Last-Minute Favor + Top FinTech News

Hi FinTech Fanatic!

Today’s edition kicks off with a special twist—I need your help! I’m on the hunt for tickets to the semi-final of the European Championship, where The Netherlands will face off against England. I know it’s last minute, but you can always ask, right? If you can help me snag these tickets, I’ll owe you big time.

Many thanks in advance, and of course, the rest of this newsletter is packed with the latest and greatest FinTech industry news, just as you’ve come to expect.

Enjoy!

Cheers,

ARTICLE OF THE DAY

🎤 Q&A with Nazuk Jain.

In my recent Q&A, Nazuk Jain, VP of Product and Innovation at PayQuicker, discusses her journey in FinTech, the challenges and opportunities in payments, and offers career advice for women in the industry. Discover how PayQuicker is redefining global payout orchestration with AI-driven innovations.

#FINTECHREPORT

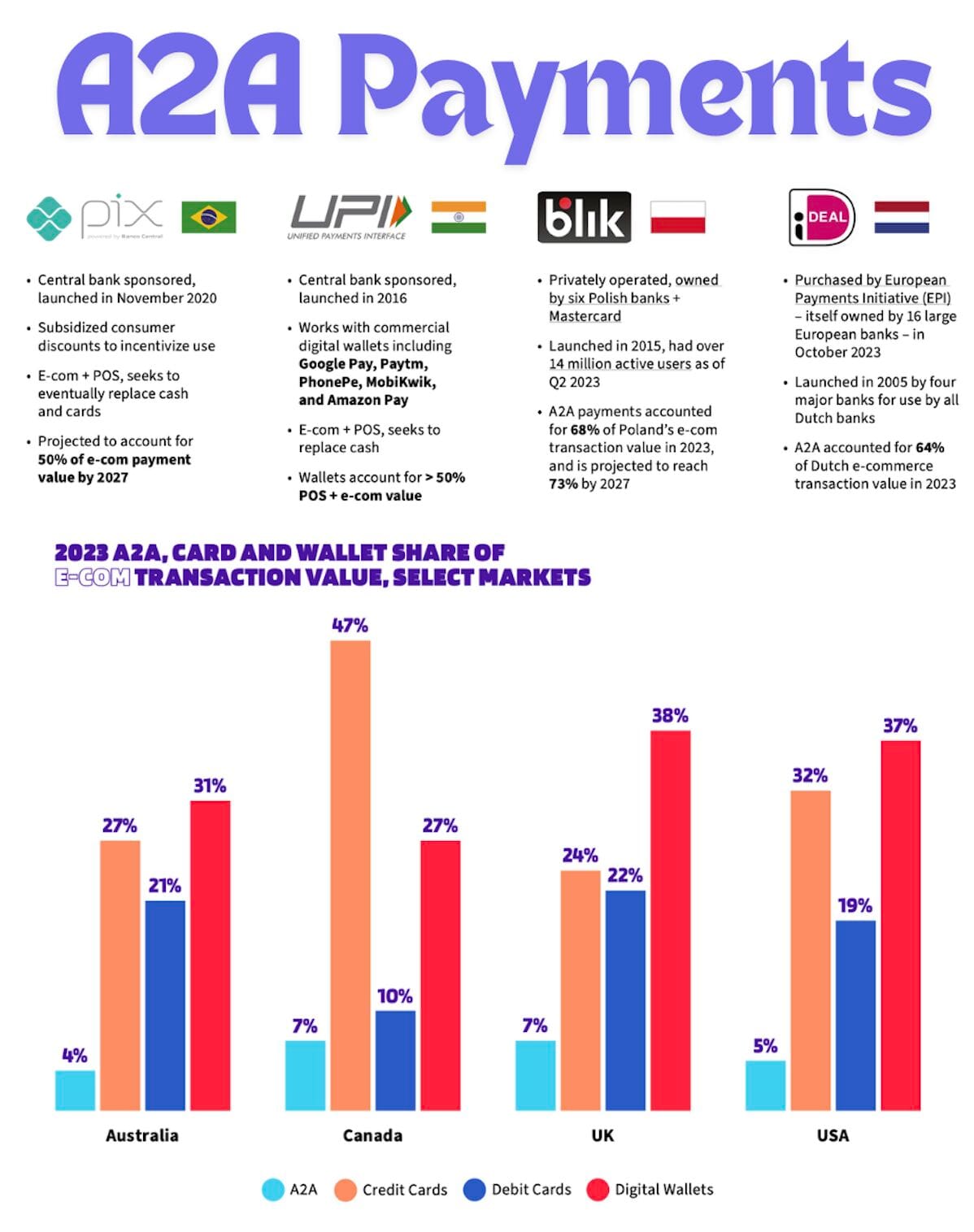

📊 𝗔𝗰𝗰𝗼𝘂𝗻𝘁-𝘁𝗼-𝗮𝗰𝗰𝗼𝘂𝗻𝘁 (𝗔𝟮𝗔) 𝗽𝗮𝘆𝗺𝗲𝗻𝘁𝘀 are thriving globally, particularly in regions with strong government and bank support. In 2023, A2A led e-commerce payments in countries like Finland, Malaysia, and The Netherlands, and is reshaping payment systems in emerging economies such as Brazil and India.

FINTECH NEWS

🇲🇾 Raiz Invest exits Malaysia after 4 years to shift focus to Australia. The company said that the closure will be implemented in phases to ensure secure handling of client assets. This exit will reportedly not affect the profit and loss of Raiz’s Australian operations, and the Malaysian operations will be classified as discontinued in their financial report.

🇳🇬 Chinese-backed FinTech giant OPay has received approval from a Federal High Court in Lagos to freeze customer bank accounts in thirty listed banks as part of a process to recover ₦714 million received by customers during a system glitch that occurred from December 10, 2023, to March 4, 2024.

🇮🇳 Investors chase wealthtech startups in India as affluent class grows. The high-net-worth and ultra-high-net-worth segments are booming in India, prompting some wealth management firms to aggressively expand their relationship manager networks to capture this market.

🇦🇪 Visa, Emaar Properties PJSC, and Mashreq have partnered to digitize B2B payments through an integrated payables solution that uses Visa and Mashreq virtual cards. By adopting this solution, Emaar will be able to make payments using virtual cards to its card-accepting suppliers.

🇪🇬 Azimut Egypt launches first FinTech-Licensed digital investment platform. This marks a significant milestone in Egypt’s asset management sector by introducing a fully digitalized approach for accessing investment funds and portfolios. More here

🇯🇵 SoftBank Group firm PayPay Securities aims to double accounts. PayPay Securities needs to increase its users and the amount of assets they invest in to meet its goal of becoming profitable in the next few years.

🇪🇺 The rise of spend management FinTechs in the EU and UK by Sam Boboev. Let’s explore the EU and UK spend management market, players, and their innovative products like integrated corporate cards, automated bookkeeping, and real-time spend management tools: Click here to learn more

PAYMENTS NEWS

🇲🇽 Yuno, the leading global Payments Orchestration platform, announced a strategic partnership with Openpay, BBVA Group’s digital payments company, in Mexico. The partnership is making it easier for companies of all sizes to conduct online transactions seamlessly and benefit from the country’s e-commerce boom.

🇨🇳 Alipay, a leading mobile payment platform in China, has launched Tap! to enhance in-store payments in major Chinese cities. Tap! allows users with NFC-enabled smartphones to tap their phone against the merchant’s NFC tag, which activates the Alipay app to complete the payment.

🇧🇷 Pix set a new record last Friday July 5th, with 𝟮𝟮𝟰.𝟮 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 transactions in a single day. The previous record, set on June 7th, was 206.8 million transactions. Link here

🇧🇷 Cumbuca, a FinTech specializing in expense sharing, has just received authorization to operate as a payment transaction initiator (ITP) via Pix in Open Finance. The initiation via Pix moved almost R$ 200 million in June; today, 32 institutions are able to operate with the modality.

🇲🇦 EdfaPay, a Saudi Arabia-based FinTech company, announced on Monday expanding its operations to Morocco after securing the necessary regulatory approval. Established in 2021, EdfaPay specializes in creating digital payment solutions. Its service offerings include Soft POS, and Payment Gateway - a platform that acts as an intermediary in electronic financial transactions -, which would be available to merchants and customers across Morocco.

OPEN BANKING NEWS

🇨🇱 Chilean FinTech company Floid is expanding its reach in Latin America by launching a new line of products designed to streamline online transfers. These products include pay-ins and payouts, aiming to provide a more comprehensive service within the framework of Open Banking.

🇨🇱 The Financial Market Commission (CMF) has released regulations governing the Open Finance System (SFA) as part of the FinTech Law (N°21.521), marking a significant milestone for Chile's financial market. This step is central to implementing the FinTech Law, approved in early 2023, which aims to promote competition, innovation, and financial inclusion.

DIGITAL BANKING NEWS

🇬🇧 Ethos partners with Thought Machine to pave the way for Shariah-compliant banking innovation. Initially targeting Muslim communities, Ethos will expand its services to other consumer groups in the UK. Looking beyond the UK, Ethos has global ambitions, with plans to expand its service to new markets such as Saudi Arabia and beyond.

🇬🇧 Africhange launches in the UK. Africhange, a global remittance services provider, has launched its operations in the UK, offering more efficient, cost-effective and reliable solutions for individuals to send and receive money internationally.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Yield App, a crypto wealth management app, abruptly announces liquidity proceedings. The Yield App team announced via social media on June 28, 2024, that the Seychelles-incorporated company is suspending all activity on the digital wealth platform as it prepares for liquidation proceedings.

🇩🇪 Germany still holds $1.3B worth of Bitcoin, Blockchain data show. The pending coin stash, a potential selling pressure, represents nearly 5% of BTC's 24-hour trading volume of $25.3 billion, suggesting further price turbulence. Read on

DONEDEAL FUNDING NEWS

🇮🇳 Healthcare-focused FinTech startup Care.fi has raised $2.6 million in funding, which includes $2 million in debt capital from venture debt firm Trifecta Capital and an additional $600,000 from UC Inclusive Credit. The funding will be directed towards scaling the company's book size, expanding operations, enhancing the business, and strengthening the team.

MOVERS & SHAKERS

🇿🇦 TymeBank has announced the appointment of Karl Westvig as its new CEO. The bank’s current CEO, Coenraad Jonker, will turn his full attention to his role as Executive Chairman of Tyme Group, where he will drive the growth of the multi-country digital banking group. The changes are effective 1 October 2024.

🇬🇧 ezbob announces Galia Goldstein as New Chief Product Officer. Galia joins ezbob with extensive experience in the payments domain and a history of establishing robust processes and frameworks that support growth. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()