Massive £4 Billion Claim Against Mastercard and Visa Moves Forward

Hey FinTech Fanatic!

Mastercard and Visa face a collective lawsuit in the UK over claims they overcharged businesses on multilateral interchange fees (MIFs), with claims exceeding £4 billion.

The Competition Appeal Tribunal has approved the action, allowing businesses affected between June 2016 and June 2022 to seek compensation. Sectors such as retail and hospitality were particularly impacted by these fees, which raised business costs significantly.

Harcus Parker Limited, representing the Class Representatives, aims to hold Mastercard and Visa accountable for imposing unlawfully high fees. Trade groups like UK Hospitality support the lawsuit.

Mastercard has denied the claims, arguing businesses benefit from using their cards.

To be continued...

Cheers,

FEATURED NEWS

🇺🇸 Ingo Payments Acquires Deposits Inc. to Redefine Money Mobility for Banks and Corporates.

There’s moving money and then there’s money mobility. One represents the current state of how money moves in and out of accounts. The latter is the cornerstone of yesterday’s announcement that money mobility platform Ingo Payments has acquired cloud-based banking platform Deposits Inc.

The Deposits integration into the Ingo Payments platform will create a modern, bank-grade, money movement platform that connects “money in and money out” functionality with an embedded, proprietary “money stack.” Ingo Payments now gives bank and non-bank issuers new plug-and-play capabilities to fund and monetize existing account relationships or to establish new virtual ones — by turning payments into new feature-rich accounts.

#FINTECHREPORT

📊 Payment Orchestration Vendor Evaluation by Datos Insights. This report explores key trends in payments orchestration. It discusses new market needs and challenges and provides high-level provider market analysis and projections. Check out full report here

INSIGHTS

🇬🇧 In the face of growing government and industry pressure, the UK's Payment Systems Regulator (PRS) is set to bow to demands to reduce the reimbursement limit offered by banks to victims of authorised push payment fraud from £450,000 to just £85,000. PSR confirms implementation date for APP scam protections as 7 October, and publishes high value APP scams review and consultation.

🇺🇸 Six credit rating agencies agreed to pay a total of more than $49 million in civil penalties to settle U.S. Securities and Exchange Commission charges they broke recordkeeping rules, the regulator said on Tuesday. Keep reading

FINTECH NEWS

🇬🇧 Aspire Commerce launches Muloot Money. New financial services brand, Muloot Money, co-created by UK banking expert, Adam Rigler, is a simple and powerful solution developed to streamline day-to-day money management and revolutionise international transactions for UK-based businesses and individuals.

🇬🇧 Robinhood now offers stock lending for British customers, part of the platform’s ongoing U.K. expansion. Introduced Wednesday (Sept. 4), the offering lets customers lend out any fully paid stock in their portfolio, with Robinhood taking care of finding interested borrowers.

🇪🇸 Deliverect and YouLend launch business financing solution for restaurants in Spain to offer revenue-based financing to their thousands of small and medium-sized (SME) customers. This innovative approach provides businesses with direct access to funding right at their point of need.

🇿🇲 Paymentology to launch virtual Mastercard debit cards on ChitChat social commerce platform. With the help of Paymentology’s cloud-first, API-driven technology, users can now conduct both in-person and online transactions using their ChitChat virtual Mastercard debit card.

🇸🇪 Froda and Juni, two prominent Swedish FinTech firms, have formed a partnership to advance embedded finance solutions. This collaboration aims to tackle the financing challenges of European SMEs by leveraging Froda’s embedded finance expertise to offer more accessible, scalable solutions.

PAYMENTS NEWS

🇺🇸 ACI Worldwide collaborates with Red Hat to deliver enterprise payments for the cloud era. The collaboration will help ACI customers simplify payment operations, allowing them to deploy ACI’s enterprise payments platform on any cloud infrastructure and offering enhanced resiliency and scale while reducing operating costs.

🇺🇸 U.S. Bank works to simplify SMB banking, payments. A recent survey by the bank is leading it to bring its payments and banking tools together to work for small and mid-size business clients in a more simplified way. Read more

🇺🇸 Jack Henry and Moov to simplify digital payments for small business. The cloud-native service will allow SMBs to accept payments with the tap of a phone, receive same-day funds for payments accepted, and automate reconciliations to accounting software packages.

🇬🇧 UNIPaaS and American Express Partner to Boost B2B Card Payments for SaaS Platforms. The partnership will enable more small and medium-sized businesses (SMBs) to offer their customers the option of paying invoices with Amex Cards through its platform.

DIGITAL BANKING NEWS

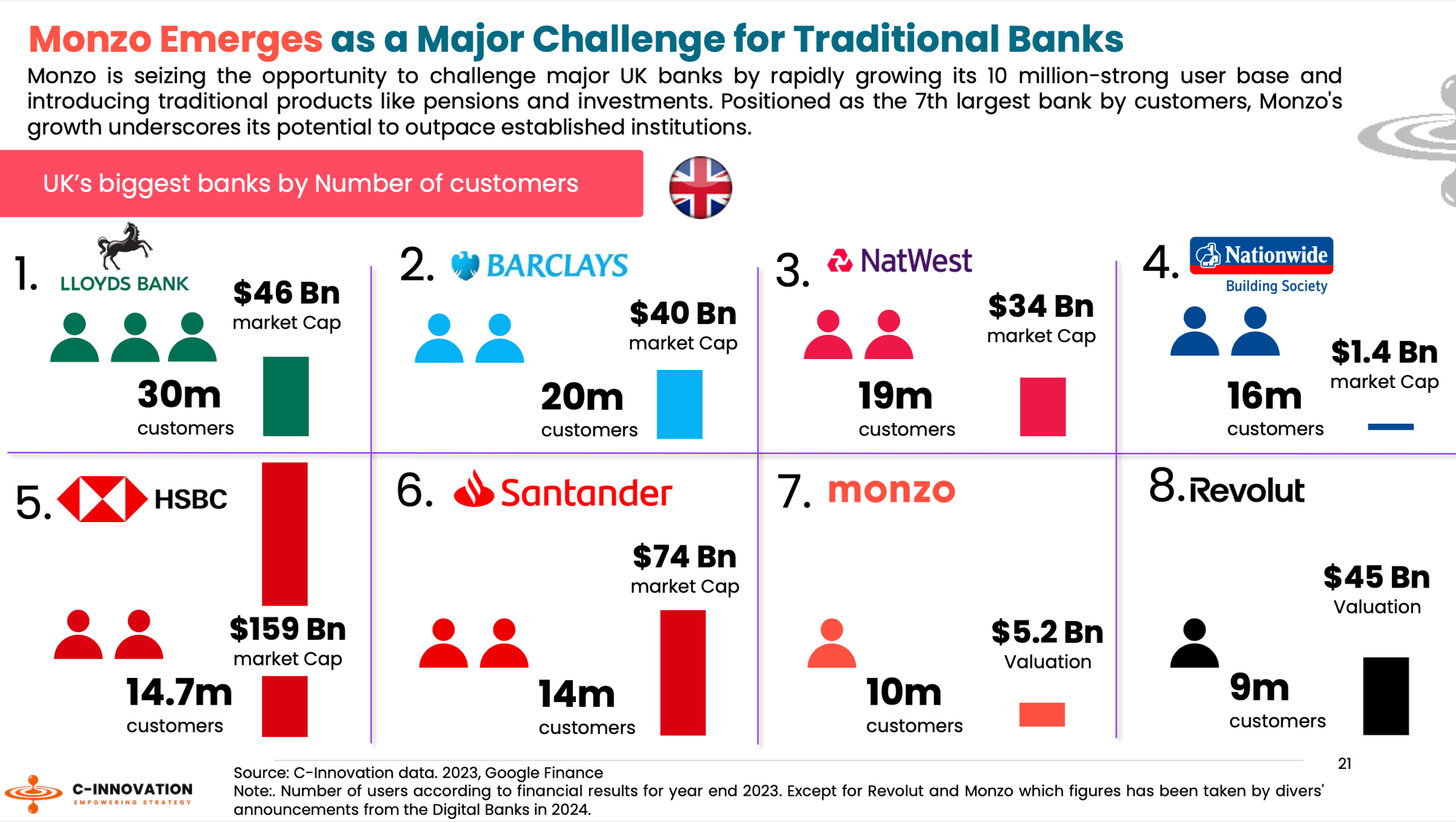

🇬🇧 One in five UK adults is now using Monzo Bank 🤯

🇬🇧 Revolut is launching 𝗕𝗶𝗹𝗹𝗣𝗮𝘆, which automates payments and is designed to save businesses time managing and paying bills. BillPay integrates with major accounting software packages, including QuickBooks, Xero, and FreeAgent and will enable users to manage and pay bills to suppliers in over 150 countries, the company says.

🇭🇰 ZA Bank becomes Hong Kong's first virtual bank to declare monthly net profitability. This accomplishment underscores ZA Bank's robust growth and positions Hong Kong at the forefront of digital banking.

🇬🇧 Tide hits one million customer milestone. This includes 650,000 members in the UK, and 350,000 in India, where it launched in December 2022. Tide entered the German market in May, where it has started to roll out its product proposition.

🇬🇧 Income Group taps Griffin for savings accounts. This partnership allows Income Group to enhance IGsend by integrating Griffin’s savings account, promoting a culture of saving among its users. Continue reading

🇭🇰 Mox becomes the first virtual bank in Hong Kong to offer crypto investments. The service lets users invest in crypto through a regulated platform without managing a personal wallet, making Mox the first virtual bank in Hong Kong to offer crypto-related investments.

🇹🇭 Thailand’s digital wallet stimulus plan has suddenly become less digital. As Reuters reported Tuesday (Sept. 3), Prime Minister Paetongtarn Shinawatra said the government’s planned 450 billion baht ($13.1 billion) “digital wallet” handout will be distributed in cash, a change from the government’s flagship policy.

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 The Singapore branch of crypto exchange OKX has received a major payment institution (MPI) license from the Monetary Authority of Singapore (MAS). The local entity received in-principle approval for an MPI license from MAS in February, the company said.

DONEDEAL FUNDING NEWS

🇬🇧 From their experiences at Uber and PayPal, Palm founders want to make moving cash easier for big companies. The firm is announcing a $6.1 million seed round led by Speeinvest and Target Global. The company has built all-in-one platform to let businesses move money between hundreds of bank accounts and subsidiaries in a more efficient way.

🇧🇷 Brazilian neobank Neon Raises over 𝗥$ 𝟱𝟬𝟬 𝗠𝗶𝗹𝗹𝗶𝗼𝗻 in new funding round. The raise occurred in two tranches – one worth R$ 310 million (US$ 64 million) in December 2023, and another R$ 208 million (US$ 38 million) in August 2024.

🇺🇸 Morgan Stanley invests in 3forge, a provider of code platforms for building mission-critical applications in financial services. The investment marks the first time 3forge has raised external capital since launching in 2011. Terms of the transaction were not disclosed.

M&A

🇫🇷 Axway has officially completed the acquisition of Sopra Banking Software (SBS), establishing one of France’s leading enterprise software publishers, particularly in the banking and financial services sectors. This landmark deal, valued at €330 million, marks a significant expansion for Axway.

🇬🇧 ClearCourse acquires retail Eftpos vendor CSY Retail Systems (“CSY”). Following the acquisition, CSY will become part of the ClearCourse Retail & Hospitality division, significantly strengthening the group’s integrated offering in this sector.

🇦🇪 Middle Eastern open banking platform Tarabut has acquired UK FinTech Vyne, a real-time account-to-account (A2A) payments platform for online businesses, for an undisclosed sum. The acquisition was completed on 1 August following the approval of the Saudi Central Bank (SAMA) and the Financial Conduct Authority (FCA) in the UK.

MOVERS & SHAKERS

🇮🇱 Nayax, a global commerce enablement payments and loyalty platform designed to help merchants scale their business, announced that Keren Sharir has been appointed to the newly created role of President in addition to her current role of Chief Marketing Officer (CMO), effective immediately.

🇨🇿 Twisto founder joins Malcom Finance (formerly 4Trans). The FinTech company specialising in financial services for supply chain and logistics SMEs, has appointed the founder of Twisto, Michal Šmída, as a Non-Executive Director.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()