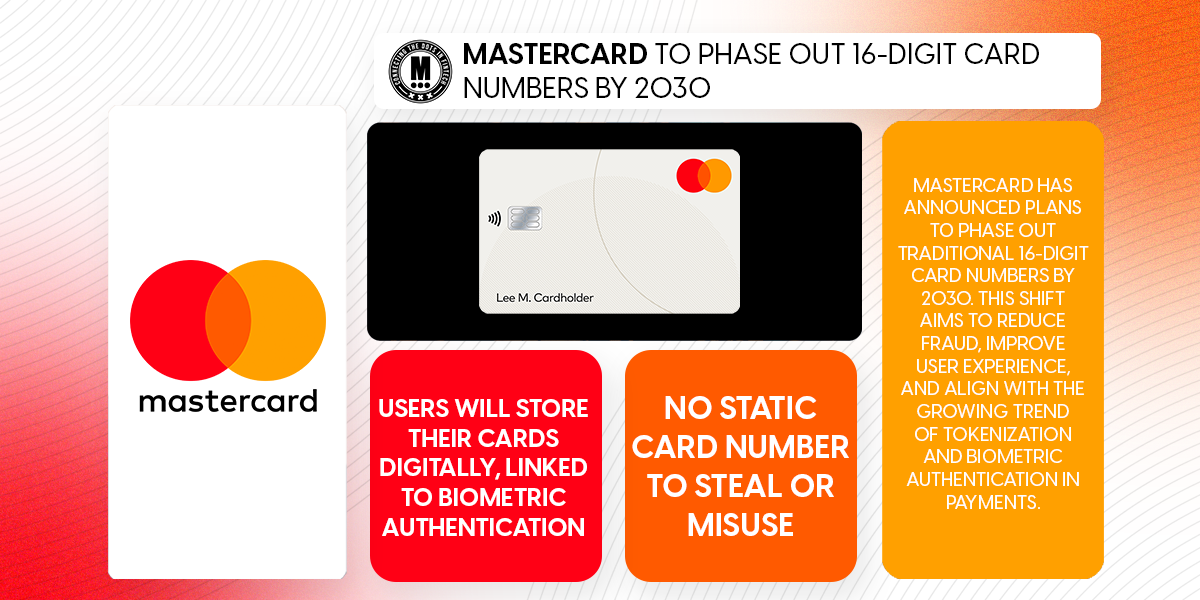

Mastercard to Phase Out 16-Digit Card Numbers by 2030

Hey FinTech Fanatic!

Mastercard has announced plans to phase out traditional 16-digit card numbers by 2030. This shift aims to reduce fraud, improve user experience, and align with the growing trend of tokenization and biometric authentication in payments.

𝗪𝗵𝘆 𝗜𝘀 𝗠𝗮𝘀𝘁𝗲𝗿𝗰𝗮𝗿𝗱 𝗥𝗲𝗺𝗼𝘃𝗶𝗻𝗴 𝗖𝗮𝗿𝗱 𝗡𝘂𝗺𝗯𝗲𝗿𝘀?

Traditional card numbers, printed on physical cards, have long been a target for fraudsters.

Whether through data breaches, skimming, or phishing attacks, stolen card details fuel billions of dollars in fraud losses annually.

By removing the visible card number, Mastercard seeks to eliminate a critical vulnerability in the payment ecosystem.

𝗛𝗼𝘄 𝗪𝗶𝗹𝗹 𝗧𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻𝘀 𝗪𝗼𝗿𝗸 𝗪𝗶𝘁𝗵𝗼𝘂𝘁 𝗮 𝗖𝗮𝗿𝗱 𝗡𝘂𝗺𝗯𝗲𝗿?

Instead of a fixed 16-digit number, Mastercard will implement tokenization—a process where a unique, encrypted token replaces the actual card number.

𝗧𝗵𝗶𝘀 𝗺𝗲𝗮𝗻𝘀:

✅ No static card number to steal or misuse.

✅ Each transaction will have a unique identifier, making fraud much harder.

✅ Users will store their cards digitally, linked to biometric authentication (e.g., fingerprint, face recognition).

𝗪𝗵𝗼 𝗪𝗶𝗹𝗹 𝗕𝗲𝗻𝗲𝗳𝗶𝘁?

1️⃣ Consumers – More security and fewer worries about stolen card details.

2️⃣ Merchants – Reduced fraud risks and chargebacks.

3️⃣ Banks & Payment Providers – A stronger, safer payments ecosystem.

𝗪𝗵𝗮𝘁 𝗗𝗼𝗲𝘀 𝗧𝗵𝗶𝘀 𝗠𝗲𝗮𝗻 𝗳𝗼𝗿 𝘁𝗵𝗲 𝗙𝘂𝘁𝘂𝗿𝗲?💳

The physical card may become obsolete, as mobile wallets and biometric authentication become the standard.🔐 Data security will improve, making payments safer for consumers and businesses.

📱 Digital-first banking will accelerate, favoring smartphone-based transactions over plastic cards.This shift marks a significant evolution in how we pay, shaping a more secure, seamless, and digital-first future.

Get ready to say goodbye to 16-digit card numbers—and hello to a new era of payments!

More FinTech industry updates await you below! 👇

Cheers,

Subscribe to my Spanish Daily FinTech Newsletter for daily updates and analysis on the evolving world of financial technology—entirely in Spanish. Join now and stay in the loop!

INSIGHTS

🇧🇷 Nubank, PagBank, and other FinTechs may need to change their names. A public consultation by Brazil’s Central Bank (BC), open until May, aims to restrict FinTechs from using terms like “bank” or “banco” in their names. A proposed rule would ban misleading terms in names and branding. The restriction would apply to company names, trade names, branding, and website domains. Nubank is monitoring discussions and says a banking license wouldn’t require more capital due to its structure.

💳 Mastercard has announced plans to phase out traditional 16-digit card numbers by 2030. This shift aims to reduce fraud, improve user experience, and align with the trend of tokenization and biometric authentication in payments. This marks a significant evolution in how consumers pay, shaping a more secure, seamless, and digital-first future.

FINTECH NEWS

🇺🇸 How Stripe’s billing experiment propelled a $500 million AI-fueled business. In 2010, Patrick and John Collison were experimenting. Fifteen years later, one of those early ideas is stepping into the spotlight, providing what Stripe has come to see as a new pillar to its business.

PAYMENTS NEWS

🇦🇺 Airwallex CEO and Co-Founder Jack Zhang reflects on 2024 and what’s next. The company’s annualized transaction volume rose from US$100 billion in August to US$130 billion just three months later, following its ARR surpassing US$500 million. This marks a 73% year-over-year increase in transaction volume.

🇦🇪 Checkout. com becomes the first acquirer in the UAE to launch Visa Direct Push-to-Card solution. The Push-to-Card solution enables merchants and consumers in the UAE to send money quickly and easily to eligible Visa cards, offering near real-time fund disbursements. This solution brings many benefits, including fast remittances, peer-to-peer (P2P) payments, and merchant payouts.

🇧🇪 Bancontact Payconiq Company will introduce Wero. Customers can scan QR codes in stores to pay via Wero, while users from other banks can still process payments via Bancontact within the app. Wero will be integrated into the banking apps of BNP Paribas Fortis, KBC, ING Belgium, and Belfius.

🇿🇦 Visa launches ‘Tap to Add Card’ in South Africa. Called Tap to Add Card, it allows cardholders to add Visa contactless cards to digital wallets with a tap on their mobile device. The feature will help drive further adoption of digital wallets by addressing key security concerns and simplifying the user experience.

🇺🇸 Payments technology Orum launches ‘Monitor’, a payments portal purpose-built to optimize & orchestrate payment operations for enterprise businesses. Monitor tracks transfers and bank account verification in real-time with one-click solutions to schedule payments, verify accounts, build custom insights, & more.

🇮🇳 PhonePe launches device tokenization solution for secure card transactions. With this launch, users will be able to tokenize their cards on the PhonePe App and use the card tokens seamlessly across all use cases such as bill payments, recharges, booking travel tickets, and making payments on Pincode.

REGTECH NEWS

🇺🇸 ISO 20022 implementation for Fedwire Funds Service postponed to July. Originally scheduled for 10 March, the implementation has been postponed to 14 July 2025, to allow additional time for industry participants to prepare. The decision to delay was made after evaluating customer readiness and responding to industry requests.

🇸🇬 EBANX moves closer to full payment license. The company has received in-principle approval for a Major Payment Institution (MPI) license from the Monetary Authority of Singapore (MAS). This license will allow it to offer cross-border money transfers and merchant acquisition services in Singapore.

🇮🇳 Aviva's India arm hit with $7.5 million fine for fake invoice scheme. Indian authorities have ordered the British insurer to pay in back taxes and penalties after an investigation found it created fake invoices to pay illegal commissions and claimed incorrect tax credits, an order shows.

🇺🇸 Trump’s Washington is opening its doors to eager FinTech firms. Some of the biggest FinTech firms are now getting a lot more facetime on Capitol Hill. Groups that lobby for FinTech companies have significantly ramped up their meetings with lawmakers, White House officials, and financial regulators since Donald Trump won the election.

DIGITAL BANKING NEWS

🇪🇸 BBVA will offer AI-Powered account and card management with its virtual assistant. The virtual assistant Blue now has enhanced abilities to interact with customers using natural language, provide tailored information on their finances, and perform some of the most common account and card transactions.

🇩🇪 Tomorrow introduces savings accounts with Solaris. The savings deposit account is available to all Tomorrow customers on Change and Zero account models and offers an interest rate of 1.5% p.a for existing customers and 2.5% p.a. for new customers for the first 90 days. The interest rate is paid monthly.

🇺🇸 Third Federal embarks on digital upgrade with Fiserv’s DNA platform. The collaboration will see the implementation of Fiserv's DNA platform, a move aimed at enhancing Third Federal's customer service capabilities through real-time transaction processing across all channels.

BLOCKCHAIN/CRYPTO NEWS

🇨🇳 Standard Chartered, Animoca Brands, HKT to pursue Hong Kong dollar-backed stablecoin. The bank said the joint venture would “fully utilise its bank-grade infrastructure and rigorous governance”. Animoca Brands will help to “tap into crypto-native opportunities”, while HKT would use its mobile wallet expertise to develop stablecoin use cases and enhance domestic and cross-border payments.

🇺🇸 FTX to repay small creditors starting Feb. 18. The initial repayments will focus on “convenience class” creditors with claims of under US$50,000. This initiative aligns with FTX’s reorganization plan following extensive bankruptcy proceedings. FTX aims to distribute about US$17 billion in various stages.

PARTNERSHIPS

🇬🇧 Lloyds Bank has partnered with FinTech platform Doshi to target Gen Z. The platform, which dubs itself the “Duolingo of Money,” will allow users to earn points through lessons, quizzes, and challenges and redeem gift cards from retailers. Read more

🇺🇸 TransUnion teams up with Credit Sesame to launch direct-to-consumer experience. The new platform will give U.S. consumers daily access to their credit score, tailored financial offers, and premium credit monitoring services. TransUnion expects to increase consumer engagement and grow its direct-to-consumer business.

🇬🇧 Payrails supports Flix with scalable payment solutions to fuel global growth. The collaboration optimizes checkout experiences, streamlines transactions, and strengthens fraud prevention, enabling Flix to scale efficiently across global markets while advancing its mission to make sustainable travel more accessible.

🇬🇧 Yonder partners with Griffin to boost credit limits with “Top-ups”, a new feature that helps customers unlock a higher spending limit while enjoying all the benefits of credit. Yonder can give its customers more control over how they spend credit while still enjoying all the rewards.

DONEDEAL FUNDING NEWS

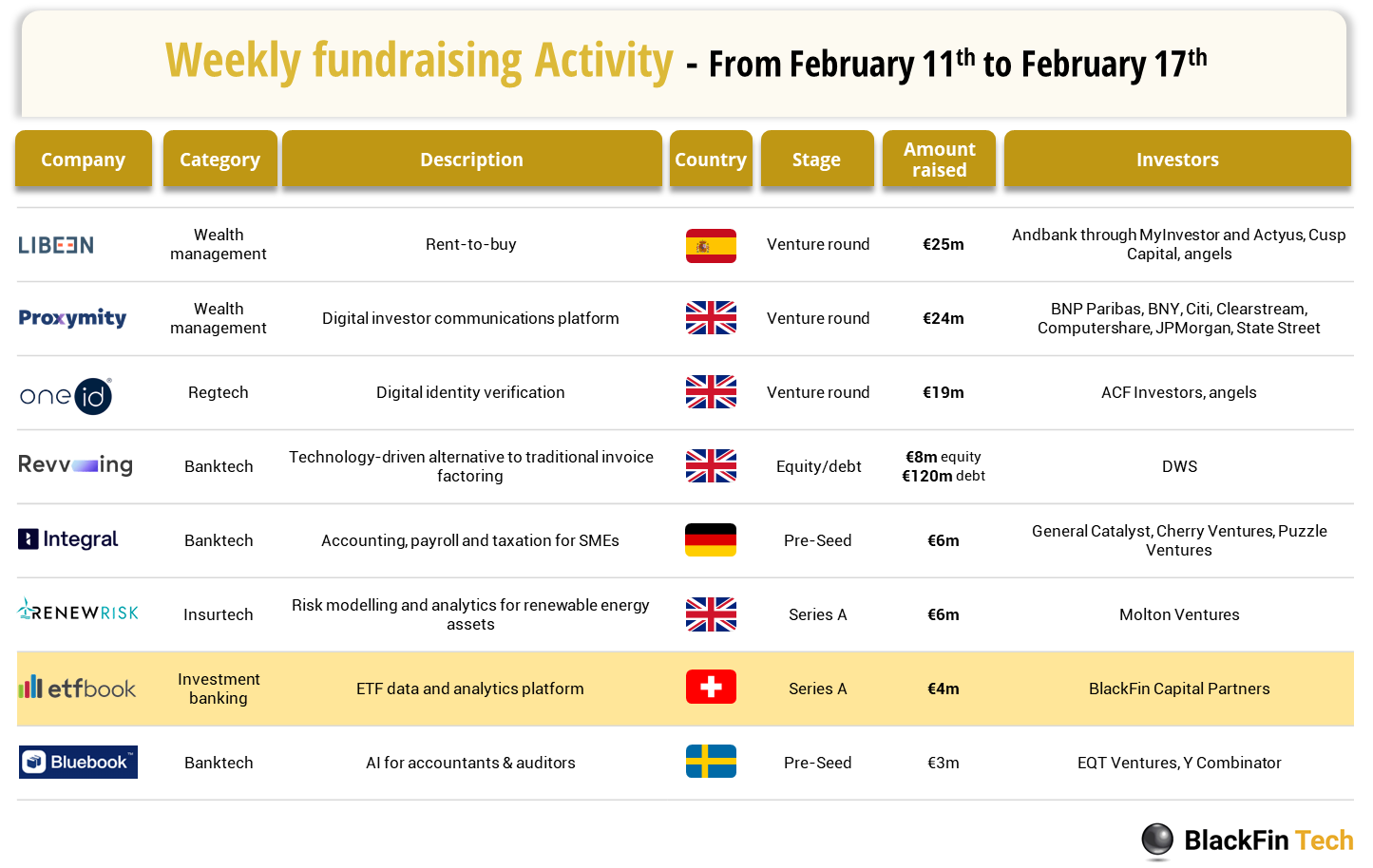

💰Over the last week, there were 8 FinTech deals in Europe, raising a total of €95 million in equity, 4 deals in the UK, as well as 1 deal in Switzerland, Germany, Sweden and Spain each.

🇳🇱 Dutch Payments company CM.com announced that it has raised €20M. The company will use the proceeds to strengthen its balance sheet and provide greater operational and tactical flexibility during the next phase of the Company’s growth plan. Read more

M&A

🇩🇰 Market Pay completes its fourth acquisition with the purchase of Altapay. The acquisition of Altapay represents an incredible opportunity to enhance its online payment offerings. Their team has developed a cutting-edge, robust, and reliable platform that will seamlessly complement its current solutions.

🇩🇪 UniCredit’s Commerzbank bid sapped by Berlin pushback. UniCredit’s attempt to build a stake in Commerzbank has faced political backlash in Berlin. With upcoming elections, the potential new government under Friedrich Merz is expected to maintain its stance. As a result, Commerzbank's outlook remains uncertain.

MOVERS AND SHAKERS

🇺🇸 Goldman, Point72 alumni hired at Blockchain.com amid IPO plans. The firm hired Justin Evans as Chief Financial Officer and Mike Wilcox as Chief Operating Officer, aiming to grow headcount by 50%. The hires align with the company’s long-term goal to go public, as Wall Street shows increasing interest in crypto IPOs.

🇬🇧 Wealthify appoints Jessie Kwok as CIO. Kwok joins Wealthify from Investec, where she was Senior Investment Director for over three years. She is a CFA Institute Charterholder with certificates in Sustainable Finance and ESG Investing. Read more

🇸🇬 FinTech firm Lendela hires new CFO, CTO. The firm, a loan matching platform in the Asia Pacific, has appointed Kent Huang as CFO and Steven Wong as CTO. These appointments aim to bolster the company’s executive leadership as it expands operations in the region.

🇺🇸 Varo Chief Colin Walsh steps down. Walsh, who will remain on Varo’s board, will be succeeded by Gavin Michael, former CEO of cryptocurrency exchange Bakkt. Michael announced his departure last year, saying he would remain in an advisory position at Bakkt until March 2025.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()