Meet Me in NYC and Experience Commerce Aware AI to Transform Data Into Unstoppable Growth in Real-Time

Hey FinTech Fanatic!

You know me - I can never say no to a trip to NYC! Especially when it involves checking out some cool new tech.

On January 12th, I'll be heading to the Big Apple to meet DEUNA and experience the first commerce-aware AI to transform data into unstoppable growth in real-time.

What should I look out for while I'm there? Any specific questions you want me to ask? Or better yet - are any of you planning to be there too? Request your invitation here.

Tell me in the comments if I will see you there, and don't miss the present and future in action 😉

I've got more exciting FinTech updates lined up for you below 👇 and I'll be back in your inbox on Monday!

Cheers,

SPONSORED CONTENT

#FINTECHREPORT

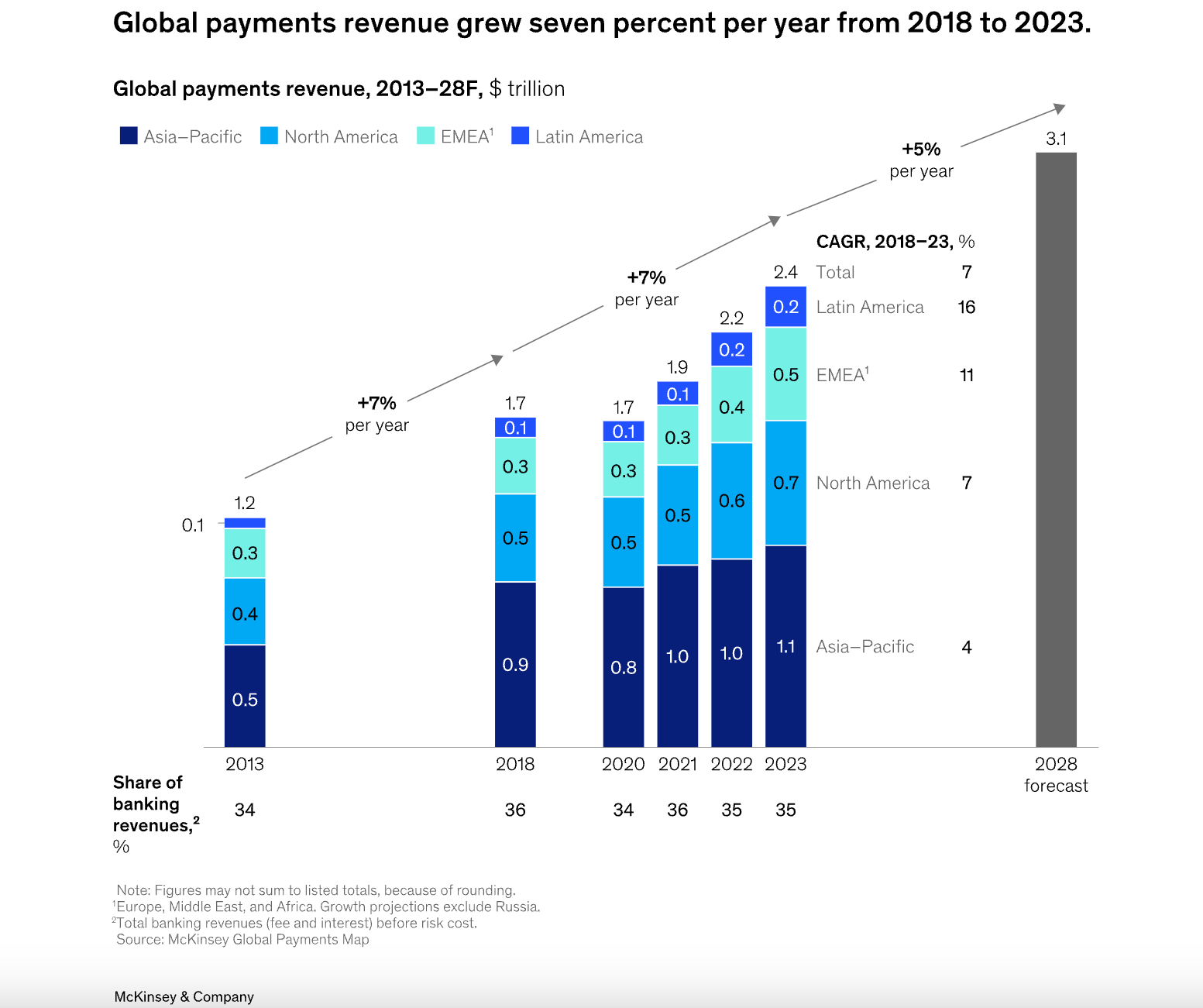

📊 Global payments in 2024: Simpler interfaces, complex reality. Global payments are becoming simpler for users, yet complexity continues to grow behind the scenes. McKinsey’s report explores this paradox and the options available to providers. Check out the full report here

FINTECH NEWS

🇫🇷 EBA CLEARING launches latest VOP solution. The new solution provides options on the requesting and responding side, and aims to support payment service providers (PSPs) by offering verification of payee services, which aligns with the instant payments regulation (IPR).

PAYMENTS NEWS

➡️ Kuady strengthens Latin American footprint with Ecuador and virtual prepaid Mastercard in Argentina launch. Kuady, a leading payments service processor, has announced significant strides in its Latin American expansion, with the introduction of its digital wallet services in Ecuador and the launch of its virtual prepaid Mastercard in Argentina. These developments underscore Kuady’s commitment to driving financial inclusion and delivering innovative payment solutions across the region.

Lorenzo Pellegrino, CEO at Kuady commented: : “The expansion into Ecuador and the launch of our virtual prepaid Mastercard in Argentina mark major milestones in our journey to drive financial inclusion and innovation across Latin America. We’re empowering individuals and businesses with secure, real-time payment solutions that break down barriers to financial access, whether through our e-wallet or the flexibility of our Mastercard. These efforts reflect our dedication to fostering digital economies and creating opportunities for communities across the region and beyond." Read the full press release here

🇺🇸 Visa Direct to make funds available in U.S. cardholders’ bank accounts in one minute or less. Starting in April 2025, consumers, businesses, and governments can use Visa Direct for real-time deposits into bank accounts linked to eligible debit cards.

🇸🇪 Swish introduces tap-to-pay feature. The new feature lets users link their payment cards directly to the app, simplifying everyday transactions for its 8.6 million users. This update is part of Swish’s efforts to adapt its services to meet changing consumer preferences and expand its functionality.

🇬🇧 The Payments Association calls for action to address the environmental impact of digital payments. A report by The Payments Association’s ESG Working Group shows that while digital payment emissions are small, their scale has an impact. It calls for standardizing measurement, collaboration, aligning with regulations, and tying sustainability to business goals.

🇬🇧 Mercia exits card payments specialist in sale to US company. Shift4 has acquired Grimsby-based Card Industry Professionals, a provider of card terminals, POS, and online payment solutions to SMEs like retailers and salons. The deal marks an exit for Mercia Ventures, which backed the firm in 2022 via NPIF and MEIF funding.

🇺🇸 equipifi and Synergent partner to expand Credit Union access to buy now, pay later platform. As a result of this partnership, Synergent credit unions will be able to launch their own BNPL programs through their digital banking apps, helping members split their larger purchases into flexible installment loans.

🇳🇱 eBay and Klarna expand tie up bringing buy now pay later service to new markets. Expanding from a launch in Germany, eBay is offering Klarna (including Pay in 3 and Pay in 30 Days) to people in the UK, Austria, France, Italy, the Netherlands and Spain, with more markets coming soon.

🇭🇰 The Payment Cards Group and Black Bear Merchant Services join forces to launch a new brand 'AbbyPay'. This partnership will accelerate PCG's expansion in market share by covering 50,000 local merchants in Hong Kong and other APAC regions with multiple brands to meet diverse market demands and empower local merchants through innovative payment technology.

🇬🇧 GoCardless and Endava partner to streamline bank payment solutions. Endava will integrate and manage GoCardless payment solutions for enterprise clients undergoing digital transformation, expediting the implementation of bank payment systems for faster access to their features.

🇺🇸 Slope taps Marqeta to power BNPL Card, enabling brands and marketplaces to offer flexible loan options. By integrating with Marqeta, Slope enables its customers to make in-store purchases when needed and spread payments over time, enhancing cash flow and allowing for faster access to working capital. The Slope Card offers cost-effective, modern business capital at checkout.

OPEN BANKING NEWS

🇬🇧 Ordo teams up with Eviden to launch the new payment platform. The new Open Banking solution is being piloted with the aim to facilitate direct payments between businesses and customers in real-time, providing a lower-cost alternative to direct debit and standard credit.

🇬🇧 UK’s Salad Money secures first AISP licence given to a CDFI lender. This allows direct access to applicants' banking data for fairer, data-driven lending decisions. The company announced it has been registered as an official AISP by the UK’s FCA, marking an industry first for a consumer Community Development Financial Institution (CDFI).

REGTECH NEWS

🇬🇧 UK FinTech Stenn collapsed after Russia money laundering case drew scrutiny. Stenn, once valued at $900mn with bank partnerships like Citigroup and Barclays, saw two UK units placed into administration after HSBC Innovation Bank's court application. HSBC began probing suspicious transactions linked to Stenn’s CEO, amid a U.S. case.

DIGITAL BANKING NEWS

🇮🇪 Revolut’s Irish customer base rises to more than three million. Revolut now has over 3m customers in Ireland. 3/4 of adults and 1/3 of children in Ireland now have Revolut accounts. Business customers are up 30% YoY to 27,500. Read on

🇳🇱 ABN AMRO starts Achteraf Betalen (‘Pay Later’) pilot for business clients. Under this new feature, ABN AMRO guarantees payment and also takes over the merchant's debtor management. ‘Pay Later’ has been developed in collaboration with Two, a B2B tech company that provides payment solutions.

🇺🇸 Interactive Brokers introduces AI-generated news summaries. This advanced feature, available at no additional cost, enables clients to access concise summaries of news articles, streamlining insights from leading providers and making it easier for investors to stay informed.

🇨🇦 TD Bank upgrades retail card business with Backbase Engagement Banking platform. Through this collaboration, TD Bank will utilize Backbase’s Engagement Banking platform to deliver an enhanced, digital-first experience for retail cardholders, according to the vendor.

🇬🇧 Monzo’s Game-Changing Gambling Block stops over £9 million of gambling payments in 2024 so far. The Gambling Commission recently revealed the UK has seen a 12% increase in gambling transactions to £1.46 billion in 2024. Over 70,000 Monzo customers are using the bank's new gambling-block features.

🇺🇸 Publicis Sapient and OneSavings Bank partner to launch new digital platform. The collaboration uses Publicis Sapient’s integrated SPEED capabilities to modernize the bank’s operations, create a strategic roadmap, and deliver a flexible, scalable platform focused on customers and employees.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Ripple secures NYDFS approval for RLUSD stablecoin, aiming for $2 trillion market cap by 2028. CEO Brad Garlinghouse announced the regulatory greenlight on Dec. 10 and said exchange and partner listings for the stablecoin would be live soon.

🇫🇷 Financial Group Oddo plans foray into swelling stablecoin market. The Paris-basedl group has been working with crypto firm Fireblocks on developing the instrument, sources said, asking not to be named as the plans are private. Oddo expects to launch the token next year, pending regulatory approval, sources added.

Bitpanda launches Fusion, a new way to trade crypto on all markets with maximum liquidity via one account. Bitpanda Fusion aggregates price data from crypto exchanges, market makers, and liquidity providers to provide competitive buy and sell prices in one platform.

PARTNERSHIPS

🇬🇧 Everyday Loans signs multi-year licence agreement with Jaywing. The partnership focuses on Jaywing's explainable AI platform, Archetype, which uses deep learning to improve decision-making. This technology enables organisations to build sophisticated models while maintaining transparency and regulatory compliance.

DONEDEAL FUNDING NEWS

🇬🇧 Upvest, Europe’s leading investment API, has raised a €𝟭𝟬𝟬𝗺 Series C round led by Hedosophia and joined by Sapphire Ventures. With this funding, Upvest will accelerate the expansion into the UK following their recent FCA-approval and will extend its product suite for global financial institutions to propel the company towards their goal of empowering 100 million people to invest.

🇺🇸 Walmart’s FinTech races to $2.5 billion value in omen for banks. Walmart Inc. is deepening its push into financial services with a $300 million funding round for its majority-owned startup, called One, co-led by Ribbit Capital. The venture, valued at $2.5 billion, provides financial products for Walmart customers and employees.

🇬🇧 Themis secures over £7.25M in scale-up funding, surpassing targets ahead of round closing. This funding will advance Themis’ mission to democratise due diligence across regulated and unregulated businesses by leveraging the latest advancements in AI combined with years of in-depth financial crime expertise.

🇱🇹 Goose Valley Ventures backs Lithuanian FinTech Torus, solving a $13B transparency challenge in fees charged by card schemes like Visa and Mastercard. With this strategic investment, GVV underscores its commitment to backing high-potential startups that drive innovation in the FinTech sector.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()