Mesh Payments Partners with SoFi Bank and Galileo to Revolutionize Expense Management

Hey FinTech Fanatic!

Mesh Payments is shaking up corporate travel and expense management with a game-changing partnership with SoFi Bank and Galileo Financial Technologies. By integrating Mesh's expense solutions with SoFi Bank's scalable financial framework and Galileo’s API-driven payments platform, the collaboration promises faster innovation and streamlined enterprise spending.

SoFi Bank’s role as sponsor bank highlights its growing influence in commercial payments, while its integration with Galileo eliminates inefficiencies common with separate banking and payment providers.

What’s in it for businesses?

- Faster Product Development: Streamlined infrastructure speeds up feature delivery.

- Regulatory Confidence: Compliance aligned with federal banking standards.

- Improved Efficiency: Real-time data and automation reduce errors and delays.

“Partnering with SoFi and Galileo empowers us to deliver smarter, more efficient solutions for corporate expense management,” said Oded Zehavi, CEO of Mesh Payments.

Processing over $1B annually, Mesh equips enterprises with virtual and physical cards, automated tracking, and centralized visibility—simplifying operations for modern businesses.

Have a great start to the week and I'll be back with more FinTech industry updates tomorrow!

Cheers,

#FINTECHREPORT

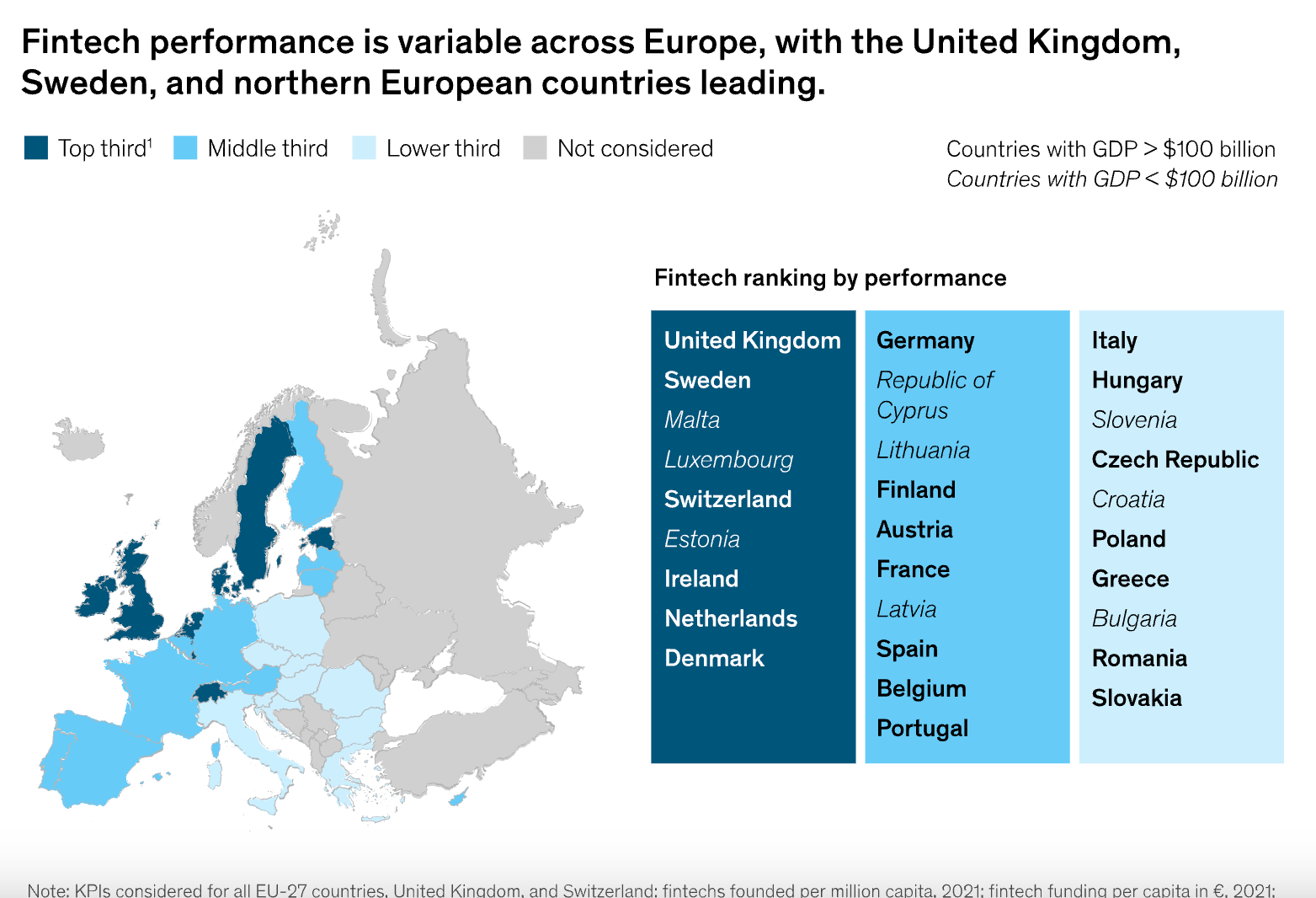

📊 Europe’s FinTech opportunity. This McKinsey analysis highlights the surge in FinTech activity across every European country. Link here

FINTECH NEWS

🇺🇸 Affirm signs $4 billion loan deal with private credit firm Sixth Street. The deal, which will ramp up over time, is expected to result in over $20 billion in loans by 2028. This partnership reflects the growing trend of FinTech firms seeking non-bank financing options.

🇩🇪 N26 adds BlackRock Funds to its investment options. This addition complements N26's Stocks & ETFs product, simplifying investing for users. Customers can start investing quickly with professional support. The collaboration focuses on making diversified investments accessible with just a few taps.

🇺🇸 MANTL enhances platform for unified deposit and loan origination, creating an all-in-one solution for banks and credit unions. This integration enhances cross-sell opportunities, improves customer and employee experiences, and boosts operational efficiency. Read More

🇺🇸 UK FinTech Stenn collapsed after Russia money laundering case drew scrutiny. The FinTech collapsed into administration after a reference to the company in a US criminal indictment about a Russian money laundering scheme prompted its lenders to begin probing potentially suspicious transactions, according to people familiar with the situation.

🇨🇴 Colombian FinTech Minka eyes Uganda in major expansion. The firm says it has supported building real-time payment networks across Latin America and aims to address key challenges in Uganda's financial ecosystem, including low financial inclusion, heavy, cash reliance, and non-interoperable payment systems

PAYMENTS NEWS

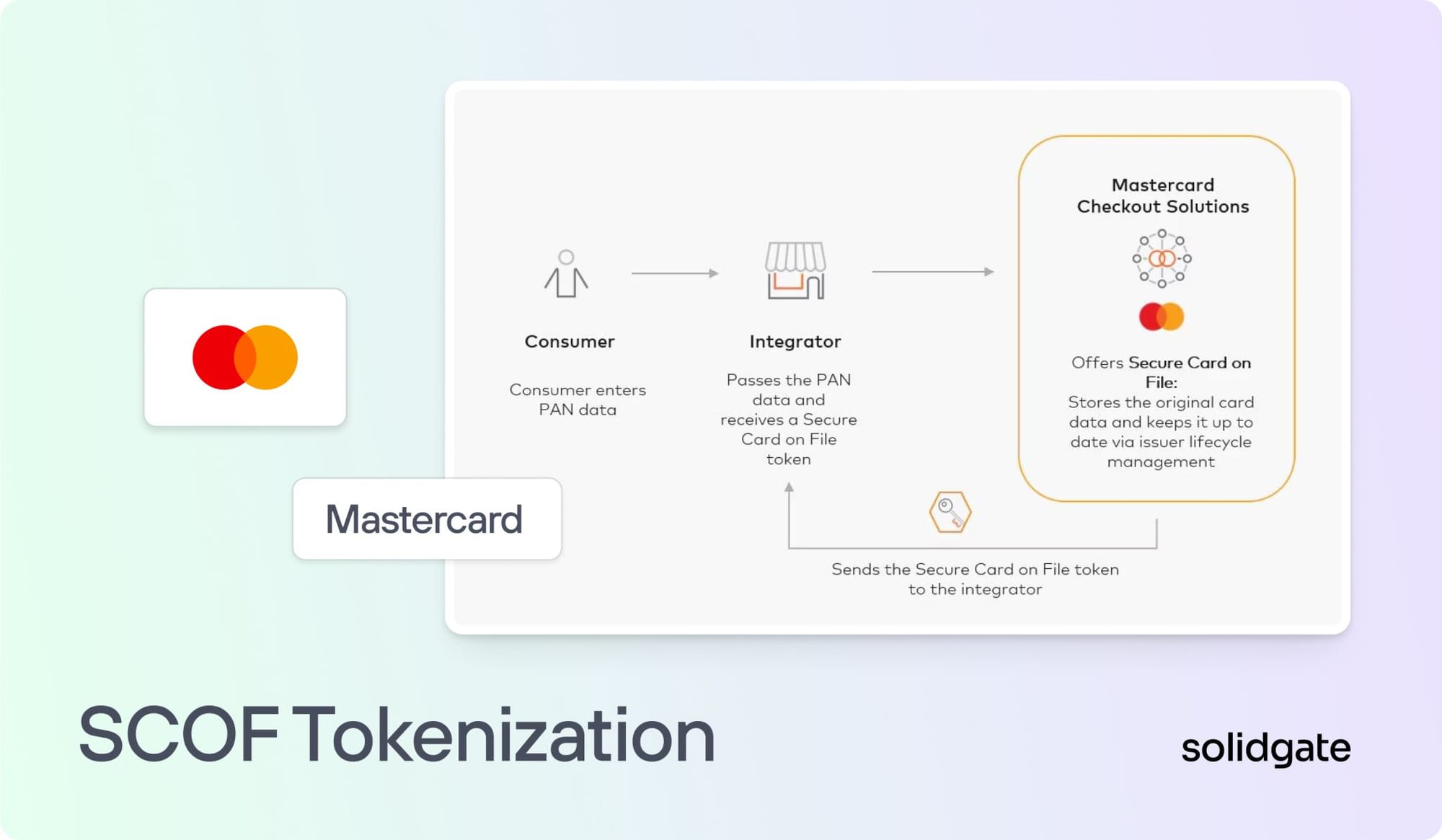

🇬🇧 Solidgate upgrades to Mastercard's Secure Card-on-File (SCOF) tokenization. This milestone is pivotal in the company's journey to redefine payment security and efficiency. Through SCOF, they’ve adopted Mastercard’s robust tokenization technology to enhance payment security, reduce fraud, and optimize the payment experience for merchants and cardholders around the world.

🇺🇸 Global Payouts Orchestration: Driving Payments 3.0. As businesses expand globally and workers seek faster, more flexible access to earnings, Global Payouts Orchestration is reshaping the industry. Discover how it’s driving speed, flexibility, and seamless cross-border transactions in the evolving global payments landscape. Explore PayQuicker’s insights to learn more

🇪🇬 Meeza National Payment Scheme introduces Apple Pay for customers in Egypt. The move is in line with Meeza’s commitment towards bringing its customers more secure and convenient payment methods. Continue reading

🇮🇱 Mesh Payments partners with SoFi Bank and Galileo to revolutionize travel and expense management. This partnership integrates Mesh Payments’ next-generation expense and card infrastructure with SoFi Bank’s scalable financial framework and Galileo’s modern, and customizable API-based payments processing platform. Read More

🇪🇬 Visa introduces Apple Pay to customers in Egypt, offering a secure, seamless way to pay in-store, in-app, and online. It also enables faster purchases on apps and websites without requiring repeated input of contact or billing details. Visa aims to align with Egypt’s growing demand for secure, digital-first payment solutions. Read More

🇧🇷 Central Bank approves payment of bills via Pix, effective on February 3, with experimental use of QR codes for instant Pix transactions. This eliminates delays associated with traditional slips. Additionally, the BC introduced a dynamic collection slip for greater security in payments tied to negotiable securities, ensuring funds go to legitimate holders.

🇺🇸 GoAuto Insurance adopts One Inc's ClaimsPay® and PremiumPay® to streamline operations. This move consolidates inbound and outbound payment activities into one platform, improving efficiency. The Baton Rouge-based insurer aims to expand payment options beyond checks.

🇨🇦 Nuvei has expanded its partnership with Google, to integrate Google Pay into its cashier solution for merchants across Latin America. The integration helps businesses access new customer segments and supports growth in the region. The shift to mobile and digital payments is driven by consumer demand for convenience and speed.

🇻🇳 Vietnam and Cambodia launch cross-border QR payment linkage. The initiative allows Vietnamese and Cambodian visitors to use their domestic currencies, VND and KHR, for payments at various merchants in each other’s country. This new payment system is expected to boost tourism and economic ties between the two nations.

🇬🇧 Wirex launches Visa Platinum Card in the UK, giving exclusive benefits in addition to standard Visa perks. The card has no annual fees and flexible spending limits. It also offers secure, contactless payments and advanced fraud protection. Explore more

🇺🇸 FlexPoint’s AI System enables same-day ACH Payments. The system connects to the Federal Reserve’s FedNow® Service, enabling faster transfers for businesses of all sizes. FlexPoint aims to bring faster payment capabilities to a broader market, helping to address cash flow challenges.

🇬🇧 The UK payments regulator is consulting on a cross-border card fees cap, which is costing UK businesses £150-200 million annually due to reduced competition. These fees apply to online purchases made with EU-issued cards. Mastercard and Visa dominate 99% of UK card payments. Read More

🇪🇬 Mastercard partners with Central Bank of Egypt to launch Apple Pay. Users can pay in-store with an iPhone or Apple Watch or make online purchases on iPhone, iPad, and Mac without typing card details repeatedly. Transactions are secured with Face ID, Touch ID, or passcode and a unique dynamic security code.

⬆️ 10 Top payments trends for 2025. In an effort to make online checkout as efficient as physical, Mastercard announced that by 2030, shoppers won’t even need a physical card number or have to punch in a password or one-time code to make a transaction online, by combinating tokenization, biometric authentication and the Click to Pay digital wallet.

DIGITAL BANKING NEWS

🇺🇸 US watchdog caps bank overdraft fees despite industry objections. The new rule from the Consumer Financial Protection Bureau (CFPB) caps overdraft fees at a maximum of $5, providing significant relief for families. However, the American Bankers Association expressed opposition, arguing that the CFPB had overstepped its legal authority.

🇺🇸 Scotiabank to move forward with KeyCorp investment. On Thursday, the Federal Reserve Board approved Scotiabank's acquisition of an additional 10% stake in KeyCorp, the parent company of KeyBank. Continue reading

BLOCKCHAIN/CRYPTO NEWS

🇦🇺 Kraken exchange operator fined $5 million in Australia for compliance issues. This follows a court ruling favoring the Australian Securities and Investments Commission (ASIC), which accused Bit Trade of offering a credit facility without a license. While ASIC sought a A$20 million fine, Bit Trade argued for a penalty no higher than A$4 million. Kraken said it is “disappointed” with the outcome of this case.

🇦🇪 Paxos and Standard Chartered collaborate on stablecoin reserve management. StanChart supports Paxos’ tokenization platform with banking capabilities in transaction management, financial markets, and custody. This collaboration simplifies access to Paxos’ stablecoins and promotes secure, regulated digital asset solutions.

🇱🇹 Kasta secures Lithuanian VASP registration to enhance compliance, marking its third European regulatory approval alongside Italy and Bulgaria. This enables Kasta to offer crypto-to-fiat, fiat-to-crypto, and crypto-to-crypto exchange services, as well as crypto wallet services.

DONEDEAL FUNDING NEWS

🇺🇸 Current reports record growth in 2024, secures capital for expansion and innovation. The capital will support strategic member acquisition, efficient expansion, and deepen Cross River’s partnership to enhance Current's financial products. This investment will enable Current to provide more accessible solutions like faster paycheck access, savings pods, and credit-building tools.

🇺🇸 Quantix secures $500m asset-backed securitisation financing from Citi. The subsidiary of Astra Tech, secured one of the largest financing deals for a UAE FinTech, enabling expansion of its CashNow platform and Ultra app ecosystem. The financing supports Astra Tech’s goal of creating an all-in-one platform for simplified financial decisions.

🇺🇸 Paidly, Inc. closes series A funding to tackle student loan debt for employers and employees. The funding will enable Paidly to enhance its platform and expand its reach. The partnership with S30Build, LLC underscores Paidly’s ability to make a meaningful impact when addressing the challenges posed by student loan debt.

🇺🇸 Jiko raises $29M in series C, expands board and advisory team, This financial round bolsters Jiko’s position in the institutional and enterprise market. Its platform enables real-time management of corporate cash through Jiko Pockets, allowing 24/7 T-bill transactions as a safer alternative to traditional investments.

🇮🇳 MobiKwik IPO receives $4.7B in bids as investors bet on FinTech growth, MobiKwik’s IPO saw retail investor shares oversubscribed by 135 times and institutional bids 120 times their allotment. The stock is expected to debut on December 18, trading at a 50% premium in the grey market. Read More

🇮🇳 India’s AI lender Aye Finance to raise $174m via IPO. Aye Finance, a non-banking financial company, plans to go public with an IPO to raise up to 1,450 crore rupees (US$174 million). The IPO was approved during an extraordinary general meeting.

M&A

🇺🇸 Upbound Group acquires FinTech Brigit in $460M deal. Brigit offers financial tools like cash advances and credit building, serving over two million users.Brigit’s tech will enhance Upbound’s brands, including Acima Leasing and Rent-A-Center, which provide lease-to-own options. The deal is expected to close in Q1 2025.

MOVERS & SHAKERS

🇮🇳 Indian FinTech Super.money appoints Ex-Flipkart Exec as CTO. The Flipkart-backed FinTech platform, has appointed Kaushik Mukherjee as CTO. He will focus on driving innovation and improving scalability at Super.money. Click here to learn more

🇸🇬 Singapore Bank UOB names Leong Yung Chee as group CFO. Leong will succeed Lee Wai Fai as group CFO in April 2025, and start as CFO-designate immediately before officially taking on the role on April 22, 2025. Read More

🇺🇸 Galaxy Digital hires Point72's Anthony Paquette as CFO. Paquette previously worked at FinTech firm SoFi and JPMorgan Chase. He will replace Alex Ioffe, who will move to a senior advisor role in January. This appointment strengthens Galaxy Digital's leadership under CEO Michael Novogratz.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()