Mastercard CFO Critiques India's UPI System

India's Universal Payment Interface (UPI) has garnered both praise and criticism from the global payment giant, Mastercard.

At a recent UBS conference, Mastercard's CFO, Sachin Mehra, commended UPI for its role in digital transformation. However, he expressed concerns about its long-term financial viability.

What is UPI?

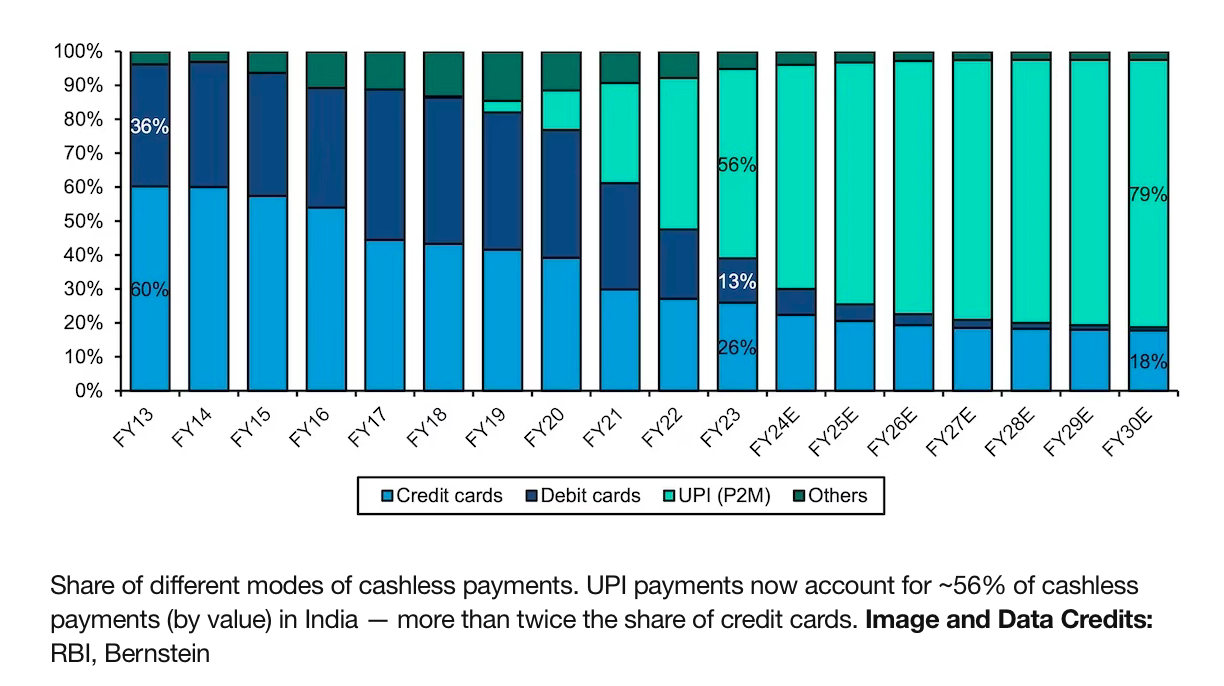

UPI is India's mobile payment system, which facilitates over 10 billion transactions each month in a country where card usage is relatively low.

Developed seven years ago by a consortium of banks and overseen by the Reserve Bank of India's NPCI unit, UPI's distinct feature is its negligible cost to merchants, making digital transactions more appealing.

Why the Concern?

While companies like Mastercard and Visa usually charge merchants a transaction fee, UPI operates largely free for them. This model, while supported by Indian regulatory bodies, poses sustainability questions for the broader ecosystem.

Mastercard's Mehra earlier stated, "The banks enabling these payments often incur losses."

The debate around UPI's economic structure isn't new. Some FinTech leaders have urged the government to implement fees for merchants using UPI.

Innovation Around UPI

Despite the concerns, many Indian businesses have creatively integrated UPI into their operations. For instance, Paytm's "soundbox" offers auditory notifications for completed UPI transactions.

While the UPI transaction is free, merchants pay for the device either as a monthly subscription or a one-off fee. This innovation has helped companies like Paytm to tap into the UPI wave, further monetizing their services.

Beyond Payments: The Data Advantage

The rise of systems like the soundbox also enables businesses to tap into a goldmine of merchant cash flow data. This data access is revolutionizing areas like credit underwriting, helping businesses offer credit solutions to merchants previously reliant on high-interest lenders.

The Bigger Picture

The move from cash to digital payments in India has predominantly been a win-win for stakeholders. Analysts from AllianceBernstein recently argued that the advantages, such as cost savings from decreased ATM transactions and potential lending opportunities, far outweigh the expenses linked to UPI.

The Indian government also benefits from reduced currency printing expenses and enhanced tax collection efficiency.

Challenges for Global Players

For international giants like Mastercard and Visa, India is an essential market. Yet, their journey in India might be bumpy.

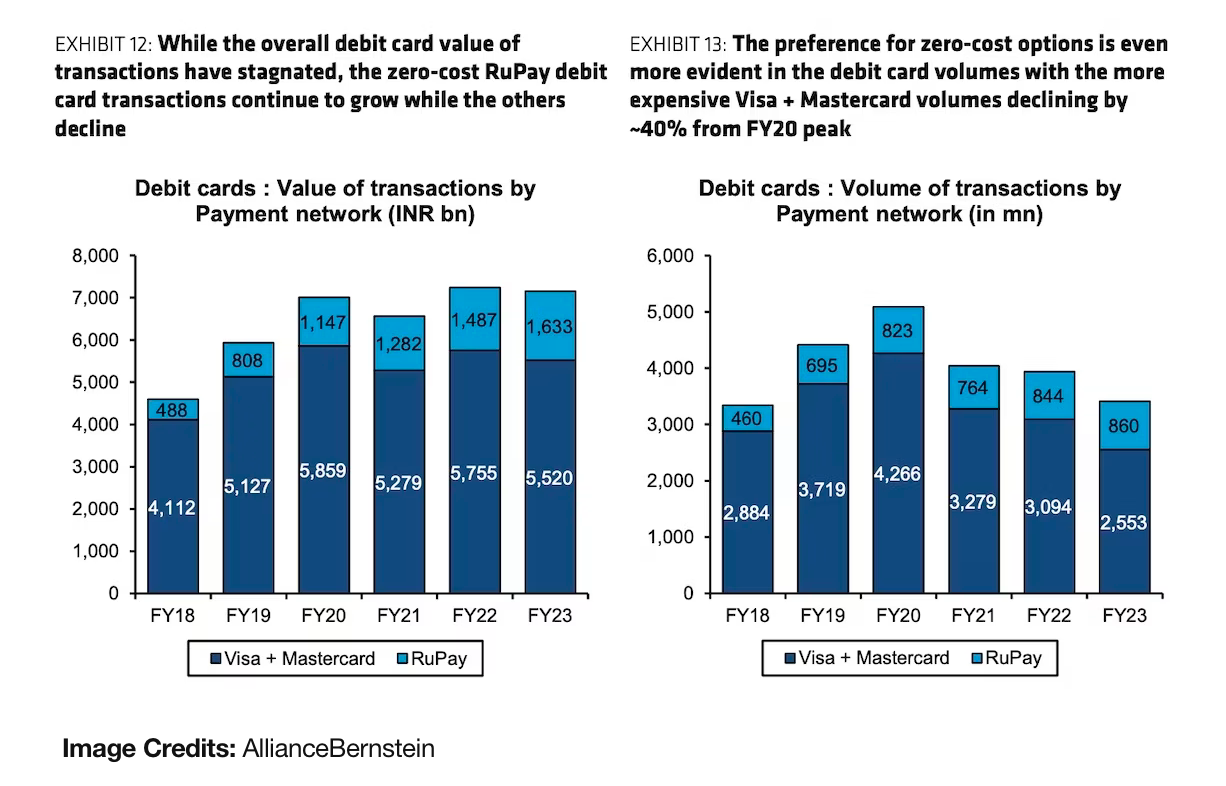

The Indian government is pushing for the RuPay card network, a local competitor. RuPay's features, like its integration with UPI and zero transaction costs, have driven its rapid adoption, challenging the dominance of global networks.

In summary, while UPI's economic model raises concerns for some, its significant role in India's digital transformation and the innovative solutions sprouting around it suggest its influence is here to stay.

Comments ()