Marqeta Shares Fall 40% Due to Regulatory Delays and Q4 Forecast

Hey FinTech Fanatic!

In a record plunge, shares of Marqeta Inc. fell more than 40% after disappointing fourth-quarter guidance left investors scrambling.

"Heightened regulatory scrutiny has delayed the timelines for getting clients card programs up-and-running," Chief Financial Officer Mike Milotich said on a conference call Monday after Marqeta released third-quarter results.

Card launches that were planned for the third quarter have been pushed into the fourth and into early 2025, affecting gross profit, he added. In the first half of 2024, the time it took to launch a client program went from an average of 150 days to over 200 days.

“That just gives you a little more color on sort of the magnitude of what’s happening,” Milotich said on the call. “We had 15 programs that were delayed on average of 70 days.”

Marqeta, which stepped into the public arena in 2021, saw its stock plummet to as low as $3.52, marking a stark 50% decline for the year. Analysts quickly responded: JPMorgan Chase & Co., Morgan Stanley, and Mizuho all cut price targets, with Mizuho’s Dan Dolev calling this quarter “perhaps the most disappointing quarter in Marqeta’s short history.”

You can read more (and more positive 😀) FinTech industry updates below👇, and I'll be back in your inbox tomorrow!

Cheers,

ARTICLE OF THE DAY

🎤 In my latest Q&A, Kent Henderson, VP, Product Management at Mangopay, discusses key challenges businesses face in cross-border payments, including hidden fees, FX rate fluctuations, and slow transactions, all of which impact profitability and growth. Dive into our conversation to learn more about his insights and strategies for optimizing cross-border payments.

#FINTECHREPORT

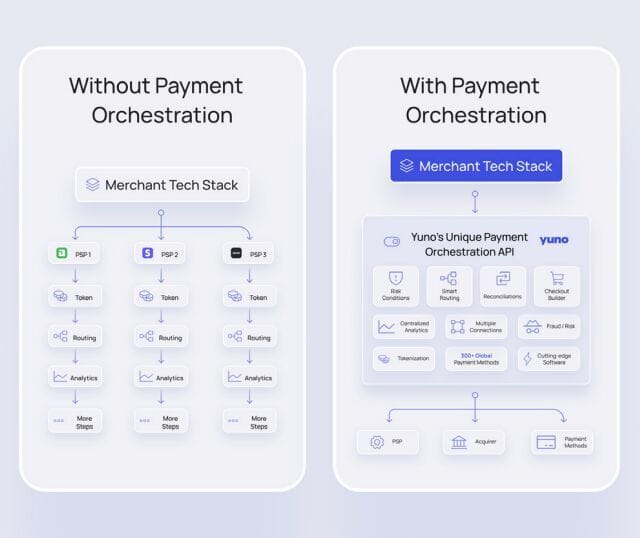

📊 The Payment Orchestration is a new rising Industry in the payments ecosystem, with expected value of over $𝟭𝟱 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 by 2026 🤯

Read this great FinTech report by Carol L. Grunberg from Yuno to learn all about 'The Payment Revolution.'

FINTECH NEWS

🇺🇸 Takeaways from Money 2020: Trends, transformations, and predictions. According to Alex Lazarow, despite claims of FinTech struggles, the industry's growth is evident at Money2020. In this article, he shares a round-up of key trends based on conversations with CEOs, founders, VCs, and other insiders, in and around the event.

🇨🇴 Germany reinforces sustainable finance leadership with updated Green Bond Framework, supporting its “Twin Bonds” model, offering green and conventional bond options. DZ BANK AG and Deutsche Bank will serve as joint ESG coordinators for the 2025 Framework revision.

🇺🇸 Consumer advocates demand tougher oversight on Bank-FinTech partnerships. AFREF and CFA are urging tighter regulation of bank-FinTech partnerships in a bid to protect consumers, citing risks associated with BaaS products, which many mistakenly see as secure as traditional banking.

🇺🇸 Marqeta falls most on record after giving disappointing outlook. Marqeta shares fell over 40% after the card partner for firms like Block and Affirm forecast weak Q4 results, citing increased regulatory scrutiny in banking as a factor. Find out more

PAYMENTS NEWS

🇩🇪 The Payments Market Map Germany

Anyone missing in this overview? 👇

🇮🇱 Nium and HyperGuest join forces to streamline payments for the travel and hospitality industry. The integration of Nium’s virtual card solution into HyperGuest’s platform will facilitate faster, more secure, and transparent payments for travel businesses globally.

🇬🇧 Klarna now available at John Lewis & Partners. The companies are committed to making it easier for customers to manage their budgets with a range of flexible and secure ways to pay. Continue reading

🇮🇹 Visa expands partnership with Intesa Sanpaolo. As part of their expanded partnership, the companies plan to focus on advancing the digital transition of payments and intend to continue their existing projects and introduce new products and services for the latter’s customers.

🇰🇪 Mastercard signs 10-year agreement with Diamond Trust Bank. The partnership focuses on developing a wider range of financial tools for individuals and businesses, aiming to enhance both convenience and security in the region’s digital transactions.

🇮🇳 Mastercard and PayMate partner to streamline B2B payments in EEMEA. The collaboration aims to streamline payment operations for organisations in these regions by introducing digital solutions designed to improve speed, security, and convenience in B2B transactions.

🇸🇬 Mastercard launches Pay Local, enabling Asia’s digital wallet providers to process card payments from more than 2 billion Mastercard cardholders. The service lets residents and travelers link their cards to a digital wallet and shop at participating merchants instantly, without setting up or topping up a prepaid account.

🇧🇷 Pix by Proximity is introduced. The Central Bank of Brazil has launched a contactless payment system for Google Wallet users, with a full rollout to all Pix users by February 2025, allowing payments via linked bank accounts by tapping phones near a terminal.

🇱🇧 TerraPay and Suyool join forces to enable instant and secure money transfers to anyone in lebanon. This collaboration is set to transform how Lebanese residents send and receive money, addressing the pressing demand for fast, secure, and convenient remittance services.

🇸🇬 StraitsX, Grab, and Ant International further partnership to simplify cross-border payments. The partnership enables users of Alipay+ payment partners to transact in local currencies at GrabPay merchants, with immediate SGD settlement for merchants via a Singapore dollar-denominated stablecoin.

DIGITAL BANKING NEWS

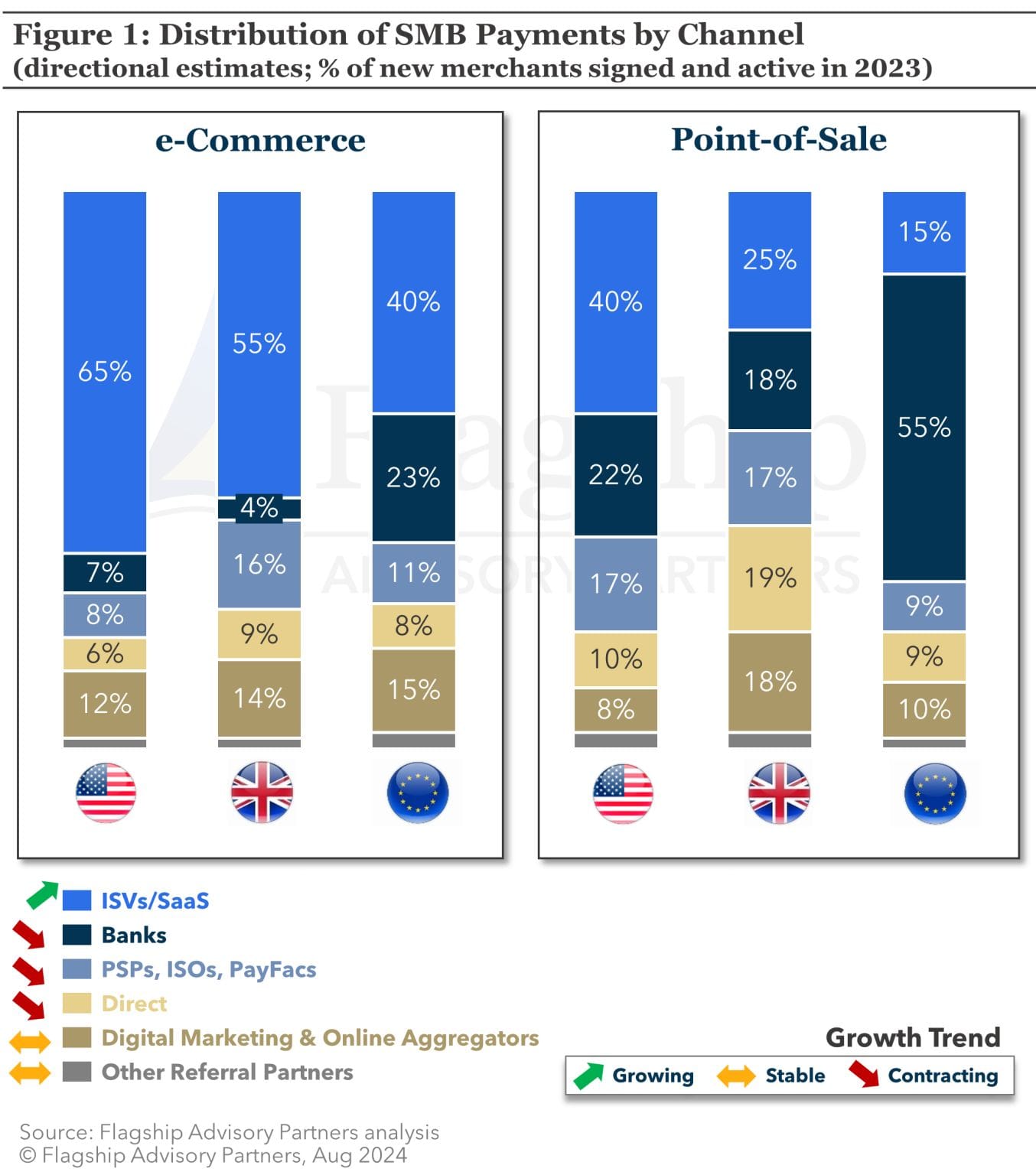

🏦 Banks face numerous challenges when it comes to merchant acceptance. Dive deeper in this comprehensive article from Flagship Advisory Partners for further information.

🇦🇪 UAE-based Commercial Bank International to explore digital asset sustainability with Zumo. The partnership will enable Dubai-based CBI to leverage Zumo’s platform to "provide carbon footprint insights with carbon offsetting for digital assets," according to CBI Chief Strategy and Innovation.

🇬🇧 Big banks denying UK SMEs vital cash as the savings gap grows again. UK SMEs are losing thousands in interest due to low big bank rates. Allica Bank’s Monthly Savings Tracker shows a widening gap, with big banks offering just 1.35%, 3.02% below challenger banks. More on that here

🇬🇧 Standard Chartered taps Wise Platform for cross-border payment service upgrade. Through this collaboration, StanChart states that SC Remit customers in Asia and the Middle East can transfer funds internationally in 21 currencies, including EUR, GBP, USD, CAD, SGD, JPY, and HKD, "in seconds."

🇬🇧 NatWest and Mastercard launch mobile virtual card solution for business. NatWest plans to enable companies to issue virtual cards for their employees worldwide, eliminating the need for physical cards and enhancing flexibility, control, and security in corporate payments.

🇹🇭 KakaoBank partners with SCBX to open an internet bank in Thailand. The collaboration is expected to start a local launch of branchless banking solutions amid a digital push. KakaoBank and SCBX will combine their expertise and suite of solutions to establish a local virtual bank.

🇬🇧 GSMA and UK Finance team up for API based anti-fraud initiative, offering a ‘collaborative framework’ for UK operators and banks to roll out Scam Signal, delivered via an Application Programmable Interface (API).

🇪🇸 BBVA to train top executives in GenAI. The course focuses on the use of GenAI to improve productivity among top executives by optimising their strategic decision-making and daily operations. Learn more

BLOCKCHAIN/CRYPTO NEWS

🪙 Ingenico and Crypto.com launch global crypto payment solution for millions of merchants. Through this partnership, the companies aim to bring secure crypto payment solutions to global merchants, offering seamless integration and broader accessibility.

🇸🇬 Monetary Authority of Singapore unveils plans to enable industry-wide adoption of tokenisation. Under Project Guardian, an international collaboration exploring fund and asset tokenization, the Monetary Authority of Singapore has conducted over 15 trials in six currencies across various financial products.

🇦🇹 Bitpanda to deploy Eventus' Validus platform. This move follows Bitpanda's review of its trade surveillance providers, leading to the selection of Eventus to automate the detection and prevention of market abuse, manipulation, and insider trading.

🇫🇷 The Banque de France (BDF) and the Monetary Authority of Singapore (MAS) announced the completion of a joint experiment in post-quantum cryptography (PQC) conducted across continents. The PQC experiment aims to enhance communication and data security against cybersecurity threats from quantum computing.

🌐 Swift, UBS Asset Management, and Chainlink complete pilot for settling tokenized fund transactions via Swift network. This initiative enables digital asset transactions to settle with fiat systems across 11,500+ financial institutions in over 200 countries and territories.

DONEDEAL FUNDING NEWS

🇰🇪 Visa targets Kenyan firms with investment. Visa announced investments in four FinTech start-ups through its inaugural Visa Africa Fintech Accelerator program, reinforcing its commitment to digital innovation and financial inclusion in Africa. Read more

MOVERS & SHAKERS

🇬🇧 Payabl appoints Marios Tsiailis as new Group Chief Financial Officer (CFO). With over a decade of experience in finance, Marios steps into this role to drive initiatives that optimize payabl.’s financial framework and foster sustainable growth.

🇬🇧 Lloyd’s appoints Nathan Adams as Chief People Officer. Adams is set to join Lloyd’s early next year, where he will also serve as a member of the executive committee, reporting directly to CEO John Neal. Read on

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()