Middle East's FinTech Leap: The Rapid Transformation of Digital Banking

The digital banking sector in the Middle East is undergoing a significant transformation, marked by an impressive surge in digital payment adoption and technological advancements.

This change is particularly noteworthy considering the region's substantial population of 450 million and a robust GDP of $4.8 trillion, creating a fertile environment for digital financial services.

At the forefront of this digital shift are the Gulf Cooperation Council (GCC) countries, where smartphone penetration has reached a remarkable 91%. This high rate of smartphone usage signals a growing preference for online banking services among consumers and indicates a move away from traditional cash transactions. This trend is further accelerated by strategic initiatives like "Vision 2030," which aim to transition the economy towards a more technology-driven model, thereby facilitating the growth of digital banking.

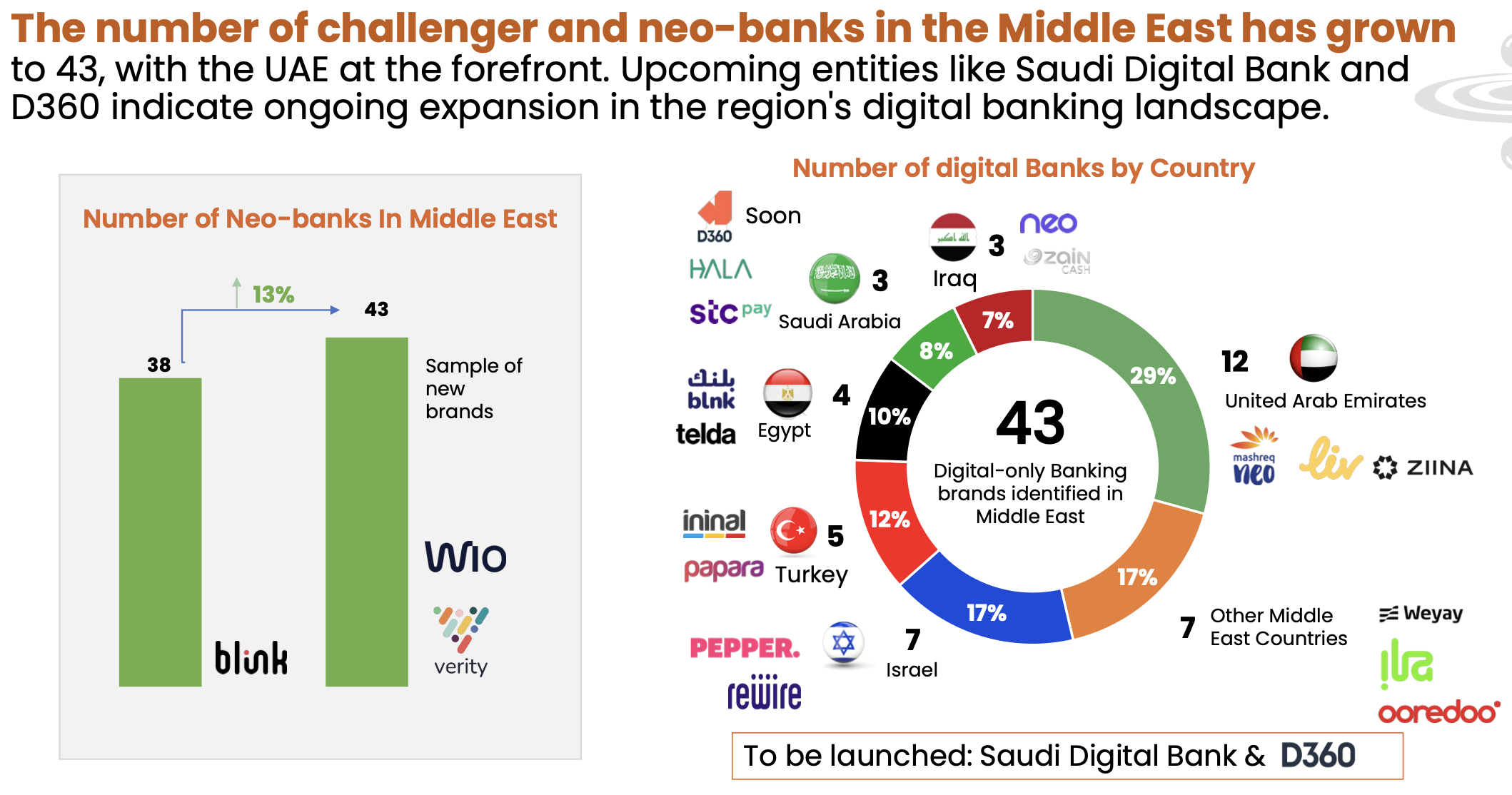

The landscape of the sector is dynamic and competitive, with the presence of 43 challenger and neo-banks.

The United Arab Emirates stands out as a key driver of this growth. Moreover, the imminent launch of new entities such as the Saudi Digital Bank and D360 adds to the vibrancy of the sector.

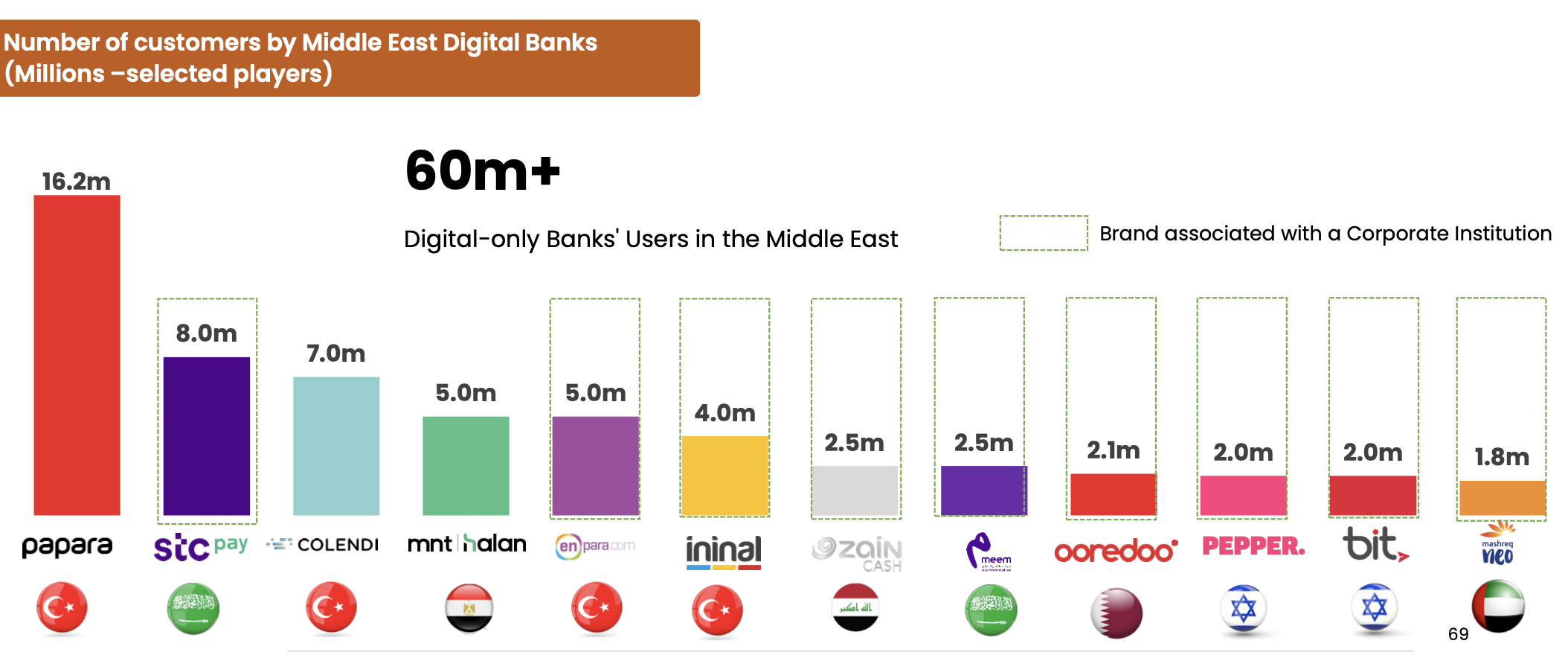

The reach of digital-only banking platforms is extensive, with over 60 million users, underscoring the sector's significant advancement.

The progress in digital banking is also evident in the strategic corporate partnerships and investments that are being made, reflecting a strong commitment to innovation in digital finance.

In terms of service offerings, Middle Eastern digital banks are concentrating on making their services affordable and accessible. They are adopting a user-centric approach and introducing tailored features, such as loyalty programs aimed at younger customers.

The rise of specialized products like multi-currency and expatriate-focused accounts also highlights the sector's responsiveness to diverse customer needs.

A key aspect of the region's digital banking landscape is the distinct market conditions across various countries. Each country presents its own set of opportunities and challenges.

For instance, Egypt represents a largely untapped market with significant growth potential, while Israel, being a more mature and competitive market, demands innovative strategies for businesses to differentiate themselves and capture market share.

This diversity in market conditions underscores the complexity and dynamism of the digital banking sector in the Middle East.

Download the complete C-Innovation source report for more interesting info, stats, figures, and use cases.

Comments ()