authentication’ procedures to stop criminals from using accounts they may have accessed illegally.

💰 How Safe Is Your Money in a FinTech, Really? In the wake of Synapse’s collapse, the FDIC proposed a rule in September that would require banks to closely monitor accounts maintained by their FinTech partners. Read this comprehensive article to learn more.

PAYMENTS NEWS

🇺🇸 Stripe has announced new features to help businesses accelerate their growth. The updates were part of Stripe Tour New York, the company's annual product showcase in NYC. Click here and discover the 6 most recent updates

🇺🇸 FreedomPay and Stripe team to streamline enterprise payments. Together, the companies will provide enterprises flexibility and modularity, allowing them to add Stripe to an existing set of commerce tools without requiring significant development resources.

🇸🇬 Alipay+ transactions triple in 2024 as travel industry embraces cross-border digital payment and marketing technology. As of October 2024, Alipay+ has over 30 payment partners, including top e-wallets and bank apps, reaching 1.6 billion consumers and connecting them to 90 million merchants across 66 markets.

🇬🇧 Revolut Business enables UK merchants to accept American Express. The collaboration enables American Express payments via Revolut Gateway, Payment Links, and Tap to Pay on iPhone, with more in-person solutions coming later this year.

🇬🇧 Vodafone, Sumitomo Corporation, and Mastercard team up to advance the economy of things. The new embedded payments technology will launch in the UK and roll out across Europe, enabling autonomous payments between machines in the freight, shipping, fleet and logistics industries.

🇳🇴 MeaWallet and B89 join forces to enhance digital payments with advanced tokenization. Through this partnership, MeaWallet delivers tokenization services that support B89's vision of secure and seamless digital payments, including the integration of MeaWallet's SDK Push Provisioning.

🇿🇦 Mastercard accelerates the path toward real-time card payments. Mastercard announced that South Africa will be the first market to experience immediate card payments, enhancing security and speed. Through product innovations and strategic partnerships, Mastercard will enable acquiring banks to process these real-time transactions.

📲 Who are buy now, pay later borrowers, and what are they buying? As Amazon's Prime Day kicked off the holiday shopping season this week, U.S. consumers are expected to spend a record $18.5 billion using BNPL for purchases in the last quarter of the year, according to projections by data firm Adobe Analytics. Discover everything you need to know in this insightful article

OPEN BANKING NEWS

🇳🇿 New Zealand Banking Association choose obconnect to deliver Confirmation of Payee ecosystem. Starting November 2024, obconnect will provide Confirmation of Payee services to major New Zealand banks. This feature gives customers added reassurance by ensuring the account name matches the account number before domestic payments are made.

DIGITAL BANKING NEWS

🇬🇧 COGO partners with green bank, Tandem, to help customers lower their carbon footprint. Through the integration with Cogo’s services, Tandem will also open up the app to all consumers in the UK, irrespective of whether they are Tandem customers or not.

🇺🇸 Capital One debuts AirKey to help banks lock out fraudsters. Developed over the past seven years by Capital One, the tool transforms credit and debit cards into a tap-based authentication method, providing financial institutions with a convenient new tool to combat fraud.

🇺🇸 Lakeside Bank selects Volante’s PaaS for RTP processing. The technology will assist Lakeside in deploying real-time payment and treasury services through both the RTP system operated by The Clearing House and FedNow, which the Federal Reserve launched in July of last year.

🇹🇷 tbi bank Opened Its Own Technology Hub in Türkiye. With this strategic move, the bank aims to not only accelerate the development and integration of innovative services into its products, but also expand its access to international talent.

🇬🇧 New HSBC boss ‘ready to cut jobs of senior bankers to save $300m’. Georges Elhedery, who took over as chief executive last month, is planning to remove a layer of senior bankers as part of a restructure that would result in the bank’s global banking and commercial banking units merging.

🇸🇪 Multitude Bank acquires 9.9% stake in Norway-based LEA Bank ASA. The bank has also signed an agreement to acquire an additional 8.7 per cent stake, subject to approval by the Norwegian Financial Supervisory Authority and the Swedish Financial Supervisory Authority.

🇮🇹 Banca Sella adopts TQ Braille for accessible banking services. This technology, which incorporates a QR code, enhances accessibility for blind and visually impaired individuals by providing them with information about the bank’s products, services, and initiatives.

🇬🇧 Britain's TSB bank fined for unfair treatment of customers. The bank has been fined 10.9 million pounds ($14.25 million) for failing to ensure customers in arrears were treated fairly, the markets watchdog said on Thursday.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Ripple launches crypto storage services for banks in bid to diversify. The company told CNBC it is debuting a slew of features to enable its banking and FinTech clientele to keep and maintain digital tokens — as part of a broader push into custody, a nascent business for Ripple under its recently formed Ripple Custody division.

DONEDEAL FUNDING NEWS

🇧🇷 Asaas secures R$820m in Series C funding to fuel SME financial automation expansion. The fresh capital will be used to bolster operations, enhance research and development, and support inorganic growth through strategic acquisitions, aimed at rapidly diversifying and enriching Asaas's solutions.

🇺🇸 FlexFactor raises $16.8M Series A to tackle payments failure. FlexFactor takes a novel approach to rejected payments by covering the cost if a bad one slips through. The company leverages data and AI to reliably predict in real-time whether a payment failure was legitimate or an error.

M&A

🇬🇧 Pockit, a financial services business for the “unbanked”, has acquired Monese, an HSBC-backed rival, creating a combined business serving three million customers. The acquisition follows Monese's failed funding attempt and 2022 pre-tax losses of £30.5m, despite revenues rising to £27.7m. The terms of the deal were not disclosed.

🇬🇧 ClearCourse acquires B2B eCommerce platform GOb2b. The acquisition of GOb2b by ClearCourse enhances their software and payment solutions portfolio, offering integrated eCommerce features like live search, pricing updates, and complex shipping management.

🇦🇺 Banked has acquired Australian payment technology firm Waave. The acquisition positions Banked as a leader in Australia’s Pay by Bank market and enhances its account-to-account payment solutions and supports the shift toward real-time payments in Australia and beyond.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()